Electronic Invoicing Reform in Peru Paying Off

Mandatory e-invoicing in Peru is helping increase firm sales and tax revenues.

In This Episode

The use of digital technologies is transforming how tax administrations operate, helping to improve efficiency and service delivery. A striking example has been Peru's adoption of electronic invoicing, which allows the automatic transfer of billing information between firms and the tax authority. Drawn by its potential to strengthen tax compliance and reduce costs, Peru is among more than 50 countries around the world to have implemented e-invoicing and many others are preparing to follow suit. IMF economists Salma Khalid and Matthieu Bellon have been studying the impact of Peru's mandatory e-invoicing reform that started back in 2014. Their research paper will be published this fall.

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

Bruce Edwards

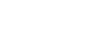

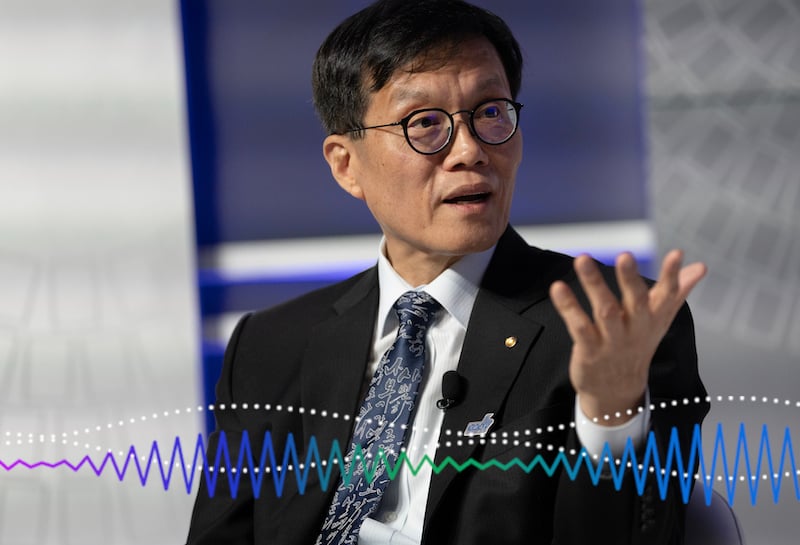

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

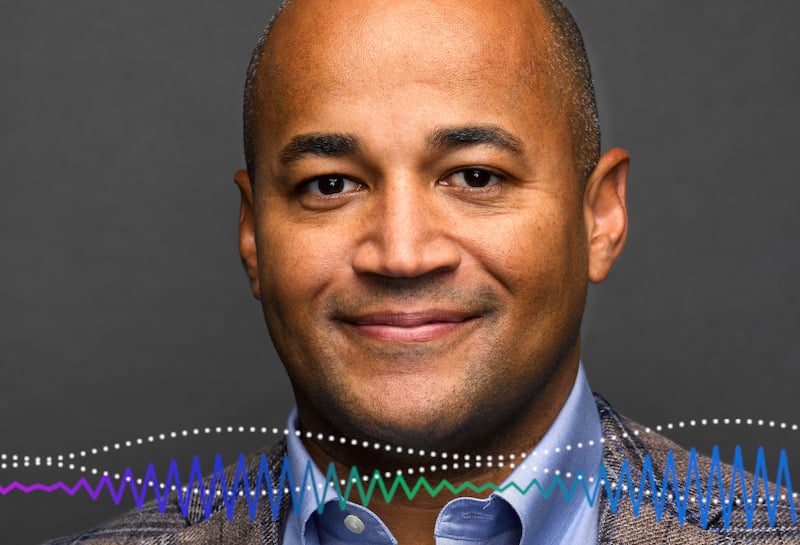

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.