What $650bn in SDRs Means for the Global Recovery

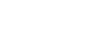

IMF's Ceyla Pazarbasioglu says SDRs will help build confidence and strengthen resilience but they are not a silver bullet. The allocation is part of a broader range of support measures that countries need to exit the crisis.

In This Episode

Special Drawing Rights (SDR) are international reserve assets and used as the accounting unit for IMF transactions with its member countries. Earlier this month, in a historic multilateral response to the pandemic, the IMF board of governors approved a new SDR allocation of $650 billion, the largest in the institution's history. Ceyla Pazarbasioglu heads the Strategy, Policy and Review Department at the IMF. In this podcast, she says the SDR allocation will go a long way toward helping vulnerable countries and minimize the dangerous divergence in recovery paths around the world. Transcript

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

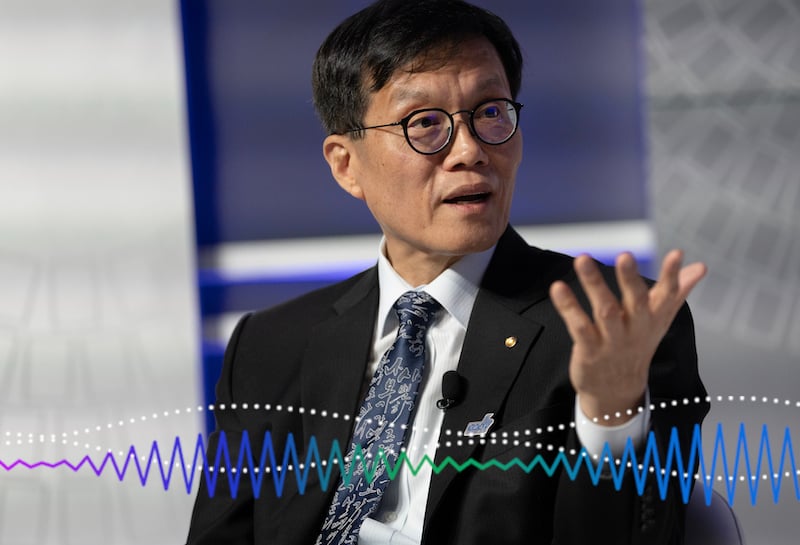

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

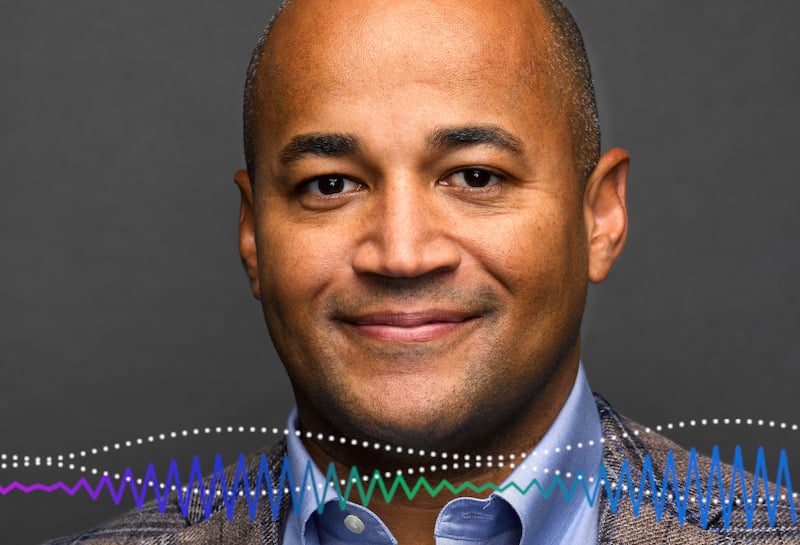

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.