Inequality / Macro-fiscal policy

Alex Cobham on Tax Injustice

In This Episode

Economies grow better when they are more equal, and taxation is a powerful tool to help reduce inequalities. But increasingly, the international tax system is doing the opposite of that by allowing corporations and the world's wealthiest people to avoid paying their fair share. The Tax Justice Network estimates the combined global revenue losses from cross-border tax abuse by people with undeclared offshore assets and of multinational companies amount to some $483 billion a year. Alex Cobham is Chief Executive of the Tax Justice Network, and in this podcast, he speaks with journalist Rhoda Metcalfe about his article Taxing for a New Social Contract in Finance and Development. Transcript

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

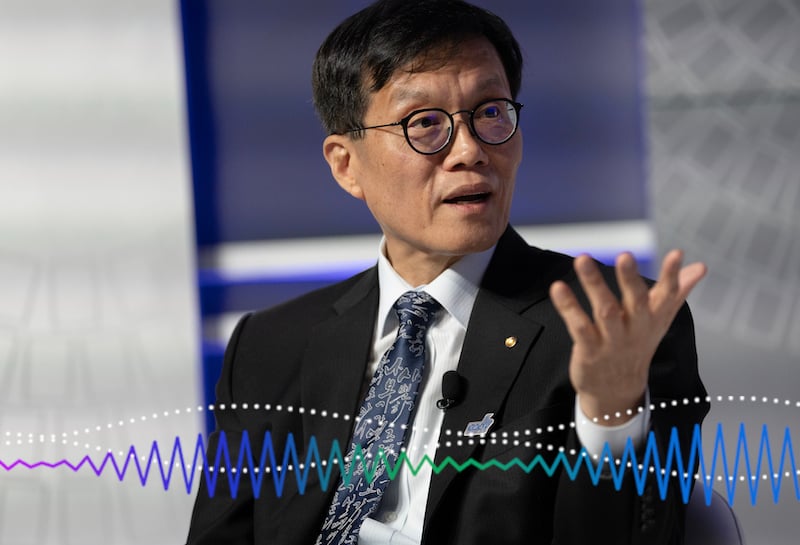

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

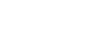

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.