Michael Keen on Adapting Old Tax System to New Economy

Digitalization is putting added pressure on international tax system. (iStock by Getty images)

In This Episode

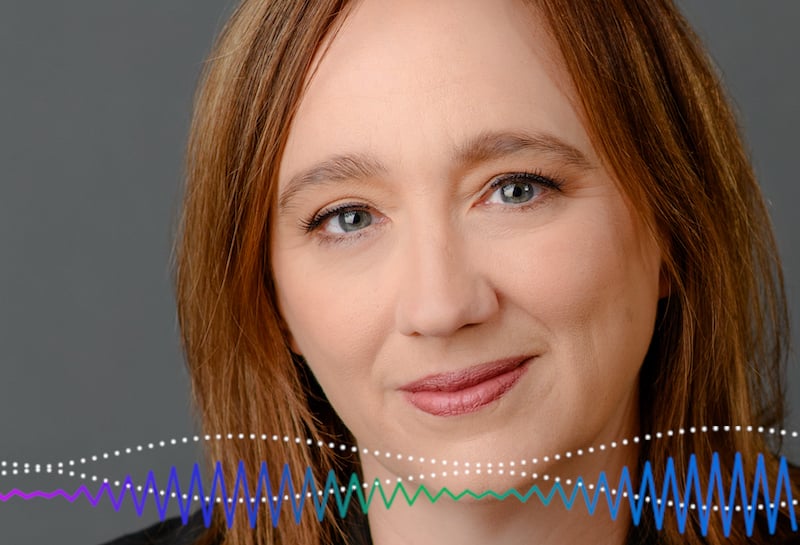

International corporate tax avoidance is a growing concern for both advanced economies and low-income countries. The changing nature of the global economy–notably increasing digitalization, in some cases, is making it easier for firms to shift profits to low-tax countries. Michael Keen is a Deputy Director in the IMF's Fiscal Affairs Department, and in this podcast he says the international tax system is under unprecedented stress. Keen was a lead author of a recent IMF policy paper that sets out the current state of the international corporate tax system and explores ways to address some of its shortcomings.

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

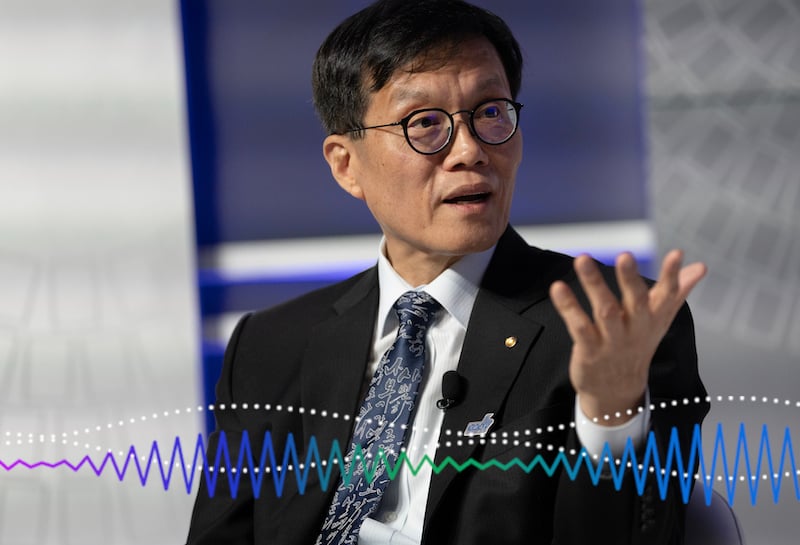

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

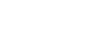

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.