Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Commodity Prices Rebound on Supply Shortfalls

October 12, 2012

- Weather-related supply shortfalls boost food prices

- Energy prices up on supply constraints and geopolitical concerns

- Strong link between economic activity and commodity prices

Commodity prices, led by food and energy, leapt 10 percent in the third quarter due to supply constraints, according to the latest IMF research.

Severely damaged corn stalks in Indiana. Widespread drought across the United States has led to higher prices for corn and other agricultural commodities (photo: Saul Loeb/Newscom)

Food & Fuel Prices

After a strong recovery during 2009–10, the IMF’s Primary Commodities Price Index (PCPI) stayed essentially flat during 2011 and then fell during the second quarter of 2012 on weakening demand, only to stage a comeback in the third quarter on various supply shortfalls, as shown in Chart 1.

The PCPI is a weighted average of prices for 51 primary commodities, grouped into three main clusters—energy, industrial inputs (mainly base metals), and edibles (of which food is the main component).

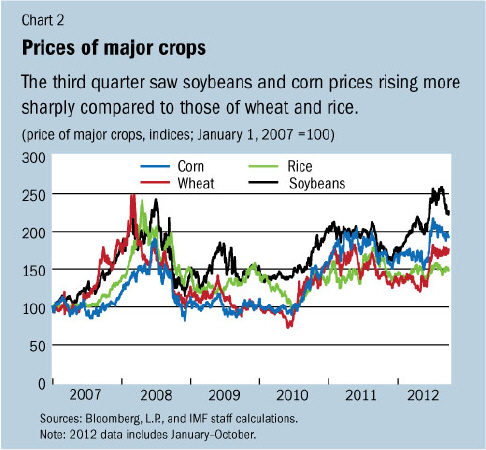

Among the three clusters, the IMF food price index rose by 8 percent in the third quarter (September over June monthly prices) to the highest level since May 2011, driven by weather-related disruptions to key crops—soybeans, corn, and wheat—whose prices have increased by about 24 percent on average the past four months.

Drought affects prices

The price increases in grains and soybeans have been driven higher because of the worst U.S. drought in over half a century and persistent dryness in other key grain-producing countries (Chart 2).

Earlier in the year, the La Niña weather pattern—marked by lower-than-normal water temperatures in the eastern Pacific Ocean—led to a drought in South America, hurting corn and soybean crops in Argentina, Brazil, and Paraguay. Hot and dry weather in the U.S. Midwest that began in mid-June lowered corn and soybean yields.

Wheat crop estimates have also been downgraded in the Black Sea region (Kazakhstan, Russia, and Ukraine) and in China due to adverse weather conditions. Rice prices have remained fairly stable despite the supply concerns associated with below-average monsoon rainfall in India which led to some concern in markets over the summer months.

Energy strengthens

Energy prices increased 14 percent during the third quarter, with the average petroleum spot price—a simple average of the Brent, Dubai, and West Texas Intermediate (WTI) crude oil varieties—jumping 17 percent (Chart 3).

Prices were driven higher by unplanned outages and maintenance in off-shore oil fields in the North Sea, lower exports from Iran due to U.S. sanctions and EU embargo, and ongoing geopolitical concerns.

Refiners have also been induced by high product prices relative to crude prices to increase crude oil purchases to replenish low product inventories (especially for diesel/gasoil).

Crude oil stocks are ample, particularly in the U.S. mid-continent due to transportation bottlenecks to the Gulf coast and rising production from shale oil deposits in North Dakota and oil sands in Canada. This has caused the price of WTI crude to trade at a substantial discount to internationally traded Brent ($20 per barrel less in early October).

Metals weaken

Metals prices, on the other hand, continued to fall in the third quarter and are down 28 percent from highs in April 2011 on weak demand.

Markets are concerned about faltering economic growth and weakening import demand in China where the country accounts for more than 40 percent the world’s base metal consumption.

Metals prices did get a boost in September on various stimulus measures in anticipation of economic growth, but it is uncertain when such measures will translate into growth and higher metals demand—especially in China (Chart 4).

The prices for some metals—aluminum, nickel and zinc—-have fallen to levels comparable to the costs of production for high-cost producers and may receive support via production cuts by these enterprises.

Metals markets remain largely tied to economic activity, and are especially geared to import demand in China, although supply conditions are often important.

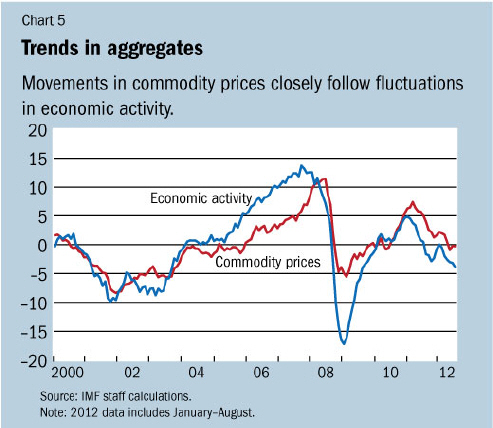

Economic activity and commodity prices move together

IMF research, published in the latest World Economic Outlook, shows that fluctuation in economic activity and in the macroeconomic outlook is the primary determinant of short-term commodity price movements (Chart 5).

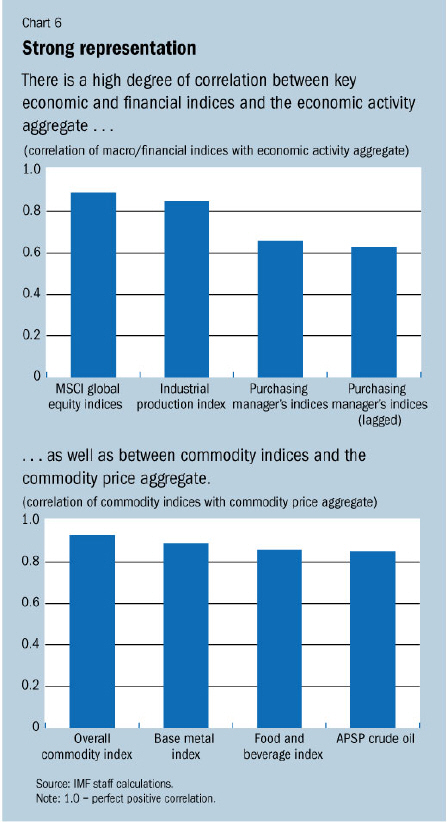

The “economic activity” aggregate is a compilation of a number of monthly economic and financial indices from a broad swath of advanced and emerging economies.

These indices are industrial production indices, purchasing managers’ indices, and equity returns (using MSCI)—which are good proxies for current global economic activity, economic sentiment, and broad asset market performance, respectively. The indices are all highly correlated with the “economic activity” aggregate, making it a useful barometer of what’s going on in the global economy (Chart 6, top panel). The aggregate also accounts for most of the variance among observed economic and financial indicators.

The “commodity price” aggregate is a compilation of more than 50 internationally traded commodity prices. The main sub-indices—for oil, food and metals—are all highly correlated with the overall “commodity price” aggregate (Chart 6, lower panel), which means the overall aggregate is a strong representation of the commodity price dynamics across the various sectors of the commodity spectrum. It is also a good barometer of what’s transpiring among global commodity markets more generally.

The strong link between “economic activity” and “commodity prices” in the analysis implies that overall commodity prices have been significantly affected by economic activity. This is true historically as well as during the price declines in the second quarter of this year.

Macroeconomic outlook affects prices

Macroeconomic factors affect commodity prices through changes in current and prospective demand and the cost of carrying inventories.

In 2012, commodity prices rallied somewhat at the beginning of the year on the back of recovering market confidence in response to the European Central Bank’s longer-term refinancing operations, as well as better-than-expected global growth in the first quarter.

However, with renewed setbacks to the global recovery in the beginning of the second quarter, leading indicators pointed to a synchronized slowing in the pace of global activity, implying that the declines in commodity prices over this period were largely driven by global economic conditions. In particular, growth in a number of major emerging market economies, notably China, slowed significantly.

There are caveats to the above trends. Supply disruptions can also have an effect on commodity prices, which has occurred in oil and metals markets from industrial or political problems. Regarding food prices, weather is the predominant factor that can affect production and prices.

IMF Research Department Commodities Team: Samya Beidas-Strom, Joong Shik Kang, Prakash Loungani, Akito Matsumoto, Marina Rousset, and Shane Streifel