Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Strong Growth in Sub-Saharan Africa, but Pockets of Difficulty

October 20, 2014

- Infrastructure, services, agriculture driving growth in most economies

- Positive outlook overshadowed by Ebola impact in affected countries

- Goals are high, inclusive growth and addressing fiscal risks in a few countries

Strong growth in the majority of sub-Saharan Africa’s economies should underpin a robust regional expansion in 2014 and 2015, the IMF said in its regional outlook.

Rail station site in Addis Ababa, Ethiopia. IMF urged that public spending shift toward infrastructure investment (photo: Tiksa Negeri/Reuters/Newscom)

REGIONAL ECONOMIC OUTLOOK

In most countries, growth benefits from a combination of infrastructure investment, expanding services, and robust agricultural production. Growth momentum remains particularly strong in Nigeria, the region’s largest economy, and in the region’s low income countries. Recent revisions of national accounts data, notably in Nigeria, have also revealed that the economies of the region are more diversified than previously thought, highlighting in particular the large role played by services.

The IMF’s latest Regional Economic Outlook for sub-Saharan Africa projects regional GDP growth to pick up from about 5 percent in 2013-14 to 5¾ percent in 2015. This overall positive outlook is however overshadowed by pockets of acute difficulty in a few countries. In Guinea, Liberia, and Sierra Leone, the Ebola outbreak is exacting a heavy human and economic toll. In addition, the security situation continues to be difficult in some countries, including the Central African Republic and South Sudan.

In a few other countries activity is facing headwinds from domestic policies. In South Africa growth remains lackluster under the drag of difficult labor relations, low confidence, and inadequate electricity supply. More worrisome, in a few countries, including Ghana and, until recently, Zambia, large macroeconomic imbalances have resulted in pressures on the exchange rate and inflation.

Rising vulnerabilities

A more protracted Ebola outbreak or a wider extension of the epidemic could have severe consequences for the economy of the region, as it would undermine trade, transport activities, and investment. In other parts of sub-Saharan Africa, a deterioration of the security situation could also have severe regional spillovers.

In a few other countries, rapid growth has masked increasing fiscal vulnerabilities, especially where large deficits have been prompted by an acceleration of recurrent spending.

Less supportive environment

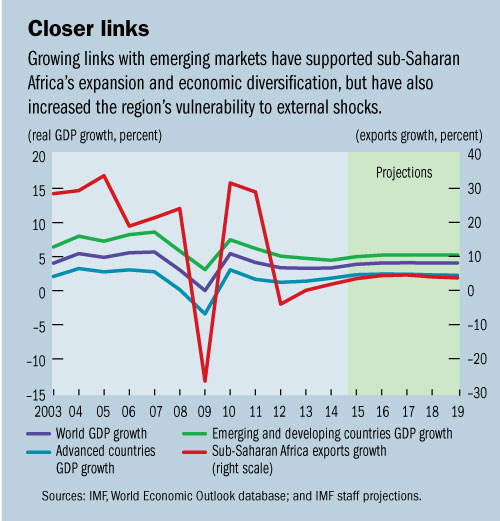

During the past decade, growing links with emerging markets have supported the region’s expansion and economic diversification but have also increased its vulnerability to external shocks (see chart).

Although global growth is projected to gradually strengthen, an expected deceleration in emerging markets and a rebalancing of Chinese demand toward private consumption will make the external environment less supportive for the region. In particular, these trends could soften global demand for key sub-Saharan African exports, including commodities.

Tightening financial conditions -- stemming from a faster-than-expected normalization of U.S. monetary policy, adverse geopolitical developments, or a worsening of the countries’ fundamentals -- could also result in lower and more expensive access to external funding and a scaling down of foreign direct investment.

Sustaining high growth

For the vast majority of the countries the over-riding policy objective remains sustaining high growth to facilitate employment creation and inclusive growth, while preserving macroeconomic stability. Countries should continue to prioritize growth-enhancing measures, including by directing public spending toward investment in infrastructure and other development spending and safeguarding social safety nets.

Boosting fiscal revenue mobilization and improving the business climate also remain important policy priorities. Monetary policies should continue to focus on consolidating the gains achieved in recent years in reducing inflation.

In the few countries where large fiscal deficits and sharply risen current spending have become a cause of concern, these imbalances should be addressed but fiscal consolidation should avoid overly adverse consequences on the poor and other vulnerable groups.

In countries affected by the Ebola epidemic, fiscal accounts are coming under considerable pressure. Ideally, support should be provided through grants from the donor community. However, when grants are not immediately forthcoming, and provided that public debt is manageable, fiscal deficits should be allowed to widen, subject to the availability of financing.

Building up resilience

The Regional Economic Outlook also discusses, in two background studies, how fragile states can become more resilient and how countries in the region can cover their remaining infrastructure deficit.

The first study compares the experience of countries that were deemed fragile in the 1990s and have managed to build resilience since then with that of other countries that have not made progress or have even regressed. The analysis performed on a panel data from 26 sub-Saharan African countries and on four case studies from the region highlights that overcoming fragility is a slow and complex process.

Succeeding in these efforts requires an appropriate combination of well-prioritized actions, including a political arrangement that deters violence, strong leadership, and selected policies geared at fostering good governance, transparency, and economic stability. In particular, strengthening fiscal institutions is critical, both to create the fiscal space needed to deliver key public services and urgent investments, and to establish trust between the citizens and the state.

International stakeholders should be prepared to engage with these countries on a long-term basis, both to support their capacity building process and to provide the high levels of aid that may continue to be needed until the country has achieved a minimum level of resilience.

Addressing infrastructure deficit

The second study reviews the progress achieved in recent years by countries in sub-Saharan Africa in fulfilling their need to expand their infrastructure, highlighting the current trends in financing these operations and the challenges that lie ahead. The study finds that many countries in the region have sustained a high level of public investment, but only some of them have managed to improve their infrastructure significantly.

The major obstacle to addressing the continent’s infrastructure deficit does not generally appear to be a lack of financing, but rather capacity constraints in developing and implementing projects. The study concludes that countries should seek to make the most of new financing instruments and flows by improving their absorptive capacity and removing remaining regulatory constraints, while controlling fiscal risks and maintaining debt sustainability.

More specifically, countries should strengthen their public financial management capacity by upgrading their methods to plan, execute, and monitor public investment, strengthening their project appraisal procedures, and adopting a medium-term budgetary framework that includes adequate provisions for the cost of operation and maintenance. Public-private partnerships can be an effective tool to upgrade infrastructure, but need to be underpinned by an appropriate institutional and legal framework, and to be carefully monitored to minimize fiscal risks.