Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : New Fiscal Transparency Code to Improve Policies and Accountability

August 7, 2014

- New Code is cornerstone of modern fiscal transparency architecture

- Emphasis on fiscal risks, quality of fiscal reporting, forecasting, and budgeting

- Allows assessment of key country transparency practices and reform needs

Transparency is critical for effective fiscal management, and helps ensure that governments have an accurate picture of their finances when making economic decisions, including of the costs and benefits of policy changes and potential fiscal risks. It also provides legislatures, markets, and citizens with the information they need to hold governments accountable.

Parade crosses Murillo Square in La Paz, Bolvia. Better fiscal transparency will help countries across Latin America and other regions in the move to more stable economic growth (photo: Carlos Barrios/ABI)

Public Spending & Accountability

The new Fiscal Transparency Code and new Fiscal Transparency Evaluation are part of the IMF’s efforts to strengthen fiscal surveillance, support policymaking, and improve fiscal accountability. The IMF’s Executive Board, where all member countries are represented, has just approved the first three pillars of the new four-pillar code.

Since they were first published in 1998 and last updated in 2007, the IMF’s Code of Good Practices on Fiscal Transparency and accompanying Manual and Guide have been centerpieces of the global architecture of fiscal transparency standards. The Code also provided the framework for conducting fiscal transparency assessments, or “Fiscal ROSCs,” which, as part of the Fund’s Reports on the Observance of Standards and Codes (ROSC), analyzed countries’ adherence to the principles and practices in the Code.

Focus on four pillars of fiscal transparency

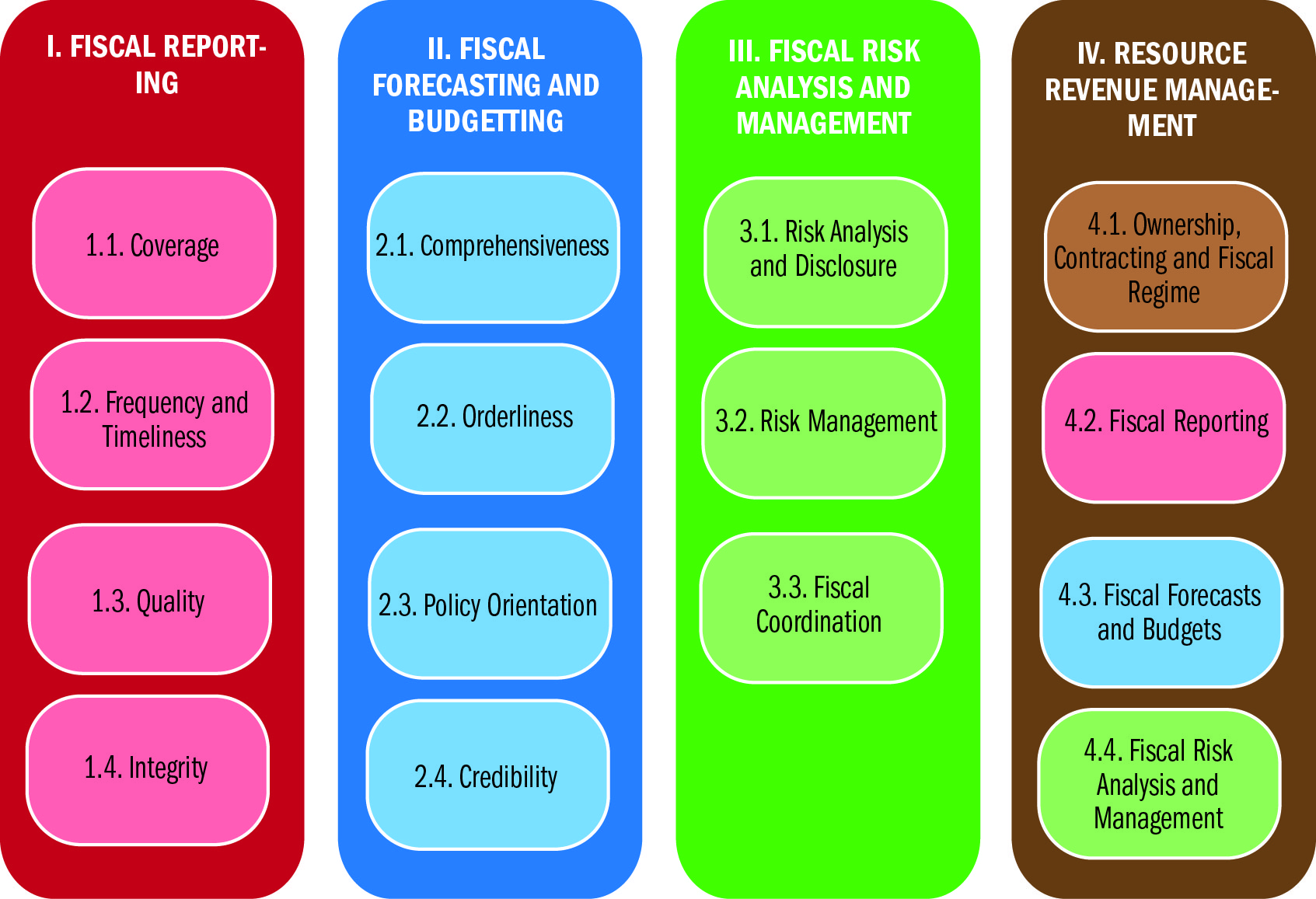

The new Code, described in the Update on the Fiscal Transparency Initiative, covers four key elements of fiscal transparency (see figure):

• Pillar I: Fiscal Reporting, which should offer relevant, comprehensive, timely, and reliable information on the government’s financial position and performance.

• Pillar II: Fiscal Forecasting and Budgeting, which should provide a clear statement of the government’s budgetary objectives and policy intentions, together with comprehensive, timely, and credible projections of the evolution of the public finances.

• Pillar III: Fiscal Risk Analysis and Management, which should ensure risks to the public finances are disclosed, analyzed and managed, and fiscal decision-making across the public sector is effectively coordinated.

• Pillar IV: Resource Revenue Management, which should provide a transparent framework for the ownership, contracting, taxation, and utilization of natural resource endowments.

While Pillars I, II, and III have been finalized, Pillar IV will be completed later this year, and requires adapting the principles of the first three pillars to the particular circumstances of resource-rich countries.

“The new Fiscal Transparency Code and Fiscal Transparency Evaluation address the weaknesses of the 2007 Code and Fiscal ROSC,” said Richard Hughes, Division Chief in the IMF’s Fiscal Affairs Department. “They are designed to ensure that policymakers, legislators, citizens, and markets have a complete picture of the state of public finances, covering the entire public sector, incorporating accurate and comprehensive fiscal forecasts, and recognizing all major fiscal risks.”

The new Code and Evaluation improve fiscal disclosure and management in countries at all income levels, and reflect feedback from governments, civil society, academics, market participants, and the public that was received through two rounds of consultation in December 2012 and July 2013.

A modern approach to fiscal transparency

To achieve its goal of modernizing the Fund’s fiscal transparency architecture, the new Code:

• Focuses on outputs rather than processes. Unlike the 2007 Code, which emphasized the legal, institutional, and procedural arrangements for fiscal disclosure, the new Code puts greater emphasis on the quality of published information as a more objective basis for evaluating the degree of effective fiscal transparency;

• Pays close attention to different levels of country capacity. While the 2007 Code provided a single standard for each of its principles, the new Code differentiates between basic, good, and advanced practices for each of its 36 principles to provide less developed countries with a clear set of milestones toward full compliance with standards;

• Places greater emphasis on fiscal risk. The 2007 Code devoted relatively little attention to fiscal risks. The new Code devotes a full pillar (with 12 principles) to the disclosure, analysis, and management of the most important sources of fiscal risks; and

• Reflects recent advances in fiscal management and international standards. For example, the new Code’s “advanced” practices call for publication of fiscal reports covering the entire public sector, preparation of full public sector balance sheets, and publication of audited annual financial statements within six months. The new Code also adds a new principle on public participation in budget deliberations, in response to consultations with key stakeholders.

Successful country pilots of new evaluation tool

Fiscal Transparency Evaluations will replace the fiscal ROSCs as the Fund’s tool for assessing country fiscal transparency practices. Eight country pilot evaluations have been conducted to date, covering four geographic regions, and four of these reports have been published to date. The Fiscal Transparency Evaluations assess country practices against the standards set by the new Code and improve upon the fiscal ROSCs by:

• quantifying information on the comprehensiveness and quality of published fiscal data and key sources of fiscal risks. These include measures of the coverage of fiscal reports, credibility of fiscal forecasts, and size of unreported contingent liabilities;

• summarizing the strengths and weaknesses of countries fiscal transparency practices, and their relative importance. This is achieved through a set of heat maps which facilitate benchmarking against comparator countries, identification of reform needs, and prioritization of recommendations.

• offering an option to specify a fiscal transparency action plan. This identifies the concrete sequence of steps involved in implementing the Fiscal Transparency Evaluation recommendations; and

• allowing for modular assessments of the new Code’s individual pillars. Modular Fiscal Transparency Evaluations would meet the need for more targeted evaluations aimed at addressing the most pressing transparency issues.

Approach harmonized with other institutions

The new Code and Evaluation focus on the information required for effective fiscal management and surveillance, and have been harmonized with other standards and diagnostic tools in the fiscal area, including the revised Public Expenditure and Financial Accountability framework, the Open Budget Index, and the Tax Administration Diagnostic Assessment Tool.

To enhance consistency and complementarity, the new Code focuses on core aspects of fiscal transparency and does not cover more procedural issues, including in the areas of public sector employment, public procurement, tax administration, and internal audit procedures. Also, attempts have been made to standardize terminology across different standards and tools to send a consistent and mutually re-enforcing message about fiscal transparency.

Next Steps

Having finalized Pillars I, II, and III of the new Code, next steps in advancing the fiscal transparency initiative will include:

• Finalizing, by mid-2015, Pillar IV of the new code, following a public consultation later this year.

• Releasing, in the course of 2015, a two-volume Fiscal Transparency Manual, which will provide more detailed guidance on the implementation of new Code’s principles and practices. Volume I of the Manual will cover Pillars I, II, and III, while Volume II will focus on Pillar IV, and integrate the previously separate “Guide on Resource Revenue Transparency.”

• On the basis of the new Code, carrying out a number of Fiscal Transparency Evaluations in priority countries.