Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Falling Oil Prices Hurt Exporters across Mideast, Central Asia

January 21, 2015

- Lower oil prices challenge exporters, provide contained benefits to importers

- Exporters need to adjust spending gradually, reform subsidies, diversify

- Importers should avoid spending windfall, continue reforms to boost jobs and growth

The steep decline in oil prices presents new economic realities for oil-exporting countries in the Middle East, North Africa, Afghanistan and Pakistan (MENAP) and Caucasus and Central Asia (CCA) regions, said the IMF in its update of the Regional Economic Outlook, released on January 21.

Oil refinery in Zawya, Libya. Falling oil prices are expected to lead to significant fiscal losses for oil exporters in the Middle East and Central Asia (photo: Ismail Zitouny/Reuters/Newscom)

REGIONAL ECONOMIC OUTLOOK

The IMF projects oil exporters in the MENAP and CCA regions to have large export and revenue losses. In the countries of the Gulf Cooperation Council (GCC)—which are most affected—oil and gas export earnings are expected to go down by about $300 billion. For importers, lower prices provide relief through lower energy import bills, which could help governments, producers, and consumers.

The global institution advised exporters to avoid abrupt spending cuts despite the unfavorable developments in the oil market while urging importers to treat savings from lower prices as transitory.

“Fortunately, most oil exporter governments have the financial resources to avoid a steep reduction in their spending plans for this year. Over the medium term, however, they would need to gradually but decisively adjust their fiscal positions to ensure sustainability and intergenerational equity,” IMF Middle East Department Director Masood Ahmed told a press conference in Washington. “Importing countries are well-advised to avoid entering into spending commitments that would be hard to reverse if oil prices returned to higher levels,” he added.

New realities

Oil prices have declined by more than 55 percent since September 2014 to levels not seen since a short period in 2009. The drop is estimated to have been driven by both supply and demand factors: higher-than-expected supply, particularly from the United States, was not offset by production cuts by the Organization of the Petroleum Exporting Countries (OPEC) members, just as global oil demand (especially from China, Japan, and the euro area) was weakening.

Over the medium term, the outlook for oil prices is likely to depend on how oil investment and production respond to lower oil prices. It will also depend on whether OPEC resumes its role as the swing producer or whether oil prices will be more strongly influenced by the marginal cost of shale oil production, the IMF said.

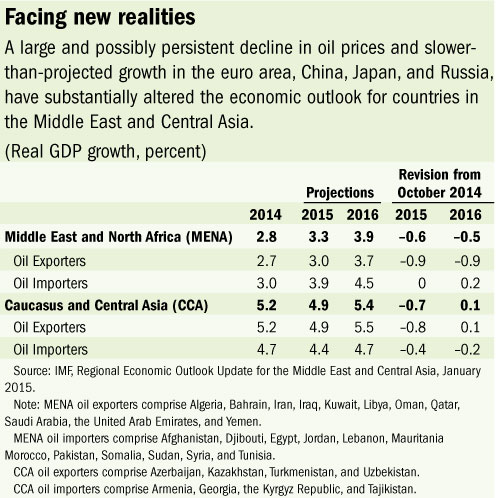

Taking into account developments in the oil market and world economy, the report revised growth projections for the MENAP and CCA regions in 2015 (see table).

Oil exporters lose big

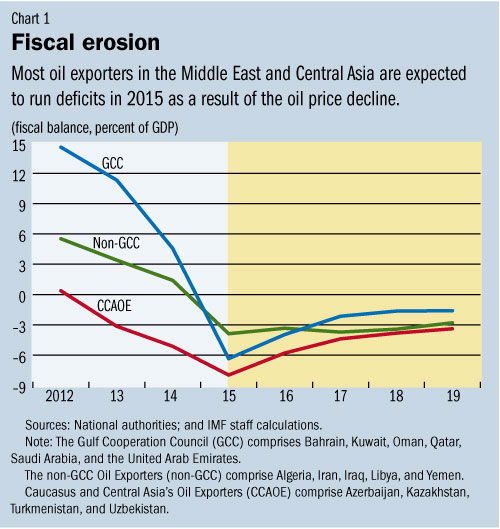

Plummeting oil prices are expected to lead to significant declines in the fiscal balances of oil exporters in the MENAP and CCA regions (see Chart 1). Except for Kuwait, Qatar, and Turkmenistan, all countries in the region are expected to run fiscal deficits in 2015. For countries in the CCA, the impact of lower oil prices is compounded by the deepening recession in Russia, to which CCA countries are closely linked through trade, remittances, and foreign direct investment, the report says.

Across both regions, with buffers eroding at varying speeds, most countries will need to re-assess medium-term spending plans and, if lower oil prices persist for a prolonged period, will need to gradually adjust to new realities in the oil market. Some countries that do not have significant reserves or borrowing capacity will need to adjust faster, with adverse consequences for economic growth, says the IMF.

The Washington-based institution emphasized that lower oil prices make it increasingly urgent to advance energy subsidy reforms and change the economic growth model in exporting countries in both the MENAP and CCA regions.

“Looking ahead, government spending will likely be constrained for a number of years. This means that the current growth model which is anchored in rising oil prices and government spending will no longer work. Instead, countries will need to further diversify their economies and enable the private sector to become a self-sufficient engine of growth and jobs,” Ahmed said.

Oil importers gain little

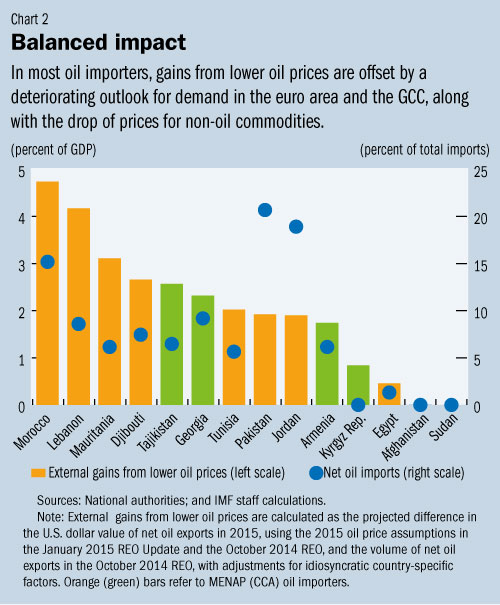

For oil importers, lower oil prices provide welcome relief. As energy import bills are reduced, pressures on government budgets ease reflecting the lower cost of subsidizing fixed energy prices (see Chart 2). In addition, lower energy costs can lessen production costs and raise disposable income if they are passed on to companies and consumers, the report says.

However, in most oil-importing countries, gains from lower oil prices are offset by other factors. A deteriorating outlook for demand in the euro area and the GCC, along with the drop of prices for non-oil commodities, which some countries export, erode the windfall gains from lower oil import bills.

The IMF stressed that the future course of oil prices remains highly uncertain and, hence, oil importers should avoid entering into spending commitments that would be hard to reverse if oil prices returned to higher levels or in the face of other adverse developments.

The IMF stressed that the future course of oil prices remains highly uncertain and, hence, oil importers should avoid entering into spending commitments that would be hard to reverse if oil prices returned to higher levels or in the face of other adverse developments.

The report emphasized the need to continue energy subsidy reforms and the importance of high and sustainable growth to deal with the chronic issue of unemployment, especially in the MENAP region.

“Sustained growth of over 8 percent would be needed to markedly reduce unemployment and raise people’s incomes,” Ahmed told reporters, adding that the key is to use this period of lower oil prices to step up economic reform efforts, especially in areas of the business environment, governance, education, and trade integration.