Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Donor Support Crucial to West Bank and Gaza’s Recovery

May 19, 2015

- Gaza struggles to rebuild economy after last summer’s war

- West Bank economy continues to labor under weight of Israeli restrictions

- Israeli-Palestinian peace will be key to turning around economy

The West Bank and Gaza will need policy discipline and donor support in the short run, but a new financing model will be essential over the medium term for sustained private-sector-led growth, the IMF says.

West Bank harvesters: Economic reforms and donor support will help sow the seeds of West Bank and Gaza’s future growth (photo: Mohamed Torokman/Reuters)

MIDDLE EAST AND NORTH AFRICA

The Gazan economy is struggling to rebuild in the wake of the violent conflict last summer that resulted in losses of over $4 billion. The war also affected confidence in the West Bank, where Israeli restrictions on the movement of labor, access to resources, and trade continue to undermine growth prospects.

The IMF has issued its latest report on the economy of the West Bank and Gaza in advance of the May 27 meeting of the Ad Hoc Liaison Committee, a coordination mechanism chaired by Norway for development assistance to the Palestinian people.

IMF mission chief Christoph Duenwald spoke to the IMF Survey about the report’s findings, outlining what the Palestinian Authority can do to turn the economy around and how the international community can assist.

IMF Survey: The Gaza-Israel conflict dealt a harsh blow to the Palestinians in the summer of 2014. What was the impact on the economy of West Bank and Gaza?

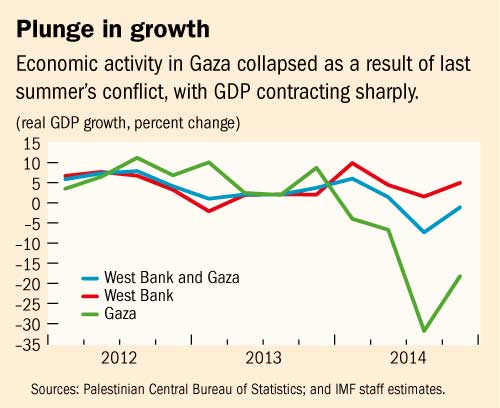

Duenwald: Gaza, where the war played out, saw real GDP decline by 15 percent last year. According to official estimates, the losses from the war are over $4 billion, about 35 percent of West Bank and Gaza’s GDP. Tens of thousands of homes and enterprises were destroyed or damaged, businesses shut down, and utilities and infrastructure were severely damaged.

The humanitarian impact of the war was devastating. More than 2,100 Palestinians died during the conflict, with thousands more injured, and a third of the population was internally displaced. After 51 days of war, there was a truce that ended the fighting, but there’s no permanent truce yet between the two sides.

IMF Survey: Can you provide an update on where things stand now with the economy?

Duenwald: The economy faces very severe challenges. Even if you don’t factor in last year’s conflict, growth in recent years has not been sufficient to absorb the rapidly growing labor force, so unemployment rates have been very high, especially in Gaza.

In Gaza, reconstruction is proceeding slowly, which reflects in part limitations on the import of construction materials into Gaza. Still, we expect some rebound this year from a low base, with real GDP growing at 7 percent. A big challenge in Gaza is the high unemployment rate, which stands currently at 43 percent overall and at 60 percent among the youth. With the rebuilding of Gaza stalled and many youth unemployed, there is a risk of social unrest.

In the West Bank, we project very modest growth in 2015, after the non-transfer of revenues collected by Israel on the Palestinian Authority’s behalf led to sharply reduced wage payments to civil servants. Now that these transfers have resumed, growth should recover modestly, averaging around 1 percent in 2015.

IMF Survey: What is the IMF’s role in assisting the West Bank and Gaza?

Duenwald: While the IMF cannot provide financial support to the West Bank and Gaza because it is not a member country, we have been providing policy advice in the macroeconomic, fiscal, and financial areas since 1994. We established an IMF Resident Representative Office for the West Bank and Gaza in July 1995 to help fulfill the IMF’s mandate to assist the Palestinian Authority as specified under the Oslo Accords. We’ve also been providing technical assistance to support capacity building in the areas of tax administration, public expenditure management, banking supervision and regulation, and macroeconomic statistics.

IMF Survey: What measures should the authorities take to close the financing gap and put the economy on the path to fiscal sustainability?

Duenwald: The intense fiscal pressures earlier this year caused by the Israeli withholding of clearance revenue (tax revenues collected by Israel on behalf of the Palestinian Authority) were nimbly handled by the authorities. Still, as in previous years, the IMF staff project a large financing gap this year, of nearly half a billion dollars. This means that expenditure is higher than revenue, donor aid, and other financing combined by that amount.

There are also significant downside risks—shortfalls in donor aid, higher-than-expected expenditures, and litigation risks that could involve payment of a large deposit in escrow in connection with the Sokolow lawsuit against the Palestinian Authority and Palestinian Liberation Organization in a New York court.

For 2015, we are advising the Palestinian Authority to keep a tight control over spending, especially the wage bill. We are recommending phasing out the fuel tax subsidy, while using direct cash transfers to protect the poor. There is also scope to strengthen revenue collection. But these measures alone will not close the gap, so stepped up donor assistance is needed.

IMF Survey: With very high unemployment, there’s a limit to how much revenue they can mobilize.

Duenwald: Exactly—that’s why it’s such a difficult situation. It is aggravated by lack of progress on national reconciliation between main Palestinian factions. Hamas remains largely in control of Gaza, and very little tax revenue is collected there yet there are significant expenses. So, if this financing gap is not met by donors or other financing, the West Bank and Gaza will continue to accumulate arrears. This means that private suppliers to the government would not be paid, and the impact of that would ripple through the economy and undermine confidence in the private sector. These developments would, in turn, affect revenue collection.

Over the medium term, we see a critical need to change the financing model. Currently, large deficits with heavy emphasis on current spending and shrinking capital spending are partially financed by generous (but at times fickle) donor aid. This has left financing gaps that are filled by arrears accumulation or bank borrowing. We think that it’s important from a sustainability perspective to change this approach to one that delivers gradually lower deficits with a pro-growth reorientation of government spending, and sustained predictable donor aid.

IMF Survey: The Palestinians have been in a precarious economic position for some time. What can be done to turn the situation around?

Duenwald: The West Bank and Gaza is an economy that is subject to restrictions imposed by Israel on the movement of labor, on access to resources, and on regional and international trade. Those restrictions will likely remain in place as long as there’s no peaceful solution to the conflict.

So I would emphasize four points:

• First, the need for peace between Israel and Palestinians. The overarching factor that constrains growth and greater integration with the global economy is Israeli restrictions—although the Israeli government emphasizes that security concerns limit its ability to lift the restrictions. Until a political solution to the Israeli-Palestinian conflict is found, these restrictions are likely to stay largely in place, although some easing is hoped for in the interim. The key to truly turning this situation around is peace.

• Second, the need for national reconciliation. Another requirement is a fully unified government. Currently there’s a divide between the main political factions, and it will be important for there to be a unified government that speaks with one voice operating in both Gaza and the West Bank. For Gaza specifically, a turnaround would also require a removal of the limitations on imports of construction materials, for donors to make good on the substantial support promised at the Cairo conference last October, and a lifting of the blockade of Gaza.

• Third, the need for reforms by the Palestinian authorities themselves. It is critical that the Palestinian Authority, which has made a lot of progress in institution building over the years, continue on a path of reform, with disciplined fiscal policies and courageous structural reforms. Safeguarding the financial system, which the Palestinian Monetary Authority has managed well so far, is a critical component of the overall policy framework.

• Fourth, the continued importance of donor aid. For the time being, the West Bank and Gaza cannot survive without continued donor aid, so it is important for the international community, which faces many competing demands for aid, to continue their support.