World Economic Outlook

Global slowdown and rising inflation

July 2008

[$token_name="PublicationDisclaimer"]

The global economy is in a tough spot, caught between sharply slowing demand in many advanced economies and rising inflation everywhere, notably in emerging and developing economies. Global growth is expected to decelerate significantly in the second half of 2008, before recovering gradually in 2009. At the same time, rising energy and commodity prices have boosted inflationary pressure, particularly in emerging and developing economies. Against this background, the top priority for policymakers is to head off rising inflationary pressure, while keeping sight of risks to growth. In many emerging economies, tighter monetary policy and greater fiscal restraint are required, combined in some cases with more flexible exchange rate management. In the major advanced economies, the case for monetary tightening is less compelling, given that inflation expectations and labor costs are projected to remain well anchored while growth weakens noticeably, but inflationary pressures need to be monitored carefully.

The Growth Slowdown Continues

The slowdown in global growth, which started last summer, is expected to continue through the second half of 2008, with only a gradual recovery during 2009.

Global growth decelerated to 4½ percent in the first quarter of 2008 (measured over four quarters earlier), down from 5 percent in the third quarter of 2007, with activity slowing in both advanced and emerging economies. The first quarter slowdown was somewhat less sharp than predicted in the April 2008 World Economic Outlook. However, recent indicators suggest a further deceleration of activity in the second half of 2008. In advanced economies, business and consumer sentiment have continued to retreat, while industrial production has weakened further. There have also been signs of weakening business activity in emerging economies.

Accordingly, global growth is projected to moderate from 5 percent in 2007 to 4.1 percent in 2008 and 3.9 percent in 2009 (see table). The picture is clearer on a fourth-quarter-on-fourth quarter (q4/q4) basis: growth would decelerate from 4.8 percent in 2007 to 3.0 percent in 2008, before picking up to 4.3 percent in 2009.

• Growth for the United States in 2008 would moderate to 1.3 percent on an annual-average basis, an upward revision to reflect incoming data for the first half of the year. Nevertheless, the economy is projected to contract moderately during the second half of the year, as consumption would be dampened by rising oil and food prices and tight credit conditions, before starting to gradually recover in 2009. Growth projections for the euro area and Japan also show a slowdown in activity in the second half of 2008.

• Expansions in emerging and developing economies are also expected to lose steam. Growth in these economies is projected to ease to around 7 percent in 2008-09, from 8 percent in 2007. In China, growth is now projected to moderate from near 12 percent in 2007 to around 10 percent in 2008-09.

Risks to the global growth outlook are seen as balanced around the revised baseline. Financial risks remain elevated, as rising losses in the context of a global slowdown could add to strains on capital and exacerbate the squeeze on credit availability. Moreover, as discussed below, inflation is a rising concern and will constrain the policy response to slower growth. On the positive side, demand in advanced and emerging economies might be more resilient than projected to recent commodity price and financial shocks, as was the case during the first quarter of 2008.

Risks related to global imbalances also remain a concern. The continuing decline in the U.S. dollar and slower growth of the U.S. economy relative to its trading partners have put the current account deficit on a more sustainable trajectory. However, the pattern of exchange rate adjustments has borne little relationship to the pattern of current account balances, as the euro and other flexible currencies have carried the brunt of U.S. dollar adjustment and there has been less movement in currencies of several emerging economies recording large external surpluses. Moreover, rising international oil prices have raised projected current account surpluses of oil exporting countries.

Inflation Is Increasingly a Problem

Inflation is mounting in both advanced and emerging economies, despite the global slowdown. In many countries, the driving force behind higher inflation is higher food and fuel prices. Oil prices have risen substantially above previous record highs in real terms, driven by supply concerns in the context of limited spare capacity and inelastic demand, while food prices have been boosted by poor weather conditions on top of continued strong growth in demand (including for biofuels).

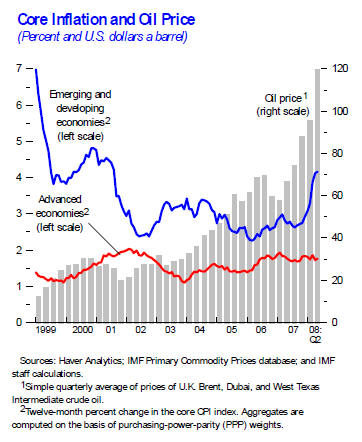

In advanced economies, headline inflation rose to 3.5 percent in May 2008 (12-month change), and, while core inflation remained at 1.8 percent, central banks have expressed growing concerns (see figure). The increase in inflation is more marked and broader in emerging and developing economies, where headline and core inflation have risen to 8.6 percent and 4.2 percent, respectively, the highest rates since around the beginning of the current decade. In these economies, food and fuel make up a larger share of consumption baskets and sustained strong growth has tightened capacity constraints.

Looking forward, in advanced economies, inflationary pressures are likely to be countered by slowing demand and, with commodity prices projected to stabilize, the expected increase in inflation for 2008 is forecast to be reversed in 2009. In emerging and developing countries, inflationary pressures are mounting faster, fueled by soaring commodity prices, above-trend growth, and accommodative macroeconomic policies. Hence, inflation forecasts for these economies have been raised by more than 1.5 percentage points in both 2008 and 2009, to 9.1 percent and 7.4 percent, respectively.

Food and Fuel Price Increases Have Pushed Some Countries to A Tipping Point

Commodity prices, particularly those of fuel and foods, have surged further since the release of the April 2008 World Economic Outlook, and the IMF's near-term commodity price baseline forecasts have been revised upwards (see Annex). The new oil price baseline, for example, is 30 percent higher than in the April 2008 WEO, consistent with oil futures market pricing. Commodity price increases are having a major impact on the global economy. Inflationary pressures around the world have intensified; purchasing power in commodity-importing economies has been eroded; and some low- and middle-income countries face difficulties in ensuring adequate food supplies for their poorest citizens and are in danger of losing the gains in macroeconomic stability achieved in recent years.

The analysis in the annex below, which examines the origins of surging food and fuel prices, suggests that price pressures are unlikely to abate much in the foreseeable future. The policy challenge, especially for low- and middle-income countries, is therefore to find ways to feed the hungry without also feeding inflation or depleting foreign exchange reserves.

Passing on the full price increases to consumers would encourage producers to increase supply and consumers to reduce demand. However, temporary and targeted social measures are also needed to help to cushion the impact of rising food and fuel prices. Furthermore, a multilateral effort is needed to address both the effects and the causes of the crisis. Some low-income countries will need help from the international community to finance imports and social spending. Others will need help in designing policies to adjust to the shock. In addition, there is a need for multilateral efforts to promote better supply-demand balance in commodities markets, including stronger responses to higher prices.

Financial Market Turbulence Remains a Significant Downside Risk

Financial market conditions remain difficult. Forceful policy responses to the financial turbulence and encouraging progress toward bank recapitalization seemed to have reduced concerns about a financial meltdown but, as events over the past week have underlined, markets remain fragile amid concerns about losses in the context of slowing economies. At the same time, extension of new credit will be constrained by the need to repair balance sheets. Accordingly, credit conditions in advanced economies are expected to remain tight in the coming quarters and efforts aimed at advancing balance sheet repair in financial sectors need to continue.

These issues will be discussed further in the Global Financial Stability Report Market Update, due to be released in late July.

Macroeconomic Policies Need to Balance Slowing Demand and Rising Inflation

Policymakers face a difficult environment. They need to head off rising inflationary pressure, while also being mindful of downside risks to growth.

Many central banks have tightened monetary policy stances but interest rates in emerging and developing economies generally remain negative in real terms, particularly in countries where exchange rate management has limited monetary policy flexibility.

The risk of second-round effects from the surge in commodities prices and continued stress in financial markets complicates the response to the slowdown, particularly in advanced economies. The case for policy tightening in these economies is stronger than before the recent oil price increase but still not established, given that inflation expectations and labor costs are projected to remain well anchored and growth momentum is weak. However, inflationary pressures need to be monitored closely. In many emerging economies, particularly those that continue to operate above trend growth, monetary policy needs to be tightened combined with greater fiscal restraint and, in some cases, with more flexible exchange rate management, in order to reverse the recent build-up in inflation.

Annex. Surging Fuel and Food Prices: Origins, Prospects, and Risks

This Annex discusses the origins, prospects, and risks associated with surging food and fuel prices. The origins of the boom in oil and food prices can be traced to the unusually strong global growth in 2003-07. The rapid growth in emerging and developing economies in particular has catalyzed demand for commodities, as the industrialization take-off and strong per capita income increases from a low base are associated with more commodity-intensive economic growth. Thus, slowing growth in advanced economies has had less impact on commodity prices than in previous business cycles.

Global growth performance alone, however, cannot explain the emergence of the broadest and most buoyant commodity price boom since the early 1970s. This annex argues that, broadly speaking, growing supply problems in conjunction with a low short-term responsiveness of demand and supply to price increases have underpinned much of the sharp run-up in prices of fuels and foods.1 It is well known that commodity prices tend to respond particularly strongly to demand (or supply) shocks when spare capacity or inventories are limited.

In the oil market, the strong upward momentum in prices has reflected a sluggish supply response against the backdrop of already stretched spare capacity at the start of the global recovery. There is now widespread realization that production and distribution capacity will be slow to build up, reflecting soaring investment costs, technological, geological, and policy constraints, as well as the run-down of existing fields. This is expected to perpetuate very low spare capacity and tight market conditions. High oil prices along the entire futures price curve now partly reflect expectations that only sustained high prices will induce the massive investment required to satisfy demand going forward. In this environment, oil prices have been very sensitive to any news signaling risks of short-term supply disruptions, including those related to geopolitical risks.

Financial conditions have temporarily added to upward pressure on prices of oil and other commodities. Some financial variables, notably exchange rates, affect prices of oil and other commodities through their impact on physical demand and supply of oil. In contrast, there is little evidence that the increasing investor interest in oil and other commodities as an asset class has affected price trends for oil and other commodities, although purely financial factors, including shifts in market sentiment, may have short-term price effects.

Turning to food commodities, the recent price surges reflect a confluence of factors. Demand growth—partly reflecting the strong growth in emerging and developing economies noted earlier—has generally outstripped supply growth for many food commodities over the past 8-10 years, notably major grains and edible oils. Global inventories of these crops have thus declined to low levels last seen in the mid-1970s.

The general upward pressure on prices has been strongly reinforced by a number of developments since 2006.

• Unfavorable weather conditions reduced harvest yields in both 2006 and 2007 in an unusually large number of countries. Wheat harvests, in particular, had been adversely affected, which led to a sharp bidding-up of wheat prices, with spillovers into close substitutes (particularly rice).

• Rising biofuel production in advanced economies—in response to higher oil prices, and, increasingly, generous policy support—has boosted food demand. In particular, rising corn-based ethanol production accounted for about three-fourths of the increase in global corn consumption in 2006-07. This has pushed up not only corn prices but also prices of other food crops and, to a lesser extent, edible oils (through consumption and acreage substitution effects), and poultry and meats (feedstock costs).

• The rise in oil prices and energy prices more generally has boosted production costs for food commodities, through the impact on transportation fuels and fertilizer prices (the latter have more than tripled since early 2006).

• The growing use of export restrictions by food exporters to raise domestic food supplies and lower domestic prices has put pressure on world prices. Export restrictions by some major rice exporters likely contributed substantially to the run-up in rice prices in 2008.

Oil and food prices are likely to remain high and volatile, with the baseline forecast showing only moderate declines, as the impact of many of the factors discussed above will be lasting while low inventories and capacity margins are expected to persist for some time. Oil production is expected to remain broadly stagnant, as much of the small amount of new capacity coming on stream is likely to be offset by further production declines in existing fields. In food markets, rising biofuels production and continued strong net demand from emerging and developing economies should continue to exert pressure on some prices. Among the more temporary factors, weather conditions seem likely to have mixed effects this year. Wheat prices have declined by some 30 percent from their March 2008 peak on expectations of a better harvest, but corn and soybean prices have risen further because of harvest concerns. In the medium term, food prices should ease more substantially, as there are, in principle, less lasting constraints on supply expansion than in the oil sector, provided that appropriate policy incentives are in place.

1 Oil demand in many countries has recently been increasingly sheltered from rising world market prices (see "Food and Fuel Prices-Recent Developments, Macroeconomic Impact, and Policy Responses").