As a commodity exporting region, Latin America has greatly benefited from the commodity price boom of the past decade. But with talk of a new global recession, what will happen to the region if the boom turns to bust?

The IMF’s latest Regional Economic Outlook: Western Hemisphere sheds light on Latin America’s reliance on commodities from a historical perspective. Our study also looks at the effect of a sharp decline in commodity prices on emerging market economies and on the policies that could shield countries from that shock.

More dependent but also more diversified

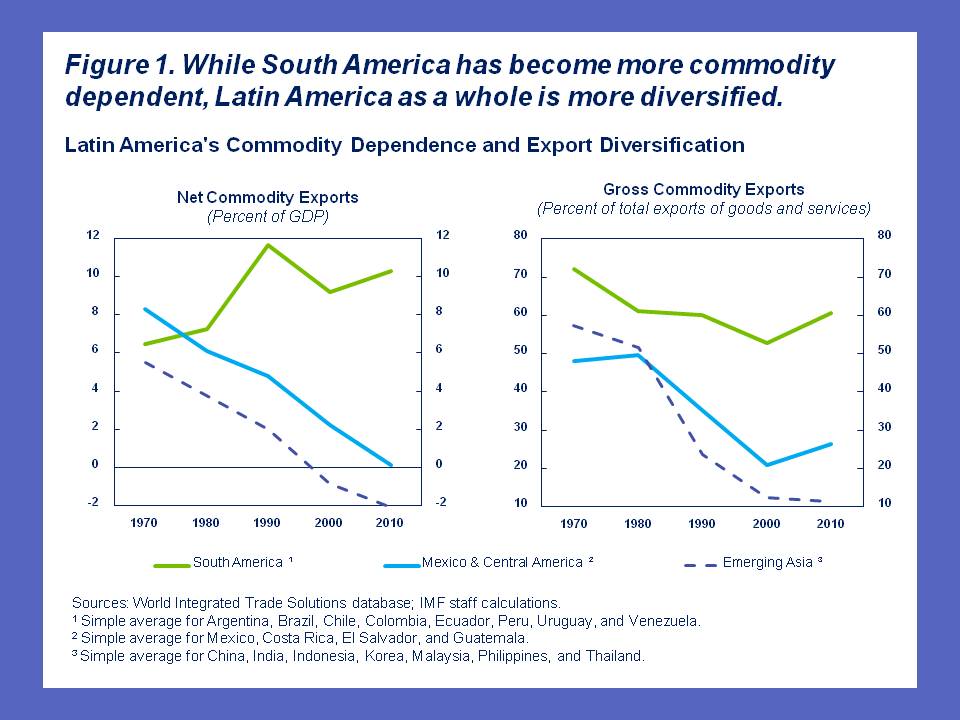

The reliance on commodity exports can be looked at as a share of GDP (commodity dependence) as well as relative to total exports of goods and services (export diversification).

The first ratio tells us about the potential impact of a commodity price shock on domestic output, while the second tells us about the economy’s ability to adjust to a commodity price shock. There are significant differences within the region across these two dimensions:

- South America is as commodity dependent (or more) as four decades ago, with exports of basic goods reaching about 10 percent of GDP in 2010 (see Figure 1, left panel). But this contrasts markedly with the pattern seen in Mexico and Central America—where commodity dependence has fallen sharply, reaching balanced trade in 2010. It is also very different from the trend observed in emerging Asia, which has gone from being a net commodity exporter in 1970 to a net importer in 2010.

- At the same time, Latin America as a whole is today more diversified than four decades ago, as noncommodity exports have grown even more rapidly than commodity exports during the past 40 years, especially in Mexico & Central America (see Figure 1, right panel). But not all countries have followed this trend: heavy energy (Colombia, Ecuador, and Venezuela) and metal exporters (Chile and Peru) have witnessed both increasing dependence on and little (or no) diversification away from commodities, making them especially vulnerable to a commodity price slump.

Metal and energy prices are highly sensitive to global growth

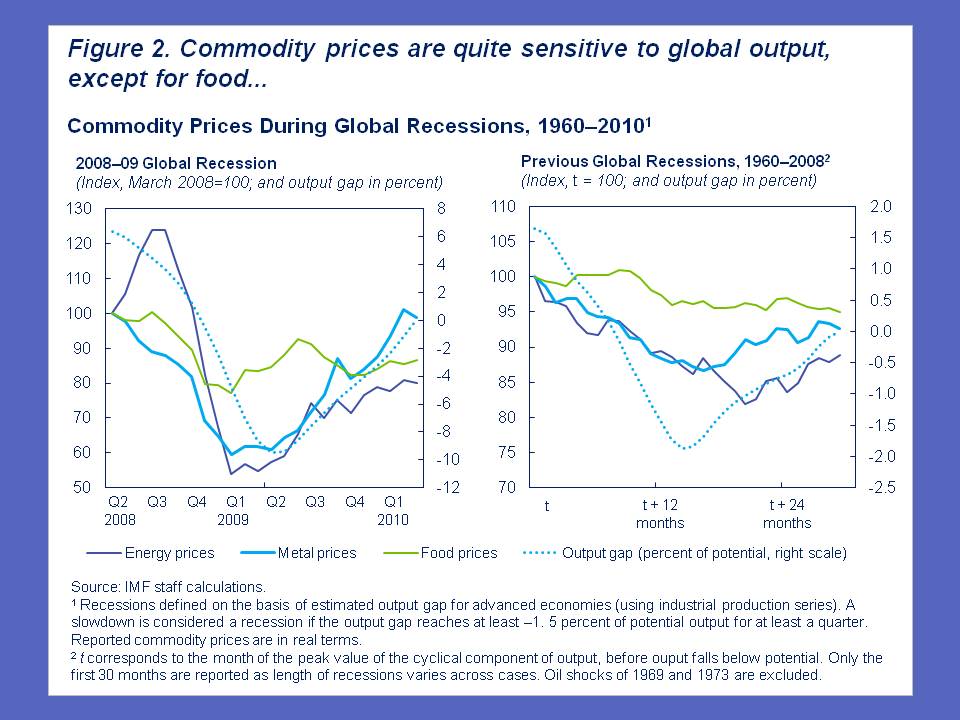

Prices of many commodities have moved closely during the last cycle, but the magnitude of their booms and their sensitivity to global output have varied across categories (see Figure 2):

-

Energy and metal prices have tripled since 2003, and current prices are not far from the historic peaks of the 1970s. However, these prices are highly sensitive to global output, as seen during the 2008–09 crisis and all previous recessions (the only exception being the oil shocks of the 1970s).

-

The surge in food prices since 2003 has been less spectacular. Prices are up about 50 percent, and they have only partly reversed the pronounced downward trend seen for several decades. At the same time, food prices are much less sensitive to world growth.

Policies matter

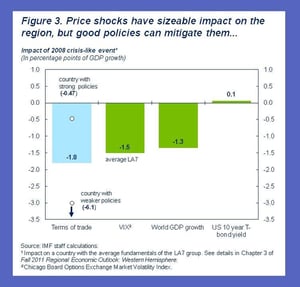

The history of sharp terms-of-trade drops during the past 40 years tells us that these price shocks can have a sizeable impact on the region, and can be even more important than other external shocks (see Figure 3). But their magnitude cannot fully explain how countries fare during episodes of price busts.

Instead, policies during the boom years play a critical role in determining a country’s subsequent economic performance. Our study finds that:

- Countries that behave more prudently during the boom phase of commodity price cycles—preventing a deterioration of their underlying fiscal and external positions—perform better during the bust.

- Exchange rate flexibility is a powerful shock absorber, although less so in the context of highly dollarized economies.

- In countries with strong fundamentals, the extent of financial integration with the rest of the world can also play an important role in buffering the shock, by helping to keep external funding available.

Latin America has reaped the benefits of the commodity boom of the last decade. But preserving those gains requires undertaking the right set of policies to be prepared for a possible bust, while favorable conditions last. This is especially important in the case of metal and energy exporters, which are particularly vulnerable to a global slowdown.