In mid 2010 the Turkish central bank decided to introduce a policy that increased uncertainty in interest rates hoping that would stop foreign investors who were pouring money into the country in search of a quick buck. That’s right. ‘Keep calm and carry on’ was replaced by ‘Keep them guessing.’

The Turkish economy was overheating. Money poured into the country from foreign investors attracted by a strong economy and high yields. A lending boom resulted in excessive growth along with an appreciating exchange rate and widening current account deficit. While evidence of success, these kinds of capital inflows are a headache policymakers would rather avoid, as they expose a country to risks that affect the economy and financial system as a whole, while undermining the objective of controlling inflation.

Turkey’s unorthodox approach to this problem earned central bank governor Erdem Başçi the 2013 “Banker of the Year” award from the Financial Times’ The Banker magazine. Although it is too soon to judge the benefits and drawbacks of Turkey’s approach, there are a number of lessons about the world of monetary policy in the wake of the global crisis for both advanced and emerging economies. In particular, a lack of policy coordination and clear communication can undermine the success of any approach.

Act I: Keep them guessing

Although targeting inflation, in 2010 the Turkish central bank became increasingly vocal about dangers to financial stability. In the absence of a timely response from the banking supervisor, it started to employ less traditional tools with an explicit purpose of addressing both price and financial stability concerns. A cornerstone of the strategy was using policies that created uncertainty.

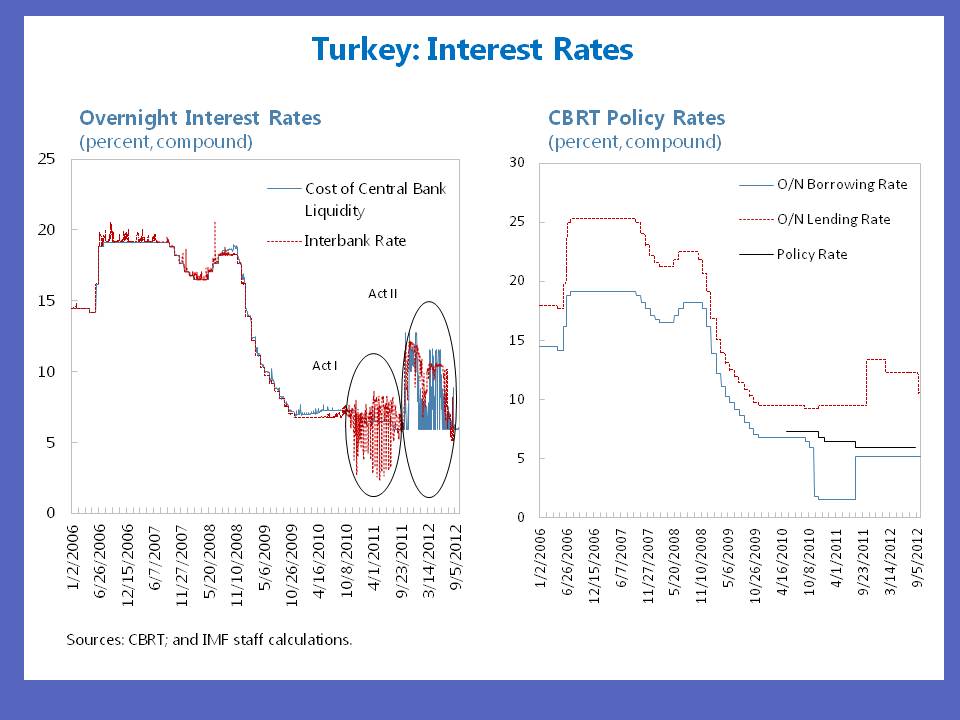

In October 2010, the central bank sharply lowered the overnight borrowing rate, at which banks deposit money at the central bank, while keeping the overnight lending rate, at which the central bank lends money to banks, unchanged. By varying the volume of liquidity provided to the markets through repo auctions, which are essentially short-term collateralized loans, it started to generate a lot of volatility in the overnight interbank rate within this widened interest rate corridor (Chart 1).

The corridor, formed by the two overnight rates, became a signaling device for investors. Previously, the overnight interbank rates were kept close to the policy rate at which the central bank provides liquidity through quantity repo auctions, indicating the potential rate-of-return for a foreign investor. As the corridor widened, the volatility of the market rates increased. While on average the market rates continued to be close to the policy rate, now it was the “floor” of the corridor that signaled to investors a guaranteed rate-of-return. Lowering it, it was hoped, would deter speculative inflows.

Meanwhile, to directly impact lending to the economy, the central bank opted to rely on the required reserve ratios. These are portions of deposits that banks attract and by regulation cannot lend out. Besides being a monetary policy instrument, the required reserves also served a macroprudential purpose, lowering systemic risks from excessive credit growth. The central bank stopped remunerating the reserves, increased the ratios, and differentiated them by maturity, making reliance on short-term funding more expensive.

However, it was not until the second half of 2011 that lending started to slow down: in June, the banking supervisor introduced macroprudential measures that made consumer loans costlier; the central bank publicly expressed its preference for a 25 percent credit growth; and, finally, external conditions started to worsen.

Act II: The pivot to progress

Even though Turkey’s credit growth decelerated, the central bank had to significantly alter its approach to monetary policy in late 2011 when capital inflows weakened. This caused the lira to depreciate beyond original intentions, bringing inflation to 10.4 percent, while the current account deficit still rose to 10 percent of GDP, the second highest in the world in dollar terms.

By late December, the central bank increased both the overnight and lending rates, switched to selling its foreign exchange reserves, and lowered the required reserve ratios. At that time, it felt it needed more flexibility given the crisis in Europe and the uncertain outlook for both the Turkish and the global economy.

So it began to provide liquidity to the markets through different repo facilities: the quantity auctions at the policy interest rate and the price auctions with interest rates determined by the market. Varying the amounts of liquidity provided through these facilities allowed the central bank to change the cost of lending to banks literally on a daily basis, tightening whenever conditions required and loosening when the domestic economy needed support (Chart 1). Once again these policies created uncertainty, this time for local banks.

The central bank also stopped its foreign exchange market operations as investors started to perceive it as overreaching its mandate by aiming at certain levels of the exchange rate. Instead, it allowed banks to convert part of their required reserves on lira liabilities into foreign exchange and gold. The goal of this—not yet fully tested—facility, the Reserve Option Mechanism (ROM), is to allow market forces to determine the exchange rate while mitigating pressures from volatile capital flows.

In 2012 Turkey secured a soft landing: the economy grew 2.2 percent, the current account deficit narrowed by some 4 percentage points of GDP, and inflation ended up at 6.2 percent. This is in sharp contrast with the downturns in 2001 and 2009 when sizeable adjustments in the current account deficit were accompanied by significant declines in the country’s economic output. But the jury is still out on just how much of this success was due to the country’s complex monetary policy framework.

Live and learn

Turkey’s experiment offers a few important lessons:

Policy coordination is crucial for success. The banking supervisor could have employed macroprudential measures sooner than June 2011, reducing financial risks that affect the economy. This would have reduced the pressure on the central bank, which was fighting battles alone on several fronts, allowing it to concentrate on what it could do best—control inflation.

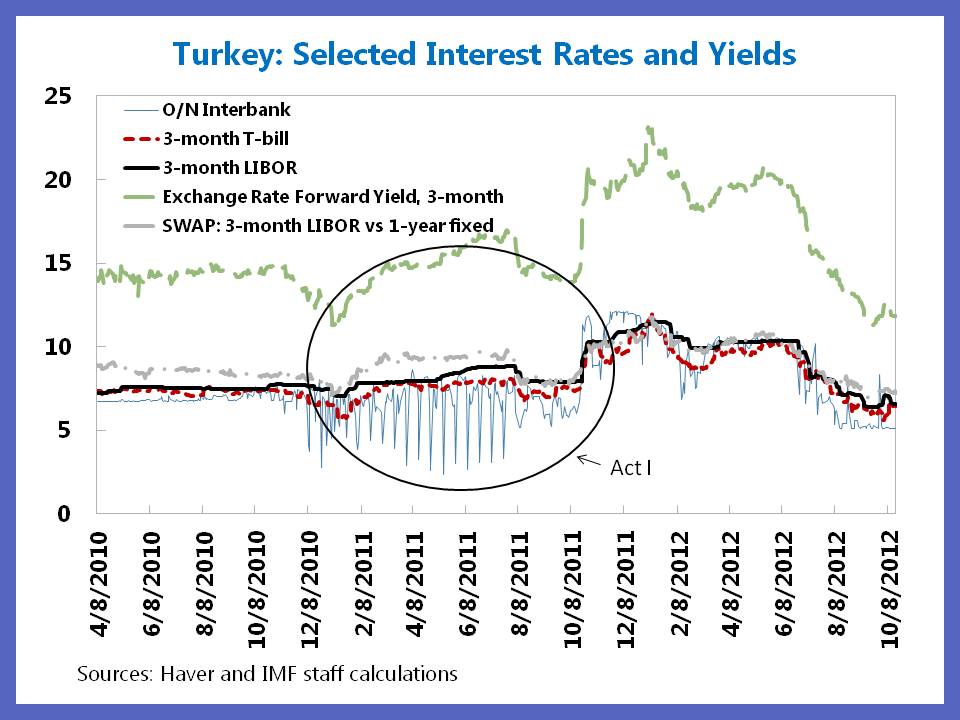

Complex approaches come at a cost and results are difficult to predict. With too many objectives and tools, and in absence of clear messages, market participants got confused about the ultimate goal of the policies. This weakened the transmission of monetary policy to inflation expectations and market interest rates. Contrary to expectations, uncertainty in the overnight interbank rates did not lead to a decline in other yields as hoped (Chart 2).

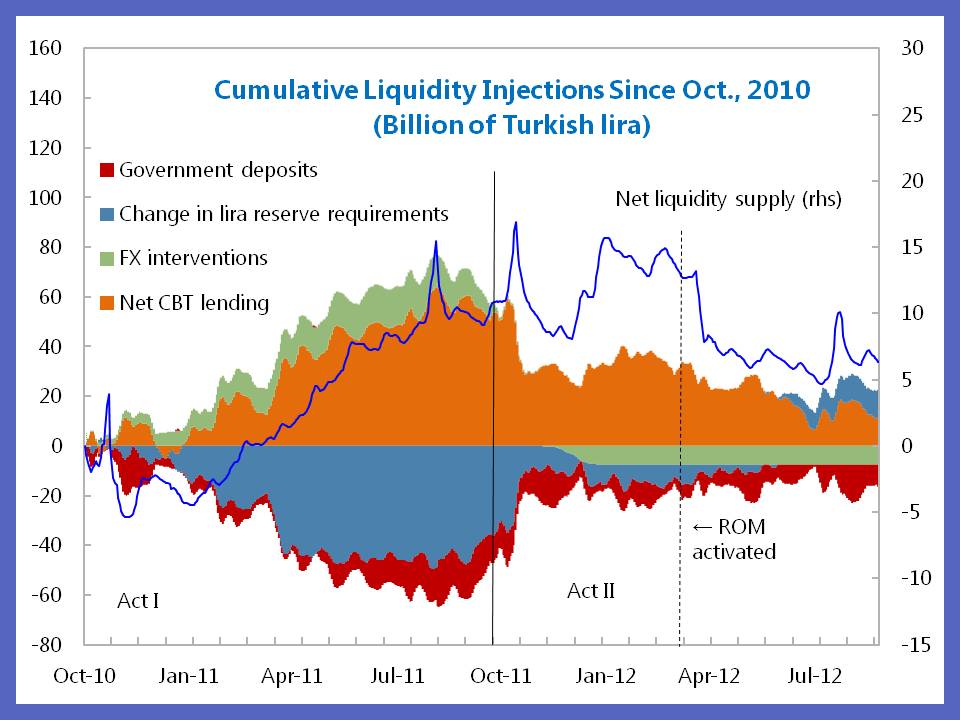

It is the amount of liquidity that matters, not how it is provided by the central bank. The central bank employed various tools for different purposes, but in the end, inflation rose and the currency weakened when the cumulative injection of liquidity peaked. Likewise, the currency stabilized and inflation started to decrease only when liquidity was tightened (Chart 3).

In 2012, after almost two decades, Turkey received an investment grade from Fitch, a vote of confidence by financial markets. The ability of the country’s policymakers to navigate the economy to a soft landing was an important factor. But the path was not smooth, and it offers an important lesson: lack of coordination and clear communication can undermine the success of any approach, no matter how thoroughly thought through.