(Version in Español & Português)

For many Latin American and Caribbean economies, clouds have appeared on the economic horizon. As the global growth momentum shifts from the emerging to the advanced economies, the strength of domestic economic policies will be crucial for how countries can cope with the combination of lower commodity prices and tighter external financing conditions.

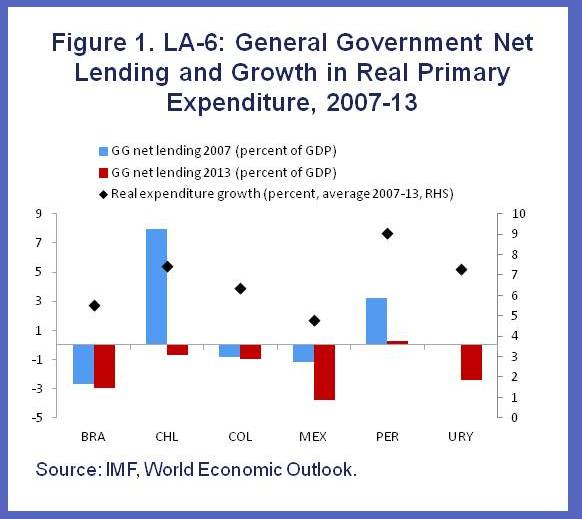

Lower commodity prices have already started to affect the region’s commodity exporters. Even though prices remain high by historical standards, countries can no longer count on the tailwind from ever-improving terms of trade, which had propelled economic activity over the past decade.

Meanwhile, longer-term U.S. interest rates have started to rise, with knock-on effects for emerging markets. Across all of the financially integrated economies of Latin America, bond yields have increased, equity prices have fallen, and currencies have depreciated since May, when the U.S. Fed first mentioned the possibility of tapering its bond purchases later this year. Financial conditions remain fairly benign for now, but the strong tailwind from ultra-low external financing costs may also be gone for good.

Against this backdrop, economic activity across the region has continued to moderate. As detailed in our latest Regional Economic Update, presented in Washington, D.C. today, we project growth this year at 2¾ percent, the lowest rate in ten years, with the exception of 2009.

For 2014, we are projecting a pick-up to about 3 percent, but even this rate remains well below the average annual growth of 4 percent observed between 2003 and 2012. The outlook holds particular risks and uncertainties for those economies in the region that depend heavily on commodity exports and are less well placed to benefit from higher U.S. growth.

Strong domestic policies are key

With less supportive external conditions in the offing, the strength of domestic economic policies will be crucial for how individual countries can cope. Fortunately, many of the larger economies in the region are in a good position to weather more challenging times, as policy frameworks and economic fundamentals have been strengthened over the past decade. Banking systems are generally healthy and well-funded; external debt is moderate; official foreign exchange reserves are sizable; and flexible exchange rates are acting as a useful buffer for shocks, while allowing countries to adjust monetary policy within their inflation targeting frameworks.

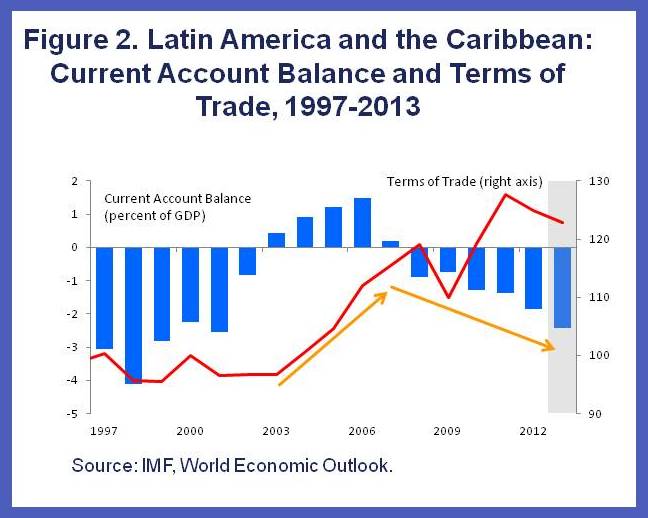

Still, there are reasons for caution. Fiscal balances are generally weaker than they were on the eve of the global financial crisis, reflecting expansionary policies since then (see Figure 1). External current account deficits have widened, creating a potential vulnerability at a time of tightening external funding conditions (see Figure 2). The long period of very loose credit conditions has also encouraged greater risk-taking and some build-up in leverage that may have created pockets of financial fragility. Finally, economic activity in several countries is bumping against supply constraints that reflect insufficient investment in infrastructure and other policy shortcomings.

Avoid fiscal stimulus

How should policymakers deal with these challenges?

The first priority is to calibrate macroeconomic policies appropriately. Even though near-term growth is projected to be well below recent cyclical highs, output is generally close to potential. In fact, tight labor markets, infrastructure bottlenecks, and sizable current account deficits all point to very limited spare capacity in most of the larger economies. Under those circumstances, now is not the time to respond to a slowdown with fresh stimulus. Fiscal policymakers, in particular, should be wary of extending themselves further, especially since the expansion launched in response to the global financial crisis is yet to be reversed.

This is not to say that policymakers should sit on their hands. The period ahead is likely to bring fresh shocks and bouts of volatility that need to be handled carefully. For the most part, monetary policy and flexible exchange rates provide the right tools to cope with such shocks. In case of sudden large pressures for capital outflows, central banks should also stand ready to use foreign exchange interventions to preserve orderly market conditions. However, it is important not to try and defend exchange rates at fundamentally unsustainable levels, or to use interventions as a substitute for a necessary tightening of macro policies. More broadly, there is no better insurance against market pressures than maintaining credible policy frameworks and strong buffers.

Focus on structural reforms to boost medium-term growth

Looking beyond short-term stabilization policy, it is clear that the region will require extra efforts to ensure sustainable, robust growth over the medium term. Structural reforms should aim squarely at boosting productivity and addressing the chronic shortage of domestic saving to finance investment. Redirecting budgetary resources toward critical capital spending, enhancing the quality of education, and improving the business climate are but a few examples of what is needed across much of the region.

In sum, an exceptionally bright decade has come to an end, and policy frameworks in the region will have to stand the test of less favorable weather conditions over the period ahead. With the right emphasis on macroeconomic prudence and targeted structural reforms, Latin America and the Caribbean should be able to shine even under cloudier skies.