(Version in Türk)

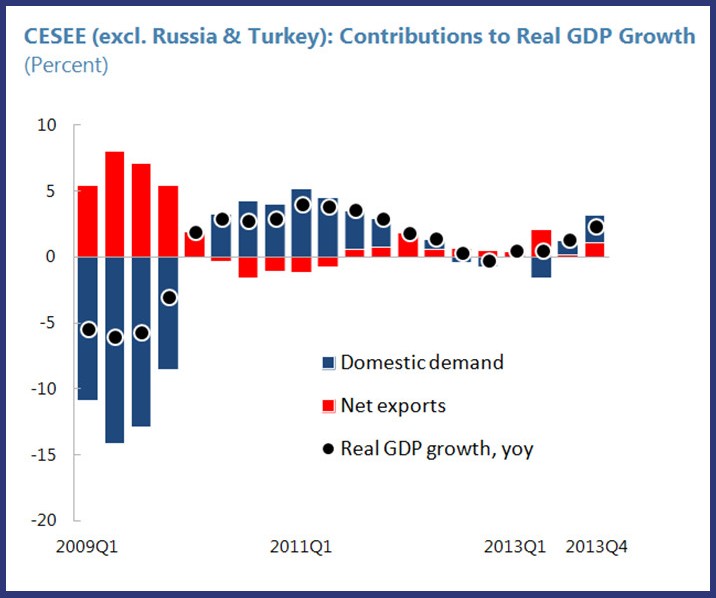

Growth is gathering momentum in most of Central, Eastern, and South-Eastern Europe (CESEE) in the wake of the recovery in the euro area. Excluding the largest economies—Russia and Turkey—the IMF’s latest Regional Economic Issues report projects the region to grow 2.3 percent in 2014, almost twice last year’s pace. This is certainly good news.

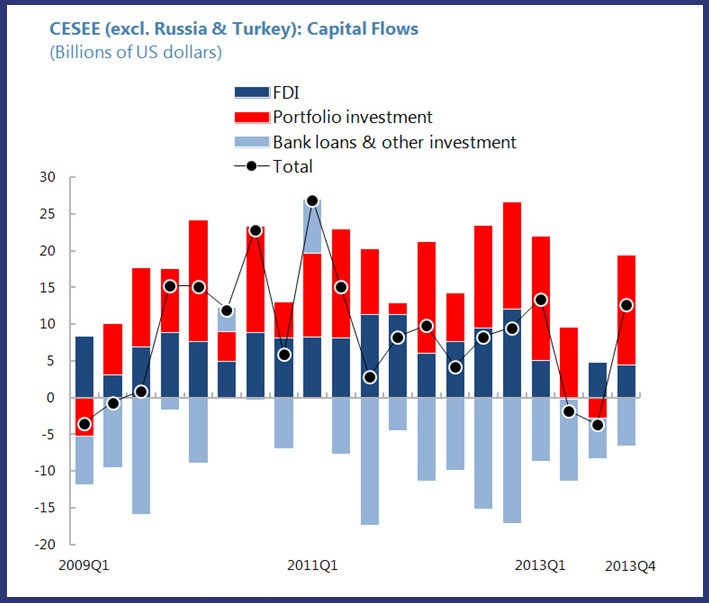

But an unusual constellation of risks clouds the outlook. Geopolitical tensions surrounding Russia and Ukraine, more challenging global financial conditions as monetary policy in advanced economies normalizes, and the possibility of protracted weak growth in the euro area could take a toll on the region’s growth prospects. As market jitters over Fed tapering intensified, portfolio outflows from the region (excluding Russia and Turkey) exceeded inflows in 2013Q3—for the first time since 2009. This may have been a warning signal that the road to monetary policy normalization in advanced economies may be bumpy for CESEE region.

How vulnerable is the region to tighter external conditions?

The region is diverse, encompassing 22 countries—Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kosovo, Latvia, Lithuania, Macedonia, Moldova, Montenegro, Poland, Romania, Russia, Serbia, Slovak Republic, Slovenia, Turkey, and Ukraine.

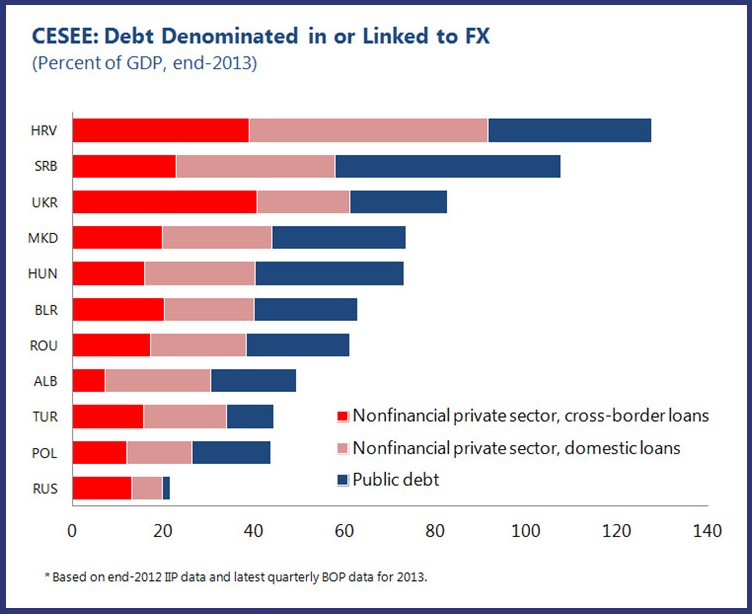

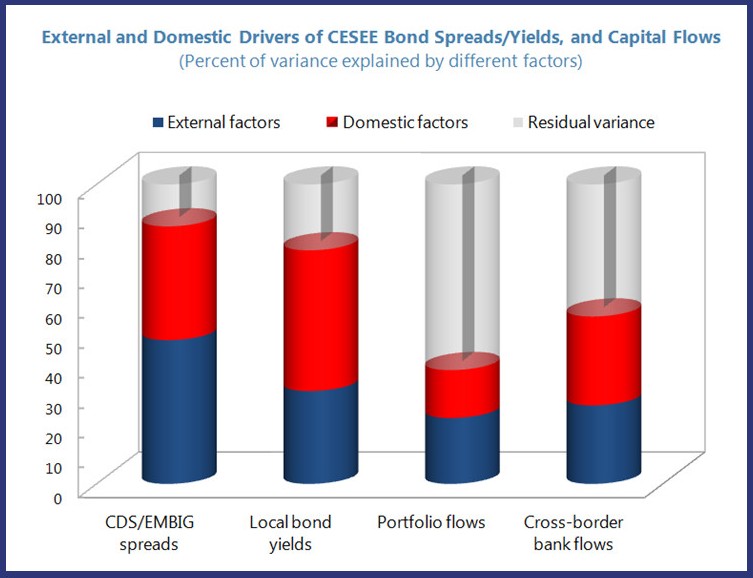

Most of these countries have greatly improved their current account positions since 2007, but many still have a high stock of external debt and large refinancing needs. And some have increasingly borrowed in foreign currency and from non-residents, which exposes them to currency movements and sudden shifts in foreign investor appetite, as was evident in May and June last year and again in January of the current year. Empirical analysis in our April 2014 report [link to report] confirms that higher interest rates in advanced economies, higher global investor risk aversion, and tighter global liquidity conditions have been associated with increased funding costs and reduced capital flows to CESEE countries.

Most countries in the region rely on a few common creditors (large cross-border banks or global asset management companies) which makes them vulnerable to spillovers through those lenders. For example, Austrian banks serve as the largest cross-border lenders to the region, on a scale equivalent to over 60 percent of Austria’s GDP. A shock to a country in which Austrian banks have high exposure, or a shock in Austria itself, could prompt readjustment of the entire portfolio of regional exposures by Austrian banks.

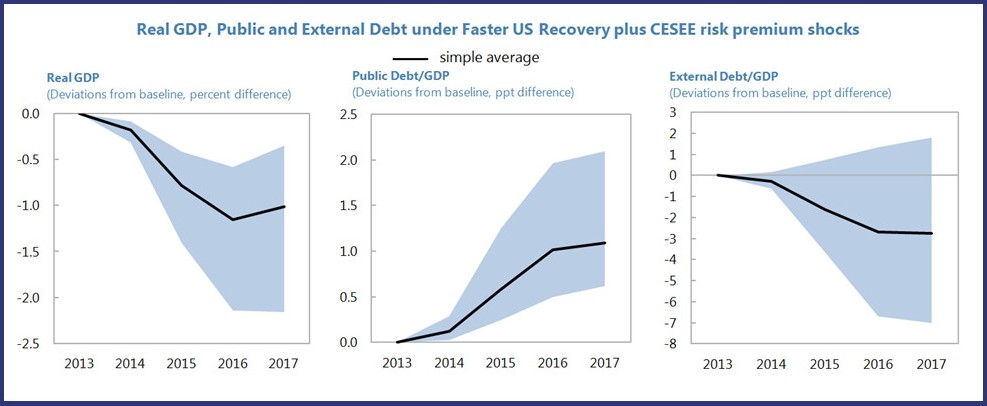

Faster-than-expected normalization of U.S. monetary policy accompanied by heightened financial market volatility would have a net negative—but manageable—effect on most countries in the region. Simulation analysis in our April 2014 report shows that a faster U.S. economic recovery, which would presumably accompany faster normalization, would boost growth. However, for most countries, this positive effect could be more than offset by the contractionary impact of tighter global monetary conditions and financial market volatility.

Taking steps to safeguard the recovery

Bigger buffers matter a great deal in reducing the effects of external shocks and unlocking higher growth potential. Better domestic fundamentals—such as higher economic growth potential and lower fiscal and current account deficits—are strongly associated with lower sovereign bond yields, which helps countries better manage their debt burden by allowing them to borrow at a lower cost. On the other hand, less favorable domestic factors—such as higher public sector debt or lower market liquidity—tend to push yields higher. Our empirical analysis also suggests that weaknesses in host-country macroeconomic and banking sector fundamentals (asset quality, profitability, heavy reliance on non-deposit funding) increase the risk of outside lenders cutting back cross-border funding.

In the end, strong and measured policies will be essential:

- Countries with exchange rate and monetary policy flexibility should continue to use it as the principal line of defense during episodes of market volatility.

- Diversifying funding sources and deepening the local investor base will reduce countries’ vulnerability to shocks and to contagion through common lenders.

- Rebuilding fiscal space and addressing problems exposed by the crisis—structural weaknesses that are holding back growth and keeping unemployment unacceptably high and high levels of nonperforming loans that are hamstringing credit—will raise growth potential and help to safeguard against external shocks.