Many advanced countries need structural reforms to make their economies more productive and raise long-term living standards. Our new research shows that provided countries can afford it, fiscal policy, through spending or tax incentives, can help governments overcome some obstacles to the reforms, particularly in the early stages.

Structural reforms help boost employment, encourage business start-ups, and raise productivity. For example, reforms to product markets, such as deregulation in industries like energy and transportation, can boost competition among firms. Reforms to labor markets, such as lower employment taxes and changes to unemployment benefits can help workers join the labor force and find jobs.

At the same time, some of these reforms can entail short-term economic costs, and often face strong political opposition from vested interests.

Our analysis shows that:

- Reforms do not just grow the economy, they also reduce public debt burdens over time. Implementing reforms will therefore help cash-strapped governments.

- Because reforms tend to boost growth and raise tax revenue, combining reform packages with temporary fiscal support—in the form of spending on high-return projects or tax incentives—may reduce rather than increase a country’s debt burden over the medium term, even when such incentives are provided in a way that does not increase the budget deficit.

- However, for countries to consider such packages, they need to be able to afford it, and have sustainable fiscal positions, a robust medium-term fiscal framework, and a credible commitment to major reforms.

Growth and public finances win with reforms

Our findings are based on new empirical and model-based research of past labor and product market reforms in 26 advanced economies, as well as more detailed case studies of reforms in Finland, Germany, Ireland, the Netherlands, and the United Kingdom.

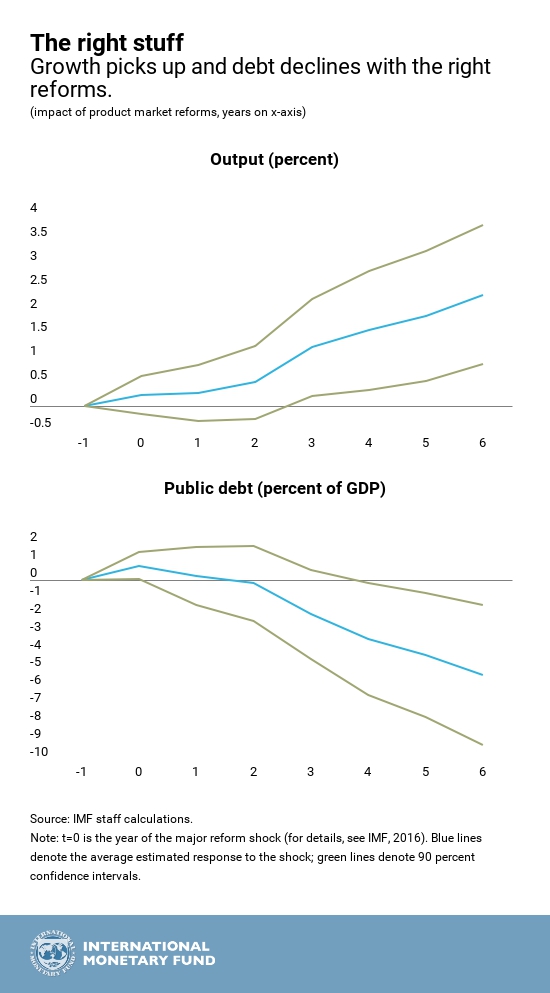

We found that labor and product market reforms generally increase GDP—up to 2-3 percent over the medium term, depending on the type of reform—by boosting productivity or employment.

In turn, higher GDP brings in more tax revenues to the government. Both higher GDP and increased tax revenues reduce public debt-to-GDP ratios. This has been the case on average, for example, in past product market deregulation, such as in the mid-1990s in several network industries in Germany such as the telecommunications and the energy sector.

Fiscal cost for fiscal gain

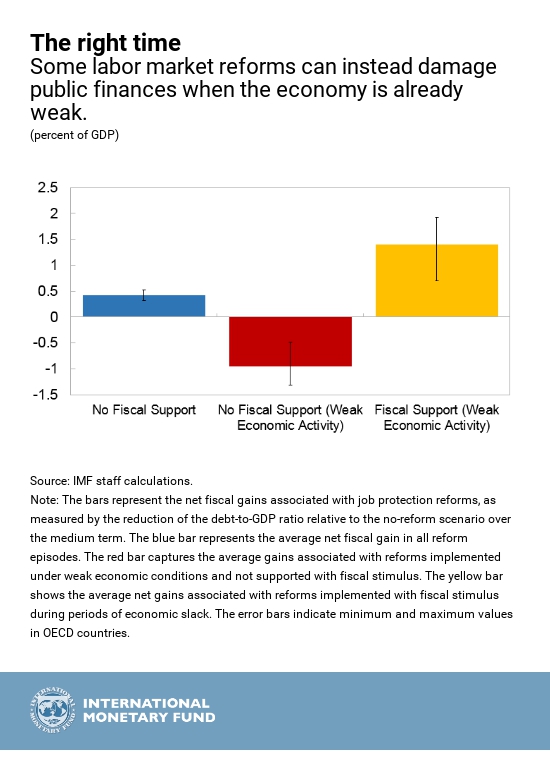

We also found that because some reforms can temporarily reduce rather than increase GDP, they can damage public finances in the process. This can happen, for example, when governments reduce employment protection for regular workers, or cut unemployment benefits when the economy is weak.

In such cases, in countries that can afford it, some temporary spending on high-return projects or tax incentives can make reforms work more effectively. This leads to fiscal gains over the medium term, when the output improvements due to reforms kick in. During the early stage of reforms, governments can use tax or spending incentives to help those most affected, which should help garner political support for the effort.

However, these policies may be counterproductive in countries with little money to spare, unless they are implemented in a budget neutral way. For example, Finland, Germany, and the United Kingdom reduced the tax burden for people with low incomes. But they combined cuts in personal income tax rates with reforms in unemployment benefits and other social safety nets to help those people affected by the reforms, without increasing the budget deficit.

Germany, Ireland, and the United Kingdom also combined incentives for product market reforms with reforms that reduced government spending—for example, cutting corporate taxes while also reducing government subsidies that benefitted industry. Occasionally fiscal sweeteners were provided, such as a tax write-off of capital losses from the deregulation of the taxi industry in Ireland, but only after reforms were implemented.

The efforts to reduce government debt and deficits while providing incentives for reform meant that in some countries harmful cuts were made in infrastructure investment.

The case for countries to decide when and how to use spending or lower taxes to support labor and product market reforms will vary. It depends on the type of reform, whether the economy is on a roll or in a spiral, and the government’s ability to increase spending or lower taxes to support reform.

Countries with sufficient room in their budgets can use it to provide temporary immediate support for reforms—particularly labor market reforms where the economy is weak.

What should countries without money to spare do?

Countries should push forward on labor and product market reforms, prioritizing those that have lower costs in the near term. Such reforms will reduce public debt-to-GDP over time and alleviate pressures on tight budgets.

These countries can also provide help, but in a budget neutral way, as part of a broader reform package. Moreover, they should design reforms in smart ways—for example, by passing job legislation reform that will come into force with a one- or two-year delay. This would encourage firms to invest and recruit in the near-term while the economy is still weak, without laying-off workers.

Reform ownership is critical

And for all countries, the case for providing fiscal support at the start of the reform process rests crucially on the credibility of the government’s commitment to strong implementation of comprehensive reforms and sustainable fiscal policies.