October 31, 2017

[caption id="attachment_21811" align="alignnone" width="1024"] The global financial crisis has left high levels of problem loans in the Caribbean (image: William Potter/iStock by Getty Images).[/caption]

The global financial crisis has left high levels of problem loans in the Caribbean (image: William Potter/iStock by Getty Images).[/caption]

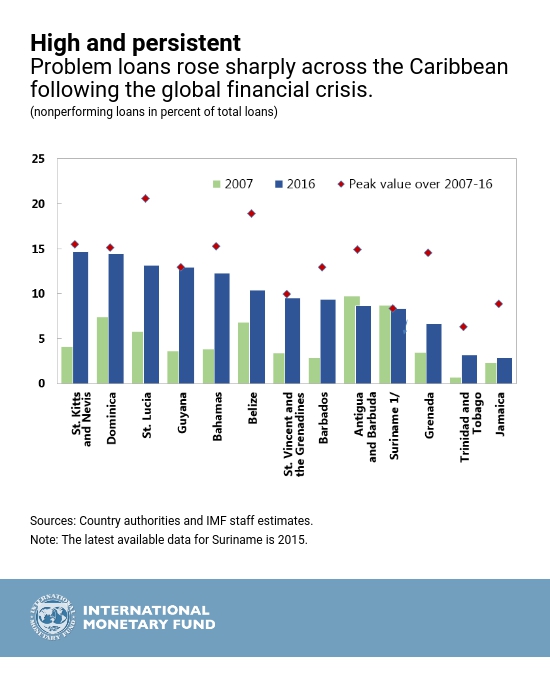

The global financial crisis and subsequent economic recession saddled banks in the Caribbean with high levels of problem loans. The share of nonperforming loans to total loans more than tripled in many Caribbean countries from 2007 to 2016, and they have been slow to come down. Problem loans (loans that are 90 days or more past due) are bad news for banks and the economy.

Our recent work—to be published in a forthcoming IMF book —looks at the causes and consequences of persistently high levels of problem loans in the Caribbean. We find that the weak economic recovery, deficient legal frameworks, and the lack of distressed loan markets are the most severe obstacles to resolving nonperforming loans in the Caribbean.

A drag on economic activity

The quality of banks’ assets gradually deteriorated during the recession that followed the global financial crisis. The slow recovery globally and in the region left many households and businesses incapable of paying down their loans, leaving banks with high levels of nonperforming assets—mainly personal, construction, and tourism loans.

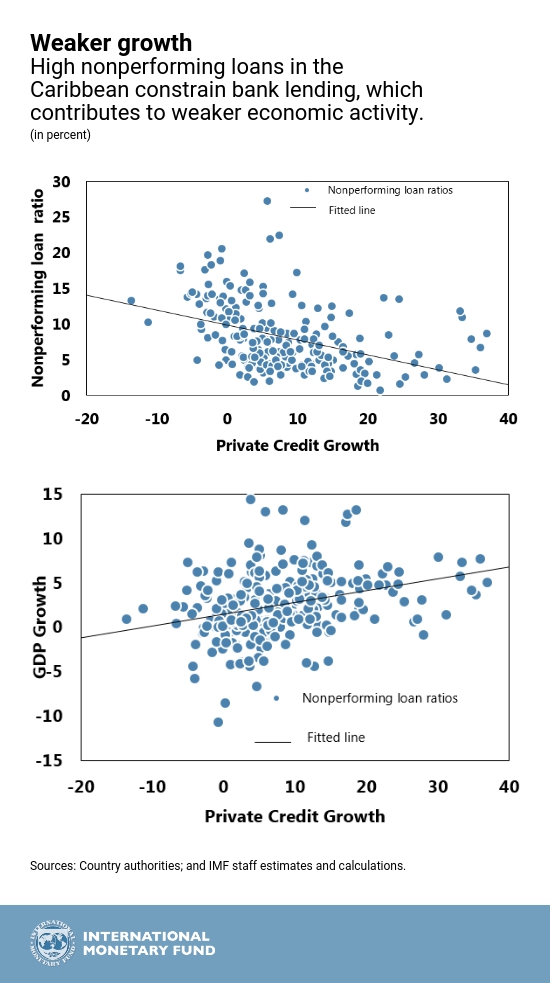

While there are significant differences across countries, the share of nonperforming loans in total loans peaked between 15–20 percent—up from a pre-crisis average of 5 percent and compared to 3–4 percent in Latin America. While nonperforming loan ratios have started to gradually recede from their peaks in most countries, banks’ slow pace of restructuring, selling, and writing off these loans has delayed their resolution. Banks on average resolved only 16 percent of nonperforming loans in their portfolios in 2013-2015. High nonperforming loans are a drag on economic activity in a region where financial systems are dominated by banks. Persistently high nonperforming loans constrain the availability of credit, as banks tighten lending standards and focus on cleaning up their balance sheets. A decline in bank lending, in turn, contributes to a weaker economy that can further increase problem loans. Our analysis suggests that these effects are persistent, with the fall in credit from worsening asset quality lasting up to five years. Limited access to credit has been a major obstacle for doing business in the Caribbean, threatening much needed investment and durable growth in the region.

High nonperforming loans are a drag on economic activity in a region where financial systems are dominated by banks. Persistently high nonperforming loans constrain the availability of credit, as banks tighten lending standards and focus on cleaning up their balance sheets. A decline in bank lending, in turn, contributes to a weaker economy that can further increase problem loans. Our analysis suggests that these effects are persistent, with the fall in credit from worsening asset quality lasting up to five years. Limited access to credit has been a major obstacle for doing business in the Caribbean, threatening much needed investment and durable growth in the region.

High nonperforming loans also make banks more vulnerable to shocks by raising their borrowing costs and reducing their profitability. As such, high problem loans pose a potential risk to financial stability. Evidence suggests that banks with low profitability, capital, and efficiency also tend to suffer from weak asset quality, suggesting a vicious cycle of weak financial condition and asset quality.

Difficult to fix

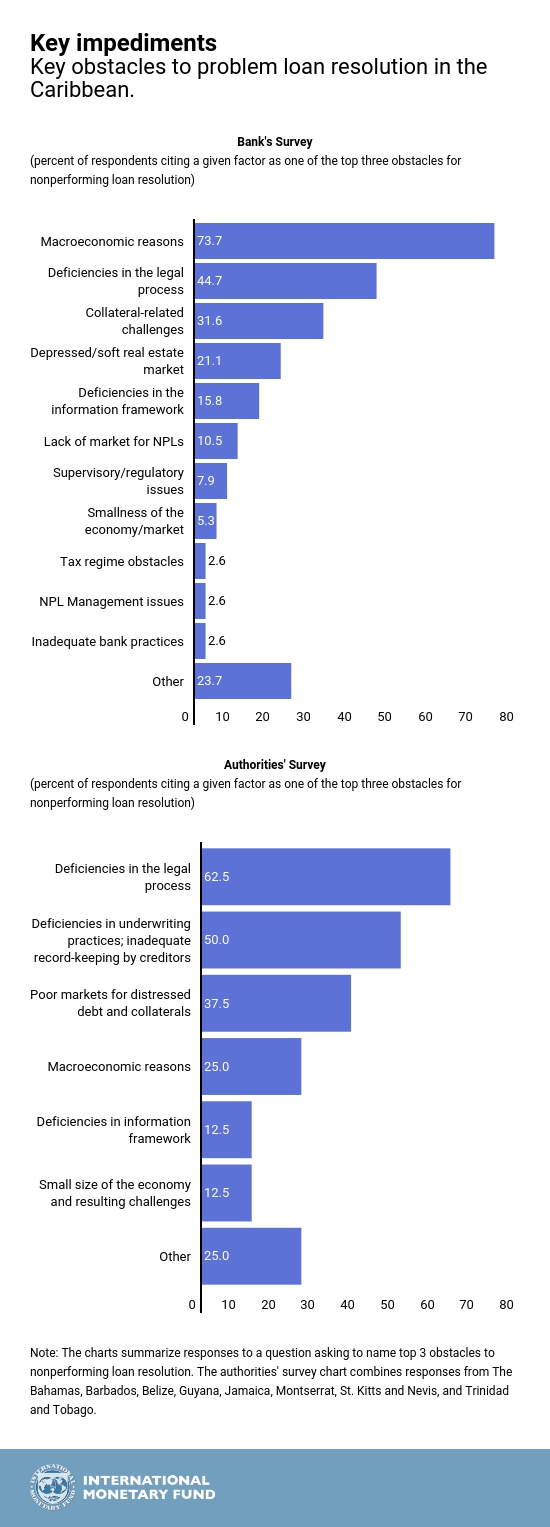

A new survey of country officials and banks highlights some common impediments that slow down progress in reducing nonperforming loans. The weak economic recovery plays a big role but it is not the full story.

The lack of distressed debt markets to move problem loans off bank balance sheets is a key impediment, as well as deficient legal frameworks. Courts specializing in insolvency cases do not exist and resolving such cases takes 2.7 years on average, affecting loan recovery outcomes and values. Deficiencies in enforcing debt contracts also prevent creditors from realizing claims on time and maximizing recovery values.

Difficulties in valuing collateral and supervisory gaps reduce incentives to recognize losses and write off loans. And the absence of credit and asset registries undermines the ability to assess debtors’ liabilities and wealth, price risk, and value collateral, resulting in gaps between prices buyers and sellers of distressed debt are prepared to accept. Add to this social and cultural factors: no one feels good about buying a neighbor’s foreclosed property.

Tackling problem loans

The multitude of factors contributing to the nonperforming loan problem calls for a comprehensive approach.

Governments need sound economic policies to support growth and employment so that borrowers can repay their loans.

Effective supervision should help prevent a further buildup of problem loans and require banks to hold adequate provisions to facilitate recognition of losses down the road. Supervisory frameworks should provide banks incentives to write off unrecoverable loans, including through higher capital charges and time limits to carry problem loans on their balance sheets.

Policies should focus on removing information gaps that hinder valuing risk and collateral and create pricing gaps that deter buyers and sellers from settling on sales of distressed properties. Well-functioning public registries can improve credit-underwriting and facilitate debt workouts. In Jamaica, the increased use of credit bureaus since 2014 has incentivized borrowers to preserve good credit ratings and banks to improve loan underwriting, and helped loan recoveries while reducing new nonperforming loans.

Reforms are needed to introduce effective insolvency regimes and make debts easier to collect. Improved judicial systems, specialized courts experienced in resolution, and greater use of fast-track and out-of-court mechanisms for debt restructuring could reduce the time required for resolution and facilitate disposal of problem loans.

A well-functioning domestic market for distressed assets is needed to facilitate nonperforming loan sales. Establishing a pan-Caribbean nonperforming loan market can create economies of scale and help address cultural and social obstacles that discourage resolution. Introducing asset management companies can also help jump-start the market, capitalizing on the limited, but promising, experience in the region (as in The Bahamas).

The design, prioritization, and sequencing of reforms should reflect country circumstances. Small Caribbean states would benefit from coordinating reforms to address regional institutional constraints. Ongoing initiatives to create a regional asset management company and credit bureaus, enhance insolvency and debt-enforcement regimes, and establish guidelines for collateral valuation in the Eastern Caribbean are good examples of integrated efforts to create the needed momentum.