February 21, 2018

Version in Français (French)

[caption id="attachment_22741" align="alignnone" width="1024"] Without more tangible elements of a fiscal union, the euro area will remain fundamentally vulnerable to shocks. (photo: iStock by GettyImages) .[/caption]

Without more tangible elements of a fiscal union, the euro area will remain fundamentally vulnerable to shocks. (photo: iStock by GettyImages) .[/caption]

The euro area is experiencing a robust recovery, but the architecture supporting Europe’s currency union remains incomplete and leaves the region vulnerable to future financial crises.

While substantial progress has been made to address some architectural issues—conditional lending facilities and key elements of a banking union—we argue in our recent paper that the euro area needs to build elements of a common fiscal policy, including more fiscal risk sharing, to preserve financial and economic integration and stability. Without some degree of fiscal union, the region will continue to face existential risks that policymakers should not ignore. While this is not a new topic, the current favorable economic climate might be the moment to advance the discussion—and the chance to strengthen the euro area.

If Europe’s Economic and Monetary Union (EMU) were like any other large currency area, such as the United States, member states would tackle economic or financial shocks together. They would have empowered a central government or jointly run institutions to deal with stressed financial entities, secure bank deposits, and provide fiscal relief to member states in a particularly deep recession.

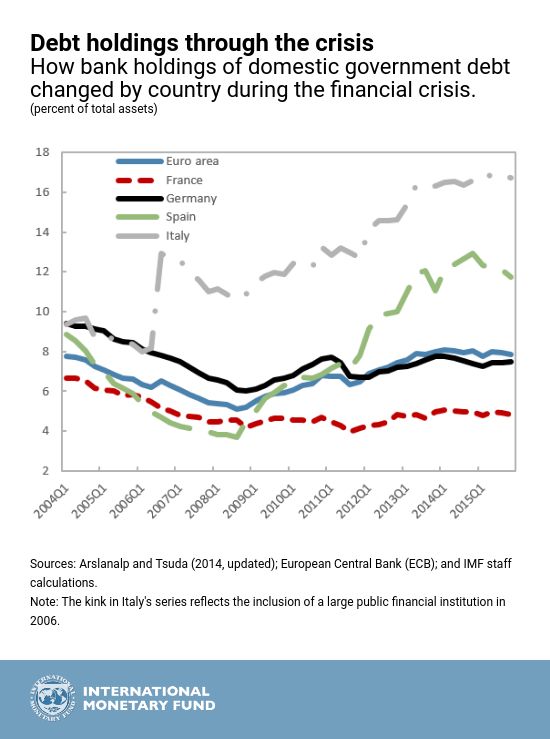

But EMU is not a political union, and its member states remain very much on their own. This structure leaves them exposed to large idiosyncratic—economic or financial—shocks, especially where public debt levels are already high and governments have little room to respond with fiscal policy moves. To make matters worse, euro area banks own large amounts of domestic sovereign or government debt, opening the door to a vicious cycle in which sovereign and financial distress reinforce each other.

As the recent financial crisis showed, this dynamic can have large negative spillovers to others both inside and outside EMU.

Next steps

Given the threat posed by the still strong bank-sovereign links, as a first step, EMU should move quickly to complete its banking union. The 2010-12 debt crisis ushered in rapid progress, from the creation of the European Stability Mechanism to central-level institutions for financial supervision and bank restructuring. The European Central Bank’s Outright Monetary Transactions framework has helped address severe distortions in sovereign debt markets.

The euro area is still operating, however, without unified policies to support effective area-wide deposit insurance and without a common backstop to the Single Resolution Fund. Filling these gaps would prevent a banking crisis from jeopardizing a country’s fiscal stability and euro membership. Together with other measures, including to regulate bank holdings of sovereign debt, it would help prevent stress in a sovereign’s bond markets from undermining confidence in local banks. And it would add credibility to the “no bailout” rule—the clause in the Treaty on the Functioning of the European Union that prohibits governments to pay for each other’s debt—by allowing sovereign debt to be restructured without threatening local banking systems.

Need for fiscal union

But a banking union, however vital, is not enough. EMU also requires a fiscal union to take the edge off country-specific macroeconomic shocks. Established currency unions, such as those in large countries with multiple regional governments, include automatic risk-sharing mechanisms, the most efficient way to insure against business cycle risks.

Private markets do not provide sufficient insurance against declines in consumption during an economic crisis. Government deficit spending is an alternative, but it comes with higher taxes or lower spending later and may not be an option when public debt is already very high. The ideal alternative is to install a system through which member states mutually insure each other by sharing fiscal risk.

There are many ways to share fiscal risk while avoiding permanent transfers of funds. For example, there are proposals for an EMU-wide unemployment insurance system to directly stabilize private incomes. However, a dedicated central fiscal capacity—which would collect annual contributions from members in exchange for transfers linked to local shocks when they occur—would offer some of the same benefits without requiring the harmonization of unemployment insurance. A forthcoming IMF paper, “ Filling a Gap in the Euro Area Architecture: A Central Fiscal Capacity for Macroeconomic Stabilization,” describes how such a facility could be designed to smooth business cycles while ensuring fiscal discipline and avoid moral hazard problems.

In principle, participation in such a mechanism could also be made conditional on complying with fiscal rules or structural reforms to help reduce the likelihood that risk sharing would lead to one-sided, long-term transfers. Legacy issues such as non-performing bank loans will need to be addressed separately.

Fiscal discipline

An added benefit of introducing some fiscal risk sharing could be more fiscal discipline. This may seem counterintuitive given that, as with any other insurance mechanism, adding fiscal risk sharing is bound to introduce moral hazard, or the temptation to make riskier decisions in the knowledge that an insurance mechanism is in place. For example, governments may put less effort into meeting fiscal targets.

However, more risk sharing could make the euro area’s “no bailout” rule more credible and thereby make financial markets pay more attention to fiscal misdeeds. Arguably, markets at present do not fully believe in the “no bailout” rule. A sovereign default can have very large negative economic and financial spillovers, which might make a bailout the least bad option for the rest of the EMU membership.

This danger is especially great when governments and their banks remain tightly interconnected, including through large bank holdings of their domestic sovereigns’ debts. Thus, more fiscal risk sharing—starting with a full banking union with adequately funded backstops—would reduce the spillovers from government default and reduce the probability of a bailout. As a consequence, financial markets would have a greater incentive to impose higher interest rates for imprudent fiscal behavior.

That said, moral hazard is a major concern, and a complete fiscal union needs effective rules and institutions to contain it. Comparing across countries, the constraints applied to state-level or regional governments’ policies tend to be tighter when the level of fiscal risk sharing is higher. For the EMU, this would mean looking for ways to simplify existing rules and enforce them more strictly. Ultimately, this might require moving some decision-making power from the member states to a central level.

Economic necessity

There is no doubt that completing the euro area’s institutional setup is politically difficult, but it is also an economic necessity. The steps discussed here involve complicated institutional decisions, reallocation of sovereign power, and questions of democratic accountability.

Progress calls for thorough public debate at a time when even the goal of European integration is no longer shared by all, and decisions that are not based on broad public support have the potential to backfire.

Economic reality has a way of asserting itself, however, whatever the prevailing political tides. Ultimately, without more tangible elements of a fiscal union, the euro area will remain fundamentally vulnerable to shocks. By the same token, the promise of a more complete EMU tomorrow will add to its resilience today.