Supervisors who monitor the health of the financial system know that a rapid buildup of debt during an economic boom can spell trouble down the road. That is why they keep a close eye on the overall volume of credit in the economy. When companies go on a borrowing spree, supervisors and regulators may decide to put the brakes on credit growth.

Trouble is, measuring credit volume overlooks an important question: how much of that additional money flows to riskier companies – which are more likely to default in times of trouble—compared with more creditworthy firms? The IMF’s latest Global Financial Stability Report seeks to fill that gap by constructing measures of the riskiness of credit allocation, which should help policy makers spot clouds on the economic horizon.

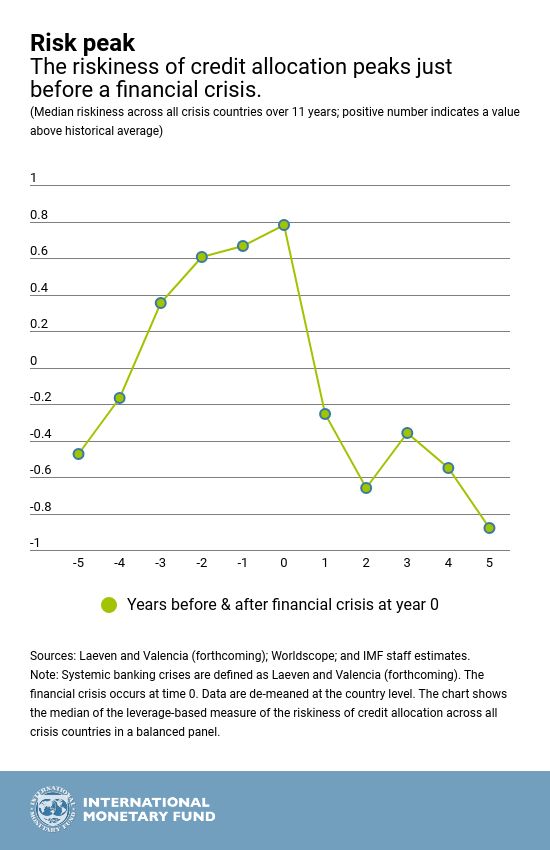

Our researchers crunched 25 years of data for nonfinancial companies in 55 emerging and advanced economies. They found that when credit grows rapidly, the firms where debt expands faster become increasingly risky in relation to those with the slowest debt expansions. Such an increase in the riskiness of credit allocation, in turn, points to greater odds of a severe economic downturn or a banking crisis as many as three years into the future.

Extra dose

This buildup of lending to relatively less creditworthy companies adds an extra dose of risk – on top of the dangers that may come with the rapid growth of credit overall. Of course, lending to risky firms may be perfectly rational and profitable. But it can also spell trouble if it reflects poorer screening of borrowers or excessive risk-taking.

Fortunately, regulators can take steps to protect the financial system, if necessary. They can require banks to hold more capital or impose limits on bank loan growth, restraining their risk-bearing capacity and increasing their buffers. Ensuring the independence of bank supervisors, enforcing lending standards, and strengthening corporate governance by protecting minority shareholders can also help keep risks in check.

Why does more credit flow to risker firms in good times? It’s possible that investors are unduly optimistic about future economic prospects, leading them to extend credit to more vulnerable firms. If interest rates are unusually low, banks and investors may be tempted to lend money – in the form of loans or bonds – to riskier companies that pay relatively higher rates of interest. We have seen this “search for yield” in advanced economies in recent years because of the prolonged period of ultra-low interest rates. The riskiness of credit allocation may thus be a good barometer of risk appetite.

Global pattern

Our study found a clear global pattern in the evolution of this new measure of financial vulnerability. Starting at elevated levels in the late 1990s, the riskiness of credit allocation fell from 2000 to 2004, in the aftermath of financial crises in Asia and Russia and the dot-com equity bubble. From a historic low in 2004, riskiness rose to a peak in 2008, when the global financial crisis erupted. It then declined sharply before rising again to a level near its historical average at the end of 2016, the last available data point. Riskiness may have continued to rise in 2017 as market volatility and interest rates remained very low in the global economy.

The Global Financial Stability Report holds a clear lesson for policy makers and regulators: both the total volume of credit and the riskiness of its allocation are important. A period of rapid growth is more likely to be followed by a severe economic downturn if more of that credit is flowing to riskier firms. Policy makers should pay close attention to both measures – and take the appropriate steps when warning signals flash.