Concerns about global economic and financial fragmentation have intensified in recent years amid rising geopolitical tensions, strained ties between the United States and China, and Russia’s invasion of Ukraine.

Financial fragmentation has important implications for global financial stability by affecting cross-border investment, international payment systems, and asset prices. This in turn fuels instability by increasing banks’ funding costs, lowering their profitability, and reducing their lending to the private sector.

Effects on cross-border investment

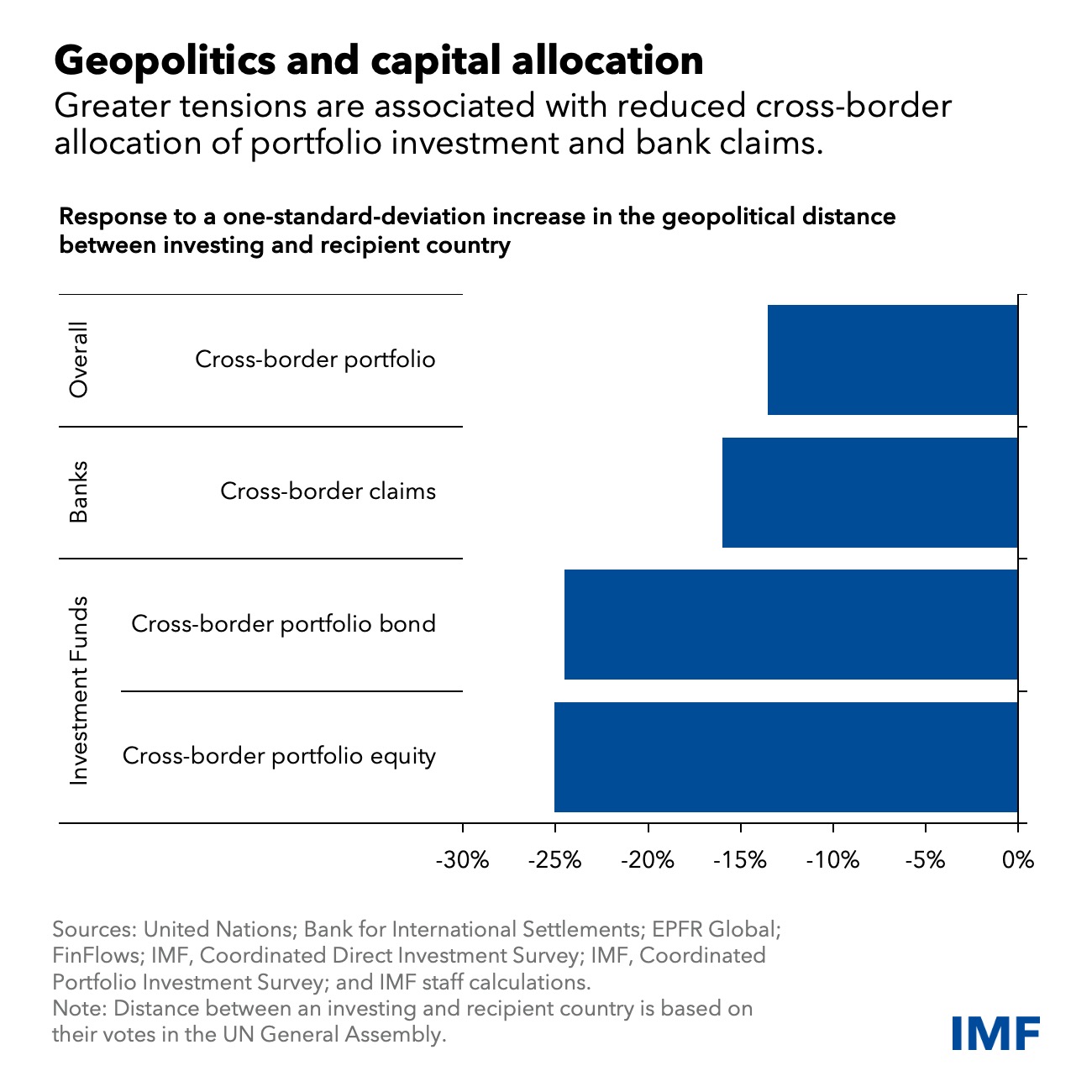

Geopolitical tensions, measured by the divergence in countries’ voting behavior in the United Nations General Assembly, can play a big role in cross-border portfolio and bank allocation, as we write in an analytical chapter of the latest Global Financial Stability Report .

An increase in tensions between an investing and a recipient country, such as between the United States and China since 2016, reduces overall bilateral cross-border allocation of portfolio investment and bank claims by about 15 percent.

Investment funds are particularly sensitive to geopolitical tensions and

tend to reduce cross-border allocations notably to countries with a

diverging foreign policy outlook.

Financial stability risks

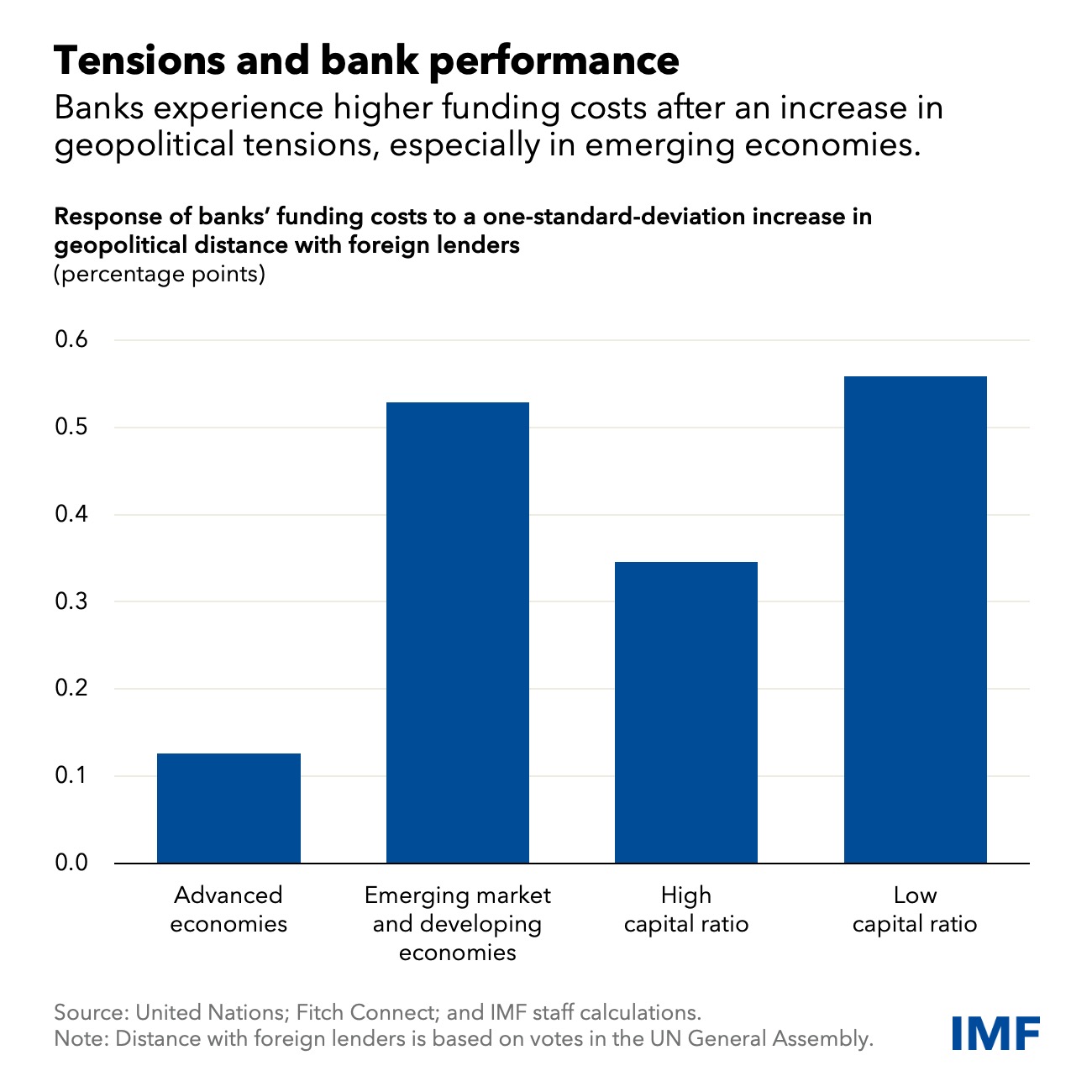

Geopolitical tensions threaten financial stability through a financial channel. Imposition of financial restrictions, increased uncertainty, and cross-border credit and investment outflows triggered by an escalation of tensions could increase banks’ debt rollover risks and funding costs. It could also drive-up interest rates on government bonds, reducing the values of banks’ assets and adding to their funding costs.

At the same time, geopolitical tensions are transmitted to banks through the real economy. The effect of disruptions to supply chains and commodity markets on domestic growth and inflation could exacerbate banks’ market and credit losses, further reducing their profitability and capitalization. The stress is likely to diminish the risk-taking capacity of banks, prompting them to cut lending, further weighing on economic growth.

The financial and real-economy channels are likely to feed off one another, with the overall effect being disproportionately larger for banks in emerging markets and developing economies, and for those with lower capitalization ratios.

In the longer run, greater financial fragmentation stemming from geopolitical tensions could also roil capital flows and key economic and financial market indicators by limiting the possibilities for international risk diversification, such as by reducing the number of countries in which domestic residents can invest.

How to curb risks

Supervisors, regulators, and financial institutions should be aware of the risks to financial stability stemming from a potential rise in geopolitical tensions and commit to identify, quantify, manage, and mitigate these threats. A better understanding and monitoring of the interactions between geopolitical risks and more traditional ones related to credit, interest rate, market, liquidity, and operations could help prevent a potentially destabilizing fallout from geopolitical events.

To develop actionable guidelines for supervisors, policymakers should adopt a systematic approach that employs stress testing and scenario analysis to assess and quantify transmission channels of geopolitical shocks to financial institutions.

Other steps include:

In response to rising geopolitical risks, economies reliant on external financing should ensure an adequate level of international reserves, as well as capital and liquidity buffers at financial institutions.

- Policymakers should strengthen crisis preparedness and management

frameworks to deal with potential financial instability arising from

heightened geopolitical tensions. Cooperative arrangements between

different national authorities should continue to help ensure effective

management and containment of international financial crises, including

through development of effective resolution mechanisms for financial

institutions that operate in multiple jurisdictions.

- The global financial safety net—a set of institutions and mechanisms that

insure against crises and financing to mitigate their impact—must be

reinforced through mutual assistance agreements between countries. These

would include regional safety nets, currency swaps, or fiscal

mechanisms—and precautionary credit lines from international financial

institutions.

- In the face of geopolitical risks, efforts by international regulatory and standard-setting bodies, such as the Financial Stability Board and the Basel Committee on Banking Supervision, should continue to promote common financial regulations and standards to prevent an increase in financial fragmentation.

Ultimately, policymakers should be aware that imposing financial restrictions for national security reasons could have unintended consequences for global macro-financial stability. Given the significant risks to global macro-financial stability, multilateral efforts should be strengthened to reduce geopolitical tensions and economic and financial fragmentation.

—This blog is based on Chapter 3 of the April 2023 Global Financial Stability Report,“Geopolitics and Financial Fragmentation: Implications for Macro-Financial Stability."