China is embarking on the next stage of its integration into global financial markets. It is a stage that is likely to see a fresh flood of overseas investment, improved liquidity, better governance, and a broader range of instruments.

The catalyst: inclusion of Chinese stocks and bonds in a larger number of global financial-market indexes. As Chinese securities are added, investment managers who seek to match or surpass the returns of the indexes will adjust their portfolios to include Chinese stocks and bonds. And increasingly it is these benchmark-driven asset managers who are propelling portfolio flows.

This trend of rising foreign ownership is likely to accelerate further.

In the past five years alone, foreign ownership of Chinese government bonds has quadrupled to almost 8 percent. Ownership of onshore equities has also increased but remains low compared with other emerging markets. This trend of rising foreign ownership is likely to accelerate further.

How much? To get an idea, let’s look at the decision, announced in April, to include two types of Chinese bonds in the Bloomberg Barclays Global Aggregate Index—local currency-denominated bonds issued by the central government and by state-owned policy banks such as China Development Bank. Assets tracking the Bloomberg Barclays index could total $2 trillion to $2.5 trillion, according to analysts. Assuming an expected weighting of 6 percent, China can expect to see an additional $150 billion of inflows by 2020.

That’s just the beginning. Add the widely expected inclusion of Chinese bonds and equities into FTSE and JP Morgan indexes, and China can expect to see benchmark-driven portfolio inflows of as much as $450 billion, or 3 percent to 4 percent of GDP, in the next two to three years. These preliminary estimates may be conservative, for a number of reasons:

- More securities may become eligible for index inclusion. Currently, only government and policy bank bonds, which account for about 40 percent of the $12 trillion Chinese market, are included in a major global bond index. Should local government and corporate bonds also become eligible, China’s weight in these indexes could increase further. Similarly, China’s onshore A-shares (equities that are locally incorporated and listed and are traded in local currency) constitute a significant proportion of China’s equity market capitalization, but only 20 percent of these will be included in the MSCI equity index by November 2019. In comparison, benchmark indexes already include most shares of companies in other major Asian economies.

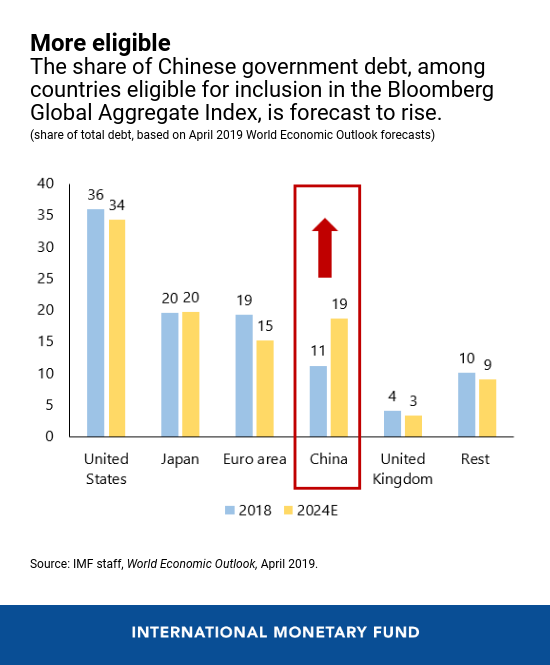

- China’s public debt is projected to rise. Weights in the global bond indexes are based on debt outstanding. That means China’s weight will rise if its index-eligible public debt grows faster than that of other index constituents. Based on the IMF’s latest projections, China’s debt share among index eligible countries may increase significantly in coming years.

- High risk-adjusted yields make Chinese bonds an attractive investment. Some foreign investors will like China’s local currency bond market for its large size, A+ credit rating, high yield relative to similarly rated sovereigns, and low correlation with other bond markets. For those reasons, investors might hold more than the benchmark target weights. Furthermore, managers of central bank reserves and sovereign wealth funds have invested relatively little in Chinese assets and are also likely to benefit from the improved liquidity and accessibility of Chinese bond markets.

What does this mean for China?

Greater foreign investor participation may subject Chinese markets to greater scrutiny and stricter governance standards. It should also lead to improved market liquidity and a potentially broader range of instruments, including those for hedging foreign exchange risks, which would benefit both local and foreign investors.

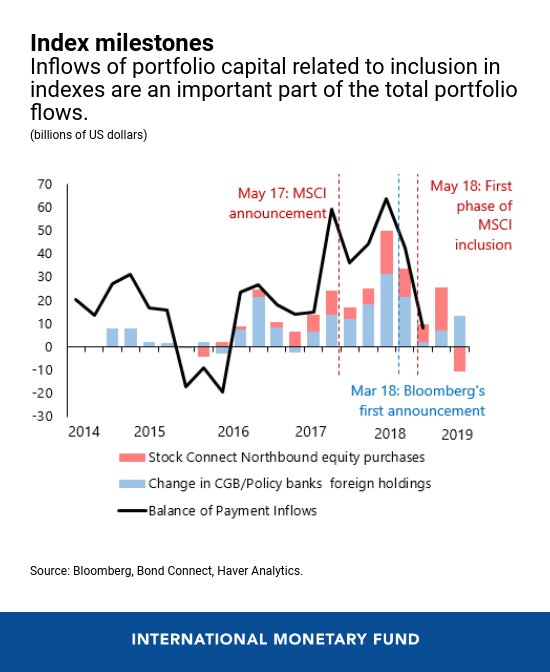

As discussed in the latest Global Financial Stability Report, benchmark driven investors are increasingly important drivers of portfolio flows. Portfolio flows to China increased sharply following the country’s inclusion in the MSCI equity indexes in 2018. Aggregate portfolio inflows rose to $159 billion in 2018 from $50 billion in 2016. Overseas purchases of A-shares through the Stock Connect program, which links the Hong Kong and mainland Chinese markets, were especially strong in 2018.

Bond flows from asset managers, on the other hand, were relatively subdued ahead of China’s inclusion in the Bloomberg index in April. However, they have picked up recently. Furthermore, the number of investors registered and participating in the Bond Connect program has also increased sharply in the last 12 months, suggesting that flows might increase in the medium term.

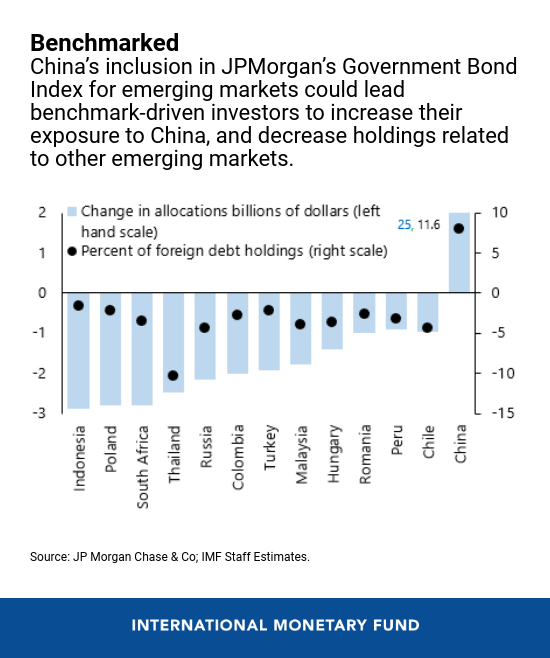

What does this mean for other emerging markets?

The news for other emerging markets may not be as good. Investors may reduce purchases of other emerging-market assets as they re-balance their portfolios to reflect China’s inclusion. As a result, emerging market government issuers could see an average reduction of allocations by $1 billion to $3 billion each. These effects could be larger for some countries, where benchmark-driven holdings constitute a significant amount of their foreign debt. More broadly, as benchmark-driven investors tend to be more sensitive to changes in global financial conditions than other investors, their greater role in international finance may mean that external shocks propagate to medium-sized emerging and frontier market economies faster than in the past.

But the reality may be more complex. Benchmark-driven investors who actively manage their portfolios can substantially deviate from the benchmark weights in an effort to outperform the index.

That said, it is clear that the inclusion of China will likely alter the risk-return characteristics of the main indexes for emerging-market local currency debt; because Chinese bonds have a better than average rating and lower yields, the average index will also have a relatively higher rating and lower yield. All things considered, we can expect a further increase in the importance of China in the emerging market universe.