Rising trade barriers and associated uncertainty weighed on business sentiment and activity globally. In some cases (advanced economies and China), these developments magnified cyclical and structural slowdowns already under way.

Further pressures came from country-specific weakness in large emerging market economies such as Brazil, India, Mexico, and Russia. Worsening macroeconomic stress related to tighter financial conditions (Argentina), geopolitical tensions (Iran), and social unrest (Venezuela, Libya, Yemen) rounded out the difficult picture.

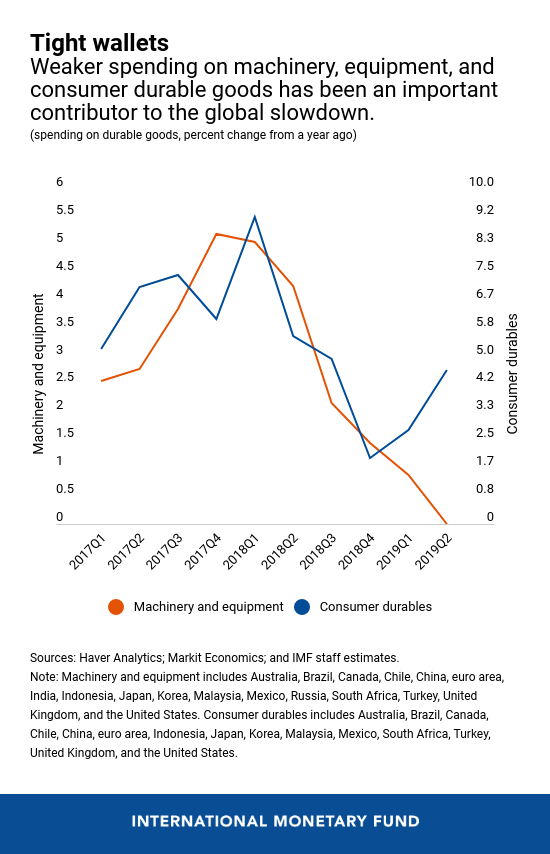

With the economic environment becoming more uncertain, firms turned cautious on long-range spending and global purchases of machinery and equipment decelerated. Household demand for durable goods also weakened, although there was a pick up in the second quarter of 2019. This was particularly evident with automobiles, where regulatory changes, new emission standards, and possibly the shift to ride-shares weighed on sales in several countries.

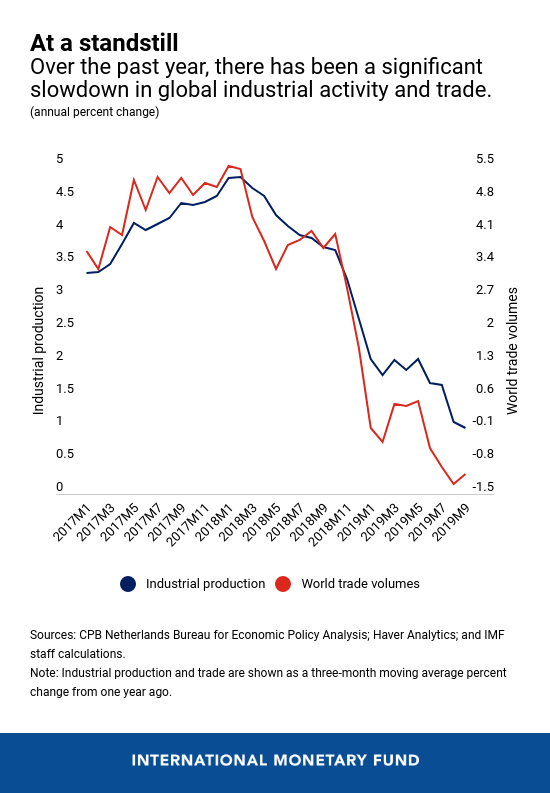

Faced with sluggish demand for durable goods, firms scaled back industrial production. Global trade—which is intensive in durable final goods and the components used to produce them—slowed to a standstill.

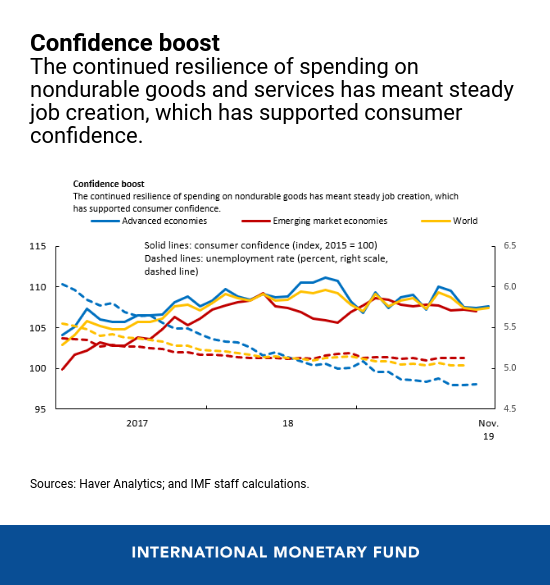

Central banks reacted aggressively to the weaker activity. Over the course of the year, several—including the US Federal Reserve, the European Central Bank (ECB), and large emerging market central banks—cut interest rates, while the ECB also restarted asset purchases.

These policies averted a deeper slowdown. Lower interest rates and supportive financial conditions reinforced still-resilient purchases of nondurable goods and services, encouraging job creation. Tight labor markets and gradually rising wages, in turn, supported consumer confidence and household spending.

Will these bright spots translate into stronger global growth next year? Find out more when the IMF releases its World Economic Outlook Update on January 20.