Financial Stability / Inflation

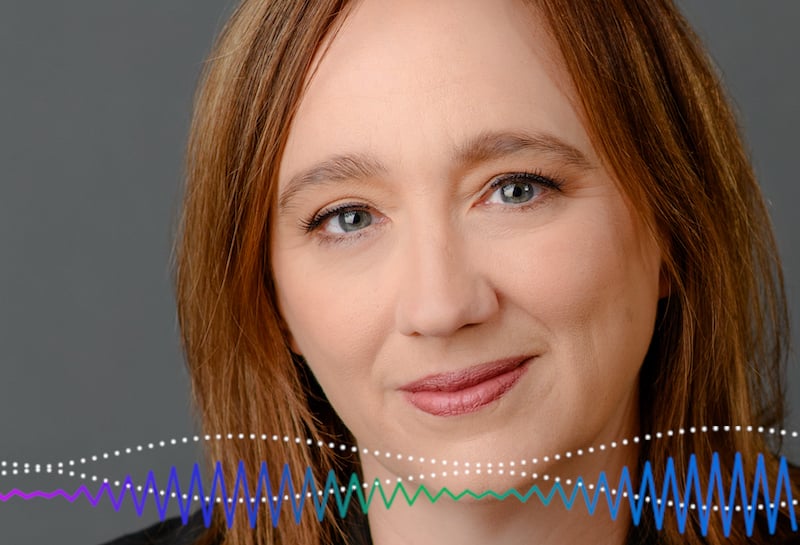

Philip Lane on the Nature of Europe’s Double-Digit Inflation

In This Episode

Inflation is high virtually everywhere, but what’s pushing prices to record levels in Europe is not necessarily what’s fueling inflation in the United States. The European Central Bank and the Federal Reserve share a common problem and similar financial tools to fight it, but Europe’s supply-dominated inflation and America’s mostly demand-dominated inflation require slightly different approaches. Philip Lane is Chief Economist for the European Central Bank. In this podcast, he says finding the “sweet spot” between fiscal and monetary policies will allow for continued support to vulnerable Europeans hard hit by high energy prices and double-digit inflation, while not further straining public finances. Transcript

Philip Lane participated in the IMF Jacques Polak Annual Research Conference. Watch the Webcast at IMF.org

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

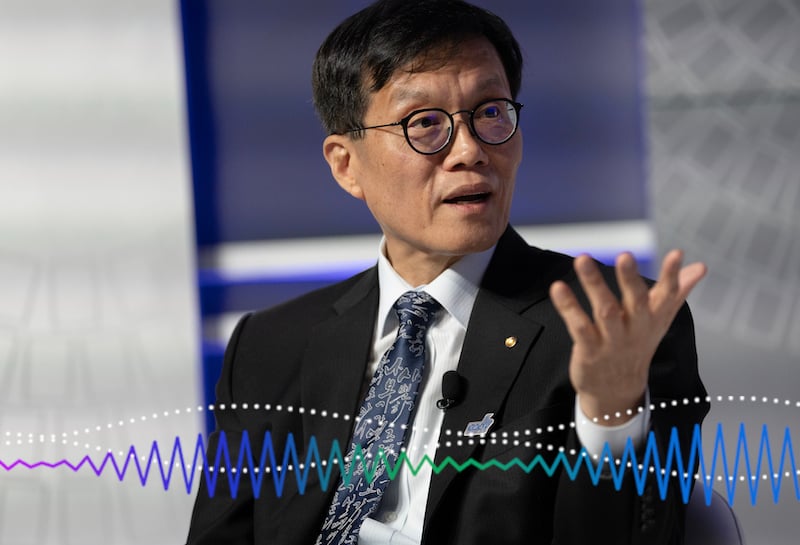

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

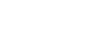

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.