In This Episode

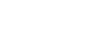

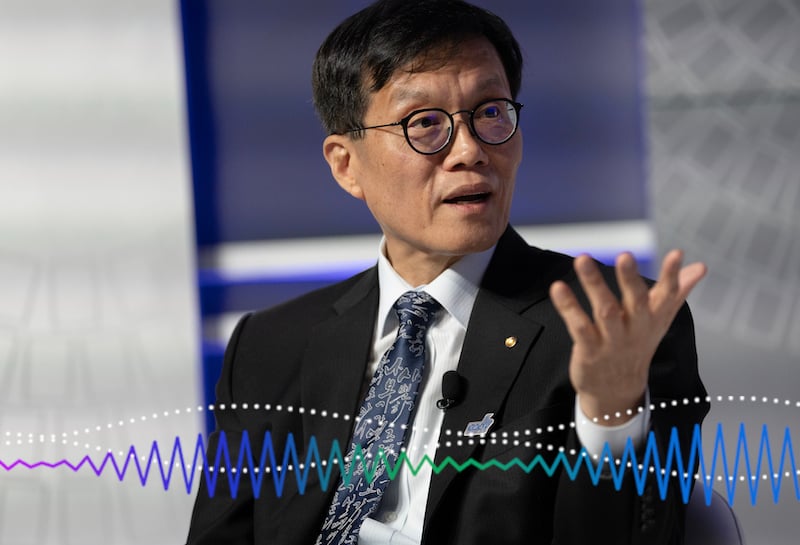

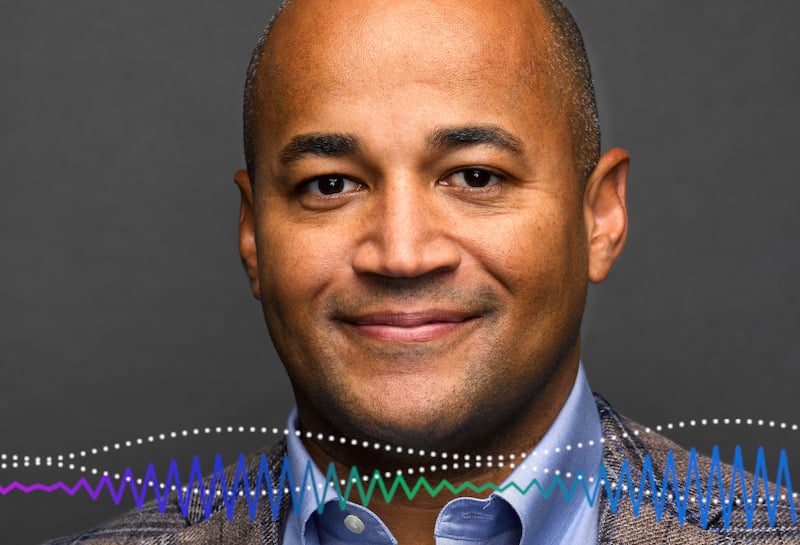

While 21st-century globalization and international trade dramatically changed how multinational corporations operate, the way they are taxed is largely based on early 20th-century thinking. Recent efforts by the OECD and the UN to modernize the international corporate tax system include a minimum corporate tax to make it more equitable. The IMF has also joined the effort by providing its expertise on global tax policy. Senior counsel Cory Hillier and senior economist Shafik Hebous are coauthors of recent research that seeks to strengthen the impact of a corporate minimum tax. Transcript

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.