About F&D Subscribe Back Issues Write Us Copyright Information Use the free Adobe Acrobat Reader to view a pdf file of this article Mongolia and the IMF |

Can Monetary Policy Be Effective During Transition?: Lessons from Mongolia Torsten Sløk Mongolia has undergone dramatic changes during its transition to a market economy, with fundamental restructuring in both the real economy and the financial sector. How effective is monetary policy in such a changing environment? A key element of each former centrally planned economy's transition to a market economy has been the establishment of financial markets and institutions that can support such an economy. But introducing and, in particular, creating confidence in, such markets and institutions has been a long process. Moreover, difficulties such as banking crises, high ratios of nonperforming loans to total loans, inexperienced management, political interference, currency appreciation, and high or moderate inflation rates have posed additional challenges for monetary policy. The policy of Mongolia's monetary authorities has been to keep the growth rate of the money supply stable while dealing with these transition-specific challenges as they occur. In addition, because of Mongolia's climate, which is characterized by extremes of temperature, the Mongolian economy is highly seasonal, and the authorities have occasionally intervened in the foreign exchange market to avoid excessive exchange rate fluctuations stemming from large, weather-related swings in exports and imports. Such a pragmatic approach to monetary policy has been necessary in many transition economies. This article discusses whether Mongolia's approach has been facilitated by a stable money demand and a predictable relationship between inflation and monetary variables. Mongolia's experience Mongolia's experience has been different from that of most other transition countries in four respects. First and most important, there has been a political consensus on the need for a bold and comprehensive approach to reforms. Despite significant shifts in the governing coalitions and periods of political gridlock, national governments have pursued essentially the same objectives. Second, Mongolia did not—unlike many other transition countries—experience a prolonged period of moderate inflation. Annual inflation fell below 10 percent in the first half of 1998 and has stayed low since then. Third, unlike the Central and Eastern European transition countries, Mongolia has not been a recipient of large capital inflows and has therefore not confronted the challenges that such inflows present for the monetary authorities. Fourth, the Mongolian economy has been significantly affected by both the Asian crisis of 1997 and, in particular, the Russian crisis of 1998. Consequently, its currency has appreciated considerably (in both nominal and real terms). This appreciation has been instrumental in lowering annual inflation rates from the moderate range to single digits, although this reduction was probably achieved at some cost to output. The table on page 45 compares real GDP in 1989 and 1998 for Mongolia with that in the other transition economies and shows that Mongolia has done better than most. Out of 27 transition countries, only Poland, Slovakia, and Slovenia have been doing significantly better than Mongolia, while the Czech Republic and Hungary have performed equally well. This simple measure has limitations, however, and does not reveal much about the development of institutions or the role of policies in individual transition countries. To analyze the role of policies during the transition—in particular, thes role of monetary policy—one has to examine the relationship between monetary variables and inflation and real economic activity.

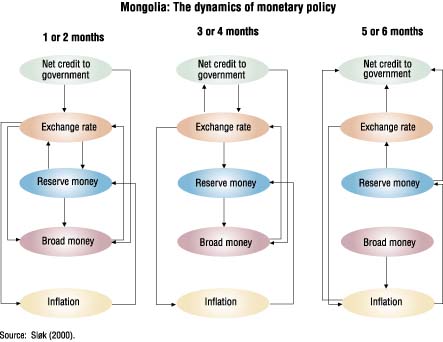

Monetary policy in transition A market-based monetary policy depends on the existence of a market for money and foreign exchange. Specifically, reserve requirements, refinance windows, government and central bank bills and bonds, and credit allocation through banks or credit auctions are needed. If the institutional framework for monetary policy and these specific monetary instruments are lacking or malfunctioning, the conduct and effectiveness of monetary policy will be impeded. Most transition economies have gradually established an institutional framework and introduced instruments and financial markets that function like those in developed countries, although they are smaller and less liquid. Mongolia enhanced the role of monetary policy in the early stages of its transition. In May 1991, a two-tier banking system was introduced to replace the previous, central bank-based system. Directed credits, which until 1991 had been determined by the credit plan, were limited to priority sectors and oil imports and were phased out in mid-1994. Bank-by-bank ceilings and interest rate controls on commercial bank deposit and lending rates that had been imposed in the initial transition phase were also eliminated. In addition, the central bank introduced reserve requirements on business and household demand deposits in 1991, central bank bills in 1993, and a regular refinancing auction at market-determined rates in 1995. The degree of independence given to the central bank, the Bank of Mongolia, is surprisingly similar to that observed in many developed countries. The Banking Law of Mongolia, adopted in 1996, states that the two primary objectives of the Bank of Mongolia are to ensure a stable value for the Mongolian tugrik and to act as supervisor of the financial system. In summary, the institutions and financial markets required for an effective monetary policy in Mongolia have, to a large extent, been created. Over the transition period, Mongolia's banking sector has faced major challenges, including a high volume of nonperforming loans. To strengthen the banking system, measures have been taken, under IMF-supported programs, to reduce operating costs, resolve the financial situations of insolvent banks, and increase loan recoveries. The ratio of foreign exchange deposits to broad money has for most years been less than 20 percent, the average for all transition countries since 1991. But the interest spread, defined as the difference at the end of the year between the rates on short-term bank loans in domestic currency and rates on deposits was, over the same period, one of the highest in the transition countries. The high interest rates have been maintained throughout the transition period to preserve and restore confidence in the banking system. While progress has been made in strengthening the system, problems remain, particularly in the balance-sheet positions of several private banks. Can monetary policy work in transition? A key challenge for monetary policy in transition is that inflation is not just a monetary phenomenon. Apart from the usual demand-pull and cost-push pressures, at least five additional influences pose challenges for the conduct of monetary policy. First, price liberalization at the beginning of transition results in an initial price level adjustment and substantial changes in relative prices and hence also in inflation. Second, this adjustment in relative prices brings about a significant reallocation of resources, and subsequent monetary financing of rising fiscal deficits resulting from a combination of declining fiscal revenues and rigid expenditure patterns also generates inflationary pressures. Third, downward rigidities in goods and labor markets, together with the indexation of prices, generate more permanent moderate inflation (15-40 percent a year) in many transition countries. Fourth, as income grows, so does the price level of the economy (in line with the so-called Balassa-Samuelson effect), and authorities have to determine to what extent inflation comes from this source. Finally, privatization, institution building, and the creation of competitive markets take considerable time, and the speed with which competition and efficiency are introduced in the private sector significantly affects inflation rates during the transition. Given all these transition-specific influences on inflation, the existence of predictable relationships between key economic variables, necessary for monetary policy to be conducted effectively, cannot be taken for granted. To investigate the relationships among inflation, the exchange rate, reserve money, broad money, and net credit to the government in Mongolia, a causal analysis of relationships among economic variables has been carried out. Granger-causality tests give an indication of how these variables affect each other over time. All series measure 12-month changes, beginning in December 1995 and ending in June 1999. The chart on page 45 shows the causal relationships among the variables for different time periods.

One conclusion drawn from the results of the causality tests is that net credit to the government plays a key role. In the short run, this variable does not affect inflation directly but has an effect on it through the above-mentioned monetary variables. In the longer term (five to six months), net credit to the government becomes a function of the other monetary variables and affects inflation directly. A second conclusion is that the exchange rate has a significant effect on inflation during all time periods examined. In the very short term, it is the only variable explaining inflation directly. In other words, if the exchange rate changes, businesses immediately react by adjusting domestic prices. Third, in the longer term, the money supply explains inflation directly, and this indicates that it is the money-supply rule that has brought down inflation in Mongolia. To explore this further, a money-demand relationship has been estimated using annual data covering 1993-98 for 22 Mongolian regions (see Sløk (2000) for details). The analysis provides two key insights. First, the money-demand estimation confirms that there is a significant and stable relationship between real money and real income over the sample period. Second, the income elasticity is approximately one-half, which suggests that a 1 percent increase in income leads to a 0.5 percent increase in the demand for money. This elasticity is significantly below that for most member countries of the Organization for Economic Cooperation and Development, which is usually close to 1. The lower elasticity in Mongolia could indicate that considerably fewer and less complex transactions are carried out by its banks and firms than by their counterparts in highly developed economies. In other words, the lower income elasticity of the demand for money suggests that, in Mongolia, money is held primarily to carry out transactions. In sum, a stable relationship exists between the money supply and economic activity in Mongolia, which has made it possible for the monetary authorities to use a money-supply-growth rule to guide monetary policy. Furthermore, their use of such a rule has been successful in bringing down inflation. Conclusion In a transition economy with institutions as rudimentary as Mongolia's, a stable demand for money and a predictable relationship between inflation and monetary variables can be found, and a market-based monetary policy can be implemented effectively. To strengthen the effectiveness of monetary policy, however, the authorities need to continue with reforms—in particular, banking sector and public administration reforms. Looking forward, other transition countries have managed to maintain annual inflation rates in the single digits by adopting inflation-targeting frameworks. Such a framework has the advantages of being transparent and easily monitored by the public and of allowing monetary policy to keep inflation low while policymakers cope with domestic and international shocks. Inflation targeting, however, is not suitable for countries that have not completed structural adjustment, are starting with high inflation, or are susceptible to large shocks. In the event of such large shocks, inflation targeting could have sudden, marked effects on monetary instruments that could, in turn, have severe implications for the real economy. Moreover, as a consequence of its pronounced temperature fluctuations, Mongolia experiences seasonal movements in the exchange rate, which, if left unsmoothed, could have undesirable effects on inflation. In sum, it is not clear whether it would be useful for Mongolia to adopt an inflation-targeting framework at this stage of its transition.

Reference:

|

||||||||||||||||||||||||||||||||||||||||