Versions in: عربي (Arabic), 中文 (Chinese), Français (French), Deutsch (German), 日本語 (Japanese), Русский (Russian), and Español (Spanish)

Baden-Baden, the German spa town built on ancient thermal springs, is a fitting venue to discuss the health of the global economy during this week’s meeting of the Group of Twenty finance ministers and central bank governors.

Policymakers will likely share a sense of growing optimism, because the recent strengthening of activity suggests that the world economy may finally snap out of its multi-year convalescence.

Economic prescriptions have played an important part in the recovery, and will continue to do so for some time. Maintaining the positive growth momentum continues to require supportive macroeconomic policies. And the participants at the meetings will need to take action, individually and collectively, to make growth more inclusive and resilient.

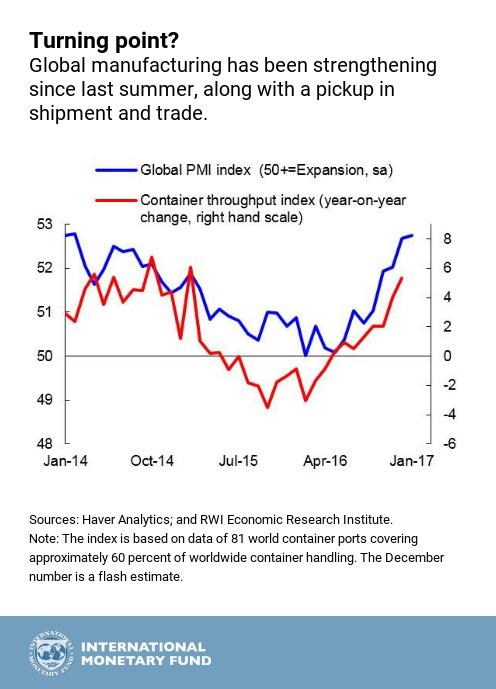

Have we reached a turning point? The short answer is yes—at least for now. Growth outturns in the second half of last year were generally solid. Manufacturing and confidence indicators are picking up, and there are signs that global trade volumes are rising along with them.

That is why the International Monetary Fund in January projected a pickup in global growth this year and next—to 3.4 and 3.6 percent—compared to 3.1 percent in 2016.

- The improved outlook partly reflects a projected pickup in advanced economy activity—helped by expectations of more expansionary US fiscal policy.

- We are especially encouraged by stronger-than-expected economic activity in the euro area, the United Kingdom, and Japan.

- Emerging and developing economies, led by China and India, continue to contribute more than three-quarters of total global GDP growth in 2017. Adding to this is a projected normalization of conditions in Brazil and Russia, which have been facing deep recessions.

So, yes, the global economy is moving into a better position. But it would be a mistake to assume that it will automatically return to rude health.

In fact, there has rarely been a period when policy choices have mattered more for what comes next, especially since there are still considerable risks to the outlook.

Maintaining the momentum

In a number of advanced economies, for example, demand is still weak and inflation is not durably back to target. This calls for continued monetary support and a greater emphasis on fiscal policy in countries that have room in their budgets. These steps should be combined with structural reforms to lift productivity and boost long-term growth.

Lack of demand is less of a problem in the United States, where growth would benefit more from efforts to expand supply, such as investment to revamp infrastructure, efficiency-enhancing corporate tax reform, and improvements in education.

Stronger US growth would certainly be good for the global economy, but a changing US policy mix may also create knock-on effects, or spillovers. For example, depending on the nature of the US policy mix, a stronger dollar and rising US interest rates could lead to a sharper-than-expected tightening in global financial conditions. This could potentially put stress on some emerging economies and low-income countries.

Sustaining the current growth momentum would also be helped by a successful transition toward slower but more balanced growth in China, and by further policy actions on the part of commodity exporters as they continue to adjust to lower commodity prices.

Above all, we should collectively avoid self-inflicted injuries. This requires steering clear of policies that would seriously undermine trade, migration, capital flows, and the sharing of technologies across borders. Such measures would hurt the productivity, incomes, and living standards of all citizens.

Global economic integration

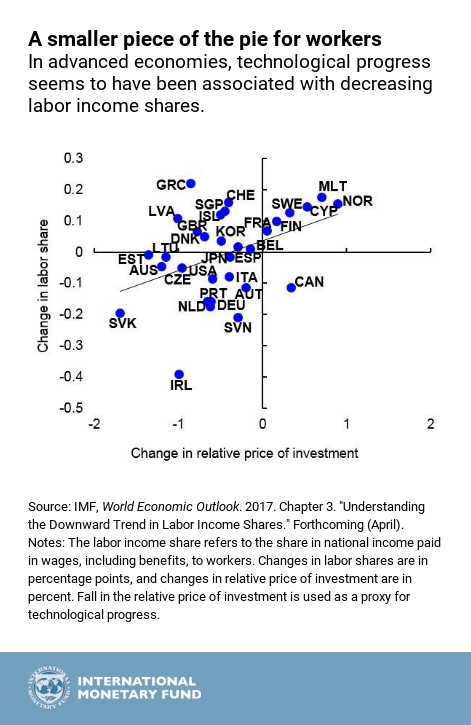

Trade and technological innovation have allowed countries to grow the economic pie and improve living standards, while lifting hundreds of millions of people out of poverty. Yet more could be done to mitigate the unwelcome side-effects seen in some places—including a rise in income inequality, job losses in shrinking sectors, and protracted economic and social problems across structurally weaker regions.

How can this be done? This is not an easy task, but it can start with boosting growth, and sharing the benefits more widely.

A critical first step is to get serious about inclusive growth. We have yet to fully understand the complex web of economic challenges faced by different cultures, regions, and demographic groups. We do know, however, that higher-skilled workers are much more likely to benefit from innovation and economic openness.

This calls for greater efforts to equip lower-skilled workers with the tools they need to seek and find better-paying jobs, such as targeted education programs, skills training, and employment incentives.

- These active labor market policies can help ease workers’ transitions to new employment. Their funding varies significantly across countries. Denmark, for instance, spends 1.9 percent of GDP on such policies, compared with 0.1 percent in the United States.

- Of course, spending more money is not enough; it must be spent more efficiently. Some initiatives have proven to be cost-effective—such as well-designed assistance for job search and job matching.

More broadly, all countries need to actively promote life-long learning to prepare citizens for technological changes. Singapore, for example, offers unconditional grants to all adults for training throughout their working lives.

Another priority for inclusive growth is the retooling of income policies and tax systems.

- In-work tax incentives and higher minimum wages can be helpful in some countries. So, too, can changes to tax and benefit systems, including more progressive income taxation.

- IMF research shows that avoiding excessive inequality will help, not hinder, growth. We also know that policy tradeoffs can be minimized: for example, most countries would benefit from reforms that make their tax systems more equitable and more efficient.

In short, we have the capacity—and responsibility—to grow the economic pie, which will facilitate sharing it more equitably.

Effective international cooperation will maximize the benefits of national policies if we:

- step up efforts to address global external imbalances and complete reforms to strengthen financial systems;

- protect and reinforce trade as an engine of broadly shared growth; and

- work together to resolve some of the most pressing issues of our time, from global security and health issues to coping with natural disasters and climate change.

G20 policymakers can move the needle on all these issues. After years of being stuck in a weak recovery, the world economy needs to move on, shape up, and generate greater prosperity for all. What better place than Baden-Baden for leaders to recommit themselves to achieving robust global economic health?