Countries in the Middle East and Central Asia have a long history of using taxes to develop their economies and promote social inclusion. The first income tax can be traced back 5,000 years to Ancient Egypt. The Pharaohs used it to build granaries and feed the poor during shortages. Zakat, a payment obligation akin to a progressive tax that began in the 12th century, is still collected to fund social spending in Saudi Arabia and elsewhere.

Tax systems have evolved significantly over the centuries, and there are striking differences between countries, including between exporters and importers of oil and gas. Despite recent progress, including the introduction of value-added and corporate income taxes in some petroleum-exporting countries, efforts to put in place modern, efficient, and fair tax systems remain a priority.

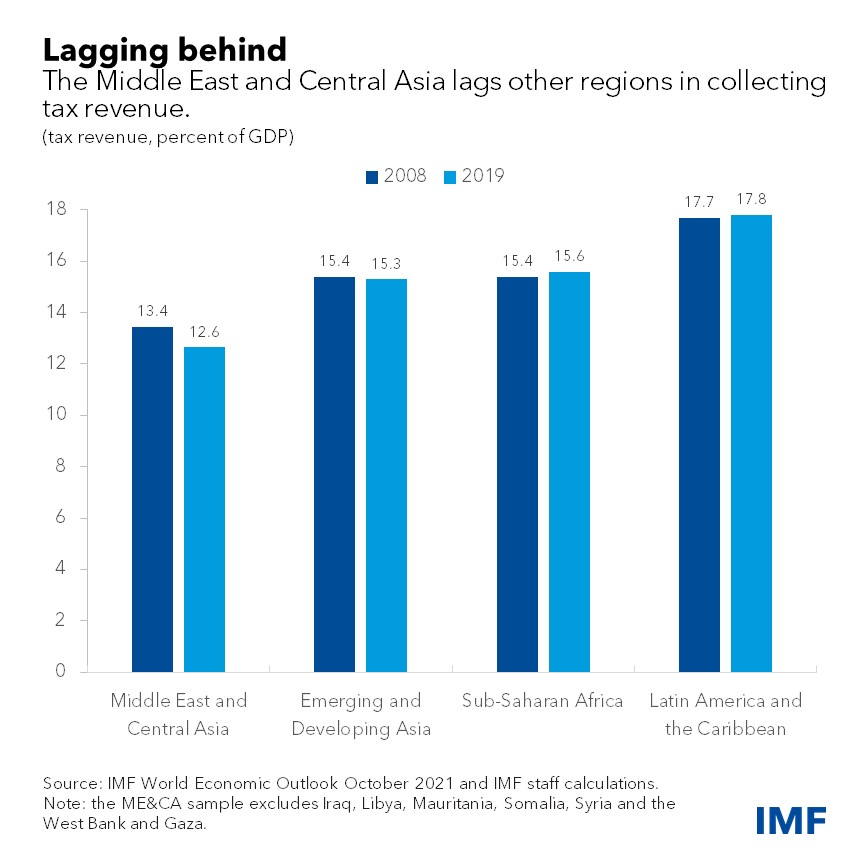

Tax revenue as a share of gross domestic product remains relatively low despite progress broadening tax bases in many countries. Governments, meanwhile, face immediate pressure to increase spending to protect the poor including from soaring food and fuel inflation, improve health and education, build resilience to future shocks, and meet the United Nations Sustainable Development Goals.

A recent IMF staff paper looks at the challenges and opportunities of raising more tax revenue in the Middle East and Central Asia. It provides new estimates of the magnitude of the additional revenue that could be collected to improve growth prospects and social inclusion: the difference between actual and potential tax collection equals about 14 percent of GDP (excluding oil and gas), on average. There is scope, in other words, for governments to raise more revenue by bringing tax ratios closer to the levels that they could achieve given their economic structures.

Some of the largest revenue gaps are found in the region’s low-income countries—often reflecting the effects of fragility and conflict. Weaker tax collections can be traced to a range of factors. The use of direct taxes—especially on personal and corporate income—is limited. Property taxes are relatively underdeveloped.

Weaker tax collections can be traced to a range of factors. The use of direct taxes—especially on personal and corporate income—is limited. Property taxes are relatively underdeveloped.

A variety of indirect levies on consumer goods account for most tax revenue (excluding revenue from gas and oil) but exemptions are common and extensive. Weak tax compliance and widespread informality reduce governments’ ability to collect.

Taxation could also be more progressive. Personal income taxes in the region vary in the extent to which the average tax rate increases with income and in their ability to redistribute from richer to poorer households. In several countries including Algeria, Iran and Iraq, personal income tax is relatively progressive. In some countries, however, revenues are too small to achieve a meaningful redistribution of income. Other countries have larger personal income tax revenues, but rates are less progressive.

Raising revenues, improving inclusion

Our research shows that eliminating widespread exemptions and inefficient incentives would broaden tax bases and make tax systems fairer and more transparent. Several countries have made notable progress broadening the tax base or are in the process of doing so. Egypt, for example, aims to reform its income tax law to simplify the legal framework and streamline exemptions.

Moreover, tax system reforms, such as redesigning personal income and value-added taxes, and further developing property taxes, could boost collection, make systems more progressive, and support inclusion.

Modernizing revenue administrations and making them more efficient would improve enforcement and compliance. Many countries such as Algeria, Azerbaijan, Pakistan and Iran already use electronic filing. Still, further efforts are needed including to streamline organizational structures, improve business processes and leverage digital technologies. Closer international cooperation to improve the exchange of information across tax jurisdictions could also be beneficial.

Reforms to reduce informality and promote economic diversification could support revenue mobilization. These include measures in Egypt and Tunisia to discourage the use of cash and to increase financial inclusion. Measures to fight corruption, improve governance, and enhance transparency could instill confidence in taxation. Efforts in Georgia and Tajikistan to fight corruption by simplifying tax systems and procedures have helped double tax to GDP ratios in the past 20 years.

Proper sequencing of reforms is important in all countries, but especially in the region’s low-income economies and its fragile and conflict-afflicted states.

With sustained political commitment, clear communication, and careful design and implementation of reforms, lasting improvements can be made to mobilize greater revenue. By building on these efforts, countries in the Middle East and Central Asia can use tax policy to promote economic development, increase social inclusion and alleviate food insecurity, continuing a path charted by the Pharaohs.