A. The Financial Sector Assessment Program (FSAP) provides in-depth examinations of countries’ financial sectors. FSAPs are done jointly by World Bank and IMF staff in developing and emerging market countries and by the IMF alone in advanced economies. FSAPs have two main components: the financial stability assessment and—in developing and emerging market countries—the financial development assessment. These components may be assessed at the same time during a joint IMF-World Bank mission or at different times in separate stability and development “modules” conducted by the Fund and the Bank, respectively.

A. The stability assessment under the FSAP is the main responsibility of the Fund in countries where FSAPs are done jointly with the World Bank. Whether conducted in the context of a joint IMF-World Bank FSAP or on a stand-alone basis as a “stability module”, the stability assessment under the FSAP covers an evaluation of three components: (1) the source, probability, and potential impact of the main risks to macro-financial stability in the near-term; (2) the country’s financial stability policy framework; and (3) the authorities’ capacity to manage and resolve a financial crisis should the risks materialize. The key findings of the stability assessment are summarized in the Financial System Stability Assessment (FSSA), prepared by the Fund team for the IMF Executive Board. The FSSA is a key input to IMF surveillance.

A. The development assessment under the FSAP is the main responsibility of the World Bank, which participates in FSAPs conducted in developing and emerging market countries. Whether conducted in the context of a joint IMF-World Bank FSAP or on a stand-alone basis as a “development module”, the developmental assessment focuses on medium- to long-term needs for the deepening and strengthening of the financial sector, and address major weaknesses affecting the sector’s efficiency, soundness, and contribution to long-term growth and social development. These may include assessments of (1) financial sector infrastructure development needs; (2) financial sector oversight; (3) public policies affecting financial sector activity; (4) the impact of an underdeveloped financial sector on financial stability; and (5) long-term financial sector reforms. These issues are particularly important in low-income countries.

A. Assessments of compliance with international financial sector standards (summarized in a Report on Observance of Standards and Codes or ROSC) are voluntary for the country, even in countries for which an FSAP stability assessment is a mandatory part of surveillance. They are an optional but potentially very useful component of the FSAP, especially if the last formal assessment of compliance is dated or the standards have changed. The standards most frequently assessed in the context of FSAPs are those on banking, capital market, and insurance supervision (BCP, IOSCO and IAIS, respectively). ROSCs can also be conducted outside an FSAP, on a stand-alone basis.

A. By IMF Board decision, all FSAPs are required to be associated with an AML-CFT assessment conducted either by the IMF’s Legal Department or by FATF or a FATF-style regional body. The AML-CFT assessment does not need to take place at the same time as the FSAP (indeed it very rarely does). It may take place separately within a three-year window around the FSAP mission. In other words, either an AML-CFT assessment must have taken place within 18 months prior to the FSAP mission (in which case a summary of its findings is reported in the FSSA), or the authorities must have firm plans to undertake one within 18 months after the FSAP mission. If either of these conditions is met, the requirement that every FSAP be associated with an AML-CFT assessment is deemed to be satisfied.

A. Since the FSAP was launched in 1999, after the Asian crisis, 157 member jurisdictions have completed the program (many more than once). In a recent survey to national authorities, about of respondents indicated that they were satisfied or very satisfied with the overall usefulness of the FSAPs. Following the global financial crisis, demand has risen, and the G-20 countries have made a commitment to undergo an assessment under the program every five years.

A. Any country can request an FSAP assessment, whether or not it is borrowing from the Bank or the Fund. In September 2010, the IMF Board decided that 25 jurisdictions with financial sectors that have the greatest impact on global financial stability-or "systemically important" financial sectors- should undergo in-depth reviews of their financial health by the Fund every five years in the context of Fund surveillance under Article IV of the Fund's Articles. This integrates the stability assessments under this previously fully voluntary program into the Fund's surveillance of the world's top financial sectors. In December 2013, the list of systemically important financial sectors was expanded from 25 to 29 jurisdictions. The methodology for determining jurisdictions with systemically important financial sectors emphasizes interconnectedness among financial sectors; takes into consideration the potential for price contagion across financial sectors; and adheres to principles of relevance, transparency, and even-handedness. In 2021, the Board reconfirmed that the 2013 methodology remained adequate with a couple of minor adjustments. The list of jurisdictions with SIFS was further expanded to 47 and made more risk-based: 33 jurisdictions with relatively more systemically important financial sectors would participate in FSAP every once in five years, while the other 15 would participate every once in ten years. Both the list of jurisdictions and the methodology for assessing systemic importance will continue to be reviewed periodically.

A. The IMF Executive Board has established prioritization criteria, which include: (i) the systemic importance of the country; (ii) macroeconomic or financial vulnerabilities; (iii) major reform programs that might benefit from a comprehensive financial sector assessment; and (iv) features of the exchange rate and monetary policy regime that make the financial system more vulnerable. These criteria are applied to prioritize all country requests, including those by the G-20 (except for those countries for which stability assessments under the FSAP are a mandatory part of surveillance, which take priority). Maintaining a balance across regions and different levels of financial sector development is also important.

A. Country authorities requesting an FSAP update, either in the form of a joint IMF-World Bank mission or as separate modules, may suggest additional topics for the exercise. The inclusion of these topics will depend on resource availability. Possible additional elements include:

•Updates of previously assessed standards and codes and the associated reassessment of the underlying compliance “grade”. The need for an update of a particular standard would take into account the elapsed time, changes since the previous assessment, and the country's level of development.

•Issues not covered in the previous assessment. These may include detailed assessments of standards not previously assessed or any issues that have gained relevance to financial stability or development.

A. Since September 2009, the IMF and World Bank have been revamping the program. The FSAP is still a joint Bank-Fund program (except for advanced countries, where FSAPs are the sole responsibility of the Fund), and country participation is still voluntary for countries with non-systemic financial sectors. However, there are four important changes:

- First, several initiatives took place to improve the quality of assessments, incorporate the lessons from the recent crisis, and progress with the post-crisis global regulatory reform agenda. FSAPs are structured by core three pillars—risk and vulnerability analysis, oversight, and financial safety nets. Within each pillar, assessment prioritizes the issues with systemic financial stability risks that could negatively impact the whole economy. Risk analysis now emphasizes macroprudential stress testing that incorporates various feedback and spillover effects. In line with the global reform agenda, teams are paying more attention to the macroprudential policy framework, nonbank financial institutions, including financial market infrastructures (such as digital payment clearing agencies), crisis preparedness and management frameworks, including institutional cooperation to resolve distressed financial institutions within and across national borders.

- Second, the scope of FSAP has been adapted to evolving financial stability landscape—such as risks from the rise of nonbank financial institutions, including (digital) market infrastructures and emerging risks from fintech, cyber risks, and climate change.

- Third, the program has become better integrated with the Fund's surveillance. In particular, as of September 2010, countries with systemically important financial sectors are required to undergo financial stability assessments every five years as part of the Fund's bilateral surveillance. This will help integrate financial sector issues into the Article IV process, allowing more continuous monitoring of developments and quicker responses.

- Fourth, the program now has a clearer delineation of institutional responsibilities for stability and development, with greater institutional accountability. The 2009 FSAP Review introduced the stability module (led by the Fund) and developmental module (led by the Bank) of FSAPs. All FSAPs to advanced economies are stability modules conducted only by the Fund.

A. The Fund’s surveillance assesses how members’ policies contribute to systemic stability. Some countries have very large financial sectors that are highly interconnected with those in the rest of the world. By making financial stability assessments mandatory for countries with such “systemically important” financial sectors, the Fund can monitor more closely those members that would have the most impact on systemic stability in the event of a crisis because of the size or the interconnectedness of their financial sector.

A. To identify jurisdictions with systemically important financial sectors, the Fund has established a set of criteria to rank jurisdictions based on the size of their financial sector and its connections with financial sectors in the rest of the world. The criteria do not reflect a country’s broader economic or political importance. They also do not capture financial sector vulnerabilities. The Fund will periodically reevaluate the list of countries with systemically important financial sectors to reflect changes in size and connections over time.

A. For jurisdictions whose financial sectors are not identified by the Fund as among the most systemically important, participation in the FSAP is voluntary. The Fund conducts FSAPs in advanced economies while sharing the work with the World Bank in emerging and developing countries. The Fund is responsible for assessing financial stability, and the Bank for the developmental assessment (see above).

For jurisdictions with systemically important financial sectors, the Fund’s financial stability assessments have become a mandatory part of the Fund’s bilateral surveillance under Article IV of the Fund’s Articles Assessment must take at least every five for ten years depending on their relative systemic importance. In all cases, the mandatory assessments will cover the key elements relevant for financial stability as outlined above. In developing and emerging market countries with systemically important financial sectors, the World Bank's developmental assessment can also take place voluntarily, either together with the (mandatory) financial stability assessment or in a separate module. International Standards and Codes assessment continue to be voluntary for all members.

A. The FSAP is a joint undertaking of the World Bank and the Fund in developing and emerging market countries and the Fund alone in advanced economies. In addition to their own expert staff, the Fund and the World Bank draw on the expertise of experts from a range of cooperating central banks, supervisory agencies, standard setting bodies and other international institutions in carrying out the assessments. The mandatory stability assessments will affect only the Fund’s contribution to the FSAP, or the “financial stability module”. The World Bank’s financial development assessments in developing and emerging market countries will continue on a voluntary basis, as at present, and may be conducted either in joint IMF-World Bank missions or in separate modules.

A. This depends on a number of factors. Typically, first-time FSAPs require two missions, and subsequent updates are conducted in one mission. In some cases, especially when an FSAP involves several ROSCs, these may take place in a separate mission in advance of the main FSAP mission. Each of these missions lasts about two weeks. In a few cases, e.g., if the country has little experience with the program or if the authorities request it, short visits (3-4 days) may take place a few months before the FSAP mission to discuss the precise scope of the FSAP.

A. This varies with the needs and complexity of the country’s financial sector and the number of formal standards assessments conducted in the context of the FSAP. The IMF core team that would assess financial stability would typically consist of one mission chief and at least 4-5 other team members. The World Bank team, if one is involved, should be roughly equal in size. The teams could be larger if the issues are complex. In addition, there would be one or two assessors for each of the ROSCs included in the FSAP.

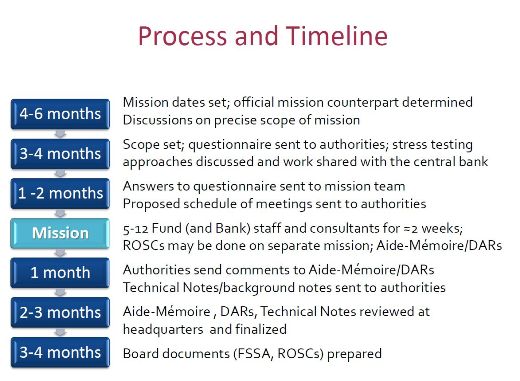

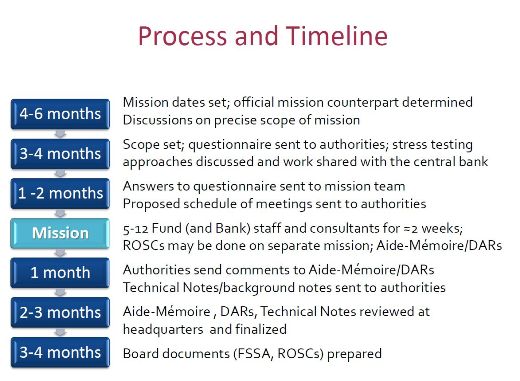

A. Please see the timeline below, which is only an illustration. It is based on the simplest case: an FSAP update conducted on a single mission. In case of additional missions, the timeline would be adjusted accordingly.

A. It is recommended that the authorities establish an FSAP Secretariat, comprising representatives of the relevant agencies that would be involved in the coordination of the mission. Each participating agency should also have an “FSAP coordinator,” typically its representative to the Secretariat. Ideally, all communications between the FSAP team and the authorities should be channeled through the Secretariat to ensure that all parties are kept fully informed of requests/developments throughout the FSAP process. Following the FSAP, comments from authorities on the various FSAP draft reports should also be channeled through the Secretariat to ensure that the FSAP team receives a consistent set of comments that is agreed upon by all agencies.

A. Relevant agencies will be asked to prepare self-assessments of any standards and codes that are to be formally assessed in the context of the FSAP assessors. Ideally, these self-assessments should be transmitted to the FSAP team 1-2 months prior to the mission to ensure that the assessors have sufficient preparation time. The quality and timeliness of the self-assessments will have significant bearing on the productivity of discussions during the mission. The authorities would also be asked to (i) complete questionnaires designed to complement the self-assessments, (ii) complete questionnaires on general financial stability issues, and (iii) provide data required for the FSAP, including institution-specific data needed for the stress tests, subject to confidentiality arrangements. These questionnaires would be provided to the authorities at least two months before the mission, and responses should be transmitted to the FSAP team at least a month before the mission. In order to minimize the burden on country authorities, FSAP teams are expected to have done the necessary groundwork ahead of time so that they do not request information that is already publicly available.

A. The FSAP team typically sends a proposed list of meetings to the FSAP Secretariat, who would then undertake to organize the meetings. In addition to meetings with the central bank and government and supervisory agencies involved in the FSAP, FSAP teams usually also meet representatives of financial institutions, market participants, trade associations, etc. In countries where the IMF has Resident Representative Offices, the Resident Representative would typically play an important role in helping to organize the meetings for the FSAP team, in close coordination with the FSAP Secretariat.

A. The team would usually visit a range of financial institutions and other market participants (e.g., insurance agencies, pension funds, mutual funds) to gain a better understanding of market developments and structure, outlook, risk management practices, etc. The FSAP team would not be asking the financial institutions to provide or disclose any proprietary or business-sensitive information.

A. The Fund takes data confidentiality extremely seriously. FSAPs have been handling confidential and market-sensitive data for over a decade now, and have an excellent record of maintaining confidentiality. If requested, the FSAP team can also provide the authorities with a formal letter of undertaking to maintain confidentiality or sign a confidentiality protocol. The most common confidential data typically provided to FSAP teams include bank-by-bank balance sheet, liquidity, and supervisory data used in stress tests and, in some cases, data on official reserves. Samples of individual bank examination reports are also provided to team members that assess the quality of supervision or conduct a formal ROSC. These data are kept within the team and not circulated to the rest of the IMF (or World Bank) or shared with the Fund’s Executive Board. Results of stress tests are presented in ways that preserve the anonymity of the individual institutions (e.g., “Bank A”, “Bank B”, etc.) or on an aggregate basis (e.g., for groups of banks or for the system as a whole). The World Bank has introduced a new policy on disclosure of information that has implications for confidentiality arrangements. Authorities of countries where the World Bank participates in the FSAP assessment should consult with World Bank staff ahead of the FSAP.

A. The FSAP team prepares an Aide-Mémoire for the country authorities summarizing the main findings and recommendations of the mission. The Aide-Mémoire remains confidential and cannot be published or shared with third parties by either the authorities or the Fund. Technical notes on selected topics and detailed assessments reports (DARS) of compliance with international standards and codes are also prepared, as appropriate. Publication of the technical notes and detailed assessment reports is voluntary. A Financial System Stability Assessment (FSSA) report is prepared for discussion at the IMF Executive Board. Publication of the FSSAs is voluntary but presumed. In cases where the World Bank is involved in the FSAP, the World Bank prepares a Financial Sector Assessment (FSA) for its Executive Board.

A. The FSAP is an independent assessment of the financial sector by the staff of the IMF (and World Bank, if relevant). Nevertheless, input and feedback from the authorities play an important role in the assessment. The authorities are given the opportunity to review and provide comments on the Aide Memoire, Technical Notes, and Detailed Assessment Reports on any financial sector standards assessed during the mission. The purpose of this review is not to influence the team’s assessment but to correct factual errors and ensure all relevant factors have been taken into account. The FSSA is prepared based on the team’s work and taking into account the authorities’ comments on the Aide-Mémoire, as appropriate. Like the Article IV staff report, the FSSA is not provided to the authorities for comments before it is circulated to the IMF’s Executive Board, but purely factual corrections are still possible after its circulation.

A. How countries choose to address these recommendations is up to the authorities. Like all policy recommendations made in the context of IMF surveillance, the FSAP recommendations are of an advisory nature. Subsequent Article IV surveillance teams, as well as future FSAPs, are required to assess the extent to which these recommendations are being implemented and report to the IMF Executive Board. Other international groupings or regional bodies may introduce monitoring processes that follow up on the implementation of FSAP recommendations or on actions taken by the authorities to address shortcomings identified in the assessment of compliance with international standards during an FSAP (for example, the FSB’s peer review and Non-Cooperating Jurisdictions processes). Such processes, however, are not part of the Fund’s policy framework or governance structure.