Lowering Public Debt

Finance & Development, June 2010, Volume 47, Number 2

Harald Finger and Azim Sadikov

Many countries have slashed their public debt ratios in the past, often thanks to macroeconomic conditions. They may be less lucky in the future

LAST year’s global recession may have yielded to a global recovery, but at least in one respect its legacy is here to stay. In many countries, public debt as a percentage of gross domestic product (GDP) has increased rapidly since the onset of the global crisis and is slated to rise even more in the coming years because it will take time to reduce government fiscal deficits from their current high levels. Once the recovery has taken a firm hold and no longer depends on life support provided by large-scale fiscal stimulus, the focus must turn to bringing down debt. Past experience shows it can indeed be done, but this task will likely become more challenging going forward.

Tale from the Middle East

Lebanon is an example of a country that was able to achieve a large reduction in the government debt–to-GDP ratio. Years of high fiscal deficits during the 1990s and a succession of shocks in the early to mid-2000s propelled government debt to 180 percent of GDP by 2006, among the highest debt ratios in the world. But over the next three years, Lebanon brought that ratio down by about 30 percentage points, a sizable and rapid improvement that few would have predicted in 2006.

How did Lebanon do it? The tale starts with a strong economic rebound. In 2006, Lebanon’s economy was battered by armed conflict with Israel, and the ensuing prolonged political stalemate left the country without a functioning parliament for more than a year (political tensions culminated in street fighting in the spring of 2008). But the economy started to turn around in 2007, in an astounding decoupling from the tense political environment. Confidence and—consequently—economic activity began to recover, reinforced by a new and ambitious fiscal reform agenda and (limited) financial backing by regional and Western donors.

A political reconciliation agreement reached in Doha in 2008 by rival Lebanese factions facilitated a strong rebound in tourism and construction. Large inflows into the banking system ensued—a signal of newly restored confidence—and even strengthened during the global financial crisis. Real GDP grew at an average annual rate of 8 1/2 percent during 2007–09. Although Lebanon’s ambitious fiscal agenda was never fully implemented, strong growth, fiscal discipline, and some donor support allowed for primary fiscal surpluses—which exclude interest payments—of 1 1/2 to 3 percent of GDP during this period, which cut its debt ratio significantly (though government debt is still high at about 150 percent of GDP).

Precedents galore

Lebanon is not alone: surprisingly many countries have managed to reduce their debt-to-GDP ratios substantially. Since 1980, there have been 84 cases among advanced and middle-income economies of debt-to-GDP ratio declines of more than 20 percentage points over at least two years. Median debt reduction was 34 percent of GDP and lasted for 5 1/2 years, with an average primary fiscal surplus of 2 3/4 percent of GDP. There has been considerable variation in the size of total debt reduction and the average primary balance (see Chart 1).

Cases of large debt reduction generally fall into three groups:

- oil exporters, which benefited from favorable price developments or expansion in extraction capacity;

- debt restructuring cases, which received support from creditors and were often helped by a quick economic recovery after a crisis; and

- other cases, which achieved debt reduction through a combination of homegrown fiscal adjustment and favorable “automatic” debt dynamics. Usually these dynamics included a combination of strong economic growth and relatively low interest rates and—for countries whose debt is denominated in foreign exchange—real exchange rate appreciation.

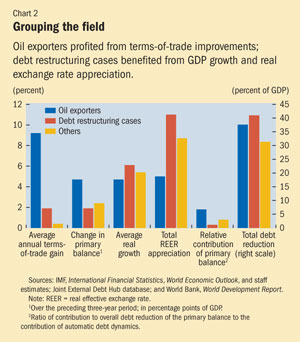

Oil exporters—filling up

Not surprisingly, oil exporters achieved a higher increase in the primary fiscal balance than other countries during debt reduction episodes, because buoyant oil prices and/or increases in production led to higher fiscal revenues (see Chart 2). Oil exporters’ average terms-of-trade improvement was several times that of other countries. But oil exporters consolidated their primary expenditures somewhat less, perhaps because the oil windfall reduced the urgency of cutting expenditures. Nonetheless, oil exporters are the only group whose primary balance contributed more to debt-to-GDP ratio reduction than did the automatic debt dynamics resulting from favorable developments in growth, interest rates, and the exchange rate.

Debt restructuring cases—reenergized

By contrast, in cases that involved debt restructuring—with either private creditors or the Paris Club—the primary balance contributed less to overall debt reduction than in the other groups. Granted, in the first year of the debt reduction episode, the primary fiscal adjustment was on average slightly higher in the debt restructuring cases than among other cases (oil exporters aside), but over the entire debt reduction period, a different picture emerges. For the debt restructuring cases—despite tightening of the primary balance by about 2 percent of GDP during such periods—primary balances on average reached only 0.7 percent of GDP, markedly less than among oil exporters (6.4 percent) and other cases (2.8 percent).

This may seem puzzling: one might expect that creditors would demand higher primary surpluses in exchange for debt relief. But the favorable debt dynamics triggered by more generous debt service terms and, in many cases, quick recovery of the economy and real exchange rate appreciation after a crisis effectively reduced the need for primary fiscal adjustment during debt reduction episodes. In fact, the debt restructuring cases achieved on average the largest debt reductions (41 percent of GDP, compared with 38 percent among oil exporters and 31 percent among other cases), even though they had the lowest primary surpluses among the three groups. Apart from direct debt relief from the terms of the restructuring, the debt restructuring cases were also helped by high GDP growth (6 percent) and substantial real exchange rate appreciation (11 percent over the duration of the episode).

Although it may thus sound tempting to solve debt problems via restructuring, growing financial interlinkages make that route increasingly costly for both the country undergoing restructuring and the international community to which it is linked.

Growing out of debt

Among the 43 countries that are neither oil exporters nor benefited from debt restructuring—especially cases in the Middle East and Central Asia (MECA; see Chart 3)— there was a tendency to rely more heavily on automatic debt dynamics than on primary surpluses to reduce the debt ratio. The amount of debt reduction varied widely, but most achieved primary surpluses in the range of 2 to 5 percent of GDP. To generate this primary fiscal adjustment, middle-income countries tended to rely equally on revenue and expenditure measures, whereas advanced economies tended to rely more strongly on expenditure cuts, perhaps because they already had relatively high revenue ratios before the debt reduction episodes.

But most MECA countries actually ran primary deficits during their debt reductions (on average 2 percent of GDP). Consequently, these countries relied more than their peers in other regions on favorable debt dynamics to reduce their debt ratios (the farther southeast a country from the 45-degree line in Chart 3, the larger its reliance on automatic debt dynamics relative to the contribution of the primary fiscal balance). By contrast, advanced economies tended to rely somewhat more on primary surpluses than on automatic debt dynamics.

The tendency to rely on automatic debt dynamics rather than primary surpluses was especially pronounced among cases with higher initial debt levels, perhaps because countries that were unable to prevent large debt buildups were also less able to consolidate their finances during debt reduction episodes and hence had to rely more on favorable macroeconomic conditions. By contrast, debt reduction episodes that relied more on primary surpluses than on automatic debt dynamics tended to be more sustained. These types of episodes were also more concentrated among advanced than middle-income economies.

Some countries might be tempted to inflate their way out of debt. In principle, a country that manages to create inflation in a way that is not fully reflected in interest rates could generate favorable debt dynamics without too much adjustment of fiscal policies. But resorting to substantial inflation can mean a quick loss of credibility. Moreover, given many countries’ substantial foreign currency debt, efforts to inflate out could be thwarted by ensuing currency depreciation. Indeed, few countries posted high inflation during their debt reduction episodes (only three cases had average inflation above 20 percent). And although countries with less foreign currency debt might be expected to resort to higher inflation than countries with more, there is no evidence of systematically higher inflation in countries with a lower share of foreign-currency debt.

In sum, middle-income countries other than oil exporters tended to rely on the automatic debt dynamics brought about by favorable macroeconomic conditions, rather than on primary surpluses during episodes of large debt reduction. But significant primary fiscal adjustment was needed to set the debt reduction in motion, and higher primary surpluses were associated with more sustained debt reduction episodes. This underscores the importance of fiscal adjustment not only as a direct contributor to debt dynamics but also to spur favorable macroeconomic conditions that reduce the debt-to-GDP ratio. In advanced economies, automatic debt dynamics played less of a role—perhaps because their economies tend to be less dynamic—and they had to rely more on sustained fiscal effort to achieve debt reduction.

With the potential for higher world interest rates and projections for a relatively slow recovery for many countries emerging from the global crisis, more significant fiscal adjustment than in the past may be required to bring down debt. For Lebanon, further debt reduction will require adequate primary surpluses, supported by structural reforms aimed at maintaining the momentum of growth.