Deeper Markets, Cheaper Capital

Finance & Development, June 2010, Volume 47, Number 2

Financial sector reforms can help reduce the cost of capital, spur investment, and promote rebalancing in Asia

THE global debate on imbalances has placed “excess” savings in Asia under international scrutiny. Although the debate has centered mostly on the role of China, savings-investment balances in other countries, especially those of the Association of Southeast Asian Nations (ASEAN) including Indonesia, Malaysia, the Philippines, and Thailand, are also attracting attention.

So does Asia save too much or invest too little? The answer varies across economies: some need to reduce savings, while others need to increase investment. But what can be done to fix imbalances is relevant for most economies. Recent research (Kalra, 2010; Oura, 2008) suggests that investment in some Asian economiesmdashhere—specifically, spending by firms on capital investmentmdashhere—would be higher if financial sector reforms could reduce the cost of capital and allocate capital more efficiently. This would moderate imbalances.

More robust systems

Asian economies have so far weathered the onslaught of the latest global downturn with greater ease than in previous crises. Asian firms’ finances have improved significantly since the 1997 crisis. Corporate leverage has declined, and profitability and liquidity have increased. Vulnerability indicators have also improved significantly, and default probabilities in the corporate sector are lower than a decade ago. In short, there is evidence of sounder corporate financing practices and strength in a number of Asian countries hit by the crisis. Financial systems in the region are also stronger. In particular, banking systems’ financial indicators have improved over the past decade. So Asian economies can now increase investment spending to meet higher demand at home as they rebalance toward domestic sources of growth and make the most of the global upswing.

How Asian countries make use of these opportunities will depend, in part, on how well their financial systems can allocate investable funds across various investment projects, both by reducing the cost of capital and by directing funds to where they are needed most. Financial sector reforms can help with both.

Room for expansion

Financial systems in a number of Asian economies are still dominated by banks, with small local currency bond markets and little corporate bond issuance within those markets. Stock market capitalization is relatively low in many countries compared with advanced economies in Asia and beyond. Foreign participation in the equity and bond markets is also limited. Indeed, large movements in equity prices generated by periodic bouts of capital inflows are in part indicative of the limited depth and breadth of the stock market. All told, a number of Asian countries’ financial systems need to grow and diversify.

Asian firms do substitute among alternative debt financing options and would actively seek alternatives to bank funding if capital markets were deeper and more liquid. For example, there was a largemdashhere—but temporarymdashhere—spurt in issuance of corporate securities in local currency debt markets in the midst of the global financial crisis in 2008. At the time, these firms’ financing needs were arguably limited, and the issuance of corporate securities reflected a shift from bank financing to bond markets to take advantage of lower spreads (Kalra and Oner, 2010).

Cost of business

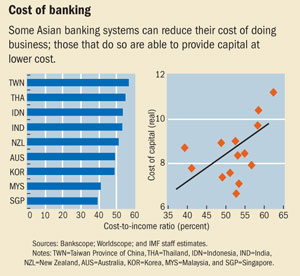

There is room for Asian financial systems to lower costs and allocate capital more efficiently. In some economies, including India, Indonesia, Malaysia, and Thailand, the cost of capital could be reduced further to levels in other banking systems in the region (Australia, Korea, New Zealand, and Singapore). Reductions in the cost of banking can be achieved through financial sector reforms to strengthen bank balance sheets, reduce nonperforming loans, and improve credit information. In addition, in countries such as Indonesia, structural reform that reduces credit riskmdashhere—for example, through clearer collateral and bankruptcy proceduresmdashhere—would also help lower lending rates.

Cost measures of economies’ banking systems are reflected in the overall cost of capital facing firms. Simple measures of the cost of capital make the point succinctly: countries with higher banking costs generally have higher cost of capital (see chart). Since equity and corporate bond markets are relatively small in a number of Asian countries, the cost of credit from banks determines the cost of capital. These measures of the cost of capitalmdashhere—encompassing cost of equity and debt capitalmdashhere—are constructed in Kalra (2010) along the lines of Ameer (2007). These are comprehensive measures of the cost of capital, which incorporate countries’ price-equity ratios, growth prospects, interest rate on debt, and corporate income tax rates.

And measures that reduce the cost of capital will, most likely, spur investment. Empirical analysis of firm-level capital spending suggests that financing costs are a key determinant of capital expenditures: a lower cost of capital is associated with higher capital spending by firms.

This holds for a range of economies in Asiamdashhere—India, Indonesia, Korea, Malaysia, Taiwan Province of China, and Thailandmdashhere—and for alternative sources of external financing of capital spending; that is, debt and equity. And capital spending is more sensitive to the cost of debt in some economies (Korea, Malaysia, and Taiwan Province of China), possibly reflecting higher stock market capitalization and significantly larger stock markets relative to gross domestic product.

Efficient allocation

Are there frictions in Asian financial marketsmdashhere—transaction costs that are high or make it difficult for firms to borrowmdashhere—that reforms can resolve? Frictions can arise for a variety of reasons, such as institutional structure, financial market size, and information gaps. There is evidence that such frictions impede the efficient allocation of capital across sectors and firms in Asia.

Of course, friction and financing constraints differ across sectors and countries especially when compared with more developed markets such as the United States, so that the constraints to rebalancing most likely vary across economies. And there are also differences across segments of the financial system.

For some economies, such as India and Thailand, there is evidence of friction in the financial sector as a whole and of financing constraints on firms. Elsewhere, evidence of financial friction is weaker. In Korea, Malaysia, and Taiwan Province of Chinamdashhere—which have deeper nonbanking segmentsmdashhere—financial systems seem to allocate capital more efficiently. In particular, equity and debt markets appear to do a better job than banking systems of allocating funding across sectors and firms.

But that only works for exchange-listed firms that access external financing. However, many firmsmdashhere—mostly small and medium-sized enterprises that are not listedmdashhere—in several countries are unable to access external financing through organized financial markets. For these firms, financing constraints remain acute. They rely heavily on internal sources to finance their growth. Financial sector reforms can be expected to ease financing constraints for unlisted firms.

Reform measures

Initiatives are already under way in Asian countriesmdashhere—at the national and international levelsmdashhere—to expand and reform financial systems. For example, Thailand has formulated its Financial Sector Master Plan II and Capital Markets Development Masterplan. Malaysia has recently adopted measures to further liberalize its financial sector and develop Islamic finance both in the banking sector and in capital markets. At the international level, the Asian Bond Market Initiative is an initiative of the ASEAN, China, Japan, and Korea (ASEAN+3) started in 2003. It aims to develop efficient and liquid bond markets in Asia, facilitating use of Asian savings for Asian investments. This initiative has made substantial headway in fostering local currency bond markets. And pan-Asian stock exchanges are being linked to improve the cross-border flow of capital in the ASEAN region.

Such reforms in Asia’s financial markets will make them deeper and more efficient. This in turn will help reduce the cost of capital, spur investment, and promote rebalancing in Asia.

References

Ameer, Rashid, 2007, “Time-Varying Cost of Equity Capital in Southeast Asian Countries,” Asian Economic Journal, Vol. 21, No. 2, pp. 207–38.

Kalra, Sanjay, 2010, “Thailand: The Corporate Sector, Financial Reforms, and Rebalancing” (unpublished).

———, and Ceyda Oner, 2010, “Asian Local Currency Bond Markets: A New ‘Spare Tire’?” (unpublished).

Oura, Hiroko, 2008, “Financial Development and Growth in India: A Growing Tiger in a Cage?” IMF Working Paper 08/79 (Washington: International Monetary Fund).