Getting Debt under Control

Finance & Development, December 2010, Vol. 47, No. 4

Emanuele Baldacci, Sanjeev Gupta, and Carlos Mulas-Granados

In dealing with the aftermath of the Great Recession, policymakers must pay attention to the mix of austerity policies

THE severe financial crisis that hit the world economy in 2008 not only caused a large decline in output and brought about an uncertain economic outlook, it also harmed many countries’ public finances. Its legacy can be seen in the massive buildup of public debt around the world—more so in advanced than in emerging market economies.

In the advanced economies, public debt is projected to reach an average of 108 percent of gross domestic product (GDP) at end-2015. This is about 35 percentage points more than at end-2007, before the onset of the global crisis. That high a level of debt has not been seen in these countries since just after the end of World War II (see Cottarelli and Schaechter, 2010) and reflects in large part a permanent loss of revenue from the bursting of the asset price bubble, lower potential output, and countercyclical fiscal stimulus. Public debt had started to pile up before the crisis in these countries, mostly because of rising spending, but the increase in the aftermath of the global recession has been rapid and large, as some countries borrowed at wartime levels.

In the absence of policy changes, the fiscal position of advanced economies is projected to get even worse. Population aging is likely to exert significant upward pressure on health care and pension spending (IMF, 2010), creating a tide against which advanced economies will be forced to swim, even as they seek to implement policies aimed at reducing their debt burden (fiscal consolidation).

In emerging economies, the impact of the crisis has been milder and underlying fiscal conditions stronger than in advanced economies (with some exceptions, such as central and eastern European economies). Nonetheless, emerging economies have less tolerance for debt, because their ability to raise revenue is more limited—for example, their large informal sectors escape taxation—and their tax bases are more volatile than those in advanced economies. Emerging economies remain exposed to spillover from debt problems in advanced sovereigns and face possible problems refinancing existing debt as it comes due.

Crises spawn debt accumulation

High public debt levels in the wake of financial crises are not new. Studies have shown that banking crises have large fiscal consequences both in advanced and emerging market economies. For example, Rogoff and Reinhart (2009) found that in a sample of historical episodes, government debt on average rose by 86 percent in the three years following a banking crisis; Laeven and Valencia (2008) report that the average fiscal cost of banking crises was slightly less than 15 percent of GDP in the past three decades. Furthermore, the average increase in the ratio of public debt to GDP was about 40 percentage points during these episodes (see Baldacci, Gupta, and Mulas-Granados, 2009).

What is unprecedented this time is that many countries—those with the biggest slice of global output—have been piling up government liabilities in a fragile global economic environment amid a high degree of uncertainty. This can be problematic for four reasons.

First, high debt levels raise solvency risks and increase the cost of borrowing for sovereigns. Second, high debt can constrain the ability of a government to use fiscal policy as a countercyclical tool, for example, when crisis strikes. Third, high interest rates spawned by high debt can have an adverse impact on output growth and productivity. Fourth, the need for simultaneous fiscal tightening—in the absence of exchange rate depreciation and with limited room for expansionary monetary policy across a number of large economies—risks harming global aggregate demand.

Restoring debt sustainability

How then should countries lower their debt-to-GDP ratio? They can either implement new revenue and/or expenditure measures to reduce the fiscal deficit or take steps to promote growth—or do both. Improvements in the primary balance (the fiscal balance without interest costs) can reduce new borrowing and help lower the debt stock. Higher output growth can help improve the overall fiscal position in two ways: increased revenue and a lower ratio of spending to GDP.

However, reducing public debt after the recent financial crisis will likely be particularly challenging. Adjustments sufficient to reduce debt to prudent levels have been achieved both in advanced and in emerging market economies in the past two decades, but this time fiscal consolidation must take place in an environment of higher global risk, more turbulent financial markets, and weaker demand. In addition, the scope for monetary policy to support growth, if countries undertake fiscal consolidation, is limited by many advanced economies’ low policy interest rates. Moreover, policymakers will find it difficult to use exchange rate policies to support competitiveness, because many large economies are in need of fiscal consolidation at the same time.

What is a desirable debt level for these countries to ensure fiscal sustainability? This is a difficult question to answer: the target must take into account country-specific considerations concerning sustainable debt in light of fiscal policies, demographics, and unfunded entitlements, as well as long-term interest rates and output growth rates. For example, a return to the precrisis public debt level may not be sufficiently ambitious for countries that had high ratios before the crisis. A widely used approach is to define specific thresholds of 60 percent of GDP for advanced economies and 40 percent of GDP for emerging market economies—reflecting the perceived higher risk for the latter. The 60 percent of GDP target for advanced economies is roughly also the median debt-to-GDP ratio of those economies before the crisis.

Previous banking crises

What factors explain the success of public debt consolidation after banking crises, and why are some countries able to reduce their public debt to a prudent level faster than others?

To answer these questions we looked at 100 banking crisis episodes that occurred between 1980 and 2008 in advanced, emerging market, and low-income economies (see Baldacci, Gupta, and Mulas-Granados, 2010). The analysis focuses on factors affecting the length of successful debt reduction episodes. These are defined as reductions in the ratio of government debt to GDP to the 60/40 percent of GDP thresholds, but we also use alternative thresholds to test the robustness of the results.

To assess the factors underlying the probability of successful debt reduction, we first determined the length of successful debt consolidation cases. Such episodes are identified by a decline in public debt to a level (in percent of GDP) that is lower than the target threshold. The length of the successful debt consolidation episode ranges between 1 and 24 years: the mean length of successful adjustment is about 10 years.

We then sought to explain differences in the length of successful debt reductions across episodes on the basis of three sets of variables. First, we control for the fiscal cost of the crisis by including the length of the banking crisis preceding the adjustment episode and the size of the debt accumulated during the crisis.

We also control for the quality of fiscal adjustment (defined as how much of it stems from expenditure savings, because studies suggest that expenditure-based adjustment is more durable). Unlike other studies, we allow interaction between the quality of fiscal adjustment and the size of that adjustment because, for countries with large adjustment needs, spending cuts alone may not generate the needed fiscal consolidation. To achieve large fiscal consolidation through spending cuts only, governments may need to rely on inefficient saving methods (such as limiting funds for public investment that could help support growth). This implies that the adjustment in these countries may need to be a balanced combination of spending cuts and revenue increases—a key hypothesis to be tested in the context of difficult postcrisis debt reduction.

We also control accompanying policies by including the share of private investment, interest rates on deposits, and budget composition.

Our analysis shows that successful debt consolidation is less likely when countries are hit by longer-lasting (and thus more severe) banking crises. This reflects typically higher uncertainty and permanent output losses that make fiscal consolidation more difficult and, in some cases, large structural fiscal imbalances accumulated before the crisis that must be reversed in a weaker economic environment.

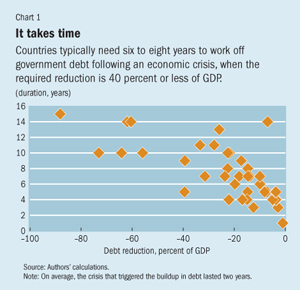

Lowering public debt takes time. Countries typically need six to eight years or more to reduce an amount of debt equal to the increase in advanced economies during the recent crisis (see Chart 1). This means that to retain creditor confidence countries should adopt fiscal adjustment strategies early on and start implementing them as soon as economic conditions are suitable.

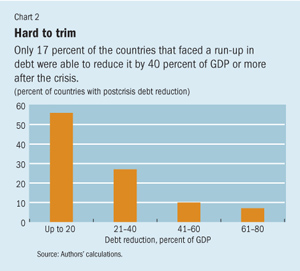

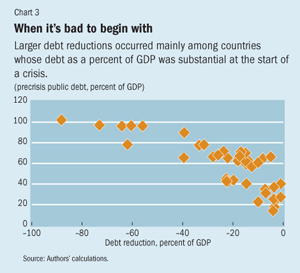

Evidence from previous postcrisis debt reductions shows that only 12 percent of countries were able to reduce their debt to precrisis levels. Only 17 percent of the countries achieved a debt reduction of 40 percentage points of GDP or more (see Chart 2). This highlights the difficulty of adjustment in a postcrisis environment. Larger debt reduction was associated with high initial levels of debt, as problems with fiscal sustainability triggered forced budget consolidation (see Chart 3).

Two lessons

Policymakers should be aware of two issues when devising debt consolidation strategies:

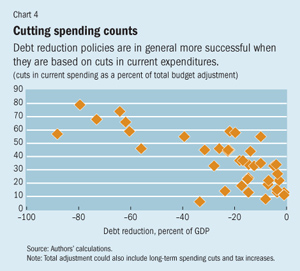

• Cuts in low-priority expenditures facilitate fiscal adjustment: debt consolidation is in general more likely to succeed when based on cuts in current expenditures (see Chart 4). This also holds true for countries in which the debt increase is not related to a financial crisis. Why? Because curtailing spending on transfers (such as pensions, subsidies, and other entitlements) and wages reduces pressure on nondiscretionary spending, which tends to rise over time, and may also raise trend growth prospects. Curtailing this spending would not only generate short-term savings for the budget, it would also limit the momentum of public spending growth.

Constraining age-related spending, including on health care and pensions, could be particularly important in light of the demographic pressures that will accompany fiscal consolidation in many countries. In this respect, entitlement reforms that also have positive effects on growth should take priority. For example, raising the retirement age can stimulate private consumption in the short term, contributing to less-painful fiscal adjustment, while at the same time ensuring the pension system’s medium-term financial viability. Increasing the share of public investment raises the likelihood of successful debt reduction by shifting the composition of the budget toward growth-friendly programs that can boost medium-term productivity through enhanced infrastructure.

• Raising additional tax revenues may also be needed: cutting spending may, however, be insufficient in countries with large adjustment needs. Unlike previous research on fiscal consolidation, our findings show that raising tax revenue is key to successful debt reduction in countries with large fiscal adjustment needs. This reflects the need to maintain a balance between expenditure savings and revenue-raising measures. The contribution of revenue to large consolidation is not dependent on the initial tax-to-GDP ratio: revenue reforms help achieve debt reduction even when the initial tax-to-GDP ratio is not low.

Measures to increase taxation should, however, be designed in a way that does not harm efficiency and minimizes distortion, particularly where taxes as a percentage of GDP are already high. Simplifying the tax system by reducing excessive tax rates and broadening the tax base could help enhance revenue collection while shifting the burden of taxes away from productive inputs. For example, financial sector and carbon taxation may help the budget while at the same time addressing efficiency concerns (see IMF, 2010).

Credible strategies

Our findings highlight the importance of credible fiscal adjustment strategies that anchor market expectations about fiscal sustainability. Fiscal policies that lack credibility can hinder debt reduction and lead to potentially self-fulfilling expectations about rising solvency risk. This is why measures to strengthen the fiscal framework—such as adopting, when needed, fiscal rules to guide budget policies and improving fiscal transparency through independent fiscal agencies—may benefit countries facing these challenges.

Other policies will strengthen fiscal efforts.

• When monetary policy establishes and maintains accommodative conditions and risk premiums are contained, debt reduction is more likely—a key lesson for countries exiting the crisis and preparing to unwind fiscal and monetary support.

• Pro-growth structural reforms (including product and labor market liberalization) always matter, but are even more essential during postcrisis fiscal consolidation: higher growth makes debt reduction easier to achieve and sustain.

We show that getting the mix of expenditure and revenue measures right can also help reduce credit risk premiums and foster growth, in addition to allowing a sustained improvement in the cyclically adjusted primary fiscal balance.

Policy implications

Successful debt consolidation is in general more likely when based on cuts in current expenditures but, when adjustment needs are large, raising taxes can result in more sustainable debt reduction. This reflects the need to maintain a balance between expenditure savings and revenue-raising measures in such instances to avoid inefficiency and help support ambitious consolidation plans. Higher taxation must, however, be handled carefully to protect economic efficiency and minimize distortions, particularly where taxes are already high. ■

Emanuele Baldacci is a Deputy Division Chief and Sanjeev Gupta is a Deputy Director, both in the IMF’s Fiscal Affairs Department. Carlos Mulas-Granados is a Professor of Economics at Complutense University, Fellow of the ICEI Research Institute, and Executive Director of the IDEAS Foundation in Madrid.

References:

Baldacci, Emanuele, Sanjeev Gupta, and Carlos Mulas-Granados, 2009, “How Effective Is Fiscal Policy Response in Systemic Banking Crises,” IMF Working Paper 09/160 (Washington: International Monetary Fund).

———, 2010, “Restoring Debt Sustainability after Crises: Implications for the Fiscal Mix,” IMF Working Paper 10/232 (Washington: International Monetary Fund).

Cottarelli, Carlo, and Andrea Schaechter, 2010, “Long-Term Trends in Public Finances in the G-7 Economies,” IMF Staff Position Note 10/13 (Washington: International Monetary Fund).

International Monetary Fund (IMF), 2010, “Fiscal Exit: From Strategy to Implementation,” Fiscal Monitor (Washington, November).

Laeven, Luc, and Fabian Valencia, 2008, “Systemic Banking Crises: a New Database,” IMF Working Paper 08/224 (Washington: International Monetary Fund).

Rogoff, Kenneth S., and Carmen M. Reinhart, 2009, “The Aftermath of Financial Crises,” NBER Working Paper 14656 (Cambridge, Massachusetts: National Bureau of Economic Research).