Gauging China’s Influence

Finance & Development, December 2010, Vol. 47, No. 4

Vivek Arora and Athanasios Vamvakidis

China’s rapid integration and growth are increasingly affecting the rest of the world

CHINA’S economy has grown dramatically and rapidly since 1978, when it launched its “reform and opening-up” strategy. It is now the world’s second-largest economy, its biggest exporter, and an increasingly important investor. And to fuel its export engine, it imports significant quantities of raw materials and semifinished products from around the globe.

But there is little empirical analysis of how much China’s growth has affected other countries—whether nearby Asian nations, commodity-producing countries in Africa and Latin America, or major consumers of Chinese products.

To help remedy this, we have quantified the implications of China’s growth for the rest of the world and conclude that China’s expansion has had a positive impact on global growth that has increased over time in both size and reach. A few decades ago, China’s expansion influenced growth only in neighboring countries; it now affects growth all over the world. These findings confirm, or at least provide a quantitative basis for, a hunch that economists have had for years.

Unprecedented growth

The ramifications of China’s opening-up policy are well documented. Even so, the facts are astonishing. From relatively poor beginnings three decades ago, China’s economy is now second in size only to the United States. Real gross domestic product (GDP) has grown by about 10 percent annually, implying a doubling every seven to eight years. The resulting 16-fold increase in a major economy’s national income during a single generation is unprecedented.

That these improvements involve one-fifth of the world’s population highlights the vast human scale of the achievement. Several hundred million people have been lifted out of poverty, and living conditions have improved for many more people in a shorter period of time than ever before.

Tighter global linkages

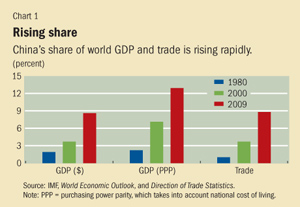

China’s opening up has meant increasing linkages with the rest of the world, as reflected in its rising share in world trade, global markets for selected goods, and capital flows. China’s stronger linkages with the global economy have also led to a growing use of its currency abroad,  as well as closer correlation of market sentiment in China and the rest of Asia and, more recently, the world. China’s share in world trade has increased nearly tenfold over the past three decades, to about 9 percent, while its share in world GDP has risen to 13 percent from less than 3 percent (purchasing-power-parity basis; see Chart 1).

as well as closer correlation of market sentiment in China and the rest of Asia and, more recently, the world. China’s share in world trade has increased nearly tenfold over the past three decades, to about 9 percent, while its share in world GDP has risen to 13 percent from less than 3 percent (purchasing-power-parity basis; see Chart 1).

Although China’s role in the world economy has increased significantly, it remains small relative to that of the United States. China’s GDP at current exchange rates is only one-third of U.S. GDP, and its private consumption is only about one-fifth. China cannot, therefore, replace the United States as a global consumer anytime soon. But it continues to be an important trading partner for many countries, and its rapid expansion can affect growth in other countries in various ways.

The increase in China’s share of world trade is particularly striking in the markets for certain products. China now accounts for nearly one-tenth of global demand for commodities and more than one-tenth of world exports of medium- and high-technology manufactured goods. China has become a major exporter of electronics and information technology products and is the largest supplier to the United States of consumer electronics products such as DVD players, notebook computers, and mobile phones.

China’s rising share in world trade over the past three decades is underpinned by a rise in its share in the external trade of every major region (see Chart 2). China’s share is, perhaps unsurprisingly, largest in the trade of other emerging Asian economies (13 percent), and this share has seen a striking increase over time. But its share of African trade is almost as large, and its share in trade with the Middle East, the Western Hemisphere, and Europe has increased several-fold in recent decades.

China’s growing integration with the rest of the world extends beyond trade. Developments in China appear to have an increasing influence on business and consumer sentiment in other countries. And other countries’ capital flows to and from China are growing steadily. Inflows of foreign direct investment (FDI) to China, for example, accounted for 7 percent of gross world FDI inflows in 2009, compared with just 1 percent in 1980. FDI outflows from China are a more recent phenomenon, rising from a negligible share of gross global outflows as recently as 2004 to 4 percent in 2009.

Impact on others

Flows of trade and capital between China and the rest of the world are affecting growth in other countries through several channels. China’s imports of commodities, inputs, and, increasingly, final products directly raise partner countries’ exports and GDP. In turn, China’s exports have a negative direct effect on partner countries’ net exports. The indirect effects on welfare and GDP, however, could be positive because relatively low-cost products from China raise consumption and production possibilities in partner countries.

China’s role in processing trade also has implications for other Asian countries in the Asian supply chain, where Chinese final goods exported to the West require, for their production, substantial inputs from the rest of Asia. This supply chain allows other Asian countries, especially smaller ones, greater access to global markets. Capital flows to and from China can also affect the global demand and supply of capital. Developments in China seem to have spillover effects on market confidence in other countries. And the list goes on.

Measuring the impact

To quantify the effects of China’s growth on the rest of the world, we conducted an empirical analysis using data from the past few decades. In light of the multiple channels through which China’s growth can influence growth elsewhere, and the difficulty of identifying—let alone quantifying—each channel, our analysis focuses on quantifying only the aggregate impact. We leave for future research the task of assessing the relative importance of various channels of impact.

Our empirical results suggest that the role of China’s growth in explaining output fluctuations in other countries is sizable and has increased substantially in recent decades. The results include effects both during the one- to five-year period typically associated with business cycles and over the longer term.

In the short and medium term, our results suggest that a 1 percentage point shock to China’s GDP growth is followed by a cumulative response in other countries’ growth of 0.2 percentage point after three years and 0.4 percentage point after five years (see Chart 3). What accounts for this impact? Our analysis suggests that initially almost all of the impact is felt through trade channels. But, over time, the impact of nontrade channels increases. Over a full five years, about 60 percent of the impact of China’s growth on other countries seems to be transmitted through trade channels and the remaining 40 percent through other channels. Examples of these other channels include capital flows, tourism (which is particularly important for some of China’s neighbors) and business travel, and consumer and business confidence.

Shifting to the longer term, we estimated the impact on the rest of the world of long-term changes in Chinese growth, smoothing over the short-term fluctuations associated with the typical business cycle and focusing on longer-term fluctuations. We looked at variables that are known to have a significant impact on GDP growth, such as investment, trade, initial income, age dependency (the ratio of non-working-age to working-age people), government consumption, and inflation. We found, as have previous studies, that domestic growth is positively correlated with investment and trade and negatively correlated with initial per capita GDP, age dependency, government consumption, and inflation. We conducted several tests to rule out the effects of such factors as common global shocks, which could simultaneously influence growth in China and the rest of the world.

The results suggest that, over the long term, as in the short and medium term, China’s expansion affects growth in other countries. And, as noted, the size and scope of this effect have increased in recent decades: initially China’s growth significantly affected only neighboring Asian countries, but the influence has spread over time to countries all over the world. The size of the global impact of China’s growth, moreover, has increased from negligible levels until about two decades ago to a sizable impact more recently.

Our results, based on data for the past two decades, suggest that a 1 percentage point change in China’s growth sustained over five years is associated with a 0.4 percentage point change in growth in the rest of the world (coincidentally the same amount as for the short and medium term). Moreover, analysis of a longer time period (1963–2007) suggests that the spillover effect of China’s growth has increased over time. Geographic distance seems to affect the strength of the spillover effects, with a stronger impact the closer a country is to China. But the estimates also suggest that the role of distance has diminished over time.

Just a first step

We have taken a first step in assessing the influence of China’s growth on other countries, but we have quantified only the aggregate impact. Future work will need to document and quantify the various channels of transmission, which may themselves change over time with changes in the structure of the Chinese economy and the composition of its trade and capital flows. ■

Vivek Arora is an Assistant Director in the IMF’s Asia and Pacific Department, and Athanasios Vamvakidis is a Deputy Division Chief in the IMF’s Strategy, Policy, and Review Department.

This article is based on the authors’ IMF Working Paper 10/165, “China’s Economic Growth: International Spillovers.”