How Ready for Pensioners?

Finance & Development, June 2011, Vol. 48, No. 2

A new index assesses which countries are the best prepared and which are the worst prepared when it comes to meeting retirees' needs

THE WORLD is on the threshold of a stunning demographic transformation brought about by falling fertility and rising life expectancy. Global aging promises to affect every dimension of economic, social, and political life—from the shape of the family to the shape of the world order. Perhaps most fatefully, it could throw into question the ability of many countries to provide a decent standard of living for the old without imposing a crushing burden on the young.

Which countries are most prepared to meet the challenge? And which countries are least prepared? The Global Aging Preparedness (GAP) Index, developed by the Center for Strategic and International Studies (Jackson, Howe, and Nakashima, 2010), provides a new analytical tool for assessing the progress that countries worldwide are making in preparing for global aging, and particularly the old-age dependency dimension of the challenge as the number of elderly relative to the working-age population continues to grow.

The GAP Index finds that with a few exceptions the countries best prepared to meet the promises they have made to retirees are those that have promised them the least.

A look at 20 countries

The GAP Index covers 20 countries, including most major developed economies and a selection of economically important emerging markets. The projections extend through the year 2040 to capture the full impact of the demographic transformation sweeping the world. The overall GAP Index consists of two separate sub-indices: a fiscal sustainability index and an income adequacy index. These sub-indices in turn are based on indicators grouped into distinct categories, each dealing with a different dimension of the challenge.

On the fiscal side, the GAP Index includes three indicator categories: public burden, fiscal room, and benefit dependence. The public burden category measures the projected magnitude of total government benefits to the elderly, defined as adults ages 60 or older. The fiscal room category measures the ability of countries to accommodate their growing old-age dependency burdens by raising taxes, cutting other spending, borrowing, or some combination thereof. The benefit dependence category measures the degree to which the elderly rely on government benefits in different countries. The assumption is that the more dependent the elderly are on those benefits, the greater the likelihood of political resistance to enacting new cost-cutting reforms or even to following through on reforms that have already been enacted but are not yet fully in effect.

On the adequacy side, there are also three indicator categories: total income, income vulnerability, and family support. The total income category measures the overall level of and trend in the living standard of the elderly relative to the nonelderly in each country, based on projections that reflect the effect of changes in government benefit programs, private pension provision, and labor-force participation rates. The income vulnerability category measures the relative level of and trend in the living standard of middle-income elders, a group that will be disproportionately affected by changes in the generosity of retirement income systems. It also takes into account the extent of elderly poverty in each country. The family support category measures the strength of family support networks, which play a crucial role in retirement security in many emerging markets and some developed countries.

Both sub-indices measure the performance of countries relative to each other rather than against some absolute standard of “preparedness.” We considered establishing such a standard but concluded that any benchmark would be arbitrary. There is no real consensus within countries, much less across countries, about what constitutes an acceptable old-age benefit burden on workers or an acceptable living standard for retirees. But almost everyone would agree that the lower the burden on workers and the higher the relative living standard of retirees, the better prepared the country is. For each of the sub-indices, the country rankings are calculated as follows. We first tabulate the results for individual indicators, ranked from 1 (best) to 20 (worst). We then transform the indicator results into index values, and combine the index values into category scores. Finally, we combine the category scores into overall scores and rankings for each of the two sub-indices.

A crucial lesson

The GAP Index contains some good news and some bad news.

The bad news is that very few countries score well on both dimensions of aging preparedness (see Table 1). Three of the seven highest-ranking countries on the fiscal sustainability index (Mexico, China, Russia) are among the seven lowest-ranking countries on the income adequacy index. Four of the seven highest-ranking countries on the income adequacy index (Netherlands, Brazil, Germany, United Kingdom) are among the seven lowest-ranking countries on the fiscal sustainability index. Not surprisingly, it is the developed countries, with their expansive welfare states, that tend to score better on income adequacy than on fiscal sustainability. In the emerging economies—Brazil being a notable exception—the trade-off is usually the reverse.

Two countries score near the bottom of both sub-indices: France and Italy. To rein in the rising cost of their pay-as-you-go old-age benefit promises, these countries have enacted pension reforms that drastically reduce the generosity of the public “deal” that future retirees can expect to receive. According to the GAP Index projections, the income of middle-income elderly in both countries is due to fall by roughly 15 percent relative to the income of middle-income working-age adults over the next three decades. But France and Italy spend so much on old age benefits and have so little fiscal room to accommodate future benefit growth that, even after reforms, they remain on a fiscally unsustainable course: both countries are moving toward retirement systems that are simultaneously inadequate and unaffordable.

The good news is that a few countries are successfully meeting the challenge. Australia, which combines means-tested public old-age income support with a large, mandatory, and fully funded private pension system, ranks well into the top half of both sub-indices. So does Chile, which has a similar mix of retirement policies.

Several other countries, moreover, are moving in the right direction. Like France and Italy, Germany and Sweden have scheduled deep reductions in the generosity of future government pension provision. But unlike France and Italy, they are on track to fill in the resulting gap in elderly income by increasing funded pension savings and extending work lives. Although their fiscal burdens remain high, they have been reduced to well beneath what they would have been without undermining the living standard of the elderly.

This contrast points to a crucial lesson. Most developed economies—as well as a few emerging economies, such as Brazil and Korea—must significantly reduce the generosity of their old-age benefit systems to stave off fiscal catastrophe. But unless reforms also provide for other sources of income support to fill in the resulting gap in elderly income, the reductions are unlikely to be socially and politically sustainable. This is especially true in Europe, where the level of elderly dependence on public benefits is very high. In France, Germany, Italy, and Spain, over 70 percent of the income of the typical elderly person comes in the form of a government check.

Policy matters

The GAP Index results also make clear that demography is not necessarily destiny. The aging trend in France, which has one of the highest fertility rates in Europe, is no more severe than in Australia or Canada, yet France ranks near the bottom of both sub-indices. Japan, despite its massive age wave, ranks in the middle of both sub-indices. That’s because it has relatively modest per capita government pension benefits, which helps minimize the fiscal burden on the young, and large percentages of elderly who are still working or who live in multigenerational households, which helps boost the income of the old.

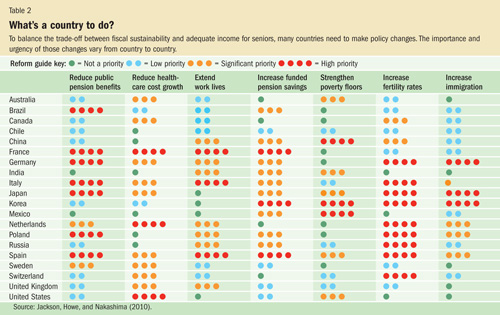

In short, policy matters. The GAP Index includes a reform guide that assesses the urgency and potential payoff of seven key reform strategies in each country, from reducing government pension benefits and health care cost growth to extending work lives, increasing funded retirement savings, strengthening old-age poverty floors, and increasing fertility rates and immigration (see Table 2). Most of the data used to assess the relative importance of the seven strategies are generated by the GAP Index model. The divisions between different priority levels, however, are based on our judgment.

We conclude that two strategies in particular, extending work lives and increasing funded pension savings, are especially important, because they allow countries to escape or at least mitigate the trade-off between fiscal sustainability and income adequacy. They represent the best means—indeed, the only means—by which countries can maintain or improve the living standard of the old without putting a new tax or family burden on the young.

With much of the world still reeling from the recent global economic crisis, many policy leaders may conclude that now is not the right time to address the long-term challenge of global aging. This would be a mistake. The economic crisis has made timely action more urgent. It has drastically reduced the fiscal room that most countries have to accommodate rising old-age benefit costs, while leaving many elderly people more vulnerable. There is also the critical issue of confidence. The public and the markets increasingly worry that governments have lost control over their fiscal future. In light of this, taking credible steps to address the long-term aging challenge may be a necessary part of ensuring near-term recovery as well. ■

Neil Howe and Richard Jackson are, respectively, Senior Associate and Senior Fellow at the Center for Strategic and International Studies.

References:

Jackson, Richard, Neil Howe, and Keisuke Nakashima, 2010, The Global Aging Preparedness Index (Washington: Center for Strategic and International Studies and Prudential plc).