Making Friends

Finance & Development, June 2011, Vol. 48, No. 2

A strong connection exists between financial industry lobbying and favorable financial legislation

AT THE END OF 2007—as markets grappled with the early stages of what would become the worst financial crisis in the post–World War II era and a severe recession seized the U.S. economy—The Wall Street Journal reported that two of the largest mortgage lenders in the United States had spent millions of dollars on political donations, campaign contributions, and lobbying activities from 2002 through 2006 (Simpson, 2007).

Ameriquest Mortgage and Countrywide Financial fought anti-predatory-lending legislation in Georgia and New Jersey and fended off similar laws in other states and at the federal level, according to the Journal. In other words, the financial industry fought, and defeated, measures that might have allowed for a timely regulatory response to some of the reckless lending practices and consequent rise in delinquencies and foreclosures that most think played a pivotal role in igniting the crisis. The Center for Public Integrity—a nonprofit Washington, D.C.–based investigative reporting organization—in 2009 linked subprime originators, most of which are now bankrupt, to lobbying against tighter regulation of the mortgage market (Center for Public Integrity, 2009). In fact, banks continued to lobby intensively against tighter regulation and financial regulatory reform, even as the industry struggled financially and suffered from negative publicity regarding its role in the economic crisis (Labaton, 2009).

As these anecdotes suggest, regulatory failure, in which the political influence of the financial industry played a part, may have contributed to the 2007 meltdown in the U.S. mortgage market, which by fall 2008 had escalated from a localized U.S. crisis to the worst episode of global financial instability since the Great Depression of the 1930s.

To go beyond anecdotes and systematically study how much lobbying and campaign contributions affected U.S. financial legislation in the years preceding the crisis, we developed a new data set of U.S. financial companies’ politically targeted activities during 1999–2006 (Igan and Mishra, forthcoming). We found that lobbying expenditures by the U.S. financial industry were directly associated with how legislators voted on key bills in the years before the crisis—and that bills proposing regulation that the industry considered unfavorable were far less likely to pass than bills proposing financial deregulation. We chose to focus on the United States not because lobbying doesn’t take place in other countries, but because U.S. transparency laws make it possible to gather the necessary details on political spending and lobbying for such analysis.

Lobbying and legislation

Questions about the role of regulation and other government activity in financial crises are not new. From a theoretical perspective, government regulation of the financial sector is well justified as a response to market failures brought about as a result of moral hazard, asymmetric information, or systemic risk (Goodhart and others, 1998). Yet in practice, many argue, such government action contributes to rather than mitigates episodes of financial instability. That’s because politics and political pressure often interfere with the design and implementation of specific regulations, leading to unintended results (Johnson, 2009; Calomiris, 2009). In other words, private agents can alter the course of government action and manipulate policymakers to obtain unjustifiable profits and tailor the financial regulatory landscape to fit their needs.

But it can often be difficult to study these outside pressures within a formal framework using a broad sample of financial crisis episodes absent detailed information on the political activities of the financial sector. As a result, there has been little formal study of the relationship between the political economy and the alleged regulatory failures that may have contributed to financial crises. The recent global financial crisis presents a good opportunity to take a closer look at this relationship thanks to detailed information for the United States, the epicenter of the recent crisis. In recent work with our colleague Thierry Tressel we looked at the association between lobbying activities and risk taking by financial institutions in the run-up to the crisis (Igan, Mishra, and Tressel, forthcoming). We found that lenders that lobbied heavily between 2000 and 2006 tended to engage in risky lending practices more often than other institutions over the same period and suffered worse outcomes during the crisis.

Mian, Sufi, and Trebbi (2010a) look at congressional voting patterns on two key pieces of legislation that shaped the regulatory response after the crisis. They also studied six bills before the crisis and found that aggregate campaign contributions from the financial industry played a significant role in the vote results for these bills (Mian, Sufi, and Trebbi, 2010b).

Finding the facts

We use a comprehensive data set of financial companies’ politically targeted activities during 2000–06. Specifically, we ask the following question: Did lobbying activity by the finance, insurance, and real estate industries directly affect politicians’ voting behavior, and hence the passage of financial regulation bills? In other words, did the politically targeted activities of these industries help them obtain the desired outcome on the proposed bills and thus contribute to the alleged regulatory failure? In addition, did legislators’ connections with the financial industry, which we dub Wall Street, and lobbyists, which we call K Street (where many lobbyists have offices), alter their voting behavior?

We gathered the following information:

• firm-level data on lobbying expenditures targeted toward specific bills and particular government entities;

• detailed information on 51 bills related to financial regulation, including whether they were passed by the House, the Senate, or both; whether they were enacted into law; and whether the targeted legislators voted in favor or against; and

• information on the professional backgrounds of legislators and lobbyists, to pin down their network connections established through, among other things, employment and schools attended.

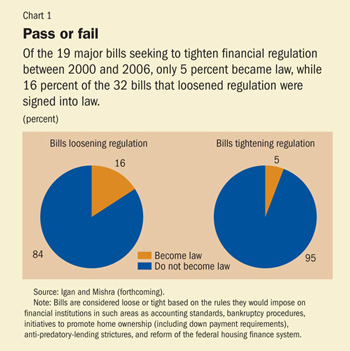

Then we looked at legislation. First, we examined whether the probability that a bill will ultimately be signed into law depends on how favorable or unfavorable it is to the financial industry. We studied the bills in detail and classified each as “lax”—that is, promoting deregulation—or “tight”—less favorable to the financial industry. During 2000–06, a bill less favorable to the financial industry was three times less likely to become law than one promoting deregulation (see Chart 1). Importantly, two key pieces of legislation that promoted lax lending in mortgage markets—the American Homeownership and Economic Opportunity Act of 2000 and the American Dream Downpayment Act of 2003—were signed into law during the period.

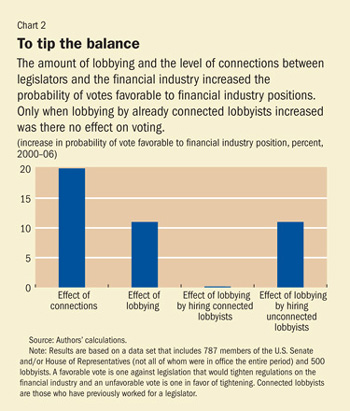

Next, we explored whether the vote of individual legislators on a particular bill is linked to the lobbying expenditures of firms affected by the bill and to the network connections those lawmakers share with the lobbyists and the financial industry. Three main findings emerge from the empirical analysis (see Chart 2).

First, there was a clear association between the money affected financial firms spent on lobbying and the way legislators voted on the key bills considered before the crisis. The more intense the lobbying, the more likely legislators were to vote for deregulation. Moreover, lobbying was more likely to garner votes for deregulation from conservative legislators.

Second, network connections between politicians and lobbyists who worked on a specific bill also influenced voting patterns. If a lobbyist had worked for a legislator in the past, the legislator was very likely to vote in favor of lax regulation.

Third, the amount of money spent lobbying a legislator who already has strong connections to K Street surprisingly seems to have had little effect on the likelihood of a vote for deregulation. Spending an extra dollar on lobbying was less effective if the lobbyist was already connected to the lawmaker. This suggests that spending more on lobbying isn’t much help to firms with well-connected lobbyists.

Certain shortcomings of the data and the empirical analysis are worth mentioning. First, we recognize that we do not have a very precise measure of lobbying efforts at the bill level—there is no breakdown of firm-level lobbying expenditures across bills. We checked to be sure the findings hold up under various assumptions about how firms allocated lobbying expenditures to particular bills. Second, lobbying by interest groups other than the financial industry may influence voting behavior. Therefore we included in the analysis spending by consumer organizations. Last, bills’ original provisions are often diluted dramatically during the legislative process. We do not include information on how lobbying can lead to changes—for the most part weakening—in bills’ provisions.

These findings support the notion that lobbying and network connections played an important role in shaping the financial regulatory landscape. Therefore, financial reform proposals should not be considered apart from these political factors. The precise policy response depends on the motivation behind the lobbying. Economic theory suggests that lobbying can be motivated by rent seeking or a desire to reveal information. But, based on our findings, it is hard to identify exactly what drove the financial industry’s lobbying efforts. For example, if lobbyists specialized in such rent-seeking activities as preferential treatment for their clients, it would be justifiable to curtail lobbying for its socially undesirable outcome. If, however, lenders lobbied mainly to offer information to policymakers and promote innovation, lobbying would be considered a socially beneficial way to help lawmakers make knowledgeable decisions. ■

References

Calomiris, Charles, 2009, “The Subprime Turmoil: What’s Old, What’s New, and What’s Next,” Journal of Structured Finance, Vol. 15, No. 1, pp. 6–52.

Center for Public Integrity, 2009, “Who’s Behind the Financial Meltdown?” (Washington).

Goodhart, Charles, Philipp Hartmann, David Llewellyn, Liliana Rojas-Suarez, and Steven Weisbrod, 1998, Financial Regulation: Why, How, and Where Now? (London: Routledge).

Igan, Deniz, and Prachi Mishra, forthcoming, “Three’s Company: Wall Street, Capitol Hill, and K Street,” IMF Working Paper (Washington: International Monetary Fund).

———, and Thierry Tressel, forthcoming, “A Fistful of Dollars: Lobbying and the Financial Crisis,” NBER Macroeconomics Annual (Cambridge, Massachusetts: National Bureau of Economic Research).

Johnson, Simon, 2009, “The Quiet Coup: How Bankers Took Power and How They’re Impeding Recovery,” The Atlantic (May).

Labaton, Stephen, 2009, “Ailing, Banks Still Field Strong Lobby at Capitol,” The New York Times, June 4.

Mian, Atif, Amir Sufi, and Francesco Trebbi, 2010a, “The Political Economy of the U.S. Mortgage Default Crisis,” The American Economic Review, Vol. 100, No. 5, pp. 196–98.

———, 2010b, “The Political Economy of the Subprime Mortgage Credit Expansion,” NBER Working Paper 16107 (Cambridge, Massachusetts: National Bureau of Economic Research).

Simpson, Glenn, 2007, “Lender Lobbying Blitz Abetted Mortgage Mess,” The Wall Street Journal, December 31.