Global Land Rush

Finance & Development, March 2012, Vol. 49, No. 1

Rabah Arezki, Klaus Deininger, and Harris Selod

PDF version

![]() IMF podcast: Moving beyond agriculture

IMF podcast: Moving beyond agriculture

Foreign investors are buying up farmland in developing countries

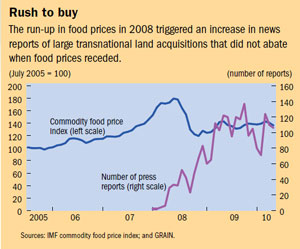

THE sharp increase in international food prices during 2007–08 triggered a spate of cross-border land acquisitions by sovereign wealth funds, private equity funds, agricultural producers, and other key players in the food and agribusiness industry—fueled by mistrust in international food markets, concern about political stability, and speculation on future demand for food.

Throughout the world, it is estimated that 445 million hectares of land are uncultivated and available for farming, compared with about 1.5 billion hectares already under cultivation (Deininger and others , 2011). About 201 million hectares are in sub-Saharan Africa, 123 million in Latin America, and 52 million in eastern Europe.

While commodity prices soon returned to more moderate levels following the 2007–08 upsurge, investor interest in land persisted. From 1961 to 2007, an average 4.1 million hectares of land were opened to agricultural production annually, of which 1.8 million were in Africa. In 2009 alone deals finalized or under negotiation involved at least 56.6 million hectares. Most were in Africa, where deals totaled 39.7 million hectares—more than the combined agriculturally cultivated areas of Belgium, Denmark, France, Germany, the Netherlands, and Switzerland.

Agriculture is characterized by long periods between investment and production with low margins and is complicated by the vagaries of weather and microclimatic conditions. Small farmers all over the world have had to live with those challenges, but in many developing countries their ability to do so is hampered by low public spending on technology and infrastructure and by inadequate institutions. Therefore, some commentators welcome these transnational purchases as an opportunity to overcome decades of underinvestment in developing countries’ agricultural sectors, to create jobs, and to bring new technology to the local agricultural sector. Others, though, denounce the transnational investments as a “land grab,” neglecting local rights, extracting short-term profits at the cost of long-term environmental sustainability, neglecting social standards, and fostering corruption on a large scale. In Madagascar the government fell in 2009 after news reports that it intended to transfer 1.3 million hectares to a South Korean company for free. Our research clarifies the factors underlying large transnational land acquisitions. This is a critical first step in the assessment of potential long-term effects of those investments and in identifying how governments can respond, through policy and regulation, to use land acquisitions in a way that promotes long-term economic development and reduces poverty.

A look at history

Large transnational land acquisitions go back at least centuries, to the era of conquests and colonial expansion. But often only a small portion of the land acquired was used for productive purposes; the rest was held idle, denying opportunities to the local population (Binswanger, Deininger, and Feder, 1995). In fact, many of these ventures survived only because they benefited from subsidies and distortions in land, labor (often slave labor), and capital markets—including restrictions on land ownership by natives, vagrancy laws, large subsidies for machinery, and monopoly of marketing channels.

These distortions were often difficult to eliminate and affected economic and social outcomes for decades and sometimes centuries (Banerjee and Iyer, 2005). Subsequent spikes in the assembly of large tracts of land were driven by changes in the cost of transportation, such as those associated with steamships and refrigeration, or with technology shifts that made previously economically unviable lands usable.

Large or small farms?

The analysis of large-scale land deals relates to key development issues, including which agricultural production structure makes the most efficient use of existing resources and thus contributes to overall development. For instance, owner-operators usually are more motivated to adjust to microvariations in climate and seasonality because they better internalize the benefits resulting from their operations. Family-owned farms, rather than large companies run by hired labor, have thus been the most competitive all over the world, including in developed countries such as the United States. Such farms have contributed to poverty reduction in a wide range of settings (Lipton, 2009). On the other hand, while some family farms can be quite large, investors usually aim to assemble tracts of land far larger than can be operated by a family. Is such a large-farm strategy viable in sub-Saharan Africa, where land is more abundant, as some have suggested (Collier, 2008)? What does the apparent export competitiveness of mega farms in Latin America and eastern Europe during the 2007–08 global food crisis suggest about optimum farm structure?

There has been a perception that such large tracts of land were not necessarily efficient. But some of the recent emergence of large farms is rooted in technological developments in crop breeding, cultivation, and information technology that make labor supervision easier (Deininger and Byerlee, forthcoming). These developments may indeed reduce the problems that have traditionally been associated with large agricultural operations and increase the benefits from vertical integration throughout the value chain from planting to food production. In cases such as Argentina, this can lead to situations where efficient management companies that are well integrated in the value chain can lease land from farmers at prices higher than what farmers could obtain by cultivating the land themselves.

But not all developments favor larger farms. Many technological innovations are not particularly scale biased. Information technology, for example, which can be used to better control a large farm, can also be used by small farmers to coordinate their efforts. Moreover, very large units of production often emerge because they can deal with market imperfections (access to finance), lack of public goods (infrastructure, education, or technology), and weak governance better than small ones. But, in a competitive and transparent environment where public goods are effectively provided, much smaller operational farm sizes could prevail. Indeed, anecdotal evidence suggests that, in many settings, farms are very large not because of inherent advantages of the technology but because of the superior ability of large operators to deal with market imperfections.

Investigating the phenomenon

To get a global picture of the recent demand for large-scale land acquisition we turned to news accounts because of the difficulty in obtaining consistent data from official sources. Our sample is based on articles published between October 1, 2008, and August 31, 2009, inventoried by the nongovernmental organization GRAIN—which reports all articles on its website Food Crisis and the Global Land Grab (see GRAIN). The website systematically records press reports on large-scale land acquisitions worldwide, an approach that is likely to limit potential bias. Nevertheless, we have cross-checked the accuracy of these data against information obtained by the World Bank for a selection of countries (Deininger and others, 2011). The chart shows that demand for large transnational land acquisitions grew dramatically after the 2007–08 food price surge and continued thereafter.

In our research, we have constructed a global database with country-level information both on foreign demand for land and on projects as documented in international and local press reports. We complement it with country-specific assessments of the amount of potentially suitable land and other relevant variables. We then use bilateral investment relationships from the database to identify determinants of foreign land acquisition, among which land availability and the potential for agricultural production in destination countries are expected to be a key factor.

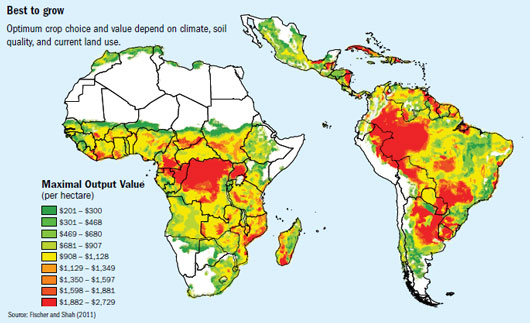

Ecological potential

The attractiveness of a country for new investment in large farming indeed depends on the availability and easy accessibility of uncultivated land with agricultural potential that can be developed without negative environmental consequences. So a measure is needed to gauge the potential agro-ecological suitability of land compared with its current use. Past attempts to measure the amount of land potentially available for agriculture suffered from conceptual and technical limitations. If potentially suitable land is either covered by forest or home to traditional communities, much of what could be available for agriculture may at the same time provide environmental and social benefits whose loss would significantly affect the economic desirability of an investment.

To establish a benchmark for an area’s potential that takes these factors into account, we first divide the earth into some 2.5 million grid cells. We then use climatic and biophysical information (including soil quality) to compute maximum potential output of key agricultural commodities under given agro-ecological conditions (for example, without irrigation) for each grid cell (Fischer and Shah, 2011). Superimposing on this information layers of current land use and population density allows us to exclude areas already used for agriculture as well as forests, protected areas, and areas with a population threshold above a designated maximum. In this way, we derive a measure of countries’ potentially suitable agricultural area. Valuing this at world market prices allows us to determine the “optimum” crop choice as well as the net output value that can be obtained for that crop. The resulting output values, unadjusted for transportation costs, are illustrated in the map.

Why foreign investors want land

As expected, use of these measures together with a range of other measures to analyze determinants of bilateral land deals, suggests, not surprisingly, that a country’s attractiveness to investors correlates directly to large amounts of uncultivated land with the potential to generate significant output. A 10 percent increase, say, in potentially cultivable land in a host country would increase the number of projects in that country by about 5 percent, all other things equal.

But comparing potential yields with yields that are achieved on currently cultivated land also suggests that there is an immense possibility of increasing productivity on that land. In Africa, for example, none of the countries of interest to large investors achieves 25 percent of its potential yield, suggesting that enormous gains can be made by investments to increase productivity by smallholders on land they already farm, rather than by costly expansion into uncultivated lands. In line with this idea, our results suggest that countries with low yields and a potential to catch up are attractive targets for land acquisition. A strategy to attract investors to agriculture to fill these gaps and allow local farmers to thrive can yield large benefits—provided local community rights are respected and investors pay a fair price for the land. Translating potential into efficient farming activity, however, is not easy, partly because closing yield gaps in many cases requires government support—including in the area of technology, institutions, and infrastructure—in addition to efforts by private investors.

Land governance

There is indeed growing evidence that resource abundance can contribute to growth and poverty reduction only under the management of well-governed institutions (Mehlum, Moene, and Torvik, 2006). Otherwise, discoveries of oil, minerals, or diamonds often give rise to a “resource curse” characterized by widespread corruption and social polarization—or even violence—rather than broad-based development. Secure property rights, transparent processes to ensure ventures’ legitimacy, and a legal framework to enforce rights are generally considered a precondition for foreign direct investment. The large land areas required for agricultural production are more vulnerable to attack, pilferage, and sabotage and are more costly to fence off and police than, say, manufacturing plants, and the time it takes to start up production, especially for perennials such as oil palm, suggests that such ventures are particularly sensitive to a country’s investment climate.

Surprisingly, though, our econometric analysis provides evidence to the contrary. Countries with weak land sector governance (as measured in the Institutional Profiles Database; see de Crombrugghe and others, 2009) are the ones most attractive to investors—at least as gauged by the number of land-related investments. A possible explanation is that it is easier to obtain land quickly and at low cost where the existing protection of land rights is weak, given that public protection may not matter to investors who can muster their own resources to defend their property rights. There is a danger, however, that the economic viability and long-term sustainability of investments can become compromised, and it may constitute a bad deal for host governments that transfer land well below its fair value.

This finding, which resonates with concerns raised by sectors of civil society, suggests that such investments may be at risk of failing to benefit local populations. Efforts to increase the transparency of individual investments and establish better land governance in target countries are needed to minimize both economic and social risks. Over the long term, better land governance, including the scope for independent monitoring of investments, may well be a key factor in determining countries’ ability and competitiveness when it comes to attracting well-conceived agricultural investment.

Looking forward

The renewed interest in large-scale land acquisition in developing countries represents an opportunity to overcome decades of underinvestment in those countries’ agricultural sector, create employment, and foster technology transfer. At the same time the apparent attractiveness of host countries with weak land governance accentuates the associated risks and suggests that host countries’ policy and regulatory frameworks will be critical to the realization of this potential.

Concern about the potential negative effects of large-scale investment has given rise to draft legislation to limit land purchases by foreigners in a number of countries—including Argentina, Brazil, and Ukraine. If foreigners can use nationals as intermediaries, such measures do little to address the underlying issues and may exacerbate governance challenges by limiting competition. A more appropriate policy response would place priority on efforts to improve land governance—by recognizing local rights and educating local populations about the value of their land, their legal rights, and ways to exercise those rights. The terms of land transfers must be well known and understood and must conform to basic social and environmental safeguards; and compliance with them must be monitored. Many countries have declared a moratorium on land purchases by outsiders until such safeguards are in place. Also, given the size of the phenomenon and the dangers it can pose, a global effort is needed to document cross-national investments in coordination with domestic authorities. Such an effort—which should be led by a suitable multilateral institution—could also provide the empirical basis for better understanding and regulation of this new and growing phenomenon. ■

Rabah Arezki is an Economist in the IMF Institute; Klaus Deininger and Harris Selod are, respectively, Lead Economist and Senior Economist in the World Bank’s Development Research Group.

This paper is based on the IMF Working Paper “What Drives the Global Land Rush?” by Rabah Arezki, Klaus Deininger, and Harris Selod.

References

Banerjee, Abhijit, and Lakshmi Iyer, 2005, “History, Institutions, and Economic Performance: The Legacy of Colonial Land Tenure Systems in India,” American Economic Review, Vol. 95, No. 4, pp. 1190–213.

Binswanger, Hans P., Klaus Deininger, and Gershon Feder, 1995, “Power, Distortions, Revolt and Reform in Agricultural Land Relations,” in Handbook of Development Economics, ed. by Hollis Cheneryâ and T.B. Srinivasan (Amsterdam: Elsevier), pp. 2659–772.

Collier, Paul, 2008, “The Politics of Hunger: How Illusion and Greed Fan the Food Crisis,” Foreign Affairs, Vol. 87, No. 6, pp. 67–79.

Deininger, Klaus, and Derek Byerlee, 2011, “The Rise of Large Farms in Land Abundant Countries: Do They Have a Future?” World Development, Vol. 40, No. 4, pp. 701–14.

———, Jonathan Lindsay, Andrew Norton, Harris Selod, and Mercedes Stickler, 2011, “Rising Global Interest in Farmland: Can It Yield Sustainable and Equitable Benefits?” Agriculture and Rural Development (Washington: World Bank).

de Crombrugghe, Denis, Kristine Farla, Nicolas Meisel, Chris de Neubourg, Jacques Ould Aoudia, and Adam Szirmai, 2009, Institutional Profiles Database III.

Fischer, Günthe, and Mahendra Shah, 2011, "Farmland Investments and Food Security," unpublished report prepared under World Bank IIASA contract, Lessons for the large-scale acquisition of land from a global analysis of land use, (Washington).

GRAIN, www.grain.org; Food Crisis and the Global Land Grab. Available at www.farmlandgrab.org

Lipton, Michael, 2009, Land Reform in Developing Countries: Property Rights and Property Wrongs (New York: Routledge).

Mehlum, Halvor, Karl Moene, and Ragnar Torvik, 2006, “Institutions and the Resource Curse,” Economic Journal, Vol. 116, No. 508, pp. 1–20.