It All Falls into Place

Finance & Development, September 2012, Vol. 49, No. 3

Adelheid Burgi-Schmelz and Alfredo M. Leone

Piecing together “missing links” in a jigsaw puzzle of data sets helps shed light on the global financial crisis

Access to the right data is critical when analyzing economic trends and events. Without it, forecasting what direction the economy is likely to take in the future, or why past economic events played out the way they did, is a bit like putting together a jigsaw puzzle when some pieces are missing so the picture is incomplete. The Data Gaps Initiative will help bridge some of the gaps and improve the quality of data used by economists across the world.

This initiative, spearheaded by the Group of 20 (G20) advanced and emerging market economies, focuses on filling data gaps by enhancing data collections, including economic and financial sector data that are the IMF’s responsibility. In doing so, it helps shed light on the global economic and financial crisis, its driving forces, and the measures taken to address it.

The Data Gaps Initiative also catalyzes joint efforts among international agencies on a broad range of economic and financial statistics by leveraging the relative strengths of each member, and thereby eliminating many blind spots in the global statistical landscape. This strengthened cooperation and coordination across international institutions has already improved data sharing, raised efficiency by avoiding duplication of efforts, and reduced the reporting burden on countries.

Interlocking crisis response

After almost four years of work, plans to implement enhancements to existing data sets are in place, and implementation of some of the enhancements has already taken place in some G20 economies. (See “Data to the Rescue” and “Finding New Data,” F&D, March 2009 and September 2010, respectively.) Substantive work is under way in other areas, including sectoral accounts that account for households, financial and nonfinancial corporations, and government; securities statistics on international debt instruments, international equities, and domestic securities; and real estate prices. Work on systemically important financial institutions is now in the developmental phase.

Within just weeks of the Data Gap Initiative’s launch, the Inter-Agency Group on Economic and Financial Statistics (IAG) was established and launched the Principal Global Indicators website, www.principalglobalindicators.org. The website draws on data from the members of the IAG—the Bank for International Settlements, the European Central Bank, Eurostat, the IMF (which serves as chair), the Organization for Economic Cooperation and Development, the United Nations, and the World Bank—and disseminates almost instantaneously. The Data Gaps Initiative continues to introduce new or expanded data sets to this website, such as the recent addition of quarterly and annual G20 growth rate aggregates.

More data make a difference

By enhancing existing statistical frameworks—including by improving country coverage and information granularity—and fostering the development of new ones, the Data Gaps Initiative aims to fill data gaps to facilitate the analysis of risk buildup in financial systems emerging from domestic and cross-border interconnections.

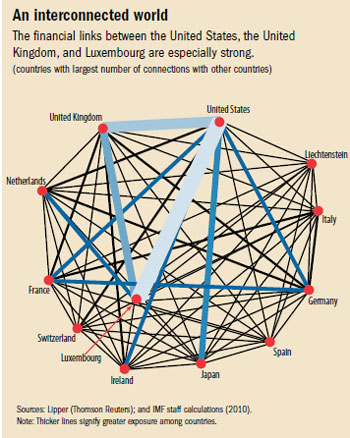

Countries and sectors are now so interconnected that it has become difficult to track the connections and determine who will be affected by economic events (see chart). For example, almost half of financial exposure remains hidden because the share of financial activities that goes through banks is much smaller than a decade ago. Traditionally, exposure meant mainly bank exposures. But exposures through the so-called “shadow banking system” could be larger and/or different. There is a growing urgency to supplement banking statistics by having better information on nonbank financial institutions and on nonfinancial corporations. Their importance is growing sharply, but the implications for the stability of the financial system are not yet well understood.

Another aim of the Data Gaps Initiative is to effectively capture what is happening across various sectors. This can provide not only a wealth of information for policy analysis, but also an excellent organizing umbrella for statistical work on an economy. Such a framework makes it possible to interlink different data sets that cover areas such as securities, government finance, and countries’ international investment positions. For government finance statistics, a standard template for data collection by all international organizations was developed through the Data Gaps Initiative that will make it easier for countries to report the data, as well as improve the comparability of the data across various countries.

Using the data

Serious data gaps revealed by the ongoing financial crisis reinforced the need for high-quality statistics in the design, implementation, and monitoring of appropriate macroeconomic and financial policies to ensure international financial stability. So it is only natural that new data sets are being proposed for inclusion in the data to be provided to the IMF when it conducts its regular monitoring and analysis of countries’ economies and their financial sectors.

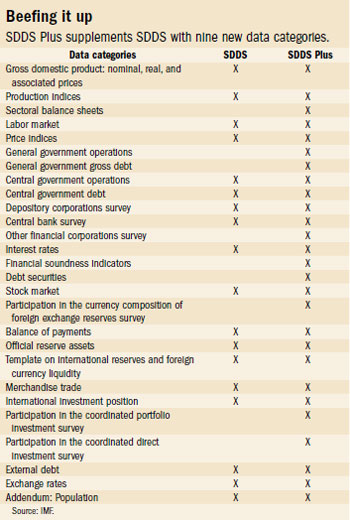

Consistent with this aim, in 2010 the IMF approved enhancements to its data standards, drawing on the Data Gaps Initiative. As of 2010, financial soundness indicators became an encouraged item, and by 2014 the dissemination of quarterly international investment positions will be mandatory under the Special Data Dissemination Standard (SDDS)—a global benchmark established by the IMF for disseminating economic and financial data to the public. On top of these incremental steps, the IMF took a major step earlier this year when it supported a new, top tier data dissemination standard—the SDDS Plus, which adds data categories that have proven essential in the work on the Data Gaps Initiative (see table). For countries signing on to SDDS Plus, the new categories will become mandatory by 2019.

Collaboration is key

The Data Gaps Initiative has achieved tremendous progress in how international organizations and statistical agencies collaborate on economic and financial statistics. IAG quarterly meetings or videoconferences have been invaluable in moving forward, and annual conferences attended by country senior officials in recent years provided important input to the annual reports of the IMF and Financial Stability Board to the G20 on the Data Gaps Initiative.

In 2010–11, IMF staff visited G20 countries to discuss their economic and financial data collections and submissions across international organizations. In 2012, four regional conferences in Mexico, Turkey, France, and China focused on how countries have achieved progress in their efforts to plug gaps identified by the Data Gaps Initiative. As a conference participant noted, “the Data Gaps Initiative is beneficial in synchronizing the coordination among all the relevant agencies producing and using macroeconomic statistics.” In other words, we are pulling together. This is a small revolution. But as with all revolutions, the key question is how to keep it going and guide it into the next productive phase.

Taking shape

The achievements the Data Gaps Initiative has made so far serve as a sound basis to address the remaining challenges. These include implementing enhancements in sectoral accounts; improving understanding of, and data on, shadow banking and cross-border positions and flows of financial and nonfinancial corporations; and completing developmental work on key measures of financial system risks, including tail risks, aggregate leverage, and maturity mismatches. Also, much work remains on data sharing among relevant official institutions on systemically important financial institutions.

Even more effort will be needed going forward, so there is no time to rest. In fact, the IMF is strengthening its technical assistance and training efforts to assist its member countries to consolidate the benefits of the Data Gaps Initiative in all member countries. This way, it will all fall into place at the global level. ■