World Economy

Convergence, Interdependence, and Divergence

Finance & Development, September 2012, Vol. 49, No. 3

PDF version

![]() Derviş on world economic integration

Derviş on world economic integration

Growth in emerging market and developing economies is less dependent on advanced economies over the long run, but in the short run they dance together

Most feel that we live in an integrated globalized world. But when looking at recent history, what can one really say about the nature of this integration? It seems there are three fundamental trends at work that today characterize the world economy.

Three fundamental trends

The first trend is a new convergence. In his 1979 Nobel Prize lecture, the late development economist Sir Arthur Lewis said, “For the past hundred years the rate of growth of output in the developing world has depended on the rate of growth of output in the developed world. When the developed world grows fast, the developing world grows fast, when the developed slow down, the developing slow down. Is this linkage inevitable?”

Recent data suggest that while there remains linkage, it is now important to distinguish between long-term trends and cyclical movements. Since roughly 1990 the pace of per capita income growth in emerging and developing economies has accelerated in a sustainable manner and is substantially above that in advanced economies. This represents a major structural shift in the dynamics of the world economy.

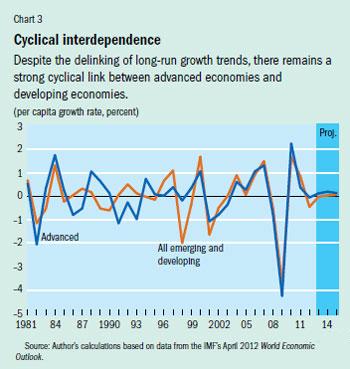

A second fundamental feature in the world economy is cyclical interdependence. Although emerging and developing economies’ long-term trend growth rates have delinked—or “decoupled”—from those of advanced economies over the past 20 years, this has not led cyclical movements around the trend to delink.

New convergence and strengthened interdependence coincide with a third trend, relating to income distribution. In many countries the distribution of income has become more unequal, and the top earners’ share of income in particular has risen dramatically. In the United States the share of the top 1 percent has close to tripled over the past three decades, now accounting for about 20 percent of total U.S. income (Alvaredo and others, 2012). At the same time, while the new convergence mentioned above has reduced the distance between advanced and developing economies when they are taken as two aggregates, there are still millions of people in some of the poorest countries whose incomes have remained almost stagnant for more than a century (see “More or Less,” F&D, September 2011). These two facts have resulted in increased divergence between the richest people in the world and the very poorest, despite the broad convergence of average incomes.

New convergence

The world economy entered a new age of convergence around 1990, when average per capita incomes in emerging market and developing economies taken as a whole began to grow much faster than in advanced economies. The sharp division between rich and poor countries that characterized the world since the industrial revolution in the early part of the 19th century is now weakening. A key question is whether this new convergence is likely to continue and lead to a fundamental restructuring of the world economy over the next decade or so.

The industrial revolution and colonialism brought about great divergence (Maddison, 2007). Between the beginning of the 19th century and the middle of the 20th, the average per capita income gap between the richer, more industrial “North” and the less developed “South” rose from a factor of 3 or 4 to a factor of 20 or more (Milanovic, 2012). This divergence slowed after World War II, with the end of colonialism, but the relative income gap remained stable on average between 1950 and 1990.

For the past two decades, however, per capita income in emerging and developing economies taken as a whole has grown almost three times as fast as in advanced economies, despite the 1997–98 Asian crisis. Growth in emerging markets sped up in the 1990s, followed by an acceleration in the less developed countries around the turn of the century (see Chart 1).

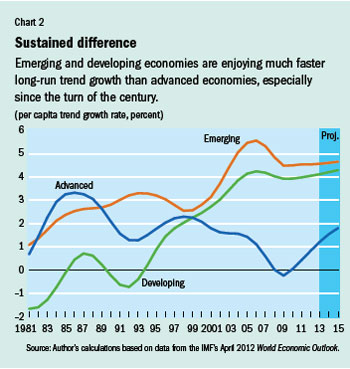

Chart 2 shows the underlying trend growth rates calculated using a statistical technique, the Hodrick-Prescott filter, to separate cyclical movement from the longer-term trend. The delinking of the trend growth rate of emerging market countries from the 1990s onward, and that of developing countries in the past decade, is quite striking.

Three developments explain much of this new convergence.

First, globalization—through strengthened trade links and rising foreign direct investment—facilitates catch-up growth as latecomers import and adapt know-how and technology. It is much easier to adapt technology than to invent it.

Second, the demographic transition of most emerging and many developing economies that accompanied slower population growth supported greater capital intensity and faster per capita growth. At the same time, many of these countries enjoyed a golden age as the ratio of the economically active to the total population peaked. Meanwhile, the share of the aged increased significantly in the advanced economies, particularly in Europe and Japan.

A third significant cause of convergence is the higher proportion of income invested by emerging and developing countries—27.0 percent of GDP over the past decade compared with 20.5 percent in advanced economies. Not only does investment increase the productivity of labor by giving it more capital to work with, it can also increase total factor productivity—the joint productivity of capital and labor—by incorporating new knowledge and production techniques and facilitate transition from low-productivity sectors such as agriculture to high-productivity sectors such as manufacturing, which accelerates catch-up growth. This third factor, higher investment rates, is particularly relevant in Asia—most noticeably, but not only, in China. Asian trend growth rates increased earlier and to a greater extent than those of other emerging economies.

Will this convergence continue? Projections are always risky, and some of the factors that led to convergence in the past 20 years may soon lose strength. A good part of the catch-up growth in manufacturing has already taken place, and the reallocation of labor from low- to high-productivity sectors has also exhausted some of its potential; in some countries even rapid manufacturing growth has not generated much employment, leading to a greater labor share in low-productivity activities (Rodrik, 2011).

But the convergence we are referring to is the aggregate convergence of the emerging and developing world as opposed to an analysis where very small countries get equal weight with China, India, or Indonesia. In the aggregate, at least for the next 10 to 15 years, there is substantial potential for more catch-up growth. Labor reallocation from low- to high-productivity sectors may slow down, but its reallocation from low- to high-productivity firms within even narrowly defined subsectors is likely to continue at a solid pace. The service, energy, and infrastructure sectors may also have substantial potential for the adaptation of new technology. And with the notable exception of China, demographics will favor emerging and developing economies over the “old” rich countries for more than a decade to come. Finally, the very high debt ratios that most advanced economies have accumulated will constrain their macroeconomic policies and slow investment.

This continued, if perhaps somewhat slower, convergence will profoundly transform the world economy. By 2025–30 many emerging market economies’ per capita incomes will be much closer to those of the advanced economies, reflecting both growth differentials and the likely real appreciation of their currencies. The economy of China will no doubt become the largest in the world, and the economies of Brazil and India will be much larger than those of the United Kingdom or France.

The rather stark division of the world into “advanced” and “poor” economies that began with the industrial revolution will end, ceding to a much more differentiated and multipolar world economy.

Cyclical interdependence

There was a time, particularly at the beginning of the financial crisis in late 2007 and early 2008, when it seemed the emerging markets and Asia in particular would grow rapidly regardless of what happened in the United States and Europe. Then came the panic of late 2008, after the collapse of the investment banking firm Lehman Brothers. The marked worldwide slowdown, even in China, sparked concern that the crisis that started on Wall Street could lead to a collapse of growth in the emerging and developing world.

There was indeed a worldwide slowdown in 2009, with per capita growth in the emerging markets and developing economies slowing to less than 1 percent and a decline of nearly 4 percent in advanced economies. But the former recovered quickly, with a growth rate of 6 percent in 2010 compared with 2.3 percent for advanced economies. The resilience of the former group during the crisis led to renewed claims of divergent fortunes.

Chart 2 shows the divergence in the trends of growth rates of the two groups: per capita GDP of the former grew two to three times as fast as in advanced economies and will likely continue. Chart 3 shows that there was no such divergence in the cycles around the trend. Particularly since the Asian crisis of 1997–98, there has been cyclical interdependence that, if anything, may have become stronger (Kose and Prasad, 2010; IMF, 2010). Interdependence has also become more complex, with stronger linkages among developing economies. Upturns and downturns in large raw material importers such as China have an immediate impact on many developing countries’ raw material exports.

The world economy remains one of interdependence, where countries’ business cycles travel across borders. Emerging and developing economies are growing much faster than advanced economies, mainly thanks to supply-side factors such as long-term capital accumulation, technological catch-up, and demographics. But cyclical movements around trends, linked more to shorter-term demand-side factors, are likely to be strongly correlated. The recent global growth declines in early 2012, due much more to macroeconomic and financial sector management issues than to long-term supply-side factors, vividly reflect this worldwide interdependence.

There appear to be three main channels of cyclical interdependence.

The first is trade. As the share of trade in global economic activity has increased, the changes in demand in one country resulting from macroeconomic developments in another can be expected to increase. The effect of a recession in one country, for example, spreads across borders by reducing the demand for exports from other countries. In theory, if greater specialization in production is encouraged by trade, sector-specific shocks will tend to reduce cyclical interdependence. But in practice the macroeconomic demand effects are much more significant.

The second channel works through increasingly global, huge, and complex financial markets. A new IMF report measures “spillover effects”—the impact of policies in one country on another as a result of the large volume of trade and financial linkages in today’s economy—and documents the importance of the financial channel. Using the euro area as an example, the report concludes that “direct (trade-linked) spillovers from stress in the euro area program countries are manageable, but if the stress were to cast doubt on the soundness of euro area banks, the spillovers to the rest of the world would be large—in many cases as large as after Lehman” (IMF, 2011). The report also finds that under stressful financial conditions—for example from an asset price bubble collapse or overleveraged banks—the correlation with long-term bond yields is much higher, which suggests that the strength of the financial channel depends on the overall situation in world financial markets. And changes in the term structure of interest rates—reflecting similarities in monetary policies and financial market conditions—can also influence business cycle comovement through the profitability of financial institutions and credit conditions (Claessens, Kose, and Terrones, 2011).

Finally it appears that there is a third channel of interdependence—perhaps closely linked to the second, but less tangible—in the form of worldwide propagation of confidence, or “animal spirits,” that significantly influences financial markets and investment decisions. News about the U.S. subprime crisis seems to have directly affected credit default swap spreads in emerging markets simply through a spread of “sentiment” (Dooley and Hutchinson, 2009).

For all these reasons, the delinking of long-term growth trends and continued correlation in cyclical movements coexist, with global and regional factors weaving the world economy into an interdependent whole.

Divergence in distribution

In addition to broad convergence of per capita incomes and cyclical interdependence in economic activities across borders, higher inequality within countries and a wider gap between the world’s richest and poorest citizens appears to be spawning divergence between top and bottom incomes, an emerging third fundamental trend. Income has become concentrated at the very top in many countries. Added to this within-country evolution of income distribution is the absence of per capita income growth in a group of very poor countries unable to participate in the broad convergence described above.

Certainly, convergence resulting from the rapid catch-up growth affecting a large majority in the emerging and developing countries is giving rise to a rapidly growing global middle class. However, a variety of factors—including the nature of technological change, the increased skill premium, the huge expansion of the global market and the associated winner-take-all characteristics of many markets, the mobility of capital in contrast to the relative immobility of labor, particularly unskilled labor, and a declining influence of unions—have all led to increased income concentration at the very top in many of the largest countries, advanced as well as emerging and developing.

Meanwhile in some very poor countries, many of them experiencing conflict and government failure, hundreds of millions of people have real incomes that are not much higher than they were 200 years ago (Milanovic, 2012). In that sense, there is a huge new divergence in the world economy, with both global and within-country dimensions. The distance between the extremes of the income distribution of the world as a whole has increased.

Within many countries the dramatic divergence between the top 1 percent and the rest is a new reality. The increased share of the top 1 percent is clear in the United States and in some English-speaking countries and, to a lesser degree, in China and India. But it is not clear from the available data whether this new hyperconcentration at the top is a truly global phenomenon. The World Top Incomes Database (Alvaredo and others, 2012) shows that, at least until 2007, continental Europe and Japan did not experience the same shift of incomes to the top of the income distribution. But because the causes of the concentration are largely global and can be counteracted only partially by national policies, it is likely that this top-heavy concentration will only increase. Top executive pay in countries such as Germany and the Netherlands, for example, was already increasing very rapidly during the past decade (Fabbri and Marin, 2012). And the euro area crisis and its accompanying austerity policies will likely lead to further inequality in Europe as budget constraints curtail social expenditures while the mobility of capital and the highly skilled make it difficult to effectively increase taxes on the wealthiest.

This new divergence in income distribution may not always imply greater national inequality in all parts of a national distribution. It does, however, represent a concentration of income and, through income, of potential political influence at the very top, which may spur ever greater concentration of income. The factors—technological, fiscal, financial, and political—that led to this dynamic are still at work.

Cooperation for a more integrated world economy

The future of the world economy will depend largely on the interaction between the rise of many large emerging and developing economies, the increasing interdependence across countries, and the widening gap between the top and bottom tails of the distribution of income, both within countries and for the world population as a whole. These trends have political, social, and geostrategic implications that will shape future policy debate.

For one, the increasing importance of emerging and developing economies must be reflected in the governance of international institutions, whose legitimacy and effectiveness depend on it. Global interdependence calls for stronger cooperation within an institutional setup that reflects the growing weight of emerging and developing economies. Second, the worldwide business cycle described above and the spillover effects, documented recently by the IMF, call for coordinated macroeconomic policy. Finally, the potentially destabilizing trends in income distribution require similar international policy coordination, without which single-country redistributive policies will be difficult to implement. To some degree at least, tax bases and tax rates must be harmonized, opportunities for tax avoidance minimized, and migration policies managed with both host and source countries’ interests in mind. Finally, assistance to the poorest countries remains an ethical as well as political necessity.

The world of the future will be ever more multipolar and interdependent, with global markets offering the potential for rapid economic progress. Whether this potential can be realized may depend largely on how well international cooperation improves both the effectiveness of national macroeconomic policies, by taking into account their spillover effects, and how much it encourages greater balance and equity in the distribution of the fruits of growth. ■

Kemal Derviş is Vice President and Director of Global Economy and Development at the Brookings Institution.

References

Alvaredo, Facundo, Tony Atkinson, Thomas Piketty, and Emmanuel Saez, “The World Top Incomes Database,” accessed June 1, 2012.

Claessens, Stijn, M. Ayhan Kose, and Marco Terrones, 2011, “How Do Business and Financial Cycles Interact?” IMF Working Paper 11/88 (Washington: International Monetary Fund).

Dooley, Michael, and Michael Hutchinson, 2009, “Transmission of the U.S. Subprime Crisis to Emerging Markets: Evidence on the Decoupling-Recoupling Hypothesis,” paper prepared for the JIMF/Warwick Conference, April 6.

Fabbri, Francesca, and Dalia Marin, 2012, “What Explains the Rise in CEO Pay in Germany?” CESifo Working Paper Series No. 3757 (Munich: CESifo Group).

International Monetary Fund (IMF), 2010, World Economic Outlook (Washington, October).

———, 2011, “Consolidated Spillover Report: Implications from the Analysis of the Systemic-5” (Washington).

Kose, M. Ayhan, and Eswar S. Prasad, 2010, Emerging Markets: Resilience and Growth amid Global Turmoil (Washington: Brookings Institution Press).

Lewis, Arthur, 1979, “The Slowing Down of the Engine of Growth,” Nobel Prize lecture, Stockholm, December 8.

Maddison, Angus, 2007, Contours of the World Economy, 1–2030AD (Oxford, United Kingdom: Oxford University Press).

Milanovic, Branko, 2012, “Global Inequality: From Class to Location, from Proletarians to Migrants,” Global Policy, Vol. 3, No. 2, pp. 125–34.

Rodrik, Dani, 2011, “The Future of Economic Convergence,” paper prepared for the 2011 Jackson Hole Symposium of the Federal Reserve Bank of Kansas City, August 25–27.