Global Banking Regroups

Finance & Development, December 2013, Vol. 50, No. 4

Stijn Claessens and Juan A. Marchetti

The global financial crisis has prompted increased scrutiny of the risks and benefits of international financial services, especially international banking

The global financial crisis led to a reevaluation of the benefits and risks of finance—including international financial services—which many observers believe had grown too big and too complicated and whose products, such as complex securitization and derivatives, seemed to offer little added value but generated many risks.

Nowhere can this reevaluation be observed more clearly than in international banking. After two decades of rapid expansion across borders, global banking is retreating. After peaking in the first three months of 2008 aggregate foreign bank lending dropped sharply. The decline was especially large in direct cross-border loans; lending through foreign affiliates has been more stable. This retrenchment was driven largely by market forces, as undercapitalized banks reduced their balance sheets. But some domestic regulatory changes have added to the desire to retreat to their home base.

The retrenchment reflects in part shortcomings in the global financial architecture—those mechanisms that facilitate global financial stability and the smooth flow of financial services and capital across countries. The crisis showed how the problems in one nation can be transmitted extensively to others, and how limited coordination among financial regulators complicates crisis management and the resolution of failing banking groups that do business in more than one country. Moreover, incentives to monitor and support banks and their foreign affiliates can differ between home and host country authorities. In many central, eastern, and southeastern European countries, for example, affiliates of western European banks were of systemic importance to the host country, but small relative to the parent bank’s global operations. Only close international coordination—through the so-called Vienna Initiative—prevented major problems for host countries when foreign banks were hit by shocks at home or in their global operations. In some other cases, when a bank’s activities were large relative to the home country’s economy, that country was not always in a position, or willing, to support the parent bank, let alone its affiliates.

Growth in globalization

During the two decades before the global financial crisis, financial globalization increased considerably, reflecting mainly

• a large rise in direct cross-border bank lending, foreign direct investment, and other forms of capital flows, such as equity and bond portfolio investments; and

• foreign-owned financial institutions, in particular banks, setting up shop in other countries and doing business there.

The sharp rise in bank and other debt-creating financial flows occurred across a broad range of countries. Between 2002 and 2007, gross capital flows rose from about 8 percent to almost 25 percent of the GDP of advanced economies and from about 2.5 percent to more than 12 percent of the GDP of emerging market economies. While financial globalization helped spread risk among countries, it also increased the likelihood that an adverse shock in one major financial center would be transmitted across countries. And that is what happened. After peaking in early 2008, global gross capital flows plummeted to 1.3 percent of global GDP in 2009, affecting advanced economies as much as emerging market economies. Flows recovered somewhat in 2010, but fell again as the European sovereign debt crisis intensified. In 2012, flows were only 3.6 percent of global GDP.

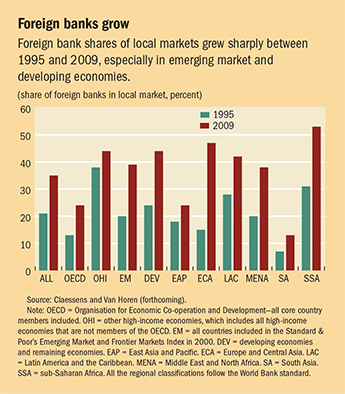

Similarly there was a large increase in the local presence of foreign banks and other financial institutions prior to the crisis. In the preceding two decades, banks enlarged their global footprint by establishing operations in many countries through branches (direct extensions of the bank) and subsidiaries (which are locally chartered and capitalized). Over the period 1995–2009, some 560 foreign bank investments took place, increasing the average number of foreign banks from 20 percent of total banks operating in local markets to 34 percent (see chart). With a local charter and physical presence, banks can raise funds locally and lend to host country firms and households more easily; they can also use capital from their parent bank or fund themselves in international capital markets. Being closer to the final customer offers important advantages to banks and other providers of financial services—notably, a better assessment of growth opportunities and risks.

In some countries, especially many emerging market economies in Latin America and in central and eastern Europe, foreign banks now dominate and sometimes comprise virtually the whole banking system. In other countries, including many advanced and Asian economies, foreign banks play smaller roles. The differences in importance reflect many factors—such as general financial reforms, including the degree of opening up to foreign competition; the privatization of state-owned banks that occurred during the transition from centrally planned economies in eastern Europe; and even previous financial crises, which often resulted in the sale of troubled banks to foreign entities. Since the recent crisis, new foreign bank investments have slowed, however, and in some cases reversed as foreign-owned operations were sold to local financial institutions.

Although the global financial crisis led to a reevaluation of the risks and benefits of international banking and a tightening of domestic financial regulation, it did not discourage countries, in particular emerging market economies, from further opening up their financial sectors. In fact, restrictions on market access and discriminatory measures (which favored domestic over foreign firms) have declined in banking, securities, and insurance markets, and previous reform efforts have been consolidated (see table). In addition, countries have continued to enter preferential trade agreements, which give financial institutions in those countries easy access to one another’s markets. Some 52 such agreements have become effective since the onset of the crisis, two more than between 2000 and September 2008. And although the so-called Doha Round of global trade negotiations has made little progress in increasing market access and reducing barriers to trade in financial services, several initiatives have emerged recently that support liberal trade in financial services. Three of those initiatives hold the promise of further—and possibly significant—liberalization: the 13-nation Trans-Pacific Partnership; the Transatlantic Trade and Investment Partnership between the European Union and the United States; and the Trade in Services Agreement, which involves 21 economies and the European Union.

Two sides of trade in financial services

There are benefits and risks to trade in financial services in general and the presence of foreign financial institutions specifically. Empirical research shows that the presence of foreign-owned banks is in general associated with increased efficiency and competition in local banking sectors, with lower net interest margins, reduced excess profits, and lower cost ratios (Cull and Martinez Peria, 2010; WTO, 2011; Claessens and Van Horen, 2013). These gains appear to vary with the size of foreign bank presence, however. There have been large competitiveness gains for Latin America and eastern Europe, for example, where foreign presence is big, and less clear gains for Asia, where foreign banks are fewer. The effects of foreign presence on access to finance—whether in terms of overall credit, lending to small- and medium-sized enterprises, or access to deposit and payments services—are more ambiguous. They differ across countries, depending on the extent of foreign participation, the degree of competition in the domestic banking sector, the country’s level of development, and foreign banks’ ability to compensate for a lack of information through lending techniques that, among other things, include collateral and rely on credit scoring.

In terms of financial stability, recent research points to differences in how countries are affected by shocks, depending on the relative size of foreign bank presence, the distance of affiliates from their parent banks, and the extent to which foreign banks raise funds domestically rather than from foreign sources. The research has found two major, somewhat opposite, effects:

• Lending provided by local affiliates, which raise much of their funds locally, was generally more stable than cross-border lending. Foreign banks reduced lending more than domestic banks did in eastern Europe, but in the largest Latin American countries no significant differences were found. In Latin America, there were fewer branches and more locally chartered affiliates than in eastern Europe, partly because of the preferences of Latin American regulators.

• When hit by shocks, global banks often rebalanced their portfolio away from international markets. Although global banks transmitted shocks from advanced economies to emerging markets (as they reallocated liquidity within the organization), foreign banks operating in crisis-affected advanced economies also reduced their local lending, repatriating funds to help absorb shocks at home.

Regulatory responses

The general regulatory reaction following the global financial crisis has been a mix of national and internationally coordinated policies aimed at reducing the risk of cross-border transmission of shocks and at dampening the effects of those shocks. These efforts include improving the way regulators deal with troubled global institutions—whether restoring them to health or guiding their unwinding process. New international standards for banks, such as those requiring higher levels of capital and better liquidity management (the recent, so-called Basel III accord among key regulators), have been agreed. Colleges of regulators have been set up to coordinate supervision of global systemically important banks. Some improvements have been made with regard to information sharing across jurisdictions and disclosure of financial exposures, possibly helping supervisory agencies detect risks earlier and allowing for more market discipline. Assessments of systemically important financial systems are conducted more frequently, and financial surveillance has been enhanced, notably regarding international spillovers from one country to others (IMF, 2012). Other important reforms concern rules for credit rating agencies, over-the-counter derivatives markets, and shadow banking (see “What Is Shadow Banking?” in the June 2013 F&D), although progress has been slower (FSB, 2013).

Although the functioning and stability of the international financial system have improved—and a global and open system with largely unrestricted trade in financial services preserved—supervisory agencies in both emerging market and advanced economies have been scrutinizing and regulating the local activities of foreign banks more intensely. Host country regulators, for example, have been encouraging banks to keep more capital and liquidity locally and/or convert foreign bank branches to subsidiaries to make it harder for banks to move capital and liquidity freely within their global operations and easier for authorities to limit local banks’ engagement in international activities. Supervisory agencies have focused more intensely on how liquidity and capital are shared between banks and their foreign affiliates.

Some new home-country regulations also seek to limit proprietary trading activity (when banks buy and sell securities on their own account, exposing the institutions to market volatility) and to separate such activity from, among other things, retail deposit taking. Such ring-fencing measures could limit how much one operation in a banking group is exposed to other operations within the same group as domestic and foreign operations of affiliated entities become legally more separated, but could also give rise to inefficiencies in international banks’ internal operations.

Next steps

To protect domestic economies and taxpayers and to reduce—if not eliminate—the negative effects that might arise from the interdependence of financial systems, the regulation and supervision of international financial activities must be improved. Despite better coordination of regulation during the early days of the crisis, financial regulation and supervision remain largely national. Preserving the benefits and reducing the risks of globally integrated financial markets call for additional policy efforts—including dealing with the wind-down of troubled global institutions and its most important aspect: which country’s taxpayers should pay, and how much.

Ultimately, it is the fear of the costs involved in winding down a failed institution (and dealing with its subsidiaries and branches abroad) that has reinforced regulators’ national focus. For example, the Swiss regulatory authorities recently proposed a scorecard approach to determine whether Swiss banks with global operations and foreign banks operating in Switzerland are organized in a way that facilitates resolution in a crisis while protecting the systemically important functions of those banks within Switzerland.

It is important to develop arrangements that specify how governments share and contribute to the financing needed to deal with a weak institution that operates across borders, how assets and liabilities are allocated if an institution is resolved or liquidated, and how any final costs (including deposit insurance, guarantees for liabilities other than insured deposits, and other forms of government support) are shared among jurisdictions. Although still a work in progress, the Banking Union in the European Union, with its supporting reforms, is an attempt to develop, codify, and institutionalize such arrangements.

The problems of dealing with failures are not the only impediment to developing coordination among national authorities. Conflict can arise between home and host supervisory authorities of a cross-border financial institution when a bank or affiliate runs into financial stress and authorities seek to retain capital and liquidity locally—or when the financial cycle is on an upswing in one country but on a downswing in another, creating the need to coordinate tools and their application across jurisdictions. Moreover, a lack of national action can have negative spillover effects on other countries. Some mechanisms recently agreed—at the Financial Stability Board and between U.S. and U.K. regulators—partially address this problem. But many issues remain unaddressed. For example, it will be difficult to ensure that the moderating influences of countercyclical capital buffers—an element of the Basel III accord that presses banks to add more capital in good times and less in bad—are not negated by banks and other financial institutions in jurisdictions not subject to such rules.

Ideally, every country should have a regulatory framework for the entry and operation of foreign financial institutions that is origin neutral—with the proviso that the home country has both adequate regulation and supervision and the capacity to support its institutions if needed. However, the proliferation of preferential trade negotiations means that special access and advantages can be granted to foreign financial institutions from specific countries. This can foster a concentration of financial services and suppliers from a limited number of jurisdictions. It can encourage situations such as those experienced in some east Asian countries in 1997 where Japanese banks were big lenders or, more recently, in central and eastern European countries where the presence of banks from a few western European countries became systemically significant. In those cases problems in the home countries triggered retrenchment and added to the problems in the supply of credit in the host countries. Multilateral trade liberalization could help forestall the concentration problem by allowing the entry of sound foreign banks from as many countries as possible. By allowing undistorted competition supported by sound regulatory and supervisory frameworks, regulators could not only ensure that the healthiest and most efficient foreign banks are allowed in, but also reduce the risk of shocks in one home country adversely affecting the whole host country market.

Global financial integration generally benefits host countries by increasing efficiency, competition, product availability, and the transfer of know-how and technology. But the recent crisis has shown that it can also expose countries to new risks and challenges. While foreign institutions have for the most part been stable providers of external financing during episodes of local financial turmoil, greater financial sector openness can amplify the effects of financial stress in other parts of the world on domestic financial systems. This can be a problem not only for emerging markets but also for more developed financial systems and economies.

These issues do not overturn the rationale for international financial integration. They do, however, call for enhanced awareness and a wise combination of national and international policy responses to ensure that financial integration takes forms that minimize its risks and maximizes its benefits for all countries. Open financial borders are an important aspect of this approach. Together with further supportive efforts, open borders can ensure both efficient international delivery of financial services and minimization of the risks associated with it. ■

Stijn Claessens is Assistant Director of the IMF’s Research Department, and Juan A. Marchetti is Counsellor in the Trade in Services Division of the World Trade Organization.

References

Claessens, Stijn, and Neeltje Van Horen, 2013, “Impact of Foreign Banks,” The Journal of Financial Perspectives, Vol. 1, No. 1, pp. 1–14.

———, forthcoming, “Foreign Banks: Trends and Impact,” Journal of Money, Credit and Banking.

Cull, Robert, and Maria Soledad Martinez Peria, 2010, “Foreign Bank Participation in Developing Countries: What Do We Know about the Drivers and Consequences of This Phenomenon?” World Bank Policy Research Working Paper WPS 5398 (Washington).

Financial Stability Board (FSB), 2013, “Progress of Financial Reforms,” Report to the G-20 (Basel).

International Monetary Fund (IMF), 2012, “The IMF’s Financial Surveillance Strategy; Foreign Bank Participation in Developing Countries: What Do We Know about the Drivers and Consequences of This Phenomenon? IMF Policy Paper (Washington).

World Trade Organization (WTO), 2011, “Trade in Financial Services and Development,” Background Note by the Secretariat S/FIN/W/76 (Geneva).