Smart Trade

Finance & Development, December 2013, Vol. 50, No. 4

The cross-border flow of intellectual property comes under 21st century economic scrutiny

A shipment containing the generic drug losartan potassium, used to help reduce arterial hypertension, leaves India bound for Brazil. While the shipment is in transit through the Netherlands, Dutch customs authorities, acting on an allegation of patent infringement, seize and hold it for 36 days before eventually releasing and sending it back to India. The December 2008 event was part of a wave of seizures of generic medicine on key transit routes through Europe. It renewed concerns about the international trade of pharmaceutical products and again cast light on the issue of access to affordable and essential medicines by the poor in a globalized world

Also on the intellectual property stage, the large international digital music services iTunes, Spotify, and Deezer expanded their global presence in the past two years from about 20 countries to more than 100. In 2012, the revenues of record companies’ digital divisions surged to more than a third of total music industry revenues—a 9 percent rise from the previous year. That same year thousands of protesters rallied across Europe against an international antipiracy agreement (the Anti-Counterfeiting Trade Agreement), fearing that it would encourage Internet surveillance and curb their freedom to download movies and music for free.

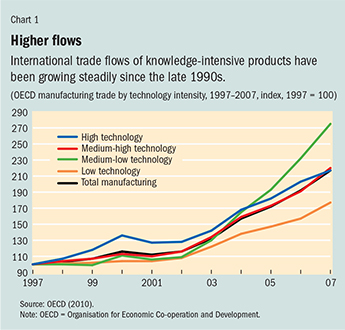

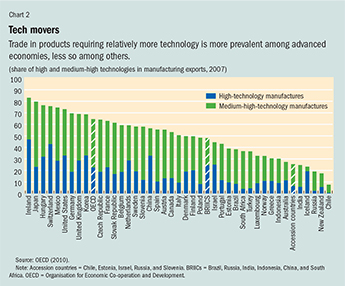

These examples illustrate two facets of the same phenomenon: ideas, information, and knowledge are increasingly tradable assets, taking many forms in their creation, dissemination, and movement across borders. They are now at the center of the 21st century global economy. Indeed most of the value created in new medicines and high-technology products resides in the amount of innovation, research, and testing involved in bringing these products to fruition. Along the same lines, movies, music recordings, books, and computer software are essentially traded and consumed because of their embedded information and creativity. Even standard manufacturing products and commodities such as clothing and plants may now include a high proportion of invention and design in their value. International trade flows of knowledge-intensive products have grown steadily since 1997 (see Chart 1). But trade in these goods is not uniformly distributed throughout the world (see Chart 2). Some countries clearly tend to export more high- and medium-high-technology manufacturing products than others.

The previous examples also highlight how the diffusion of knowledge through international transactions, whether traditional goods shipments or digital downloading, generates serious tension across countries and among individuals. That producers of knowledge have the right to prevent others from using their inventions, designs, and creations and can negotiate payment in return for their use by others is the subject of intense debate and friction between governments, firms, and civil society organizations. So-called intellectual property rights take a number of forms: copyrights for creative and cultural works, patents for innovative manufacturing products, and trademarks for design and fashion items. The legitimacy and extent of protection of such rights vary widely around the world and involve social, cultural, humanitarian, and political considerations. Here, we focus on the economic dimension of the problem: the role of intellectual property rights in international trade and the global economy, their impact on development and global welfare, and how to lessen the tension they generate across the world.

Intellectual property is based on information and knowledge, which have two specific economic properties. First, one person’s use of information or knowledge does not diminish another’s use. Consider a song, a computer program, or a fashion design: each may be used or enjoyed simultaneously or sequentially by several individuals. Unlike goods such as apples or cars, information is a nonrivalrous good; that is, more than one person can consume the product at the same time. So, once created, these works can and should be largely diffused through wide access.

Second, it is generally hard to stop others from using, imitating, or consuming information without authorization. Hence, use of intellectual property may not be prevented by individual private action. When information is costly to produce, individuals prefer to wait for others to create it and then enjoy its benefits freely. This “free-rider” problem in turn kills the incentive to invest resources and effort in creativity and innovation, which deters growth and development. Such a problem can be remedied by the definition and implementation of ownership structures on the right to use and consume the information.

This remedy often takes place through public intervention that reflects fundamental trade-offs. On the one hand, economic efficiency requires significant diffusion of information through wide access to intellectual property. On the other hand, efficiency requires incentives—through strong protection of intellectual property rights—to create new information whose value exceeds its cost for society. The problem is even more complex given that knowledge creation is a sequential process that builds on itself: information is an essential input for the production of further information. These trade-offs are resolved through the patent and copyright system: in exchange for disclosure of all the invention’s information, the government gives inventors exclusive rights and a legal monopoly for a limited period of time.

In an international context, additional trade-offs arise from the fact that the creation and diffusion of knowledge are not geographically uniformly distributed. Most inventions with commercial potential come from companies based in advanced economies and a few emerging market economies. But the logic of international trade and foreign direct investment implies that knowledge tends to spread and be used where production costs are low—namely, in low-income countries. Economic theory gives some insight into these trade-offs and the role of intellectual property rights in the global economy.

Economics of knowledge creation

For innovating advanced economies, strong protection of intellectual property rights reduces imitation and allows innovators to capture a larger share of the benefits of their creative activities. This encourages innovation and higher productivity growth. With international trade, however, intellectual property rights affect the diffusion of knowledge and thus the location of production between innovators in high-cost countries and knowledge users in low-cost regions. Economic reasoning then suggests that additional indirect effects can counterbalance the previous positive ones: better protection of intellectual property rights allows goods to be produced with a longer life span in the innovative advanced economies. In the long run, this implies a need for resources such as skilled workers, engineers, and financial resources to be reallocated into physical production and away from research and development activities in the innovating advanced region. This may as a result slow both innovation and growth in the world economy.

For most low-income countries, intellectual property rights are closely related to the issue of technology transfer and diffusion, a process that occurs through a number of channels in the global economy. International trade in goods and services—specifically imports of capital and intermediate goods—are important avenues of technology transfer. This works through reverse engineering—discovering the technology behind an object by taking it apart—but also through the cross-border learning of production methods, as well as product and organizational design. A related channel is foreign direct investment, as multinational firms share technologies with their subsidiaries, which then spread into the local economy. Finally, technology diffusion can also take place through international licensing, which requires the purchase of production and distribution rights for a product, as well as the knowledge required to make effective use of these rights.

As for innovation, economic theory suggests that the impact of stronger intellectual property rights protection on technology diffusion is not clear-cut and typically depends on a country’s characteristics. Stronger intellectual property rights protection restricts the spread of technology because patents prevent others from using proprietary knowledge. And the increased market power of foreign intellectual property rights holders shifts profits to foreign monopoly firms and away from domestic firms and consumers, causing higher prices, more expensive imports, and lower domestic output, which can impede the dissemination of knowledge. But intellectual property rights can also play a positive role in knowledge diffusion, since the information available in patent claims is necessarily made available to other potential inventors in the country rather than kept strategically hidden by the innovator. Moreover, strong intellectual property rights protection may stimulate technology transfer to low-income countries through trade in goods and services, foreign direct investment, and technology licensing. Indeed when innovations are better protected against imitation and counterfeiting, innovators may be more likely to export, invest, and license their technologies and designs across borders. Such increased flows of transactions in knowledge-intensive items eventually result in beneficial spillover effects as information spreads throughout knowledge-using economies.

While there are good theoretical presumptions that stronger intellectual property rights protection benefits innovating countries, the result for developing economies, where innovation is limited or nonexistent, is much less obvious. More precisely, intellectual property rights protection is expected to enhance growth in countries that move toward free trade and have a comparative advantage in innovative technology-intensive activities. For countries without such advantages, such protection may simply mean increased monopoly power for foreign firms and reduced domestic welfare—specifically in countries with little or no innovative capacity that would otherwise enjoy a free ride on foreign innovations.

Given the theoretical ambiguities related to intellectual property rights in the global economy, we need to turn to the empirical evidence. A United Nations Industrial Development Organization study (Falvey, Foster, and Memedovic, 2006) looks at the role of intellectual property rights in innovation, growth, and technology transfer. The study concludes that intellectual property rights have different effects in different countries. Stronger protection is shown to promote domestic innovation and growth in countries with significant domestic capacity for innovation (as measured by GDP per capita or stock of human capital) and more openness to international trade flows. Conversely, it has little impact on innovation in low-income countries with less innovative capacity.

Similarly, the effect of intellectual property rights on technology diffusion through international trade, foreign direct investment, and licensing depends on a country’s characteristics. The evidence shows that these channels are important sources of diffusion only in countries that have reached a certain capacity to adapt, use, or build on knowledge created abroad. In such cases, stronger intellectual property rights protection contributes to the spread of technology by stimulating trade flows, though not necessarily in goods and sectors considered high tech or knowledge intensive. This simply reflects the fact that for many high-tech industries, such as electronics and telecommunications, aerospace, and nuclear energy, intellectual property rights protection is not relevant to competitiveness. Products in such industries are often too sophisticated for imitation in low-income countries. And some firms may implement strategies such as industry secrecy to exploit their innovation. Stronger protection is also important for technology diffusion through foreign direct investment, but again only in specific industries—mostly chemicals and pharmaceuticals. And such protection matters more for foreign direct investment flows at certain production stages—component manufacturing, final production, and research and development—that are more sensitive to knowledge protection than other stops on the global production line.

The broad conclusion from the research is that the role of intellectual property rights in growth and welfare in an integrated global economy varies strongly across countries and sectors. Protection encourages domestic innovation and growth in countries with significant domestic capacity for innovation, and it promotes technology diffusion—but only in countries with a sufficiently educated population and an intellectual infrastructure that can use and productively adapt new technologies. Moreover, the benefits of such protection are more likely in economies that are more open to international trade and more advanced and whose larger markets mean less power for foreign firms.

Global approach

Given their strong differences across countries and sectors, it is no surprise that intellectual property rights generate intense debate, controversy, and tension among corporations, governments, and advocacy groups. At the multilateral level, the Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement is the most important attempt to narrow the gaps in how intellectual property rights are protected across countries. Within the framework of the World Trade Organization (WTO), the agreement aims to harmonize intellectual property rights under common international rules to protect patents, copyrights, trademarks, and design. It establishes minimum levels of protection among WTO members and adheres to the basic nondiscrimination principle of the multilateral trading system.

TRIPS is supposed to strike a balance between the benefits and costs of intellectual property rights protection across innovating countries and countries that do not (yet) have the capacity to innovate, with the expectation that it will encourage domestic innovation and international technology diffusion. But since its adoption it has been strongly criticized by nongovernmental organizations and global movements. Critics argue that it reflects the lobbying pressure of a few northern multinational corporations imposing the intellectual property systems of the most advanced, innovating economies on low-income countries with limited resources and infrastructure. There is indeed evidence that the so-called North-South technological gap has continued to grow (Correa, 2001), raising doubts about TRIPS’ ability to benefit the world’s poorest countries.

The trend for advanced economies is not toward relaxation of TRIPS but toward stronger intellectual property rights protection. The recent Anti-Counterfeiting Trade Agreement is an example, as are a number of bilateral investment treaties and free trade agreements signed in the past decade between advanced and less advanced economies. These agreements include explicit intellectual property rights protection obligations that exceed current TRIPS standards.

What will improve the balance of economic trade-offs associated with intellectual property rights and lessen underlying international tensions? Flexibility is a key underlying principle, and this has some clear policy implications. First, policy should vary according to a country’s level of development and its level of imitative or innovative capacity. For poor countries, with weak institutions and limited research and development capacity, intellectual property rights do not seem relevant. It is more important to improve the investment environment and implement trade policies that promote imports of technology embodied in goods. These countries may not be required to apply and enforce strong intellectual property rights obligations. Under certain conditions (such as UN classification as a least developed country) they should have access to mechanisms that reduce the cost of importing goods protected by intellectual property rights. For other intermediate-level, developing economies with higher capacity for imitation and innovation, harmonization of protection as required by TRIPS can stimulate domestic firms to switch from imitation to innovative activities and encourage the spread of technology through international trade and foreign patenting from other innovating regions. To offset the adverse effects from lost imitative opportunities, however, this process must include improved access to international markets, in particular to advanced economies’ domestic markets.

But bilateral trade agreements do not seem to be moving in that direction: the rules on intellectual property rights in the agreements reflect mainly the concerns of advanced economies. One way therefore to move closer to the policy outcomes outlined above would be to use the flexibility under TRIPS, which allows for exceptions and transition periods that help tailor the design of intellectual property rights regimes to each country’s needs in a multilateral and more balanced context. Such a process would facilitate international trade in smart things—such as medicines and digital entertainment—that save lives or just make life more pleasant. ■

Thierry Verdier is Ingénieur-Général des Ponts et Chaussées, professor at the Paris School of Economics (PSE-ENPC), and research fellow at the Centre for Economic Policy Research.

References

Correa, Carlos, 2001, “Review of the TRIPS Agreement: Fostering the Transfer of Technology to Developing Countries” (Penang, Malaysia: Third World Network).

Falvey, Rod, Neil Foster, and Olga Memedovic, 2006, “The Role of Intellectual Property Rights in Technology Transfer and Economic Growth: Theory and Evidence,” United Nations Industrial Development Organization Working Paper (Vienna).

Organisation for Economic Co-operation and Development (OECD), 2010, Measuring Globalisation: Economic Globalisation Indicators (Paris).