Senior Shock

Finance & Development, March 2014, Vol. 51, No. 1

The graying of advanced economies may make monetary policy less effective

The world is experiencing an unprecedented demographic shift. The population is aging, especially in advanced economies. The consequences of a graying population for government spending and tax (that is, fiscal) policy have been widely explored, and there is general agreement that a combination of higher taxes, reduced pension benefits, and longer working lives is essential to deal with the fiscal burden an aging population imposes—although the political challenges of doing so are enormous.

But there has been little exploration of the impact of an aging population on monetary policy—the process by which central banks influence interest rates and the supply of money to promote stable inflation, employment, and growth.

The life-cycle hypothesis—which posits that households borrow mainly when they are young, accumulate assets and pay down their loans until they retire, then live off their assets in retirement—suggests a clear link between the effectiveness of monetary policy and demographics. Part of the reason economists have barely explored that link is because monetary policy is typically designed to react to short-term shocks over a short horizon of one to two years, not to slow-moving factors, such as demographic change, that materialize over decades.

Silent and sluggish though demographic change may be, my research points to significant implications for monetary policy in advanced economies—including for current unconventional approaches, such as quantitative easing, those economies have deployed in recent years. Theoretically, the impact of an aging population is ambiguous: older populations are affected in different ways than the young by the various channels through which monetary policy moves. On balance, though, I found that a graying society blunts the effectiveness of monetary policy.

Sudden comeuppance

Monetary policy was accorded much of the credit for containing and stabilizing inflation, thereby fostering the steady growth and major reduction in business cycle volatility that lasted in advanced economies from the mid-1980s until the global financial crisis that began in 2008. By keeping inflation expectations in check, the analysis has it, central banks reduced the uncertainty that can cloud investment decisions and hold back consumption, and were able to respond flexibly to shocks. Both the Gulf War in 1991 and the collapse of the Internet bubble in 2000 were followed by a swift loosening of monetary policy to restart economic activity. That quick response was possible because inflation expectations were low.

But belief in the effectiveness of monetary policy was upended by the 2008 global financial crisis. Since the beginning of the crisis, central banks have found it difficult to prop up growth and prices—whether in Japan, the United States, or Europe. And now evidence is mounting that even during the roughly 25 years of the so-called Great Moderation that preceded the crisis, monetary policy was less omnipotent than it appeared.

That new evidence shows that monetary policy has had a diminished and diminishing impact on variables such as unemployment and inflation since the mid-1980s. The declining effectiveness—measured by the impact of interest rate changes on unemployment and inflation—is usually attributed to better-anchored inflation and output expectations, which are then less affected by interest rate changes (Boivin, Kiley, and Mishkin, 2010). Inflation is generally less responsive to changes in the cyclical unemployment-output gap (the difference between what an economy can produce at full employment and what it actually is producing) when inflation expectations remain well anchored on the central bank’s target, including during deep recessions, such as the recent global financial crisis (IMF, 2013). Many economists say these factors explain why the unprecedented monetary policy expansion since 2008 has not had a larger impact on inflation or output.

Researchers have two main explanations for the reduced effects of monetary policy.

Structural transformation of the economy, particularly in the credit market: Some analysts argue that institutional changes in the credit market explain the weakening of monetary policy’s effectiveness. They say that over the past few decades, regulatory restrictions were loosened and credit markets liberalized. New forms of lending (such as securitization, which transforms loans into securities) have allowed more types of institutions to provide credit in what has been dubbed the shadow banking sector (see “What Is Shadow Banking?” in the June 2013 F&D). Shadow banks (which can include such entities as investment companies and insurance companies) have allowed easier access to credit and more of it to people who previously had trouble borrowing—especially those with lower incomes. These changes should, in principle, increase the effectiveness of monetary policy. However, the changes in credit markets occurred at the same time that household balance sheets, especially the value of houses, began to play a growing role in consumption decisions. Consumers found they could tap the equity in their homes by refinancing their mortgages. That meant that standard consumer borrowing and interest rates became less important, which in turn reduced the importance of the credit channel—and, as a result, the sensitivity of economic activity to monetary policy changes.

Changes in the way monetary policy affects the expectations of economic players such as businesses and consumers: Some economists also argue that central banks—because of their strong credibility—have increasingly operated through “open mouth operations”—that is, managing expectations through communications alone—without having to change interest rates as much as they did before. The expectation that monetary policy would respond strongly if output deviated from its potential or to deviations from the inflation target has led to more stable income and inflation expectations. That in turn means greater stability in actual spending and inflation, which reduces the effect of interest rate changes.

These factors are important, but they are not the only explanation for the decreased effectiveness of monetary policy. One explanation that has not garnered much attention is the important role of changing demographics in weakening monetary policy effectiveness in five major advanced economies I studied—Canada, Germany, Japan, the United Kingdom, and the United States.

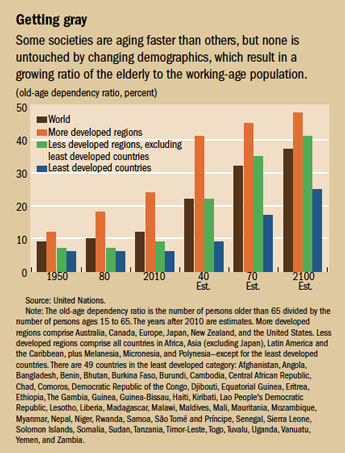

Demographic profiles vary significantly by country. Some, such as Germany and Japan, are aging more rapidly than others, but no country remains untouched by this phenomenon. The result is a growing ratio of the elderly to the working-age population, the so-called old-age dependency ratio (see chart). Moreover, because fertility rates are plummeting everywhere, the world is rapidly graying. According to the life-cycle hypothesis, older societies, especially in advanced economies, should have a large share of households that are creditors and be less sensitive to interest rate changes, especially if interest rates are fixed and do not change with inflation, as is usually the case in the countries studied. Younger societies, by contrast, should have a larger share of debtors with higher sensitivity to changes in interest rates induced by monetary policy. In other words, demographics play a role alongside structural change and expectations in moderating the effect of monetary policy on inflation and unemployment.

Different strokes

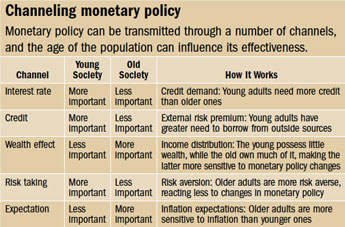

Monetary policy affects different groups in varying ways, depending on both the group and the channel through which monetary policy flows (see table). There are several ways monetary policy induces changes in behavior by adjusting interest rates (and specifically how they affect older citizens in advanced economies), including the following:

Interest rate channel: According to the life-cycle hypothesis, individuals acquire assets such as houses and stocks and bonds throughout their working lives and sell them after they retire. Both the saving and consumption patterns of households follow a well-established path that changes with age. Debt rises early in the life cycle and then begins to fall (though in recent years more gradually than in the past, given the global crisis and higher cost of education and parental care, among other things). Younger households, which are typically net debtors, are more sensitive to interest rate changes—particularly if interest rates on housing loans are mostly variable—while older households, which typically do not need to borrow, are less sensitive to this channel. That means that in societies dominated by young households, monetary policy would be a more effective tool for dampening or encouraging demand than it would be in an older society.

Credit channel: This channel amplifies the interest rate channel by affecting the so-called external finance premium—the difference in the cost to households or businesses of using their own funds to finance purchases rather than borrowing externally. Older households have greater net worth than younger households and are more likely to rely on self-financing to fund investment or consumption. At the same time, older people have a large amount of assets that can be used as collateral, so the risk premium of borrowing is lower and the cost of raising external funds should also be lower. The ability to self-finance and borrow more cheaply suggests that grayer societies are less sensitive to the effect of monetary policy on the credit channel. There are many older people in poverty in advanced economies, but they are normally little affected by monetary policy changes because they cannot obtain credit under any circumstances.

Wealth effect channel: Based on the life-cycle hypothesis, demographic shifts can be expected to affect asset prices. Young people typically have few assets, while older ones may own many. When a household has acquired substantial assets, many of them earn interest, which means that interest rate changes affect the income of older households more than those with few interest-earning assets. In graying societies, wealth effects are likely to be more important, because wealth tends to be concentrated among the elderly (at least in advanced economies) and typically more heavily invested in interest-sensitive fixed-income products (such as bank deposits or bonds) than equities. The demographic shift would, therefore, tend to raise the relative importance of the wealth effect channel, increasing the effectiveness of monetary policy. But looser monetary policy since the global crisis may have weakened monetary policy through the wealth effect channel. The lower rates resulting from the looser policies reduced the income that can be generated from savings or annuities, which may have encouraged older households to save more and consume less. However, there is not yet much convincing empirical evidence to support this position.

Although less studied and more difficult to discern, other channels may alter the way monetary policy is transmitted, for example:

Risk-taking channel: Monetary policy affects the perception of risk by individuals and firms. This channel influences risk taking by encouraging people to search for yield. Financial entities have been found to borrow more (increase leverage) when interest rates fall, and less when interest rates rise. Older people have less time to recoup losses, so in an older society there may be more risk-averse households and less overall risk taking—that is fewer stock and more bond investments. Given a less potent risk-taking channel in a graying society, monetary policy effectiveness is likely to be diminished.

Expectations channel: The demographic shift is likely to have little impact on expectations because they are so strongly based on the credibility of the central bank—which should not change when a society ages. But recent research using survey data suggests that, all else equal, inflation expectations rise as people age, leading to risk-averse behavior (Blanchflower and MacCoille, 2009). Behavioral finance economists say that this higher risk aversion occurs because older households generally are creditors and have more to lose from higher inflation than younger households, which may actually benefit from inflation. In practice, therefore, it is possible that central banks will respond to growing concern about inflation in an aging society and place greater emphasis on price stability.

To estimate the net impact of these conflicting effects of demographic change on monetary policy effectiveness, I mapped estimations of each country’s monetary policy against its demographic structure. The research focused on the five biggest advanced economies with independent monetary policies during the period 1963–2007. I picked 2007 to avoid any complications caused by the global crisis. Comparing the changes in monetary policy effectiveness with changes in the old-age dependency ratios in each of the five countries, and focusing on the extent to which aging can explain changes in interest rate sensitivity, I analyzed the impact of changes in monetary policy on inflation and unemployment. The research confirmed a robust relationship between the demographic trend and monetary policy effectiveness.

The research also demonstrated a relationship between aging and weaker monetary policy effectiveness that is long term and unaffected by short-term factors such as the business cycle. It showed that a 1 percentage point increase in the old-age dependency ratio reduces the ability of monetary policy to affect inflation by 0.1 percentage point, and its ability to affect the jobless rate by 0.35 percentage point. This is particularly significant when linked, for instance, to the projected 10 point rise in the old-age dependency ratio in Germany over the next decade. In societies dominated by older folks, therefore, the diminished effectiveness of monetary policy is more marked.

New trade-offs

My research illustrates that the demographic shift explains in part why monetary stimulus is not having a larger impact. If societies dominated by older households tend to be less sensitive to interest rate changes, then monetary policy will be less potent in an aging society. Changing demographics mean that policy rates will remain low in advanced economies for a very long time (unless, for instance, asset values fall to make younger households feel richer relative to retirees). New trade-offs will arise in a society going through the demographic shift toward aging that will likely cause monetary policy to operate differently to achieve the same impact.

First, the relative preference for inflation versus output stabilization is likely to change, because older households have on average larger asset holdings and, therefore, have more to lose from unexpected inflation. Increasing aversion to inflation may then lead to a lower optimal inflation target. Central banks around the world, in turn, will have to think through these trade-offs, and may conduct tighter monetary policies to keep inflation low, potentially at the expense of more variation in output. In other words, there may be lower inflation but also more recessions and recoveries.

Second, if monetary policy is less effective in a graying society, then to have the same impact on inflation or unemployment they had in a younger society, central banks will have to induce a larger change in the interest rate they use to transmit policy. This suggests that a change of 25 basis points (a basis point is 1/100th of a percentage point), which was the norm in previous decades, may not be enough. (Or, in the current environment in most advanced economies, where rates are already at zero, aggressive quantitative easing policies will become part of the regular toolkit and will be used more frequently.) Aging societies will require more activist monetary policy, along with bigger variations in interest rates, to enhance effectiveness.

Third, as the effectiveness of monetary policy declines, nonmonetary policies such as taxation and spending will play a greater role in stabilizing the economy and financial system. So-called macroprudential policies may also contribute to monetary policy effectiveness (see “Protecting the Whole,” in the March 2012 F&D). Macroprudential policies use financial regulatory prudential tools—such as mandatory bank loan-to-value ratios, capital requirements, and prescribed levels of cash-like assets on balance sheets—to address concerns about the overall economy. For example, if the transmission of monetary policy appears clogged, one way to induce (or dampen) borrowing or lending is to alter those prudential ratios, without compromising financial stability (Haldane, 2011).

The research reported here focuses on advanced economies, which were the first to go through the demographic shift. Although emerging market and low-income economies will also gradually age, the impact on monetary policy is likely to be different than in advanced economies because wealth is not as skewed toward older generations, and the overall society is likely to remain more sensitive to interest rate changes.

Patrick Imam is a Senior Economist in the IMF’s Monetary and Capital Markets Department.

This article is based on the author’s 2013 IMF Working Paper 13/191, “Shock from Graying: Is the Demographic Shift Weakening Monetary Policy Effectiveness.”

References

Blanchflower, David, and Conall MacCoille, 2009, “The Formation of Inflation Expectations: An Empirical Analysis for the UK,” NBER Working Paper No. 15388 (Cambridge, Massachusetts: National Bureau of Economic Research).

Boivin, Jean, Michael Kiley, and Frederic Mishkin, 2010, “How Has the Monetary Transmission Mechanism Evolved Over Time?” NBER Working Paper No. 15879 (Cambridge, Massachusetts: National Bureau of Economic Research).

Haldane, Andrew, 2011, “Risk Off” Bank of England Speech, August 18.

International Monetary Fund (IMF), 2013, “The Dog That Didn’t Bark: Has Inflation Been Muzzled or Was It Just Sleeping?” World Economic Outlook (Washington, April), Chapter 3, pp. 1–17.