Labor Rewarded

Finance & Development, June 2014, Vol. 51, No. 2

Prakash Loungani profiles Christopher Pissarides, winner of the 2010 Nobel Prize for work on unemployment and labor markets

NOBEL Prize awards for economics sometimes contain a touch of whimsy: they honor people with opposing views—such as the 1974 award to the left-leaning Karl Gunnar Myrdal and the libertarian Friedrich August von Hayek—or reach back to recognize academic achievements long forgotten. The 2010 award was given to a like-minded group: it recognized Peter Diamond, Dale Mortensen, and Christopher Pissarides, whose research coalesced in the 1990s into a workhorse model of unemployment and the labor market. And the time was right. In the aftermath of the Great Recession, 200 million people across the globe were unemployed, and getting them back to work was the most urgent economic policy task.

For Pissarides, a Cypriot of Greek descent, understanding unemployment has been his life’s work since the 1970s. It took 20 years of academic toil before the impact of his research started to transform the way economists think about unemployment—and then for its influence to seep through to policy. IMF chief economist Olivier Blanchard, a noted scholar of unemployment himself, says: “Chris persevered. And history has proven him right. There is an important lesson to researchers here. When you think you are right, don’t listen too much to others.”

Today, with everyone listening to him, Pissarides can use the bully pulpit afforded by the Nobel Prize to help address the unemployment crisis in Europe. He has supported some policies of the so-called troika of lenders—the European Commission, European Central Bank, and International Monetary Fund—but has been an outspoken critic of others (see box). He has been particularly active in his home country of Cyprus, where as head of the national economic council—akin to the Council of Economic Advisers in the United States—he advises the president on issues ranging from bank restructuring to the business model for Cyprus in the future. “Cyprus has some 10 TV channels,” says Pissarides, “and they are all chasing me for my views. Sometimes I want to retreat to my university office and lock the door. But I know if I do that, I will regret it. This is the time to help.”

Prelude

Growing up in Nicosia, Pissarides excelled in primary and secondary school, according to his mother, Evdokia: “His teachers used to say he was top of his maths class. He worked for a long time.” Despite that excellence, Pissarides was turned down by five of the six British universities to which he applied, getting an undergraduate degree in economics at the University of Essex. Among those that rejected his application was the London School of Economics (LSE), where he eventually was admitted to do a Ph.D. in economics and now teaches. Pissarides is philosophical about the rejection: “I’m probably better off having gone [to Essex] because it was a smaller place and they paid a lot of attention to us. At LSE, I probably would have got lost very easily.”

With Ph.D. in hand, Pissarides returned to Cyprus to work in the research department of the central bank. But the fates conspired to move him back to the United Kingdom. While he was on a trip to visit his prospective in-laws in Athens in 1974, the government in Cyprus was overthrown, and the ensuing political turmoil prevented his return. He turned to his former teachers in the United Kingdom for help and within a year was ensconced as a faculty member at LSE. “I moved to London in 1976. I have not moved since,” Pissarides wrote in his 2010 Nobel lecture.

Matching game

The philosopher Thomas Carlyle once wrote: “Teach a parrot the terms ‘supply and demand’ and you’ve got an economist.” Too much supply of a commodity should lead to a fall in its price, boosting demand and eliminating the excess supply. When applied to the labor market, this classical view implies that wages will fall when there is an excess supply of labor, eliminating unemployment. The persistence of mass unemployment, as was the case during the Great Depression of the 1930s, flew in the face of this view.

In the 1960s, economists—among them Diamond and Mortensen—began to recognize that the search for a job was akin to that for a spouse or a house. The housing market, for instance, has a large number of buyers and sellers. The two sides go through a search process to find a good match that makes both sides happy. Price is one aspect of the deal but not the only one because buyers care about other attributes of houses. The search is time consuming, so some houses remain unsold for a while. Applied to the labor market, this “search theory” seemed to provide a much more satisfactory view of why there was unemployment than did the classical paradigm.

Pissarides met Mortensen in the early 1970s as he was finishing up his studies at the University of Essex. Mortensen strongly recommended that Pissarides pursue search theory during his Ph.D. work at LSE. Mortensen doesn’t recall the meeting but wrote later that “it was obviously one of the best pieces of advice that I gave any student.” During the 1970s and 1980s, first as a student and then as a faculty member at LSE, Pissarides worked on understanding better the process through which workers were matched to jobs. Charles Bean, former deputy governor of the Bank of England and LSE faculty member, says Pissarides’s thesis was notable for its emphasis on the importance of incomplete information. Employers were not fully sure of the abilities of potential workers and workers were not fully informed about job opportunities, which led to “essential frictions in the way the labor market operated.”

Pissarides’s key contribution in the work that followed his dissertation was to develop the concept of the matching function. Economists use a concept known as the production function to express the relationship between inputs and outputs; technological progress can deliver more output for the same input, and sometimes adverse circumstances or bad policy choices can clog the process through which inputs are turned into outputs. Likewise, Pissarides thought of the number of unemployed people and the number of vacancies as inputs that go into the production of jobs. How well the inputs translated into jobs depended on the extent of incomplete information, on government policies, and on shocks hitting the labor market. Bean says that “although superficially a ‘black box,’ [the matching function] could be justified by a variety of microeconomic stories. It could be estimated on actual data.” Pissarides also used ideas from the field of game theory to determine how the surplus from a successful match was split between workers and employers. This, says Bean, provided “a simple but powerful theory of wage determination.”

Euro angst

The response to the 1992 launch of the euro was different on the two sides of the Atlantic Ocean. On September 21, 1992, four famous Massachusetts Institute of Technology professors—Olivier Blanchard, Rüdiger Dornbusch, Stanley Fischer, and Paul Krugman—took part in a discussion at which they agreed that “a common European currency would have unfavorable economic repercussions.” Among many Europe-based academics, in contrast, there was euphoria: “I was completely sold on the idea,” Pissarides has written. He joined the Monetary Policy Committee of the Central Bank of Cyprus “to help bring the euro to my home country.” Earlier he had worked on teams in Sweden and the United Kingdom on the implications for their labor markets of adopting the euro.

But now, he says, the adoption of the euro has “backfired: it is holding back growth and job creation; and it is dividing Europe.” The setting of macroeconomic policies may be appropriate for Germany and some northern members of the union, but it is “far too tight” in his view for the southern members of the union. Fiscal austerity in particular is “creating a lost generation of educated young people . . . The troika [European Commission, European Central Bank, and International Monetary Fund] and national governments should be softer on austerity.” Pissarides says the euro should either be dismantled or the leading members of the union should allow for looser monetary and fiscal policies to restore growth and employment creation in the south.

Diamond and Mortensen were engaged in similar efforts, but Pissarides was not fully aware of their work: it was “before the electronic era,” he wrote in his Nobel lecture. Closer to home, some of his colleagues at LSE—notably Richard Layard and Stephen Nickell—were also working on their own approach to understanding unemployment. While certainly aware of their work—and even on occasion a collaborator—Pissarides stuck to his own path. Blanchard recalls “meeting Chris in the late 1980s at LSE. At the time, the school was intensely focused on unemployment issues.” Pissarides was “toiling largely in parallel. His models looked rather exotic and complex, relative to the biblical simplicity of the Layard-Nickell model . . . I would not say that people thought Chris should move on and work on more relevant stuff, but he was not at the center of the [LSE] team.”

Enabling act

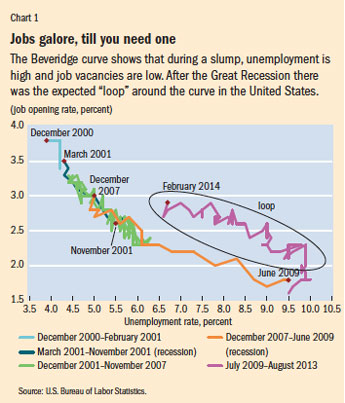

Pissarides’s work on the matching function led to a revival of interest in the Beveridge curve, the relationship between unemployment and job vacancies. The relationship itself had been observed by the British economist and social reformer William Beveridge in the 1940s: when the economy was booming, unemployment was low and vacancies were high, and the converse was true in a slump. Pissarides not only provided a theoretical foundation for the curve but helped interpret movements around it—known as “loops”—when the economy was coming out of a recession. As U.S. and other labor markets struggle today to shake off the effects of the Great Recession, there are loops around the Beveridge curve, just as Pissarides predicted (see Chart 1).

Another practical implication of Pissarides’s work is its support for policies that help the unemployed get back to work. These policies, known as “active” labor market policies, affect workers’ motivation to search for and accept jobs. Economists agree that workers should receive income support during periods of unemployment, but Pissarides wrote in his Nobel lecture that policies should also “provide incentives for more intensive job search, [which] can shift the Beveridge Curve toward the origin, and improve the performance of the labor market in matching workers to jobs.” Without such active policies, the duration of unemployment ends up being very long, which further “disillusions the unemployed . . . and disenfranchises workers from the labor force.”

These findings have made their way into policy circles and have influenced how governments react to downturns in the labor market. In the United Kingdom for instance, Pissarides told F&D, active policies “played an important role in containing long-term unemployment” during the Great Recession. In contrast, he says, the United States did the right thing by providing unemployment benefits but did not put enough effort into getting the unemployed back into jobs through active labor market policies, leading to a worrisome increase in U.S. long-term unemployment. George Akerlof, a 2001 Nobel Prize winner and also known for his work on unemployment, says that “the emphasis Chris put on the loss of skills as spells of unemployment lengthen—and hence the need to keep unemployment from becoming long term—is one of his lasting contributions.”

Go with the flow

Imagine that you are setting the table for a holiday dinner and realize that you’ve set three too many places. What would you do? Remove the extra plates, right? You would think it silly if someone advised you to first add two more place settings and then remove five, thereby eliminating the excess of three. Yet the labor market in advanced economies seems to repeat just such a waste of effort every month. Consider August 2010, when the U.S. economy shed 100,000 jobs. This net reduction in 100,000 jobs was accomplished by creating 4.1 million new jobs and destroying 4.2 million existing jobs. In the jargon of economists, the net change in the number of jobs is dwarfed by the gross flows from unemployment to employment (“job creation”) and from employment to unemployment (“job destruction”).

These facts about the enormity of gross flows were just becoming known in the 1990s, thanks largely to the work of Harvard’s Kim Clark and Lawrence Summers, Chicago’s Steven Davis, and the University of Maryland’s John Haltiwanger. It inspired the work of Mortensen and Pissarides by showing that the labor market was indeed as they viewed it—a dynamic place where a lot of job matches were created and destroyed every month. And it challenged them to build an explicit model that would be consistent with the size of these gross flows and how they changed over the course of the business cycle.

Unlike the work on the matching function, the development of this model was a joint effort by Mortensen and Pissarides in an extraordinarily fruitful decadelong collaboration in the 1990s. A central feature of the model is the assumption that once jobs are created, they cannot adapt easily to new technologies. The labor market is constantly being hit by technological and other developments that change the profitability of existing jobs. Such “idiosyncratic shocks” lead to a destruction of jobs—and to unemployment—until new jobs are established elsewhere to take their place. Job creation and job destruction are also affected by economy-wide booms and slumps. The work by Mortensen and Pissarides combined all these elements into a model that was consistent with the enormous size of gross flows and how they varied over the business cycle. Recognizing the contributions that Diamond had made earlier to its development, the model is now known among economists as the “DMP model” after the initials of its creators’ last names. Blanchard says the DMP model “has proven to be both a theoretical wonder and an incredibly useful one with which to look at data.”

‘Protect workers, not jobs’

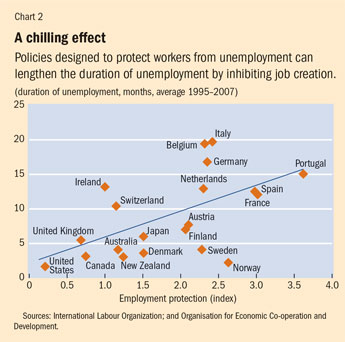

The DMP model has also proven to be very useful in thinking about the design of labor market policies. Many countries seek to shield workers from unemployment through administrative procedures that cost employers time and money when they let a worker go—essentially a tax on dismissals. Such employment protection legislation does indeed lower the size of the gross flow into unemployment, by limiting job destruction. But the legislation also hinders job creation. “When the firm is creating a job it expects to have to pay the [high dismissal] tax in some future date if it has to dismiss the worker. Job creation falls as a result,” Pissarides explained in his Nobel lecture. With lower job creation, the flow from unemployment to employment also becomes lower.

In sum, a policy designed to protect workers from unemployment can have the paradoxical effect, over time, of actually raising the duration of unemployment through a chilling effect on job creation (see Chart 2). These implications of the DMP model provide support for what has by now become a mantra: “protect workers, not jobs.” Trying too hard to protect existing jobs through excessive restriction of dismissals can stop the churning of jobs that is necessary in a dynamic economy. It is better to protect workers from the consequences of joblessness through unemployment benefits and other income support—accompanied by active policies to get the unemployed back to suitable jobs before their skills and confidence deteriorate.

Excessive employment protection can also lead to high youth unemployment. Young people do not yet know what they are good at or what they would like to do, and employers are unsure of how well they will perform. For young workers therefore, it is particularly important, says Pissarides, that they be “given the opportunity to job shop. Just as they are not expected to marry their first boyfriend or girlfriend, they should not be expected to take their first job and stick with it forever.” He says that employment protection legislation helps older “male workers . . . but hurts other workers, like women and youths, who go in and out of the labor force” more frequently.

Service with a smile

Over the past decade, Pissarides has expanded the scope of his work to include issues of structural change. As economies move toward the service sector, he says, it is important that the “sector be seen as a hope [for] rather than as a drag [on productivity and growth].” For many emerging markets, too much reliance on manufacturing is a danger, he thinks, as “much of the low-cost work in manufacturing will provide workers with neither the high-tech skills nor the interpersonal skills” that will be needed in many of the jobs of the future (see “Not Your Father’s Service Sector” in this issue of F&D).

In Europe, Pissarides told F&D, “most job shortfalls are in jobs that provide services to the public and companies.” More flexibility and better employer incentives could generate jobs in retailing, hotels, and automobile services and could “employ a lot of youths and women.” For this it is essential that minimum wages be kept low so that employers will take a chance on new workers. What is also needed, he says, is some change in attitudes about service sector work: “It does not diminish you to give better service to your customer.”

Pissarides himself is known for his easy manner and modesty. Bean says that “Chris’s unassuming style and easy approachability always made him a favorite with students.” Over the years he has supervised a large number of Ph.D. students, among them Reza Moghadam, head of the IMF’s European Department. When the Nobel Prize was announced, Pissarides was away from his LSE office. But, Bean says, “his office door was a mass of multicolored Post-It notes carrying messages of congratulations from students . . . That represents as good a testament as any” to his life’s work. ■