Prognosis: Rosy

Finance & Development, March 2015, Vol. 52, No. 1

When it comes to long-term growth forecasts, economists tend to be overly optimistic

It is human nature to be optimistic. We tend to expect things to turn out better than they often do. “People hugely underestimate their chances of getting divorced, losing their job or being diagnosed with cancer; expect their children to be extraordinarily gifted; envision themselves achieving more than their peers; and overestimate their likely life span . . . .” wrote neuroscientist Tali Sharot in The Optimism Bias (2012).

Economists are not immune to optimism bias—the belief that the future will always be as good as or even better than the past and present. It can affect the way they predict economic growth, especially over longer-term horizons.

Many emerging markets and developing economies have enjoyed an extended period of remarkable economic growth. For example, between 2003 and 2013, China’s per capita real (after adjustment for inflation) GDP increased at an average rate of 9.6 percent. Nigeria, the largest developing economy in Africa, also fared well at 5.8 percent. This has been great news for the world economy and lifted millions out of poverty. But how long will this exceptional performance last? Forecasters often predict rapid growth to continue into the medium and long term, particularly for star performers such as China and Nigeria. But historically, the association between a country’s growth rate in a given decade and the next is weak (Easterly and others, 1993); in other words, past growth is not a very good predictor of future growth over longer periods.

Ebb and flow

Economic growth, like many things in life, is subject to a natural ebb and flow. In the late 1880s, English statistician Francis Galton showed that children of tall fathers tend to be shorter than their fathers. To describe this phenomenon, he coined the term “reversion to the mean.” Similarly, exceptional growth performance also tends to dissipate. Nevertheless, as economists Lant Pritchett and Lawrence Summers recently pointed out, professional forecasters may fail to take into account “reversion to the mean” (Pritchett and Summers, 2014). A closer look at professional growth forecasts over horizons of up to 20 years for a large group of countries confirms the existence of widespread optimism bias (Ho and Mauro, 2014).

Forecasts of economic growth into the medium term (say five years) and beyond are a crucial, if often overlooked, input into economic policymaking and strategic business choices. It is also notoriously difficult to forecast well, especially as the horizon gets longer. Yet decisions based on erroneous forecasts can have major adverse consequences for various aspects of macroeconomic policymaking, as well as for the bottom line of multinational companies and international investors.

For example, take fiscal policymakers, who deal with spending and taxation. An overestimate of future economic growth implies an underestimate of the government-debt-to-GDP ratio at the end of the projection period. As a result, the country will either end up with a higher-than-expected debt ratio, which could lead to a financial crisis, or future policymakers will have to tighten fiscal policy abruptly—with disruptive consequences. In fact, unexpected growth slowdowns can explain a significant part of the increase in public debt ratios during such episodes as the debt crises in Latin American and other emerging market economies in the 1980s, the highly indebted poor country crises of the 1990s, and, most recently, the 2008–09 financial crisis in advanced economies.

For central bankers, incorrect assumptions about medium- or long-term growth could lead to mistakes in assessing the magnitude of the output gap—the difference between what an economy is capable of producing on a sustained noninflationary basis and what it is producing (a measure of the degree of slack in the economy)—and thus in determining the appropriate monetary stance. For example, a sustained decline in medium- or long-term growth that is misperceived as a temporary slowdown in output could lead central bankers to adopt an overly loose monetary policy compared with what would be considered desirable in hindsight, with possible adverse consequences for inflation or financial stability.

The past as prologue

In principle, extrapolating past trends—that is, assuming that the future will be identical to the past—is not as naive as it might seem. After all, the most likely fundamental determinants of economic growth (such as institutional quality, educational attainment, and prudence of macroeconomic policies, among others) tend to change slowly (Easterly and others, 1993). In practice, however, the record shows that extrapolation does lead to poorer predictions. Drawing on data for 188 countries over 1950–2010 and looking at individual countries’ per capita real GDP growth rates from one decade to the next show a low correlation between growth rates in adjacent decades, with correlation coefficients ranging between zero and 0.5 depending on income level and time period. (The closer to 1 the correlation coefficient, the more the two variables move in the same direction.)

Even if a country’s fundamentals are persistent, economic growth is not very persistent from one period to the next, whether the period is defined as 1 year, 10 years, or 20 years. On average, there is a 30 percent chance a country will keep growing at its past growth rate, and a 70 percent chance that its future growth rate will revert to the world average. Thus, there is a high tendency for growth to “revert to the mean.” Several Asian economies, including Japan and South Korea, are examples of economies whose growth rates have slowed significantly over the course of the last half century.

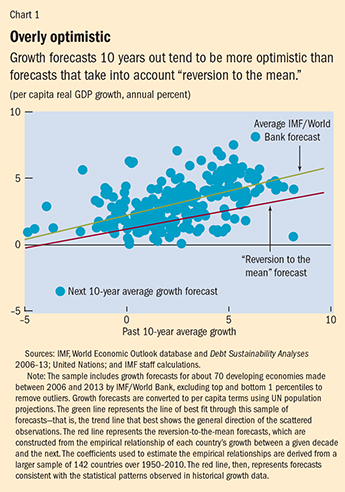

Do economists’ growth forecasts reflect the large degree of “mean reversion” observed in historical growth data? Evidence from a sample of long-term forecasts for 70 developing economies prepared jointly by IMF and World Bank teams suggests that the answer is “not enough” (see Chart 1). In particular, the average IMF and World Bank forecast over a 10-year horizon is biased upward and exhibits more persistence with past growth compared with a forecast that takes into account the estimated large tendency to revert to the mean in historical growth patterns. As an example, for a country whose per capita income grew over the past decade at an average rate equal to the sample mean (2.4 percent), the typical IMF and World Bank forecast predicts annual growth of 3.1 percent over the next decade, compared with 2.0 percent predicted by the “mean reversion” framework. In other words, there is an optimism bias of 1.1 percentage points. The optimism bias is statistically significant and becomes more pronounced for countries that have recently experienced rapid growth. The bias is also higher for forecasts at longer horizons—say 20 years out.

The tendency for growth forecasts to be overly rosy is not specific to forecasters at the IMF and World Bank—or for developing economies (though it is more pronounced for developing and emerging market economies than for advanced economies). Bias of similar magnitude is also present in projections by both the Organisation for Economic Co-operation and Development (OECD) and Consensus Forecasts for the major emerging market economies, in particular China and India—whose recent growth performance has been exceptional. All the various forecasters tend to produce results that assign an excessive weight to recent growth performance even though they use a wide range of forecasting methodologies. For example, IMF and World Bank forecasts are produced by teams working full-time on each individual country, Consensus Forecasts are an average of forecasts made by selected professional forecasters who follow individual countries, and OECD projections are based on a single sophisticated, well-documented model common to all countries (and thus are less likely to be influenced by subjective decisions by forecasters).

Potential damage

The implications of optimism bias in growth forecasting can be sizable, even for a moderate bias of, say, 1 percentage point a year. For example, consider a country that under current policies—and assuming a given growth rate—would maintain a stable government-debt-to-GDP ratio of, say, 50 percent over the next 10 to 20 years. If economic growth turns out to be 1 percentage point a year lower than expected—and assuming that a 1 percentage point decline in GDP results in a higher deficit by 0.3 percentage point of GDP (not an unusual assumption for an emerging market economy)—then the debt-to-GDP ratio would rise to more than 70 percent after 10 years and, as deficits become even larger, to more than 120 percent after 20 years. In other words, economic growth forecast errors of this magnitude are large enough to turn a country with a stable debt path into one that runs the risk of a fiscal crisis (assuming for simplicity that fiscal policy is not tightened in response to the decline in GDP growth).

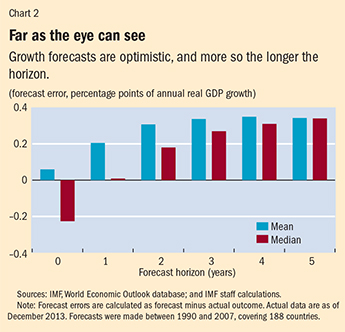

It is possible to assess directly the quality of past forecasts when enough time has elapsed to observe actual growth outcomes. An examination of five-year forecasts made between 1990 and 2007 for 188 countries from the IMF’s World Economic Outlook database shows that economists have had a pretty consistent record of optimistic forecasts. In particular, forecast errors—the difference between forecast and actual growth—tend to be positive at all horizons (except for median current year forecasts), with the positive bias increasing as the horizon becomes longer (see Chart 2).

Why do economists systematically make optimistic forecasts, giving more weight to recent growth performance than is justifiable by historical experience? In some respects, one could argue that optimism is a common trait associated with human nature, perhaps ingrained in us by natural selection. After all, as Sharot told us, people display optimism bias on a daily basis in various aspects of their personal life.

Beyond these intrinsic features of human beings, however, some factors are more specific to the context in which professional economists prepare and defend their forecasts. For countries such as China or Nigeria, whose economic growth has been strong over the past decade, forecasters would be hard-pressed to justify why they expect substantially lower growth in the period ahead if little has changed in the underlying key growth factors, such as the quality of institutions and human capital. Conversely, for countries whose growth has been sluggish for a while—perhaps due to an economic or political crisis, or even a civil war—the forecaster is unlikely to be able, or willing, to assume that similar adverse shocks, or tail events, will recur. Growth forecasts can also be based on overly optimistic policy assumptions—for example, that governments will keep their reform promises or that the IMF- and World Bank-supported programs will be successful—whereas reality can turn out differently.

Dealing with the bias

Is there a point to forecasting long-term growth if there are more “misses” than “hits”? French mathematician Henri Poincaré once said: “It is far better to foresee even without certainty than not to foresee at all.”

Those producing and interpreting the forecasts—such as policymakers and international investors—may simply consider correcting their optimism bias or at least give greater weight to alternative, less optimistic, scenarios in their deliberations. One way of encouraging more thorough discussion of the baseline forecasts could be to focus on the question “Why will this country continue to defy ‘reversion to the mean’ and keep growing faster than average?” rather than the more common “Why should this country slow down given that nothing else has changed?” Moreover, adverse-shock or low-growth scenarios, which are already routinely included in the analysis undertaken by some institutions (including the IMF and the World Bank), should receive greater prominence in policy deliberations. More generally, as is already commonplace in some multinational companies, it would seem wise to shift the focus to checking how well policy and business strategies perform in different scenarios, rather than emphasizing baseline forecasts. ■

Giang Ho is an Economist in the IMF’s European Department and Paolo Mauro is a Senior Fellow at the Peterson Institute for International Economics and Visiting Professor, Johns Hopkins University Carey School of Business.

References

Easterly, William, Michael Kremer, Lant Pritchett, and Lawrence H. Summers, 1993, “Good Policy or Good Luck? Country Growth Performance and Temporary Shocks,” Journal of Monetary Economics, Vol. 32, No. 3, pp. 459–83.

Ho, Giang, and Paolo Mauro, 2014, “Growth: Now and Forever?” IMF Working Paper 14/117 (Washington: International Monetary Fund).

Pritchett, Lant, and Lawrence H. Summers, 2014, “Asiaphoria Meets Regression to the Mean,” NBER Working Paper No. 20573 (Cambridge, Massachusetts: National Bureau of Economic Research).

Sharot, Tali, 2012, The Optimism Bias: A Tour of the Irrationally Positive Brain (New York: Vintage).