Continental Reach

Finance & Development, June 2015, Vol. 52, No. 2

Alexandra Born and Paul Mathieu

African banking groups are expanding across the region, challenging traditional players and supervisors

Africa-based banks, once largely domestic, are expanding across the continent and now dominate the banking sector in many countries. These so-called pan-African banks are establishing cross-border networks and overtaking the European and U.S. banks, which traditionally dominated banking on the continent. The new pan-African players are driving the expansion of financial services and economic integration in Africa, helping unlock the huge potential of a fast-growing region.

Pan-African banks originate mainly in the largest economies of Africa, such as South Africa, Nigeria, and Morocco, and from countries of influence within a region, such as Kenya. But one of the major pan-African institutions, Ecobank, is headquartered in tiny Togo. Ecobank emerged in the mid-1980s in the context of the 15-nation Economic Community of West African States, and although not the largest of the pan-African banks in terms of assets, it surpasses them all in geographic reach.

At a time when global banks have moved their business away from smaller-scale and higher-risk operations, the expansion of African players bodes well for financial sector development in Africa. These regional institutions are not only filling in the gaps left by the retreating global banks but are fostering financial development and economic integration. However, to be sustainable and to avoid raising systemic risks and the type of financial instability experienced elsewhere, this expansion of banks with significant cross-border networks must be accompanied by stronger supervision and heightened cross-border cooperation.

Taking off

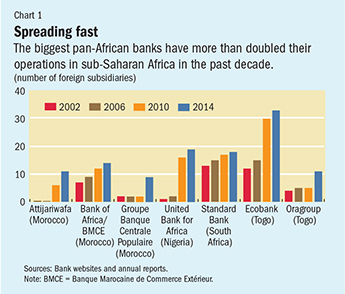

South Africa’s Standard Bank has been active across borders for a number of years. But other banks began to grow their regional operations in earnest in the mid-2000s. The number of subsidiaries almost doubled between 2006 and 2010 (see Chart 1), from 48 to 88, as the cross-border expansion of banks from Morocco and Nigeria’s United Bank for Africa gained traction. This rapid cross-border expansion was aided by improved political and macroeconomic stability and robust economic growth as well as the following specific factors:

● The end of apartheid in the mid-1990s, which opened the door for banks headquartered in South Africa to extend their expertise abroad;

● Increased trade linkages among African countries—inducing, in particular, banks in South Africa and Kenya to follow their customers abroad;

● Decisions by banks in Morocco to establish a regional presence to the south because of more limited opportunities at home and in Europe—including by buying the local operations of retrenching European banks;

● The large increase in minimum capital requirements in Nigeria that followed a banking crisis in the mid-2000s, which motivated banks to consider expanding abroad to make use of their new larger capital bases; and

● Ecobank’s long-standing social ambition, dating to its establishment in the mid-1980s, to become Africa’s leading pan-African bank.

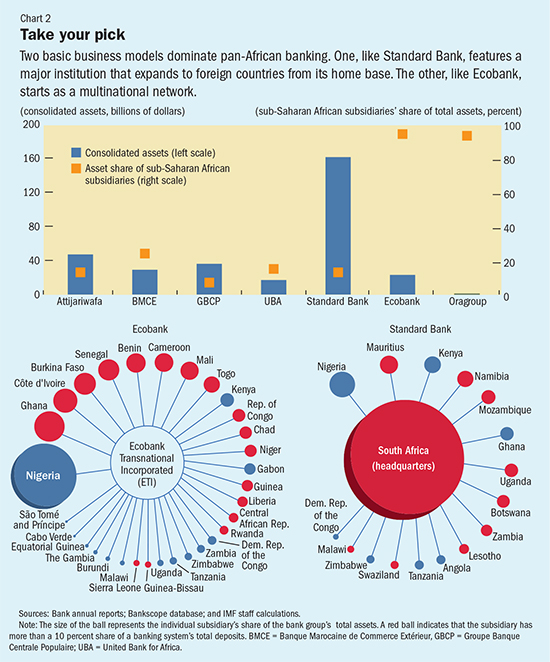

For pan-African banks, two basic business structures have emerged (see Chart 2). One is a traditional model of expansion from a dominant home base; the other was designed to be a diversified network structure from the get-go.

Banks in the traditional model have expanded from a large home base, which continues to play the dominant role in the group’s activities. In these cases, cross-border subsidiaries contribute less than 20 percent to total assets, with the contribution of any individual subsidiary a lot less. In this group are South African and Moroccan banks and to a lesser extent Nigerian banks.

For banks in the second group, none of which has a dominant home base, the network is most important. Although a bank holding company centrally manages the subsidiaries, the bank subsidiary in the nominal home country is but one among many, and the largest subsidiary might be located in a different country. Examples of this arrangement are Ecobank—headquartered in Togo but with its biggest subsidiary in Nigeria—and Bank of Africa, founded and headquartered first in Mali, with the holding company later moved to Luxembourg and eventually acquired by Moroccan Banque Marocaine de Commerce Extérieur. There are a number of banks whose structures fall between the two models. Moreover, as cross-border operations grow, the dominance of the home presence in the group diminishes.

Servicing the underbanked

The economies of both host and home countries receive numerous benefits from cross-border banking. The rise of pan-African banks has increased competition and efficiency, introduced product innovation and more modern management and information systems, and brought higher skills and expertise to host banking sectors. A number of pan-African banks have exported innovative business models and delivery channels, such as mobile banking by Kenyan institutions, to host countries. These advances have helped expand the availability of banking services and products (often called financial deepening).

Pan-African banks have also extended banking services to people with inadequate access to bank services, the so-called underbanked. For example, when Kenyan banks started operations in other member countries of the East African Community, they leveraged their expertise in agent and mobile banking to service underbanked portions of the population. Similarly, Moroccan banks expanded microfinance operations in francophone west Africa while their subsidiaries introduced a focus on lending to small and medium-sized enterprises. Nigerian banks have been instrumental in increasing the number of branches in west Africa, especially in rural areas.

The pan-African bank phenomenon can also help host countries raise their financial standards. Banks from more advanced African economies use higher home-country standards in their subsidiaries, and host authorities are exposed to more sophisticated reporting and supervisory practices—such as capital standards recommended by the Basel Committee (an international group of bank regulators) and the International Financial Reporting Standards issued by the International Accounting Standards Committee. This peer-to-peer learning effect is further reinforced as host regulators benefit through joint on-site supervisory visits of foreign subsidiaries with home authorities and as they participate in supervisory colleges, which bring together regulators for individual banking groups.

The expansion of pan-African banks also benefits the home country banks because they increase their diversification and improve growth opportunities.

Managing systemic risks

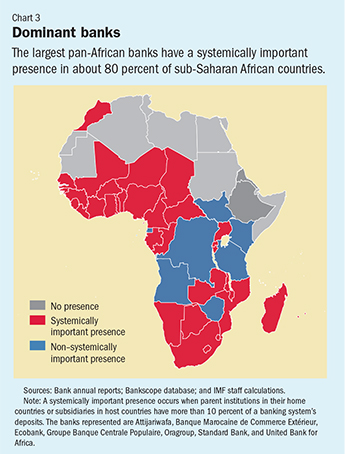

The rise of pan-African banks presents new issues for regulators and supervisors. As networks expand, new channels for transmission of macro-financial risks and other spillovers across home and host countries emerge. For example, problems at the parent-bank level, such as perceptions of mismanagement or reputational risks, could lead to bank runs on subsidiaries. Similarly, economic or financial problems in host countries could affect the parent bank if a subsidiary’s operations are relatively large compared with those of the rest of the group. As pan-African banks have grown in reach and complexity, supervision gaps have emerged. It is difficult for home country regulators to determine the soundness of a subsidiary or the potential risks it faces without some grasp of the structure and operations of the bank group as a whole. This calls for a consolidated supervisory approach for the entire group led by the home regulator in collaboration with host country regulators. Bank-group-specific supervisory colleges, backed by memorandums of understanding regarding systematic exchange of supervisory information, are important to this effort. The expansion of pan-African banks has produced a network of systemically important banks (see Chart 3)—that is, institutions whose failure could have broad financial consequences—which heightens the need for strong African home country regulatory leadership.

Supervisory capacity is already constrained and underresourced in most of Africa, and cross-border banks put additional pressure on home supervisors to ensure that these groups are adequately supervised. The recent global financial crisis made it clear that cross-border cooperation on supervision and resolution is essential to handling risks to financial stability, and inadequate cross-border cooperation can have serious repercussions. If there is no effective cooperation and planning of cross-border bank resolution, tools employed to resolve cross-border institutions tend to be last-minute, ad-hoc interventions that involve public support. Even long-standing relationships between supervisory authorities can break down in a crisis.

Home and host supervisors’ mismatched interests are exacerbated by the considerable difference in the size of institutions and economies and are serious impediments to cross-border cooperation. Some subsidiaries of pan-African banks are systemically important in their host countries, but they may represent only a small portion of the overall operations of the parent banking group. This can have implications for financial stability in host jurisdictions if home authorities or parent institutions take unilateral action—for example, putting restraints on the home country institution to recapitalize a foreign subsidiary (that is, ring-fencing). The greater the asymmetry in economic size between home and host, all else equal, the less likely a financial institution’s overall strategy will specifically take into account the host country’s needs and the greater the threat to financial stability in the host country if problems emerge at home. In Europe, for example, western European banks cut back lending to eastern Europe during the global financial crisis—a relatively small move in the West with serious implications in the East. The Vienna Initiative in 2009 and 2011 was a response to promote closer coordination to safeguard financial stability and take into account systemic risk concerns in emerging Europe.

Securing the benefits of cross-border banking

To ensure that the gains from African cross-border banking networks are sustained, the pan-African bank phenomenon must include upgraded consolidated supervision buttressed by enhanced cross-border cooperation. International best practices call for a consolidated view of owner operations and risks faced by banking groups, which typically involves establishment of individual supervisory colleges and continuous exchange of information that are outlined in memorandums of understanding between regulators and supervisors. This cooperative framework must be established in quiet times rather than when a crisis occurs.

The spread of pan-African banks increases vulnerability to, and the strength of, spillovers of financial problems across African countries. Without understandings on how the problems of a troubled bank would be resolved, supervision alone may have limited effectiveness. Individual regulators may revert to ring-fencing during a crisis, with less than optimal results. The global financial crisis demonstrated that a lack of workable cross-border operational frameworks extracts a high cost—and drove home just how difficult it is to construct those frameworks.

Regulatory and accounting norms across Africa must be upgraded to international standards to improve transparency and foster integration. In pursuing these reforms, international institutions such as the IMF can play a useful role in continuing to provide extensive technical assistance. ■

Alexandra Born is an Economist and Paul Mathieu is an Advisor, both in the IMF’s Monetary and Capital Markets Department.

This article is based on “Pan African Banks: Opportunities and Challenges for Cross-Border Oversight,” 2015, a paper prepared by an IMF staff team from the African, Middle East and Central Asia, and Monetary and Capital Markets Departments, led by Charles Enoch, Paul Mathieu, and Mauro Mecagni.