Capital Idea

Finance & Development, June 2015, Vol. 52, No. 2

By increasing spending on infrastructure, Germany will help not only itself, but the entire euro area

The economic recovery in the euro area is slow and tentative, and growth in even the strongest economy, Germany, seems to have lost some momentum in recent years. Moreover, estimates of German growth potential are low—and could go lower because of a rapidly aging population.

But there is a way to mitigate growth problems in Germany and, by extension, throughout the euro area. Increased German public investment in infrastructure, such as highways and bridges, would not only stimulate near-term domestic demand, but would also increase productivity and raise domestic output over the longer run and generate beneficial spillovers across the rest of the euro area.

Although Germany’s public infrastructure is not widely seen as deficient, it has in fact been neglected for some time, especially in the transportation area, where pressing needs, such as aging roads, have been clearly identified. Germany’s public investment in infrastructure is in the bottom quarter of the 34 advanced and emerging market economies of the Organisation for Economic Co-operation and Development. In fact, net public investment has been negligible since 2003: the average ratio of net government investment to net domestic product over the past decade is –0.1 percent, which is associated with deterioration in the public capital stock (see Chart 1). Greater infrastructure investment would likely significantly expand German potential output—that is, the largest GDP an economy can produce sustainably. For example, better infrastructure would ease the movement of goods used and produced by firms.

Spillovers from Germany

We used the IMF’s Global Integrated Monetary and Fiscal model (see box) to try to quantify the domestic effects and spillovers to other countries that would accompany increased German infrastructure investment (Elekdag and Muir, 2014). Our adaptation of the model combines four broad features:

● households that optimize consumption and saving, given their planning horizons;

● productive public stock of infrastructure;

● clear role for monetary policy; and

● multicountry framework, under which the world is grouped into six regions: Germany; Greece, Ireland, Italy, Portugal, and Spain (the Euro Five), which until recently had high external funding costs; the remaining euro area economies; emerging Asia; the United States; and the rest of the world.

A look at the model

The Global Integrated Monetary and Fiscal model (GIMF) is widely used at the IMF as a framework for analyzing the short- and long-term effects of fiscal (taxing and spending) issues, as outlined in Anderson and others (2013). The GIMF is constructed to permit researchers to analyze how government investment in infrastructure can affect the productivity of the domestic economy. We extended it to also allow for delays between the time an infrastructure project is approved and when it is fully operational and paid for.

The multicountry structure of the GIMF allows economists to analyze global interdependence and spillover effects. In this model, the world consists of Germany; Greece, Ireland, Italy, Portugal, and Spain; the rest of the euro area; emerging Asia; the United States; and the rest of the world. There are two major sources of international linkages. First, there is full accounting of trade between each region. Second, the flow of goods allows the model to determine current accounts, which are simply the flows of global saving and investment. Each region has

● Two types of households—“liquidity-constrained” households, which have no savings and consume only out of their current income, and “optimizing” households, which can save and choose how many hours to work and their level of consumption. These households are assumed to plan for a 20-year horizon on average. Households perceive government debt as wealth; there is no concern about saving for future generations.

● Firms that are forward looking—but plan only for the next 20 years.

● Monetary policy that pursues price stability through short-term control of the policy interest rate—The European Central Bank conducts monetary policy across the euro area. All other regions also pursue price stability through independent central banks.

● A government that targets a certain level of debt in the long run—although it tries to stabilize the economy during the business cycle by allowing the deficit to fall when GDP growth is strong and vice versa.

German spillovers to the rest of the euro area are transmitted in two main ways; via the trade channel and the real exchange rate channel. The trade channel comes into play when higher government spending in Germany causes the nation’s economic output to grow, which increases German demand for imports from its trading partners. The real exchange rate channel is at work when an increase in German government spending leads to higher German inflation. Given that the euro area has a common currency, one member’s real exchange rate appreciates if it has higher inflation than the other members. In this case, the German real exchange rate appreciates, leading to greater German demand for imports.

Spillovers are also influenced by monetary policy, which can dampen or enhance the effects of the trade and real exchange rate channels. A rising inflation rate in Germany would induce the European Central Bank (ECB) to increase interest rates in Germany and the rest of the euro area. This would dampen domestic demand across the euro area, but would also cause appreciation of the euro and depress euro area exports. The monetary tightening could reduce or even overwhelm the trade and exchange rate channels and leave real, or after-inflation, GDP weaker in the euro area. But if instead monetary policy accommodated the rising German inflation and left interest rates unchanged, the result would be relatively stronger spillovers. Unchanged rates would mean higher inflation and even lower real (after-inflation) interest rates, which would boost domestic demand and lead to real exchange rate depreciation in the euro area—and stronger net exports.

Increasing government spending

There are many types of fiscal stimulus, such as tax cuts and increases in infrastructure investment or general expenditures. Spillovers vary depending on the type of stimulus. Government investment in infrastructure would be more beneficial than a general increase in government spending.

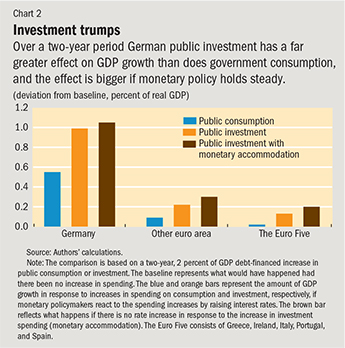

Chart 2 compares the effects in the second year of public spending on general goods and services with the effects of investment in infrastructure. If public spending is increased by 1 percent of GDP for two years, financed by a higher government deficit, the model predicts the following:

When the government boosts spending on general goods and services there is a temporary increase in real GDP of just over 0.5 percent in Germany. There are virtually no spillovers to the Euro Five economies, but there is a tiny, 0.1 percent of GDP, increase in the other euro area countries (including such major German trading partners as Belgium, France, and the Netherlands). More government consumption increases aggregate demand, yielding a positive output gap (the difference between what a country is producing and can produce efficiently) and higher domestic and regional inflation rates. Interest rates increase as monetary policy tightens in response to higher inflation pressure across the currency union. Although the extent and timing differ across the region, higher real interest rates—because of Germany’s higher domestic inflation relative to the rest of the euro area—drive up the German real exchange rate, which offsets the benefits of the stimulus on domestic activity and weakens the associated spillovers. Consequently, the German current account worsens, while those of its trading partners in the euro area improve slightly. The current account is a measure of a country’s economic relationship with the rest of the world—exports minus imports plus net income and net transfers.

When the government spends on public investment, things are different. It holds the most promise for a durable rise in real GDP. Increased public investment improves national infrastructure, which firms can then exploit to reduce costs, such as for transportation, and improve market access at home and abroad. Firms are therefore more productive and sell their goods for lower prices. This increases demand for their goods, which in turn means more domestic demand for labor and investment, contributing to a persistent rise in real GDP—which peaks at 1 percent of GDP. Spillovers are also larger—almost 0.2 percent for the Euro Five economies and almost 0.3 percent for the rest of the euro area. Because of the long-term change in the stock of German infrastructure, these domestic gains and spillovers last well past the second year.

Monetary policy plays an important role here too, because it covers the entire euro area. Typically, monetary policy works to offset the inflation pressure associated with increased government spending, meaning higher interest rates that would reduce the gains in real GDP and spillovers. However, because Germany accounts for about one quarter of the total euro area economy, the ECB is likely to raise interest rates only about 25 percent as much as a German central bank would raise them—if there were a German central bank. So spillovers and domestic effects are higher than they would be if each euro area country had its own monetary policy.

There are more gains to be made if the ECB does not react to the inflation pressure for the two years of the fiscal stimulus. Accommodation would allow for stronger real GDP growth (1.1 percent versus 1.0 percent) and an additional 0.1 percent of real GDP spillover to the rest of the euro area. The lower interest rates allow for higher inflation, which further drives down the real interest rate and leads to greater stimulus from domestic investment and consumption.

These results assume that infrastructure projects are approved, built, and operational within the very tight time frame of one year. In a more realistic case of implementation delays—in which a project is approved in the first year, but spending continues over three years and the infrastructure becomes active in the fourth year—the eventual rise in real GDP is postponed (see Chart 3). Because of the lagged completion (and the delayed productivity benefits for the economy), increases in private investment and employment also stall. Domestic output could contract for a while, with some adverse regional spillovers. Nevertheless, the longer-term output gains characterized by higher public investment are the same. A by-product of implementation delays is deferred and somewhat smoother deficit spending, which implies less of an annual budgetary burden in the short run.

Monetary policy can augment real GDP gains in this case. There is still enough stimulus that the ECB continues to raise interest rates. If, however, the ECB does not raise rates, inflation would rise across the euro area, yielding negative real interest rates, which would lead to further increases in consumption and investment in the entire euro area.

The current low-interest-rate environment presents a window of opportunity for Germany to finance higher investment at historically favorable rates, which will have good short- and long-term effects not only on Germany but on all of Europe. ■

Selim Elekdag is a Deputy Division Chief in the IMF’s Monetary and Capital Markets Department and Dirk Muir is an Economist in the IMF’s Research Department.

References

Anderson, Derek, Benjamin Hunt, Mika Kortelainen, Michael Kumhof, Douglas Laxton, Dirk Muir, Susanna Mursula, and Stephen Snudden, 2013, “Getting to Know GIMF: The Simulation Properties of the Global Integrated Monetary and Fiscal Model,” IMF Working Paper 13/55 (Washington: International Monetary Fund).

Elekdag, Selim, and Dirk Muir, 2014, “Das Public Kapital: How Much Would Higher German Public Investment Help Germany and the Euro Area?” IMF Working Paper 14/227 (Washington: International Monetary Fund).