Corruption Matters

Finance & Development, September 2015, Vol. 52, No. 3

Governance has progressed in a few Latin American countries but corruption still hinders development in the region

Hundreds of millions of soccer fans around the world are following the corruption scandal in the Fédération Internationale de Football Association (FIFA, the sport’s world governing body). The U.S., Swiss, Brazilian, Colombian, and Costa Rican governments, among others, are investigating, and executives and officials from regional and national organizations and companies throughout the Americas and beyond have been implicated. Charges include allegations of bribery and collusion in lucrative contract awards and selection of World Cup hosts.

Every scandal and organization is different. Yet this case has characteristics, such as corruption among opaque networks of colluding officials and executives of transnational and national organizations, that are found worldwide. And the FIFA scandal suggests that, even if it takes a long time, there can be eventual accountability, as some judicial actions show.

The ongoing “car wash” case involving Brazil’s national oil company, Petrobras, is also relevant: inflated contracts with Petrobras in exchange for kickbacks to former executives and illegal party contributions by powerful construction companies have led to indictments and sentencing by Brazil’s judiciary. Allegations of bribery to secure contracts from companies in Italy, Korea, and Sweden have also surfaced. Other countries in the region are experiencing their own high-level scandals, including Argentina, Chile, Guatemala, and Mexico. Some are reacting.

Beyond particular scandals, and the varying responses, the challenge of corruption is vast. Estimates of bribery around the world hover around $1 trillion, and cumulative illicit financial flows from Latin American countries over the past decade are estimated to be about the same.

Defining and measuring

As part of a research project I initiated in the late 1990s with Aart Kraay at the World Bank, we defined governance as the traditions and institutions that determine how authority is exercised (see “Governance Matters: From Measurement to Action” in the June 2000 F&D). These include (1) how governments are selected, held accountable, monitored, and replaced; (2) governments’ ability to manage resources efficiently and formulate, implement, and enforce sound policies and regulations; and (3) respect for the institutions that govern economic and social interactions.

For each of these three areas we constructed two empirical measures, for a total of six Worldwide Governance Indicators (WGIs), using data from dozens of organizations. Every year, we assess more than 200 countries on voice and accountability, political stability and absence of violence, government effectiveness, regulatory quality, rule of law, and control of corruption. Corruption is one among several measures of broader governance because it stems from weaknesses in other governance dimensions.

Traditionally corruption is defined in terms of individual public officials who abuse public office for private gain. But corruption has a wider reach. It is a costly symptom of institutional failure, often involving a network of politicians, organizations, companies, and private individuals colluding to benefit from access to power, public resources, and policymaking at the expense of the public good.

Systemic political corruption, particularly associated with campaign finance and related “elite (or state) capture”—undue influence on laws, regulations, and policies by powerful corporate interests—plagues many industrialized and middle-income (and democratic) countries around the world, including in North, Central, and South America. In this context of state capture and “legal corruption” it is pertinent to consider an alternative view of corruption—the “privatization of public policy.”

Mixed performance

Latin America’s performance on governance over the past 15 years has been mixed. On the positive side, it has escaped much of the major strife and terrorism afflicting many countries in other regions. Democracy continues to develop, despite a few setbacks such as in Honduras and Venezuela. And in a number of countries, including Chile, Colombia, Mexico, and Peru, there has been progress on key aspects of economic governance, particularly in terms of improved macroeconomic management, taming the inflation ghosts of the past, paving the way toward fiscal consolidation, and exhibiting more transparency in budgets and procurement—abetted by effective ministries of finance and central banks.

But in many countries this progress in macroeconomic policies has not been complemented by longer-term governance, particularly political and institutional, reforms. WGI evidence suggests that on average, government effectiveness, control of corruption, and voice and accountability stagnated in the region, and overall regulatory quality and rule of law deteriorated.

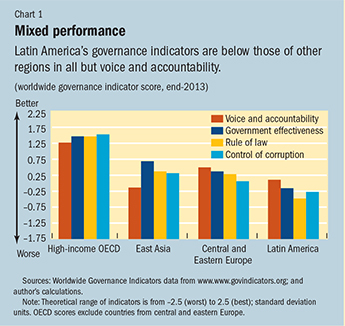

At the end of 2013, Latin America’s governance quality trailed that of other predominantly middle-income regions, such as central and eastern Europe, which progressed during the transition from central planning to market based and accession to the European Union. Similarly, except in voice and accountability (a relative strength of Latin America), east Asia, with its focus on a long-term strategy and independent merit-based bureaucracies, surpassed Latin America on many governance dimensions, including government effectiveness, rule of law, and corruption control (see Chart 1). Latin America’s average score is below the world median in all governance indicators except voice and accountability, which barely tops the median. It rates particularly poorly on (implementation of) rule of law. And on personal security and common crime, the region is at the very bottom.

Regional averages hide much variation across countries. Chile, Costa Rica, and Uruguay, for example, score relatively high in governance, unlike most other countries, which are below the world median, and some, such as Venezuela, that rate very poorly. Trends also vary: some countries—such as Uruguay, with an increasingly open political system, law-abiding population, and low tolerance for corruption, and Paraguay, which started from a very low base—have improved on corruption control over time, while Venezuela experienced a marked deterioration.

In an effort to reduce petty corruption associated with excessive bureaucracy, a number of countries, such as Colombia, Mexico, and Costa Rica, have cut red tape, but many others are lagging. More broadly, in terms of global competitiveness, as measured by the World Economic Forum, only 7 of 18 Latin American countries rank in the top half of their index covering 144 countries. Only Chile—ranked 33rd and dropping—and Panama (48th) make it to the top 50. The main factor lowering the region’s competitiveness is its subpar institutional quality.

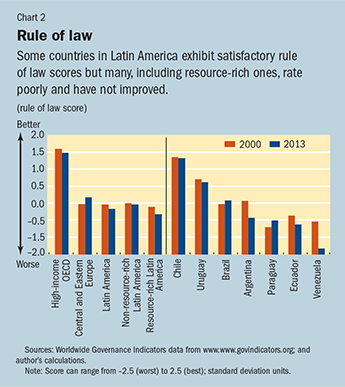

Several countries in the region have depended highly on their primary commodities, notably natural resources such as oil and minerals. With some exceptions, such as Chile and to an extent Colombia and Brazil, on average countries rich in extractives have worse governance and corruption control than the rest of the region. Evidence from all regions, including Latin America, suggests that resource-rich countries generally did not seize the opportunity for governance reform during the commodity supercycle of the past decade. The data suggest that in many countries, including in Latin America, voice and accountability deteriorated (where constraints on civil society worsened during the period, particularly in some oil-rich countries), as did corruption control and, except for example in Colombia and Brazil, rule of law (see Chart 2).

Governance matters

Research based on the WGI data shows how much governance matters for development. On average, we found a 300 percent long-run development dividend from good governance: an improvement in governance, for example, from the low corruption control (or rule of law) of Venezuela to the level in Argentina, Mexico, or Peru or from the level of any of these three countries to the higher levels of Costa Rica was causally linked in the long term to a threefold rise in per capita income, one-third less infant mortality, and significantly higher literacy rates. And there is no evidence that resource-rich countries’ additional income and potential flexibility from commodity windfalls can compensate for shortfalls in governance. The data suggest that the development dividend of good governance is at least as high for resource-rich economies as for other countries. In fact, there is recent research evidence that poor governance hinders investment in oil exploration.

Beyond the effect on incomes, according to many other researchers (including the IMF’s Gupta and others, Mauro, and Tanzi) corruption undermines outcomes in education, health, public investment, and income equality. It thwarts development, including by entrenching powerful groups and weakening the tax base, undermining public finances (as in Greece), and misallocating talent (away from productive activities toward profiteering from corruption) and public investment (toward expensive capital-intensive projects and away from education and health). And corruption is a significant tax on investors.

This is more than academic. Despite progress in some countries, Latin America’s growth has historically been below potential (and far below that of east Asia) and is slowing markedly, as is foreign investment. More than a third of people still live on less than $5 a day in a region rich in natural resources. Income inequality is among the highest anywhere (see “Most Unequal on Earth” in this issue of F&D), and education and innovation trail peers in the rest of the world.

Addressing corruption

Attempts to fight corruption have never succeeded when they are narrowly focused on traditional initiatives such as yet another unenforced anticorruption law or one more anticorruption campaign or agency. It requires an integrated governance approach that alters incentives and addresses corruption systematically, tackling capture and corrupt networks. Such an approach must prominently feature a stronger judiciary, along with political funding reform, meritocratic systems, and transparency and accountability. It must involve all branches of government as well as civil society, the media, and the private sector.

Political reforms are obviously a priority, including the democratization and modernization of political parties and an open and meritocratic system of party leader selection. Many countries in the region have adopted regulations on political financing, but these suffer from loopholes and tend to be ill enforced (reflecting an all-too-common gap between law and practice) because of weak monitoring and enforcement as well as a lack of transparency. These need to be addressed; further, political reform must include an enforced ban on corporate contributions, caps on individual funding and campaign expenditures, full disclosure of campaign contributions and spending, and stronger election monitoring (as Mexico has done).

Given how difficult it is for politicians to reform their own political system (potently visible in the United States as well), the focus on rule of law reforms is even more central to address corruption, particularly in a region where impunity prevails in many countries. The police and the judiciary are weak in most countries and are often subject to political and corporate influence, patronage, and corruption, even infiltration by organized crime in some. Brazil and Chile have shown that strengthening the judiciary is possible, yet a meritocratic—and thus rejuvenated and depoliticized—cadre of well-paid judges remains a challenge in many other countries, as does reforming the police force. Whistle-blowers must be protected and given monetary incentives to come forward.

The high-productivity and competitive segment of the private sector is painfully aware of how much it is undermined by companies that engage in corruption or exercise undue influence. Surveys of firms point to the extent of bribery in procurement and the judiciary in the region and to weaknesses in anticorruption efforts. Private sector leaders can be an important ally in promoting good governance and fighting corruption and elite capture, and they can support tougher antibribery enforcement and implement policies concerning conflict of interest and ”revolving-door” behavior between the public and private sector.

Multinational corporations from high-income countries and China also have a major responsibility. For instance, complemented by enforcement from their host country regulatory agencies, U.S. and European oil companies should fully embrace—rather than continue to resist—implementation of the section of the U.S. Dodd-Frank legislation that mandates companies in the extractives industries to disclose detailed payments to foreign governments. Further support from the governments of many high-income countries is also needed: they must fully expose and do away with safe havens and mandate disclosure of companies’ beneficial owners as well as tightening enforcement of the Organisation for Economic Co-operation and Development’s foreign bribery legislation.

Increased transparency is broadening the scope for more open governments (including, at the global level, via the Open Government Partnership, OGP). In Latin America, there has been progress on economic and financial transparency, but political transparency has a long way to go to address state capture and conflict of interest. National and subnational public officials, politicians, and judges should be required to fully disclose in timely and accessible fashion their business interests, assets, campaign funding sources, deliberation on draft laws, and voting records. Full transparency is also needed to tackle corruption in procurement, encompassing all sectors, state enterprises, and municipalities, and subject to civil society oversight. Governments should publicly list bidders that collude or bribe, barring them from government contracts—as Chile, Colombia, and Brazil, for example, now do.

Such transparency reforms, if combined with innovations brought about by the open data movement and with powerful new diagnostic tools on governance, can help rigorously analyze governance vulnerabilities and expose corruption and collusion. To help translate this invaluable information into accountability and reform, civil society (including academia and think tanks) should be further engaged and empowered. Crucially, the media should play a more central role in investigating and exposing capture and corruption, but in many countries that will mean prying open the media’s highly concentrated ownership structure.

Rich in reform opportunity

The basic governance reform pillars mentioned above are at least as relevant in resource-rich countries, but complementary measures are often also needed in extractive industries. Natural resource governance benefited from some notable initiatives during the commodity booms of the past decade. Key international financial institutions and multilateral development banks, as well as nongovernmental organizations got involved, and the Extractive Industries Transparency Initiative (EITI)—which now includes 48 countries—was launched. New approaches and tools helped with country assessment and strategy development; for example, the Natural Resource Charter, with its emphasis on policy formulation throughout the decision chain. But effective implementation is needed. And technocratic economic policy and disclosure initiatives must be complemented by enhanced accountability and rule of law.

Transparency reform is essential: countries should join the EITI, adopt its global standards, and tackle subnational, social, and environmental issues, as Colombia is starting to do. As oil prices fall, there is an opportunity for specific fiscal reforms, including reducing energy subsidies (as in Ecuador and Mexico), strengthening tax compliance by the powerful and broadening the overall tax base (moving away from excessive reliance on extractives), adopting well-governed sovereign wealth funds (as in Chile), and enhancing the effectiveness of revenue sharing and public expenditures at the subnational level, where waste and corruption often prevail.

Further, as is beginning in Mexico and Brazil, resource-rich countries should revamp their national oil companies, submit them to market rigor, reduce political interference and institute systems for merit-based appointments, and enforce effective oversight, disclosure, and corporate integrity. Stronger and meritocractic agencies in extractives and related sectors are also essential, as is attention to social and environmental challenges (such as those faced by Colombia and Peru). And greater transparency in the legislatures of many countries—including Bolivia, Chile, Ecuador, Peru, and Venezuela—is also needed.

Overall, Latin America exhibits a major governance deficit. Unless it improves, sustained and shared growth is in jeopardy, the large middle class is under threat, and gross inequalities are unlikely to be addressed. Yet there is hope and opportunity. Latin Americans’ previous high tolerance for corruption and impunity is declining. Civil society is demanding change, and some countries have embarked on reform, as in Brazil and Chile. After all, the governance strength of a country can be inferred not from the unrealistic absence of any corruption but from the resolve and quality of its institutional response. The change in public sentiment, coupled with lower commodity prices and the socioeconomic and fiscal strains brought about by slower growth throughout the region and in China, suggests that the time for governance reform is now. ■