Politics and Public Investment

Finance & Development, December 2015, Vol. 52, No. 4

Sanjeev Gupta, Estelle Xue Liu, and Carlos Mulas-Granados

Catering to voters as elections approach can upend intelligent decisions on infrastructure spending

Virtually all countries need additional infrastructure such as roads, bridges, airports, telecommunications networks, power plants, and public transportation. With interest rates low—and, as a result, cheap financing for government spending—many analysts and policy advisors advocate increasing public investment in infrastructure to promote growth, which would both lower the debt-to-GDP ratio and expand an economy’s long-term productive capacity (IMF, 2014).

However, even if shovel-ready projects have been identified and decision-making processes for public investment are working efficiently, investment still may not happen. Why?

Political considerations get in the way. When elections loom, policymakers choose to provide immediate benefits to the electorate through lower taxes or increased income transfers—at the expense of public investment, which takes time to come to fruition. Other factors can also play a role in discouraging needed investment. For example, the political orientation of parties that form a government may favor a lower level of public investment.

When there are no political or institutional constraints, public investment should be determined mainly by development needs—to meet the requirements of a growing population and to reduce infrastructure bottlenecks. Occasionally, public investment can be triggered by demand management considerations—for example, when an economy has spare capacity and policymakers believe investment would increase aggregate demand and raise employment in the short term. In reality, however, political considerations often strongly influence public investment decisions.

Bad incentives

William Nordhaus (1975) provided early modeling of how political cycles could affect economic decision making. He argued that incumbents have incentives to stimulate the economy before elections to achieve a temporary reduction in unemployment, an outcome preferred by voters, who in general have a short-term view. Research on the political economy of budget and fiscal policy has burgeoned. Four factors have been cited as possible ways political factors affect public investment:

- Politicians are opportunistic and, as a result, launch investment projects only at the beginning of the electoral term to be able to inaugurate them before the next election. As elections near, politicians choose to woo voters with public sector wage increases, tax cuts, and cash transfers, finding the wherewithal to do that by cutting back on investment.

- Fiscal outcomes reflect the ideology of different political parties. For instance, a preference of right-wing parties for limited provision of state-owned physical and human capital would imply lower public investment in infrastructure, health, and education. On the other hand, left-wing parties prefer a more activist state, implying higher public investment in these areas.

- Minority governments, a divided legislature, coalitions, and multiparty cabinets could result in fiscal profligacy and lower public investment. Large coalition and minority governments may have greater difficulty reaching agreement on balancing the budget. Government investment becomes easier to cut than some other types of spending.

- Inadequate budgetary institutions—the rules and regulations by which budgets are drafted, approved, and implemented—are unable to protect public investment during a crisis.

One or more of these four factors are likely to influence the behavior of public investment. We examined all of them to determine which factors dominate and under what circumstances (Gupta, Liu, and Mulas-Granados, 2015). We compiled a unique database from 80 democracies during 1975 to 2012, covering all regions and income levels. This database includes national executive and legislative elections and differs in important ways from those in previous studies: it goes beyond advanced democracies and includes a wide range of emerging market and low-income countries with free and competitive elections and uses more precise electoral cycle measures by identifying the exact day, month, and year in which citizens went to the polls. For example, if an election was held in November 2012, we measure months to the next elections from this date. Data on election dates by month and year are from the Database of Political Institutions published by the World Bank.

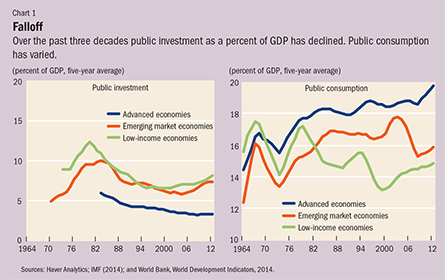

Our data show that public investment has declined over the past three decades across most economies (see Chart 1, left panel). In advanced economies, the ratio of public investment to GDP fell from about 5 percent in the mid-1980s to about 3 percent in 2014. In emerging market and low-income countries, the reduction was broadly similar, falling from close to 10 percent of GDP to about 7 to 8 percent of GDP during the same period. At the same time, public consumption increased moderately—especially in advanced economies, where it reached almost 20 percent of GDP, in part reflecting rising health care and pension costs and other transfers associated with an aging population (see Chart 1, right panel). These long-term driving factors are compatible with the evidence that in the short run, investment cycles are also affected by political considerations.

Election effects

Our analysis, which accounted for the effects of other relevant variables on investment, found that as elections approach there is a deceleration of public investment as a share of GDP, coupled with a slight acceleration in current expenditures (see Chart 2). For example, public investment grows at 2 percent of GDP in the two to three years prior to elections, but when elections are about 12 months away, its growth not only slows, it becomes negative. The opposite is observed with regard to public consumption. This pattern is consistent with work by various scholars (such as Rogoff, 1990) who have argued that electoral incentives may induce incumbents to shift public spending toward more “visible” government consumption and away from public investment.

Our quantitative analysis confirms that growth in public investment starts to decelerate about two years before elections. In fact, for each year closer to the next election the growth rate of public investment in relation to GDP declines by 0.3 to 0.6 percentage point. Between four and two years before elections, public investment accelerates. It seems that a typical government makes most public investment at the beginning of its term and gradually shifts spending toward other items as the next election approaches (see Chart 3, left panel).

These results hold whether a country is engaged in fiscal consolidation or fiscal expansion. But when considering different country groups, interesting nuances emerge with respect to how the strength of fiscal institutions may help soften the effects of elections on public investment cycles. For example, in advanced economies, which are older democracies and possess relatively stronger institutions to ensure efficient public investment planning, allocation, and execution, public investment growth peaks much later during the electoral cycle (see Chart 3, right panel), and the deceleration of public investment is smaller. This could be explained by three interrelated considerations: because public investment processes are more robust in advanced economies, the potential for manipulating them is limited compared with other country groups; in mature democracies policy-making processes are more transparent, and the electorate tends to punish incumbents for manipulating spending; and incumbent governments do not need to signal their competence by varying public investment spending because they have other means to do so, such as effective communication on fiscal policy, efficient tax policies, and project execution.

Sustained booms

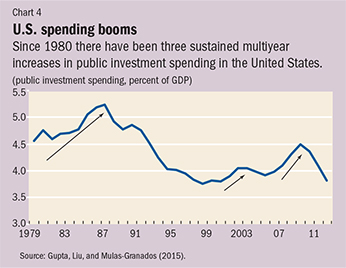

We have focused so far on short-term investment decisions. Are the same political factors behind multiyear episodes of sustained investment booms over a longer time horizon? Typically, multiyear investment spending is the result of long-term strategies to expand the productive capacity of economies: governments invest in public capital for several years—a highway project that takes several years to complete, for example. One would expect multiyear investment booms to be less affected by electoral considerations, because they last longer than the usual four to five years a government is in office. For example, between 1980 and 2012, the United States had three episodes of sustained increase in public investment (see Chart 4), with a combined duration of 18 years. The first period started at the end of Democrat Jimmy Carter’s administration in the late 1970s and continued for almost eight years through the presidency of Republican Ronald Reagan. The second coincided with the second term of Democrat Bill Clinton. The third episode began after the reelection of Republican President George W. Bush in 2004 and continued until 2009, a year into the first term of President Barack Obama, a Democrat.

To explore these long-term dynamics, we identify the change in public investment from the lowest level of the investment episode to the highest level of the episode. Between 1975 and 2012, we count 264 episodes of investment booms in the 80 democracies in our database. The average size of an investment boom is 3.8 percent of GDP, with the biggest increase being 26 percent of GDP in Lesotho between 1978 and 1982, and the smallest an increase of 0.3 percent of GDP in the United States between 1998 and 2003.

Our quantitative analysis confirms that in the long run, political characteristics such as cabinet fragmentation and ideology are more important than elections in explaining the size of sustained investment booms. More right-wing governments are associated with smaller increases in public investment, unless they are faced with a divided legislature and pro-investment parliamentary coalitions, as was sometimes the case in the United States during the Reagan and George W. Bush administrations. Fragmented governments are also associated with smaller sustained investment booms.

Policy implications

Three important policy implications can be drawn from our research. First, even when macroeconomic conditions in terms of fiscal space and monetary policy are appropriate and effective shovel-ready investment projects are available, it may not be possible to expand public investment when an election approaches. The incentive for incumbent governments is to increase “visible” current spending on tax cuts, public wages, or public transfer programs to shore up political support. Such spending may be difficult to reverse, which creates a bias toward ongoing deficits. It may also affect the long-term growth potential of the economy, because election pressures may generate suboptimal levels of public investment, thus reducing investment in such things as roads and airports and other areas that would enhance an economy’s ability to deliver goods and services. Second, when countries approach international organizations for advice or financial support, financial assistance programs should explicitly recognize the bias in favor of current spending that occurs about two years prior to elections. Stronger fiscal policy design during this period could help restrain permanent ratcheting up of certain spending items. Finally, the best option to insulate the public investment cycle from electoral pressures is to strengthen budget institutions and improve public investment management systems. ■

Sanjeev Gupta is Deputy Director and Estelle Xue Liu and Carlos Mulas-Granados are Economists, all in the IMF’s Fiscal Affairs Department.

References

Gupta, Sanjeev, Estelle Liu, and Carlos Mulas-Granados, 2015, Now or Later? The Political Economy of Public Investment in Democracies,” IMF Working Paper 15/175 (Washington: International Monetary Fund).

International Monetary Fund (IMF), 2014, “Is It Time for an Infrastructure Push? The Macroeconomic Effects of Public Investment,” Chapter 3 in World Economic Outlook: Legacies, Clouds, Uncertainties (Washington, October).

Nordhaus, William, 1975, “The Political Business Cycle,” Review of Economic Studies, Vol. 42, No. 2, pp. 169–90.

Rogoff, Kenneth, 1990, “Equilibrium Political Budget Cycles,” American Economic Review, Vol. 80, No. 1, pp. 21–36.