Guilt by Association

Finance & Development, June 2016, Vol. 53, No. 2

Atish Rex Ghosh and Mahvash Saeed Qureshi

Prejudices sway the debate on using capital controls to tame the risks of fickle inflows

“I have only eight seconds left to talk about capital controls. But that’s OK. I don’t need more time than that to tell you: they don’t work, I wouldn’t use them, I wouldn’t recommend

them . . . ”

—Governor Agustín Carstens, Bank of Mexico

(Remarks made at Rethinking Macro Policy III

Conference, Washington D.C., April 15, 2015)

Capital controls have a bad name. While their usefulness as a policy tool to manage the risks associated with capital inflows is increasingly acknowledged (IMF, 2012), as the quote above amply demonstrates, they are still viewed with considerable suspicion and misgiving.

An oft-heard argument against capital controls is that they can be evaded and circumvented. Yet no one makes that case when it comes to other policies—for example, that taxes should be abolished because they are subject to evasion. Likewise, even though macroprudential measures have been much in vogue since the global financial crisis, evidence of their effectiveness is no more compelling than it is for capital controls. Moreover, even when countries do impose controls on capital inflows, it is telling that they usually refer to them with euphemisms such as “prudential measures.”

Resentment toward outflow controls is understandable: residents may want to invest or safeguard their money abroad, and nonresidents want to be able to repatriate their funds on liquidation of their investments. More puzzling is the almost visceral opposition to emerging market economies’ use of controls to manage capital inflows—especially since such measures were integral to advanced economies’ management of speculative (“hot money”) flows when they pursued their own financial liberalization in the latter half of the 20th century.

So whence this bad name for inflow controls?

The story begins

Capital controls have a long history, with evidence of their use stretching back to ancient times. Even during the late 19th century—the so-called golden era of financial globalization—the leading capital exporters of the day (Britain, France, and Germany) at times restricted foreign lending, albeit mainly for political rather than for economic reasons. Boom-bust cycles in cross-border capital flows were already evident, but there were few restrictions on capital imports—and mostly for strategic purposes or out of concern about “foreign domination.” Much of the capital was long term, financing productive investments in infrastructure and utilities in the emerging market economies of the day.

Capital flows, especially from Europe, came to an abrupt halt during World War I, and the cessation of hostilities revealed deep differences among nations. At one extreme was the Soviet Union, which under an authoritarian and state socialist model had imposed tight controls on capital movement by 1919. At the other extreme were the private and central bankers of the leading economies of the day, seeking to reestablish the previous liberal—and for the great banking houses, highly profitable—international monetary order.

Wartime dislocation and deficit financing of reparations and reconstruction costs delayed the removal of restrictions in Europe, but starting with the 1924 Dawes Plan—under which American banks made loans to Germany to help that country pay for reparations—U.S. banks entered a period of massive international lending ($1 billion a year during 1924–29). Half of that was destined for Europe, partly intermediated by British banks, and it spurred a huge economic and financial boom.

But this resurrection of the liberal international order did not last long. When a speculative frenzy in the New York stock market drew capital to the United States, Europe suffered a sudden stop. In July 1931, unable to roll over maturing obligations, Germany declared a moratorium on foreign payments and imposed exchange restrictions, which triggered a run on the pound that forced Britain off the gold standard; numerous other countries followed suit.

What ensued was a decade of almost dizzying capital flight, devaluations, exchange restrictions, and capital controls (nearly all on outflows), protectionism, and imploding global trade—contributing to the global Great Depression. Notably, however, it was mostly the autocratic and authoritarian regimes in Europe—such as Austria, Bulgaria, Germany, Hungary, Portugal, and Romania—that imposed exchange restrictions and outflow controls (democracies preferred tariffs). In Germany, the July 1931 restrictions were extended and broadened by the Nazis, under whom violations were potentially punishable by death; exchange controls thus became thoroughly associated with the excesses of that regime.

By 1935, as the U.S. economy began to emerge from the Great Depression, and against a backdrop of worrisome political developments in Europe, capital began surging to the United States. The resulting speculative boom and swelling of U.S. banks’ excess reserves (which threatened to precipitate an inflationary spiral) prompted Federal Reserve Chairman Marriner Eccles to argue that there was “a clear case for adopting measures to deter the growth of foreign capital in our markets.”

Yet the United States did not impose inflow controls. Extrapolating from the experience of European countries trying to prevent capital outflows, American officials concluded that to be effective, restrictions had to be broad-based, covering both capital and current account (that is, trade-related) transactions. Perhaps more important, the capital outflow restrictions imposed by undemocratic, dictatorial regimes engendered a general distrust and distaste for such measures. Henry Morgenthau, Jr., the U.S. secretary of the treasury, summed up the prevailing attitude when he wrote, “Frankly, I disapprove of exchange control.”

Bretton Woods and beyond

The lesson that the main architects of Bretton Woods—John Maynard Keynes and Harry Dexter White—took from the interwar experience was that a regime of unfettered capital flows was fundamentally inconsistent with the macroeconomic management increasingly expected of governments, and with a liberal international trade regime. (Capital outflows required governments to impose import restrictions to safeguard the balance of payments and gold reserves. On the inflow side, hot money flows could lead to speculative excess—in turn requiring monetary tightening that could damage the real economy.) Given the choice, Keynes and White preferred free trade to free capital flows—especially to short-term, speculative flows and flight capital. Hence the emphasis in the IMF’s founding charter (the Articles of Agreement) is on current, rather than capital account, convertibility and on the explicit recognition that countries may need to impose capital controls.

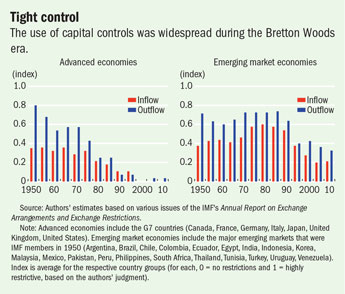

Despite opposition by powerful New York banking interests, which succeeded in watering down key provisions in the IMF’s Articles regarding capital controls (Helleiner, 1994), the Bretton Woods era was characterized by widespread use of controls (see chart). As in the interwar period, these were controls mainly on outflows rather than inflows; unlike during that period, however, they were typically not exchange restrictions but specifically capital controls.

Although advanced economies were generally more restrictive than emerging markets in the early Bretton Woods years, by the 1960s, they were liberalizing—partly because the rising trade integration made it difficult to restrict capital transactions without also affecting current transactions. This trend was occasionally interrupted as countries such as Britain and France faced balance of payments pressures or crises. Even the United States imposed outflow restrictions in 1963 and broadened coverage through the decade as its balance of payments worsened.

On the other end, countries that received increasingly large capital flows on speculation that the dollar might be devalued imposed restrictions on short-term inflows. For example, Australia embargoed short-term borrowing and imposed deposit requirements on other borrowing; Japan tightened controls on portfolio inflows and imposed marginal reserve requirements on nonresident deposits; Germany imposed a cash deposit requirement on foreign loans and suspended interest payments on nonresident deposits; and Swiss banks agreed not to pay interest on foreign deposits or invest foreign capital in domestic securities and properties.

By 1974, with the dollar floating, the United States abandoned its outflow controls. Confident that the United States would always be able to attract investors—and that capital flows would force surplus countries to adjust by appreciating their currencies—U.S. policymakers unreservedly embraced a liberal international regime for private capital flows. Reversing the thinking of Keynes and White at Bretton Woods, they also sought to put trade in financial assets on the same footing as trade in goods and services, inserting the phrase “the essential purpose of the international monetary system is to provide a framework that facilitates the exchange of goods, services, and capital among countries” when the IMF’s Articles were amended in 1978 to legitimize floating exchange rates.

Financial openness in the Anglo-Saxon countries received a further boost in the early 1980s from the free market doctrine of U.S. President Ronald Reagan and U.K. Prime Minister Margaret Thatcher. In continental Europe, a major turning point came with French President François Mitterrand’s 1983 anti-inflationary policies and the realization that controls on capital outflows disproportionately penalized middle-class investors less able than the rich to evade them (Abdelal, 2006). Most French outflow controls were thus lifted during 1984–86, with full capital account liberalization by 1990.

This shift in attitude had major repercussions beyond France as three officials from the same Socialist administration went on to key positions in international institutions where they promoted capital account liberalization: Henri Chavranski, at the Organisation for Economic Co-operation and Development, where he broadened the Code of Liberalization to cover all cross-border capital movement, including short-term flows that had originally been excluded; Jacques Delors, at the European Commission, where he championed the Directive abolishing restrictions on capital movement; and Michel Camdessus, at the IMF, where he sought an amendment of the Articles to give the IMF jurisdiction over the capital account and the mandate to liberalize it.

Emerging consensus

As advanced economies began to liberalize during the 1960s and 1970s, the trend in emerging market and developing economies was the opposite—mainly restricting capital outflows to help keep down domestic sovereign borrowing costs. Even some measures that could be classified as inflow controls because they were likely to discourage inward investment (such as minimum investment periods or limits on the pace or amount of repatriation) were intended to prevent a sudden reversal of capital inflows and balance of payments deficits. By the early 1970s, however, inflow restrictions of a “prudential” nature began to appear. These more explicitly aimed to safeguard economic and financial stability from excessive foreign borrowing and inflow-fueled credit booms.

Liberalization in emerging markets started about a decade later than in advanced economies, under a broader predisposition toward free markets and a desire to subject government policies to the discipline of the market (the so-called Washington Consensus). But as some emerging market economies liberalized their domestic financial markets and outflow controls in the late 1970s and early 1980s, they also swept away many of the existing prudential inflow measures. The result was massive inflow-fueled booms, followed by severe economic and financial busts.

This experience helped shape policy responses when inflows to emerging markets resumed in the early 1990s, and led to a marked shift in the preference for longer-term, nondebt flows. Several countries—notably Brazil, Chile, Colombia, Malaysia, and Thailand—experimented with inflow controls in the 1990s. Yet such measures were not viewed favorably, and the general trend during much of the 1990s was toward greater capital account openness, culminating in IMF Managing Director Camdessus’s 1995–97 initiative to give the IMF jurisdiction over, and the mandate to liberalize, the capital account.

In the end, the amendment never passed, partly because of opposition from emerging market and developing economies alarmed by the unfolding east Asian crisis and concerned that the IMF would use its new mandate to force premature liberalization on reluctant countries. Regardless, the IMF’s policy advice—in contrast to the vision of Keynes and White—had moved away from viewing capital controls as an essential tool to manage destabilizing speculative flows. An IMF Independent Evaluation Office review in 2005 found that the IMF staff had recommended tightening inflow controls in just 2 of 19 instances when emerging market economies experienced large capital inflows.

Despite the general disapproval, several emerging market economies restricted inflows during the mid-2000s surge. In some cases, the attempts backfired. In Thailand, for example, market reaction to the imposition of an unremunerated reserve requirement on foreign inflows in December 2006 was swift and brutal: the stock market plunged 15 percent in less than a day, forcing the central bank to reverse the measure. The perception was that the measure had evoked memories of the currency crisis and imposition of outflow controls during the east Asian crisis about a decade earlier. Financial markets thus sent a clear signal that they did not approve of capital controls—on outflows or inflows—making little distinction between the two.

Pure prejudice?

So why do controls on capital inflows evoke such apprehension today? The historical record offers certain clues. First, dating at least to the interwar period, when the United States resisted imposing inflow controls, it appears that controls on capital inflows became inextricably linked with outflow controls. The latter were often associated with autocratic regimes, financial repression, and desperate measures to avoid crises in mismanaged economies. Thus, more liberal economies shunned the use of inflow controls as a short-term policy tool out of fear of being viewed as market unfriendly and institutionally weak.

That inflow controls are damned by guilt by association with outflow controls is also evident in most of the other criticism levied against them, which is more pertinent to outflow controls. For instance, the fear that measures, once imposed, will persist and become pervasive is generally true for outflow controls. Governments often resort to heavy-handed, broad-based measures to prevent capital flight, and these are difficult to remove because of pent-up demand. Inflow restrictions, by contrast, are typically taxes or higher reserve requirements, which are easy to reverse and generally are removed when the tide turns.

Capital controls are also often criticized for being ineffective—but again that applies more to outflow controls, which have at best a weak track record when it comes to preventing a crisis (Edwards, 1999). There is, however, ample evidence that inflow controls shift the composition of capital flows toward less risky and longer-maturity liabilities (Ostry, Ghosh, and Qureshi, 2015), which strengthens the case for their use as prudential instruments.

A second plausible reason is that capital account restrictions are often associated with current account restrictions. This is because, historically, the most common form of capital controls was exchange restrictions that impeded the movement of both goods and capital. As countries embraced greater trade liberalization, in contrast to the Keynes-White thesis, they started to view capital controls as incompatible with free trade rather than as aiding free trade. Capital account restrictions were thus abolished along with current account restrictions. This trend was further accentuated by the rise of regional trade agreements and bilateral investment treaties (especially those with the United States) that increasingly incorporated clauses prohibiting the adoption of capital controls.

Finally, with the rise of free market ideology, which considers all government intervention inherently bad, capital controls—traditionally viewed as instruments to fine-tune the economy—became discredited more generally. Emerging market economies did not become entirely oblivious to the vagaries of capital flows, but they attempted to rely on more benign-sounding—also viewed as more market-friendly—“macroprudential measures” to tackle the risks to financial stability posed by capital inflows. Yet the effect on capital flows of some of these measures, especially those related to foreign currency transactions, is economically largely indistinguishable from that of more direct capital controls. If the intent is indeed to limit inflows for prudential reasons, then calling such measures macroprudential is merely a rebranding of capital controls, confirming that the negative connotation associated with the word “controls” is the real problem.

Like any other policy instrument, capital controls on inflows have pros and cons—yet, in our view, they seem to be judged not so much on their merits as by pure prejudice that is rooted in history: damned largely because of their association with outflow controls but also because of ideological battles that have little to do with their specific use. Correcting unfounded perceptions is important to ensure that policymakers respond optimally to manage the risks associated with fickle capital flows and do not shy away from using measures simply because of the connotations of their name. ■

Atish Rex Ghosh is IMF Historian and a Deputy Director in the IMF’s Strategy, Policy, and Review Department, and Mahvash Saeed Qureshi is a Senior Economist in the IMF’s Research Department.

This article is based on the authors’ IMF Working Paper, No. 16/25, “What’s in a Name? That Which We Call Capital Controls.”

References

Abdelal, Rawi, 2006, “Writing the Rules of Global Finance: France, Europe, and Capital Liberalization,” Review of International Political Economy, Vol. 13, No. 1, pp. 1–27.

Edwards, Sebastian, 1999, “How Effective Are Capital Controls?” Journal of Economic Perspectives, Vol. 13, No. 4, pp. 65–84.

Helleiner, Eric, 1994, States and the Re-emergence of International Finance: From Bretton Woods to the 1990s (Ithaca, New York: Cornell University Press).

International Monetary Fund (IMF), 2012, “The Liberalization and Management of Capital Flows: An Institutional View,” IMF Policy Paper (Washington).

Ostry, Jonathan, Atish Ghosh, and Mahvash Qureshi, 2015, Capital Controls (London: Edward Elgar).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.