A Broader Reach

Finance & Development, March 2017, Vol. 54, No. 1

Adolfo Barajas, Martin Čihák, and Ratna Sahay

When more people and more firms have access to financial services, the whole society can benefit

Many households and small-scale entrepreneurs—mainly in developing and emerging market economies—find that lack of access to financial services prevents them from saving for a rainy day, borrowing funds to expand their businesses, or purchasing a house, a refrigerator, or other consumer durable goods. Their financial transactions, whether for personal or business purposes, can be costly and sometimes dangerous, because they almost always involve cash. With limited ability to save or to buy insurance, their financial condition is vulnerable to an extended illness or a natural disaster.

The lives of a vast number of people, including many poor in advanced economies, might be improved if they had access to and used a secure and affordable formal financial system and did not, for example, have to rely on extended family for emergency funds. Similarly, their savings would increase if they could deposit any funds they can accumulate in an interest-earning bank account rather than having to hide the money in their homes and if they learned how to assess and buy the products and services that banks, insurance companies, and even securities firms offer.

In other words, people who have limited or no access to financial services could be better off if they did. So might society. The benefits of financial services could lift many people out of poverty, reduce inequality, and encourage entrepreneurship and investment. Furthermore, if it makes credit available to previously excluded individuals with entrepreneurial talent, broader access to financial services might help productivity and economic growth. Promoting financial inclusion, as the process of broadening access to and use of financial services is called, has become a mantra of many central banks and finance ministries, particularly in developing economies and emerging markets. In almost 60 countries, there are national strategies and even explicit quantitative targets for financial inclusion.

Several aspects

The notion of financial inclusion has several dimensions, but key is access to financial services such as banking and insurance at an affordable cost—particularly for the poorest—and effective and responsible use of these services.

Researchers and policymakers rely mainly on indicators from three global sources to gauge the spread of financial services and its effect on people, firms, and the economy:

- The IMF’s Financial Access Survey, based on data collected annually since 2004 by central banks from providers of financial services in 189 countries: The survey shows a great expansion in financial inclusion over the past decade. Worldwide, the number of bank accounts per 1,000 adults increased from 180 to 654 between 2004 and 2014, while the number of bank branches per 100,000 adults increased from 11 to 16. There are considerable differences across countries and regions. For example, in 2014, there were 1,081 accounts per 1,000 adults in high-income countries, compared with 88 in low-income countries. Among developing economies and emerging markets, bank branches per 100,000 adults ranged from 978 in Europe and central Asia to 158 in sub-Saharan Africa.

- The World Bank’s triennial Global Findex, constructed from a worldwide survey of individuals’ access to and use of financial services: It started in 2011, and despite only two surveys so far, its more than 100 indicators—which differentiate by age, gender, and income level—provide rich detail. The Global Findex estimates that in 2014, 2 billion adults, or almost 40 percent of the worldwide adult population, were unbanked, that is, had no account with a formal financial institution. The level varies from less than 10 percent in high-income countries to 86 percent in low-income countries. The survey also shows opportunities for increasing the use of financial services by those who bank with an institution. Only three-quarters of account holders use their account to save, to make at least three withdrawals a month, or to make or receive electronic payments. The survey also shows that despite an increase in access to and usage of formal financial services by women, about 7 percent fewer women than men are financially included.

- The World Bank Enterprise Survey, which has irregularly collected data on firms’ usage of financial services since 2002: In 2014, 36 percent of firms worldwide said lack of access to finance was a substantial impediment to their expansion, compared with 3 percent in high-income countries and 42 percent in low-income countries. Among developing economies and emerging markets, 21 percent of firms in east Asia and the Pacific said they felt constrained, and 37 percent did in sub-Saharan Africa.

Effects of inclusion

It has been clear for a while that financial inclusion is good for individuals and firms—what economists call the micro level:

- Poor people benefit from basic payment services, such as checking and savings accounts, as well as from insurance services. Field experiments show that providing individuals with access to savings accounts increases savings, income, consumption, productivity, women’s empowerment, business investment, and investment in preventive health care.

- Improved access to credit and other types of funding also helps firms, especially small and new ones, which often face difficulties in obtaining bank credit, because they lack an established reputation, track record, or collateral. Their access to credit is associated with innovation, job creation, and economic growth. But one form of lending that has gained much attention, so-called micro-credit, has had mixed success.

New data sources now make it possible to demonstrate that financial inclusion affects the overall economy—the so-called macro level. Financial inclusion was not on most macroeconomists’ radar until the early 2000s, when the problems that originated in large part in the United States due to growth in subprime mortgages (made mostly to poorer people and those with bad credit ratings who had largely been excluded) morphed into the global financial meltdown of 2008.

Sahay and others (2015), using data on access to and use of financial services in more than 100 countries, provided some evidence on macroeconomic effects of financial inclusion:

- Increased access to financial services by firms and individuals substantially benefits economic growth. A country with the median level of financial depth—the total amount of funds mobilized by financial institutions—can increase its annual long-term GDP growth by 3 to 5 percentage points by boosting people’s access to ATMs or firms’ access to credit. Moreover, sectors that rely heavily on external sources to finance investment grow more rapidly in countries with greater financial inclusion. However, the marginal benefits for growth wane as inclusion and financial depth increase. At very high levels, financial inclusion can hurt growth by encouraging such behavior as irresponsible lending by financial institutions that make loans without duly considering risks.

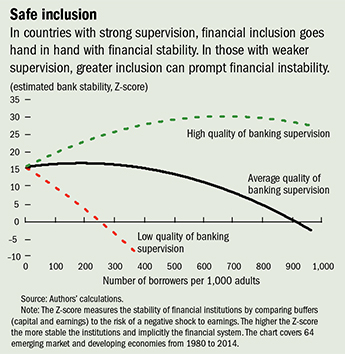

- But risks to financial stability, which can set back a country’s economic growth by several years, increase when access to credit is expanded without proper supervision. In countries with weaker supervision, there is a stark trade-off between inclusion and stability: the buffers (capital) banks should hold to guard against adverse shocks are allowed to erode, mainly because of a failure to take proper account of a rapid increase in loans that are not being paid on time. But in countries with strong supervision, financial inclusion goes hand in hand with financial stability; greater access to credit is accompanied by an increase in banks’ loss absorption buffers (see chart). Moreover, efforts to improve loan repayment can also conflict with inclusion. For example, introducing limits on the fraction of their income borrowers may pay in order to reduce the risk to financial and economic stability from housing booms and busts—as Australia, Hong Kong SAR, and the United Kingdom have done—will also limit access to credit.

- Increasing access to noncredit financial services such as payment and savings accounts—for example via ATMs, bank branches, and smartphones—does not hurt financial stability. Nor does increased access to insurance services, although there has been limited research on insurance.

- Increasing the share of women who have accounts helps raise growth without impairing financial stability, in part by enhancing diversity in the depositor base.

Raising financial literacy

Recent research shows that the financial literacy of individuals and businesses is a key element of successful financial inclusion. In advanced economies, where much of the population has access to financial services, the focus should be on educating potential customers to make sound financial decisions; in developing economies and emerging markets, the goal of increasing financial literacy should be to increase awareness of and the ability to use available services.

A more financially literate populace should enhance overall economic and financial stability. In the Netherlands, for example, a comprehensive nationwide financial literacy program that involves the government, the private sector, consumer groups, and educational institutions has undertaken projects to teach primary school children how to deal with money and to raise pension awareness among the elderly. In Pakistan, a program supported by the central bank and the private sector informs the public about basic financial concepts such as budgeting, savings, investments, debt management, financial products, and branchless banking. School-based projects in India and Brazil use family and social networks to spread the literacy effort beyond students.

Generally, financial inclusion increases with financial depth. For example, there is a positive relationship between a proxy for financial depth—the volume of credit—and a measure of financial inclusion, the percentage of firms with loans. (Of course, unlimited access to credit is not desirable, but the percentage of firms with loans illustrates the overall positive relationship between inclusion and financial depth.) The link to financial depth, however, is only part of the story. Countries with similar financial depth can have very different levels of inclusion. For example, in Mongolia, Nepal, Slovenia, and Ukraine private sector credit is about 60 percent of GDP. Yet the share of firms with loans is different—about 65 percent in Slovenia, 50 percent in Mongolia, 35 percent in Nepal, and 18 percent in Ukraine.

This suggests that other factors are also at play. For example, Love and Martínez Pería (2012) found that greater competition in the banking sector boosts access to credit—which could help explain why Slovenia has higher credit access than Mongolia (whose level of bank competition is less than half that of Slovenia). But competition cannot explain the large differences between Slovenia and Nepal or Ukraine. Love and Martínez Pería also found that the quality and availability of financial information on potential borrowers are factors. Among these four countries, Slovenia has the highest level of credit information, with a credit bureau that covers the country’s entire adult population.

Other research shows that establishing registries of movable collateral, such as vehicles—often the only types of assets owned by many potential borrowers in developing economies—helps expand firms’ access to finance.

The spread of technology can also enhance inclusion. One avenue is mobile banking, in which mobile phones provide the only contact between the customer and a financial institution. Only 2 percent of the world’s adults use mobile banking, but use is expanding rapidly in sub-Saharan Africa. About 20 percent of adults in Kenya, Tanzania, and Uganda get financial services through mobile phones. Peruvian policymakers are exploring how to increase inclusion using mobile payment platforms. Mobile accounts are still used mostly for transactions; whether they can foster saving, borrowing, and insurance is unclear.

As a broad principle, inclusion efforts are best aimed at addressing the underlying market and government failures that keep people out of the financial system. For example, when red tape makes opening accounts too costly, policymakers can take steps to make account opening simpler. Because overall financial stability can be undermined by a general increase in bank credit or by setting up goals for rapid credit growth, policymakers should consider other policies aimed at helping the poor, such as direct and targeted transfers to people in need. Policies that make financial inclusion economically viable for banks and other institutions—rather than schemes that direct lending to certain sectors—are more likely to achieve macroeconomic goals. ■

Adolfo Barajas is a Senior Economist in the IMF’s Institute for Capacity Development. Martin Čihák is an Advisor and Ratna Sahay is Deputy Director, both in the IMF’s Monetary and Capital Markets Department.

References

Love, Inessa, and María Soledad Martínez Pería. 2012. “How Bank Competition Affects Firms’ Access to Finance.” Policy Research Working Paper 6163, World Bank, Washington, DC.

Sahay, Ratna, and others. 2015. “Financial Inclusion: Can It Meet Multiple Macroeconomic Goals?” IMF Staff Discussion Note 15/17, International Monetary Fund, Washington, DC.