In Equality, We Trust

Finance & Development, March 2017, Vol. 54, No. 1

Eric D. Gould and Alexander Hijzen

Inequality in the United States and Europe erodes trust among people—and can stifle economic growth

“Trust me”—it’s a common phrase that often arouses suspicion. Trust is a commodity that’s in short supply lately, in the United States and around the world, with potentially serious implications. Take the example of the three-card monte or shell game played on streets around the world. Most people are reluctant to take part because they don’t trust the fairness of the game or the person playing it. Similarly, when conventional economic and political activities are perceived as unfair or their actors as untrustworthy, people want extra reassurance before they participate. Rising economic inequality is one reason people may be less likely to perceive economic and political activity as fair.

Our research examines whether the downward trend in trust and social capital is a response to increased income inequality.

Social glue

Trust is a key component of the social capital that “enables participants to act together more effectively to pursue shared objectives” (Putnam 1995). In survey data, trust is measured by so-called generalized trust—how much a person trusts unspecified people rather than friends or family. Typically, this is gauged by a question such as “Generally speaking, would you say that most people can be trusted or that you can’t be too careful when dealing with others?”

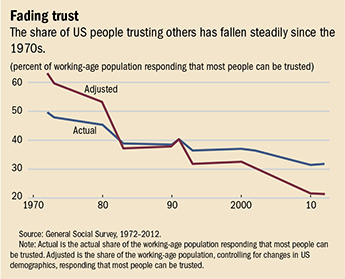

During the past 40 years, generalized trust in the United States has declined markedly. Since the early 1970s, the share of those who respond that most people can be trusted has declined from about 50 percent to 33 percent (see chart). Changes in the composition of the US population, moreover, tend to mask the true extent of the decline. When controlling for changes in US demographics, the decline in generalized trust is even more pronounced, mainly because the population has become more educated, and more educated people tend to trust more. Trust in government shows a similar downward trend. These trends may threaten the effectiveness of public policy and reduce popular support for mainstream political parties.

Evidence on trends in social capital in other advanced economies is limited and does not reveal consistent patterns. But recent anecdotal evidence and electoral results suggest that discontent is brewing in many European countries. Whether this translates into less trust and lower social capital is open to question but often assumed to be true.

Fair play

At the same time, economic inequality has increased in the United States and in many advanced economies. Rising economic inequality is typically regarded as an important reason for the decline in trust and may render economic outcomes less fair or drive a wedge between socioeconomic groups.

If economic disparity stems from family background, personal connections, or mere luck rather than individual merit, it may seem particularly unfair and, therefore, undermine trust in others and in government. When this is the case, disparity is highly persistent and social mobility limited, resulting in high inequality of opportunity (Putnam 2015).

Economic outcomes also determine socioeconomic status. If socioeconomic status is associated with shared values that foster trust, a large income gap will erode a general sense of trust when people’s values clash—in other words, “familiarity breeds trust” (Coleman 1990). According to this argument, unequal outcomes indicate the degree of social stratification in society.

Indeed, many studies have noted a strong correlation between generalized trust and economic inequality. For example, data from the General Social Survey for the United States show that trust is lower in states where inequality is high (for example, Alesina and La Ferrera 2002; Rothstein and Uslaner 2005). The World Values Survey shows that trust is higher in more equal societies (for example, Zak and Knack 2001). These correlations do not necessarily mean that differences in trust between regions or countries are caused by differences in inequality. Both trust and inequality may be the result of some third factor. However, establishing causality is crucial because of the widely different policy implications. If the relationship is causal, government measures that seek to reduce economic inequality—such as raising the minimum wage, making taxation more progressive, or strengthening public income support for the poor—could be the solution. But if the correlation between inequality and trust is driven by a third factor, such measures may not do much to restore trust. Systematic evidence on the causal relationship between inequality and trust at this point is rather limited.

Our research examines whether the downward trend in trust and social capital is a response to the increasing gaps in income. The analysis uses data from the American National Election Survey for the United States and the European Social Survey for Europe. Our analysis for the United States exploits the variation across states and over time (1980–2010), while that for Europe utilizes the variation across European countries and over time (2002–12).

The results show clear evidence that in the United States wide-ranging inequality substantially lowers people’s trust in each other. The results for the United States indicate that the increase in inequality explains 44 percent of the observed decline in trust. Findings were qualitatively similar for “trust in government.” However, the findings also reveal that different sources of inequality account for significant differences in inequality’s impact on trust and social capital.

Inequality within socioeconomic groups as defined by education, age, and economic activity weakens trust and social capital, but inequality between education groups does not. When people see a rising income gap among people like themselves in terms of age, education, and type of work, trust declines. But if the gap involves people who made different educational and career choices trust is not affected. One explanation is that inequality that stems from differences in human capital decisions and investments is easier to understand and seems fair. However, if luck or unexplained factors drive incomes apart, people lose faith in other people and in government.

Moreover, the impact of inequality on trust and social capital in the United States is driven largely by rising wage differences at the bottom of the earnings distribution. However, inequality does not appear to foster a greater demand for redistribution. So policies that seek to restore trust by reducing market wage dispersion before taking into account taxes and benefits—regarding the minimum wage or collective bargaining, for example—appear more promising than redistribution in the form of more progressive income tax or increased social spending. In other words, a quality job with dignity and a decent salary means more than just a good income.

We found similar results for European countries, suggesting that inequality’s damage to trust extends beyond the United States to advanced economies with different institutional settings. However, in contrast to the United States, the impact of inequality on trust in Europe is more general. Inequality both at the top and at the bottom of the distribution are found to eat away at trust and social capital. But in contrast to the United States, inequality in Europe does seem to increase the demand for more redistributive policies in the form of more progressive taxation policies or stronger social protection.

Who cares?

The decline in trust and social capital is troubling not only because of its effects on social cohesion; it may also have economic implications. A substantial body of literature in cultural economics shows that trust is a key ingredient for good economic performance.

This literature highlights two key ways trust influences the economy. First, it smooths the way for economic interaction in the private sphere by replacing transaction costs, such as legal and insurance fees, with less expensive, informal ways of forming and maintaining agreements. In addition, greater trust can mean fewer problems and costs when it comes to monitoring employees and determining appropriate rewards.

Second, trust can promote cooperation in the public sphere by reducing collective-action problems related to the provision of public goods and by enhancing the overall quality of public institutions. Governments may not be able to solve pressing socioeconomic challenges in a society that is distrustful, intolerant, and divided—especially when it comes to constitutional reforms and international treaties, which often require healthy popular support. Distrust also reduces the credibility of public policy, which undermines its ability to effectively change economic incentives and shape the economic behavior of citizens and business. In this case, distrust prevents policies from being effectively implemented.

There is also growing empirical evidence that trust promotes economic growth generally, via specific drivers such as international trade, financial development, innovation, entrepreneurship, and firm productivity. For example, a lack of trust in the financial system may prevent people from investing in the stock market. Similarly, wary companies may shy away from outsourcing or offshoring and thereby miss out on potentially profitable opportunities.

Given rising inequality in many advanced economies and the role of trust in economic performance, our results suggest that this growing disparity could be affecting growth and development in an important, albeit indirect, way. This study, therefore, complements other recent empirical work showing that inequality reduces growth (Dabla-Norris and others 2015; Cingano 2014; Ostry, Berg, and Tsangarides 2014) by providing evidence of a particular channel for some of the ill effects of inequality on growth.

The rise in economic inequality in the United States and in other advanced economies may have shattered hope in economic processes, societal dynamics, and political practices that deliver fair outcomes. Lower economic participation, social polarization, and withdrawal from mainstream politics may be the fallout. ■

Eric D. Gould is a Professor of Economics at Hebrew University and a Research Fellow at the Centre for Economic Policy Research, and Alexander Hijzen is a Senior Economist at the Organisation for Economic Co-operation and Development.

This article is based on the authors’ 2016 IMF Working Paper, No. 16/176, “Growing Apart, Losing Trust? The Impact of Inequality on Social Capital.” It does not necessarily reflect the views of the OECD or its member states.

References

Alesina A., and E. La Ferrara. 2002. “Who Trusts Others?” Journal of Public Economics 85: 207–34.

Cingano, Federico. 2014. “Trends in Income Inequality and Its Impact on Economic Growth.” OECD Social, Employment and Migration Working Paper 163, Organisation for Economic Co-operation and Development, Paris.

Coleman, James S. 1990. Foundations of Social Theory. Cambridge, MA: Harvard University Press.

Dabla-Norris, Era, Kalpana Kochhar, Nujin Suphaphiphat, Frantisek Ricka, and Evridiki Tsounta. 2015. “Causes and Consequences of Income Inequality: A Global Perspective.” IMF Staff Discussion Note 15/13, International Monetary Fund, Washington, DC.

Ostry, Jonathan D., Andrew Berg, and Charalambos G. Tsangarides. 2014. “Redistribution, Inequality, and Growth.” IMF Staff Discussion Note 14/02, International Monetary Fund, Washington, DC.

Putnam, R. D. 1995. “Tuning In, Tuning Out: The Strange Disappearance of Social Capital in America.” Political Science and Politics 28 (4): 664–65.

———. 2015. Our Kids: The American Dream in Crisis. New York: Simon & Schuster.

Rothstein, B., and E. M. Uslaner. 2005. “All for All: Equality, Corruption, and Social Trust.” World Politics 58: 41–72.

Zak, P. J., and S. Knack. 2001. “Trust and Growth.” Economic Journal 111 (470): 291–321.