World Economic Outlook

Rapidly Weakening Prospects Call for New Policy Stimulus

November 2008

[$token_name="PublicationDisclaimer"]

Prospects for global growth have deteriorated over the past month, as financial sector deleveraging has continued and producer and consumer confidence have fallen. Accordingly, world output is projected to expand by 2.2 percent in 2009, down by some ¾ percentage point of GDP relative to the projections in the October WEO. In advanced economies, output is forecast to contract on a full-year basis in 2009, the first such fall in the post-war period. In emerging economies, growth is projected to slow appreciably but still reach 5 percent in 2009. However, these forecasts are based on current policies. Global action to support financial markets and provide further fiscal stimulus and monetary easing can help limit the decline in world growth.

Global activity is slowing quickly

World growth is projected to slow from 5 percent in 2007 to 3¾ percent in 2008 and to just over 2 percent in 2009, with the downturn led by advanced economies (Table 1).

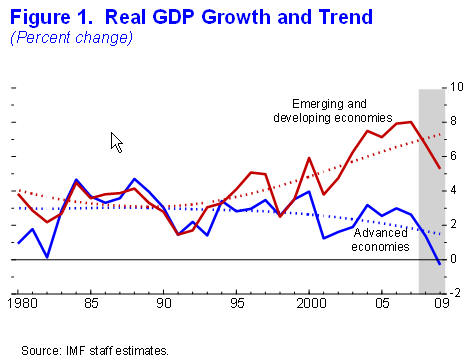

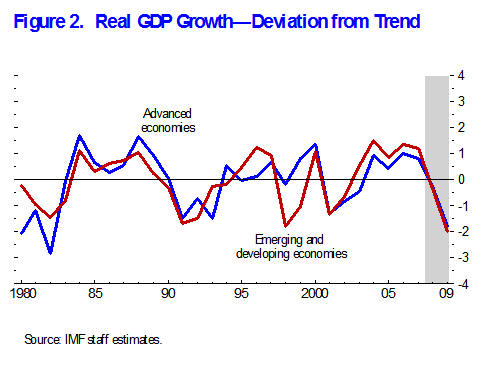

• Activity in the advanced economies is now expected to contract by ¼ percent on an annual basis in 2009, down ¾ percentage points from the October 2008 WEO projections. This would be the first annual contraction during the postwar period, although the downturn is broadly comparable in magnitude to those that occurred in 1975 and 1982 (Figures 1-2, view: Data Figure 1, Data Figure 2). A recovery is projected to begin late in 2009.

The U.S. economy will suffer, as households respond to depreciating real and financial assets and tightening financial conditions. Growth in the euro area will be hard hit by tightening financial conditions and falling confidence. In Japan, the support to growth from net exports is expected to decline.

• The downward revisions to 2009 real GDP growth projections are somewhat larger in emerging and developing economies, averaging 1 percent. This would leave their growth rate at 5 percent, higher than in earlier business cycle troughs (for example, 1990, 1998, and 2001). However, the cyclical downturn in emerging economies is of a similar magnitude to that in the advanced economies when measured relative to higher trend growth rates, in line with past cycles. Downward revisions vary considerably across regions. Among the most affected are commodity exporters, given that commodity price projections have been marked down sharply, and countries with acute external financing and liquidity problems. Countries in East Asia-including China-generally have suffered smaller markdowns, because their financial situations are typically more robust, they have benefited from improved terms of trade from falling commodity prices, and they have already initiated a shift toward macroeconomic policy easing.

Weakening prospects are depressing commodities prices

Weakening global demand is depressing commodity prices. Oil prices have declined by over 50 percent since their peak, retreating to levels not seen since early 2007-reflecting the major global downturn, the strengthening of the U.S. dollar, and the financial crisis-despite the decision by the Organization of Petroleum Exporting Countries to reduce production. In line with market developments, the IMF's baseline petroleum price projection for 2009 has been revised down relative to the October WEO, from $100 to $68 a barrel. Similarly, metals and food prices have fallen from their recent peaks. While this eases the burden on households in advanced economies and emerging economies in Europe and Asia, it lowers growth prospects in many other emerging economies.

The combination of stabilizing commodity prices and increasing economic slack will help to contain inflation pressures. In the advanced economies, headline inflation should decline to below 1½ percent by the end of 2009. In emerging economies, inflation is also expected to moderate, albeit more gradually. However, in a number of these countries, inflation risks are still manifest, as higher commodity prices and continued pressure on local supply conditions have affected wage demands and inflation expectations.

The financial crisis remains virulent

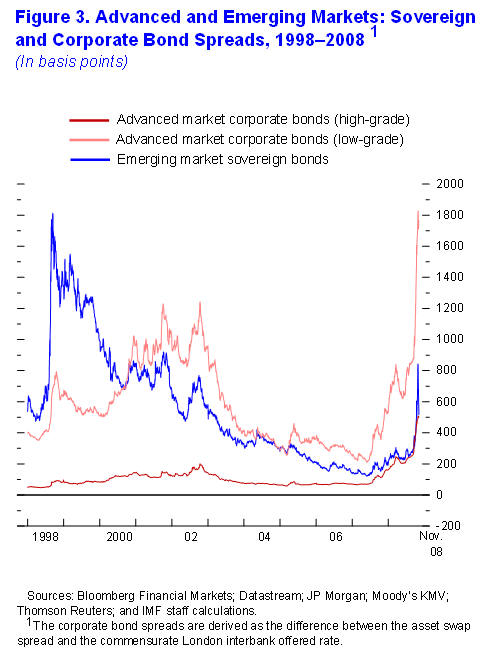

Markets have entered a vicious cycle of asset deleveraging, price declines, and investor redemptions (Figure 3, view: Data Figure 3). Credit spreads spiked to distressed levels, and major equity indices dropped by about 25 percent in October. Emerging markets came under even more severe pressure. Since the beginning of October, spreads on sovereign debt doubled, returning to 2002 levels, with more than a third of the countries in the benchmark EMBIG index trading at spreads above 1,000 basis points. Emerging equity markets lost about a third of their value in local currency terms and more than 40 percent of their value in U.S. dollar terms, owing to widespread currency depreciations.

Comprehensive policy actions are being implemented to address the root causes of financial stress and to support demand, but it will take time to reap their full benefits. The initiatives include programs to purchase distressed assets, use of public funds to recapitalize banks and provide comprehensive guarantees, and a coordinated reduction in policy rates by major central banks.

Market conditions are starting to respond to these policy actions, but even with their rapid implementation, financial stress is likely to be deeper and more protracted than envisaged in the October 2008 WEO. In the face of worsening financial and economic conditions, markets are pricing in expectations of much higher corporate default rates, as well as higher losses on securities and loans, in part, because pressures have now broadened to emerging markets, raising recapitalization needs. Thus, financial conditions are likely to remain tight for a longer period and to be more impervious to policy measures than previously expected.

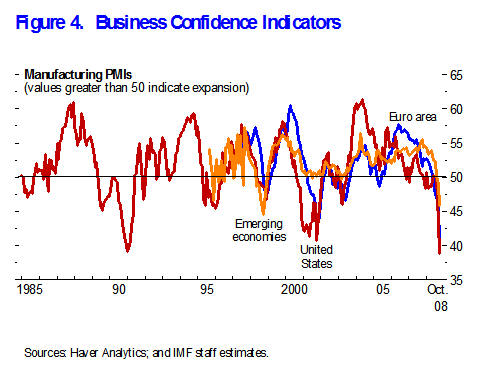

Consumers and firms are reassessing income prospects

Beyond the direct impact of the financial crisis, activity is increasingly being held back by slumping confidence. As the financial crisis has become more entrenched, households and firms are increasingly anticipating a prolonged period of poor prospects for jobs and profits (Figure 4, view: Data Figure 4). As a result, they are cutting back on consumption, notably of durables, and investment.

Macroeconomic policy easing has been limited

The recent moderation of inflation risks has cleared the way for major central banks to cut their policy interest rates. Relative to the October WEO projections and considering the latest cuts in policy rates, interest rates in 2009 are assumed to be about 1 percentage point lower in the United States and the euro area and ¼ percentage point lower in Japan, in line with market expectations. Other advanced economies have also cut rates. In emerging economies, the picture is mixed, with some central banks having increased rates to combat capital outflows and others having lowered rates to support economic activity.

Some governments have also announced fiscal policy measures to support demand. However, overall these measures are limited and projections do not build in fiscal stimulus that is under discussion but not yet adopted. As a result, the fiscal policy stance is projected to be broadly neutral in 2009. Specifically, in cyclically adjusted terms, general government deficits in advanced economies are not projected to change much in 2009 relative to 2008, unless new measures are adopted.

The economic outlook is exceptionally uncertain

Financial conditions continue to present serious downside risks. The forceful policy responses in many countries have contained the risks of a systemic financial meltdown. Nonetheless, there are many reasons to remain concerned about the potential impact on activity of the financial crisis. The process of deleveraging could be more intense and protracted than factored into these projections. Intense deleveraging could also increase the risks of substantial capital flow reversals and disorderly exchange rate depreciations for many emerging economies. Another downside risk relates to growing risks for deflationary conditions in advanced economies, although these are still small, given well-anchored inflation expectations.

In the current setting, upside risks are limited. Nonetheless, it is possible that the financial sector policy measures, once fully specified and implemented, foster a more rapid-than-expected improvement in financial conditions. In the meantime, the relatively strong balance sheets of nonfinancial corporations might help forestall a major cutback of investment. Under such conditions, confidence could also recover rapidly and spending by households and firms quickly reaccelerate.

Most importantly, the WEO projections and down- side as well as upside scenarios assume that policies do not respond to the latest deterioration in global growth prospects.

A stronger macroeconomic policy response could limit the damage

There is a clear need for additional macroeconomic policy stimulus relative to what has been announced thus far, to support growth and provide a context to restore health to financial sectors. Room to ease monetary policy should be exploited, especially now that inflation concerns have moderated. However, monetary policy may not be enough because monetary easing may be less effective in the face of difficult financial conditions and deleveraging. Also, in some cases room for further easing is limited as policy rates are already close to the zero bound. These are conditions where broad-based fiscal stimulus is likely to be warranted. Fiscal stimulus can be effective if it is well targeted, supported by accommodative monetary policy, and implemented in countries that have fiscal space.

Financial sector policies could be reinforced and better coordinated

Financial policies have responded strongly. However, they could be reinforced, clarified, and better coordinated and thereby foster a more rapid recovery of lending and demand. Depending on how much prospects worsen, the scale of current recapitalization efforts may need to be broadened. Furthermore, the coverage and legal foundation for the various guarantees as well as the asset purchase programs should be clearly specified, while central bank liquidity support should continue to be generously provided. In addition, there may be a need in some countries for measures to foster an efficient and predictable resolution of mounting debt problems in the corporate and household sectors, which would help preserve value to bank creditors. Crucially, there must be better cross-border consistency of policies. A key task will be to develop cooperative arrangements for the resolution of large cross-border institutions where none currently exist, given the limitations of individual country frameworks. Moreover, the extension of financial support and guarantees must consider potential cross-border effects, including for emerging economies. Finally, exit strategies for the public sector from financial system ownership need to be developed.