When economic crises hit, such as the one caused by the pandemic, countries have a number of financial resources—both internal and external—to draw on. The global financial safety net is a set of institutions and mechanisms that provide insurance against crises and financing to mitigate their impact.

This safety net has four main layers: countries’ own international reserves; bilateral swap arrangements whereby central banks exchange currencies to provide liquidity to financial markets; regional financial arrangements by which countries pool resources to leverage financing in a crisis; and the IMF.

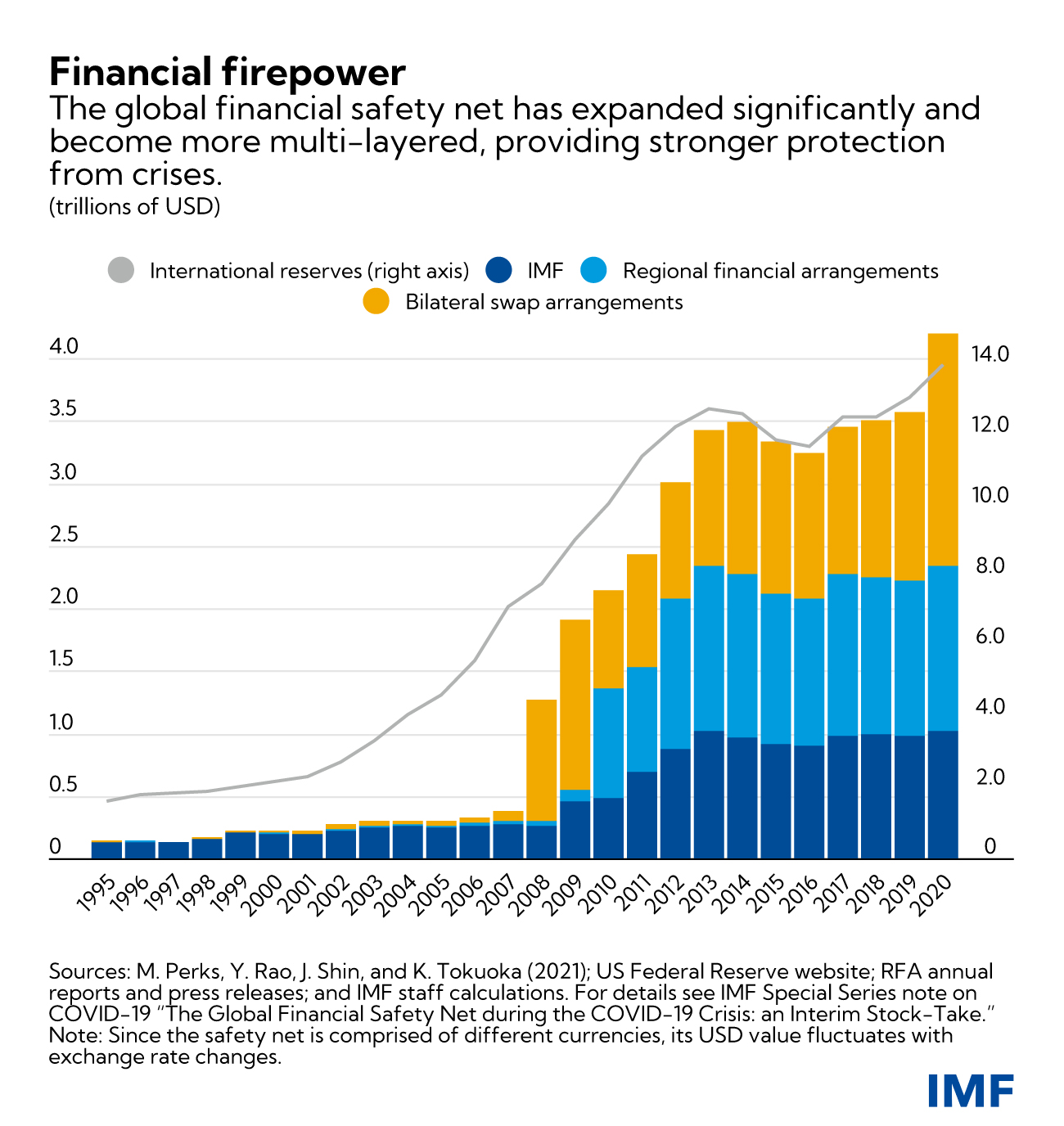

As our chart of the week shows, this global financial safety net has expanded significantly in the past decade and its sources have become more diverse.

The chart, drawn from the recent IMF Special Series on COVID-19, shows that since the global financial crisis, the total stock of international reserve holdings more than doubled, reaching about $14 trillion by end-2020. Other layers of the safety net increased about tenfold, to about $4 trillion.

This increase reflects the expansion of the bilateral swap arrangements during the global financial crisis and the recent pandemic, as well as the establishment of new regional financial arrangements, especially in Europe (e.g., the European Stability Mechanism) and in South East Asia (the Chiang Mai Initiative Multilateralization). The IMF also more than doubled available resources in the aftermath of the global financial crisis.

This reinforced insurance helped effectively cushion the shock during the first year of the COVID-19 crisis. The increased bilateral swap arrangements, primarily the US Federal Reserve swaps, provided prompt liquidity support, helping to stabilize the global financial markets and capital flows to emerging market economies.

Financing from the regional financing arrangements remained low, as demand was contained by supportive macroeconomic policies in advanced economies, and timely financing from other global financial safety net sources.

For its part, the IMF remained the linchpin of the safety net, approving debt service relief and providing financial assistance to an unprecedented number of countries, including low-income and emerging market economies that did not benefit from bilateral or regional arrangements.

As countries continue to grapple with the fallout from the pandemic and face increased risks of tighter financial conditions, the continued use of the global financial safety net will likely be needed until the crisis is over.